Largest Bank Failure Since 2008 Sparks Market-Wide Fear

With Silicon Valley Bank going under in the blink of an eye, panic is setting in for the venture capital and tech world. Circle announces exposure to the bank and the USDC peg fights to stay at $1.

Relevant Past Articles:

Genesis Files For Chapter 11 Bankruptcy, Owes More Than $3.5 Billion To Creditors

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Silvergate Bