Another Fed Intervention: Lender Of Last Resort

The Federal Reserve balance sheet increased by $300 billion since last week, leading to debate about whether these actions qualify as quantitative easing, but the bigger issue is systemic fragility.

Relevant Past Articles:

Silvergate Bank Faces Run On Deposits As Stock Price Tumbles

Not Your Average Recession: Unwinding The Largest Financial Bubble In History

The Lender Of Last Resort

Just days after the fallout from Silicon Valley Bank and the establishment of the Bank Term Funding Program (BTFP), there’s been a significant rise in the Federal Reserve’s balance sheet after a full year of decline via quantitative tightening (QT). The PTSD from extensive quantitative easing (QE) is causing many people to sound the alarms, but the changes in the Fed’s balance sheet are a lot more nuanced than a new regime shift in monetary policy. In absolute terms, it’s the largest increase in the balance sheet we’ve seen since March 2020 and in relative terms, it’s an outlier that’s catching everyone’s attention.

The key takeaway is that this is much different than the QE spree of asset buying and the stimulative easy money with near-zero interest rates that we’ve experienced over the last decade. This is about select banks needing liquidity in times of economic distress and those banks getting short-term loans with the goal of covering deposits and paying the loans back in quick fashion. It’s not the outright purchase of securities to indefinitely hold on the balance sheet from the Fed, but rather balance sheet assets that should be short-lived while continuing QT policy.

Nonetheless, it is a balance sheet expansion and a liquidity increase in the short-term — potentially just a “temporary” measure (still to be determined). At the very least, these liquidity injections help institutions not become forced sellers of securities when they otherwise would be. Whether that’s QE, pseudo QE, or not QE is besides the point. The system is showing fragility once again and the government has to step in to keep it from facing a systemic risk. In the short-term, assets that thrive on liquidity increase, like bitcoin and the Nasdaq which have ripped higher at the exact same time.

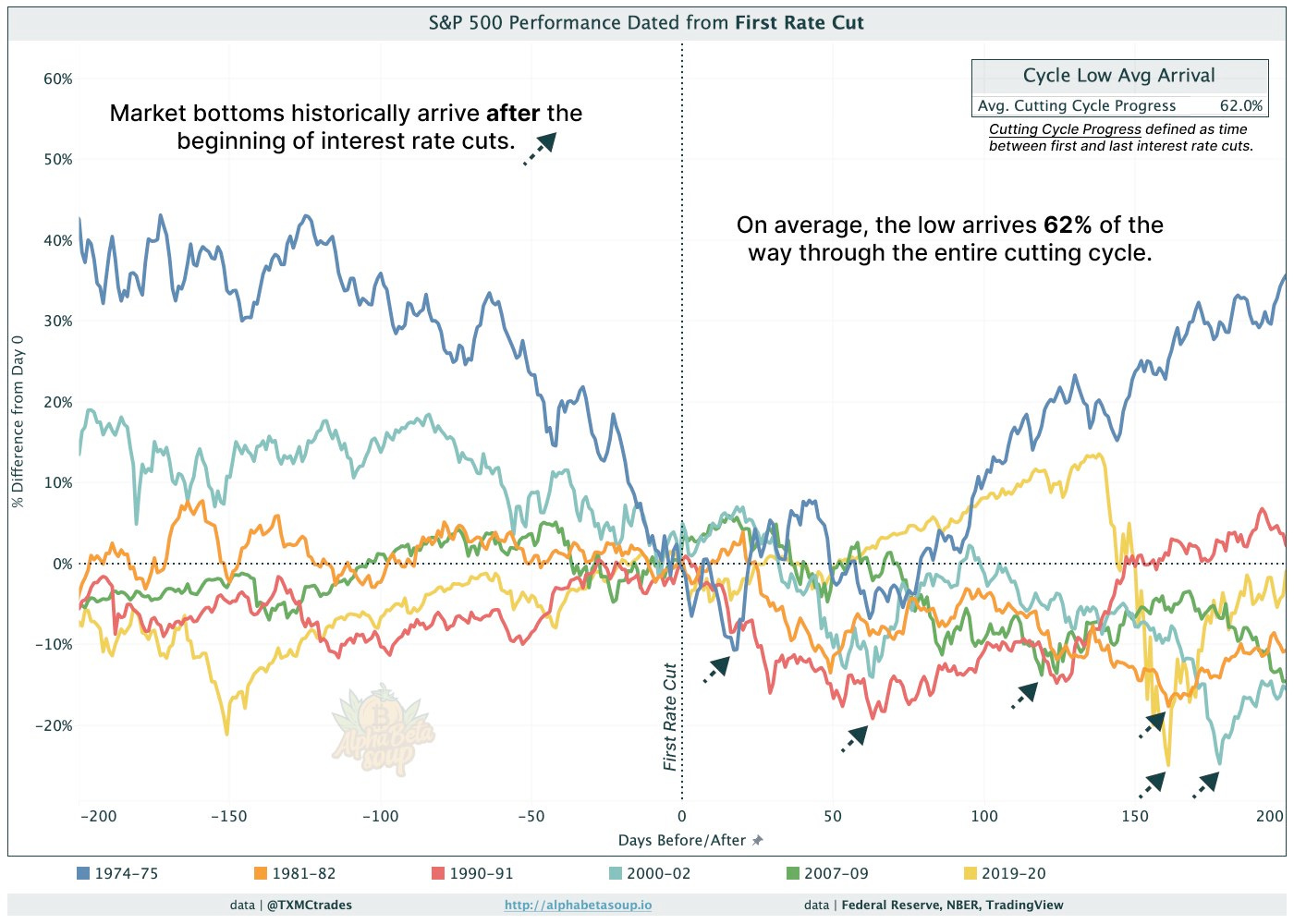

However, this is not an overall bullish, sustained sign for the market that the Fed must use its lending of last resort powers. Historically, bear markets face the worst drawdowns after the Fed intervenes and reverses policy via rate cuts.

Source: TXMCtrades

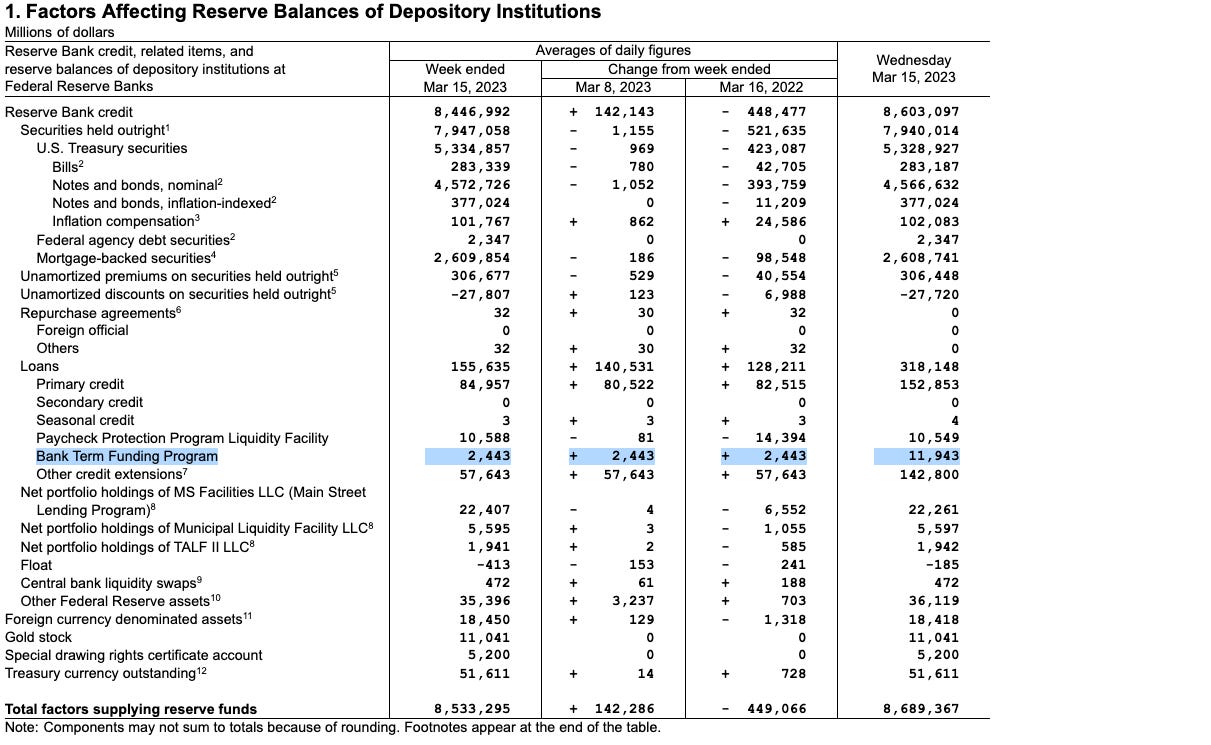

This specific increase of the Fed’s balance sheet is due to a rise in short-term loans across the Fed’s discount window, loans to FDIC bridge banks for Silicon Valley Bank and Signature Bank and the Bank Term Funding Program. Discount window loans were $152.8 billion, FDIC bridge bank loans were $142.8 billion and BTFP loans were $11.9 billion for a total of over $300 billion. Continuing with their QT policy, the Federal Reserve Statistical Release stated:

“Factors affecting reserve balances of depository institutions (table 1) "other credit extensions" reports loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks' loans to these depository institutions are secured by collateral, and the FDIC provides repayment guarantees.”

Source: Federal Reserve Statistical Release

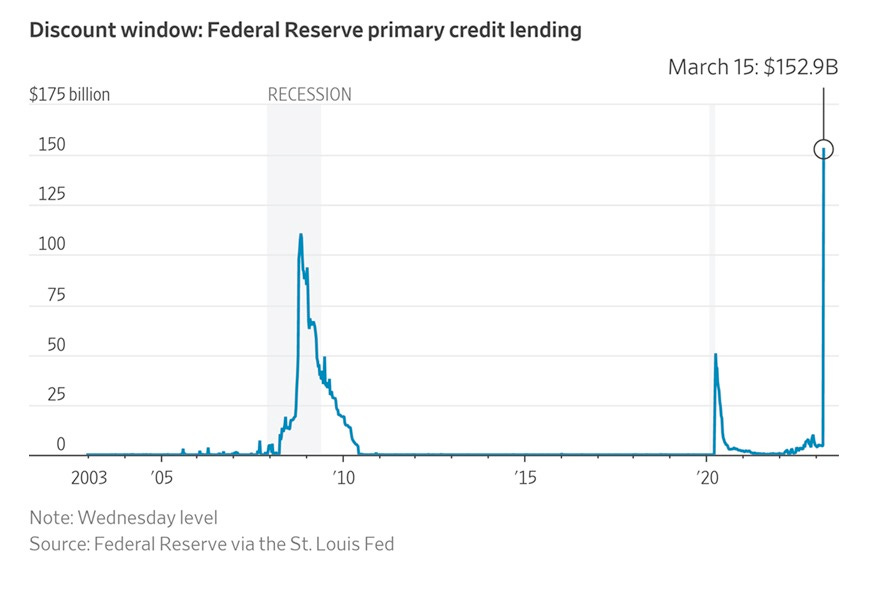

The more alarming increase is in the discount window lending as that is a last resort, high cost liquidity option for banks to cover deposits. It was the largest discount window borrowing on record. Banks using the window are kept anonymous as there is a legitimate stigma issue from finding out who’s in need of short-term liquidity.

Source: WSJ, Federal Reserve

Subscribe now to receive the “Banking Crisis Survival Guide” directly in your inbox! The full in-depth report has already been released to paid-tier Bitcoin Magazine PRO subscribers. If you would like to view the report in full, upgrade your subscription today.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Why this liquidity injection is reminiscent of 2019. 💉

Expectations for the FOMC meeting next week. 📂

Potential Federal Reserve intervention in the future. 🔮

This brings back recent memories of the 2019 emergency liquidity injection and intervention by the Fed into the repo market to stabilize cash demand and short-term lending activities. The repo market is a key overnight financing method between banks and other institutions. It was another time of short-term, temporary liquidity injection loans that had a similar debate about whether or not they were a form of QE. Ultimately, those events led to further rate cuts in policy and a reversal in QT as the Fed was forced to buy oversupplied T-bills in the market. That led into March 2020, where the balance sheet grew at an astronomical pace as a monetary and fiscal response to Covid-19.

FOMC Next Week

As of today, the market is still expecting a 64.2% chance of 25 bps rate hike at the FOMC meeting next week. Despite the chaos in the markets as of late, as long as the Federal Reserve feels that they can manage liquidity for banks facing deposit outflow pressures in the short-term, we still may not be at the pause and pivot stage of the cycle that so many are anticipating. This week, the European Central Bank had a similar decision to make and chose to opt for a 50 bps rate hike, despite Credit Suisse’s recent liquidity injections. All-in-all, the market turmoil so far hasn’t proven to “break enough things” yet, which would require an emergency pivot from central bankers.

The next few days may tell us something different. After all, the markets were pricing a 78.6% chance of 50 bps just nine days ago.

Source: CME FedWatch Tool

On its path to bringing inflation back to the 2% target, month-over-month Core CPI was still increasing in February while initial jobless claims and unemployment haven’t budged much. Wage growth, especially in the services sector, still remains fairly strong at the 3-month annualized rate of 6% growth last month. Although slightly coming down, more unemployment is where we will have to see more weakness in the labor market in order to take wage growth much lower.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Yet, the eurodollar curve is pricing in rate cuts by the third quarter of this year, which is effectively saying that something larger and more impactful than Silicon Valley Bank or regional bank temporary liquidity is going to force the Fed’s hand to reverse their policy. Now around 3.87%, 2-year bond yields are saying something similar while the bond market is experiencing some of the most volatility seen since the 2008 Great Financial Crisis via the MOVE index.

Source: Bianco Research

We’re likely far from the end of the chaos and volatility this year, as each month has brought new levels of uncertainty in the market. This was the first sign of the system needing Federal Reserve intervention and swift action. It likely won’t be the last in 2023.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Great thread. Seems like we're going to continue "having fun". Looking forward to see how it all plays out, we're writing history here.. maybe we'll see something added to a block, relatively soon.. can you make a thread about Japanese debt trading like illiquid shitcoins?

PS: when I say "having fun" is on a relative way. Nobody likes to see innocent people suffering from secondary effects of a corrupt and manipulated system.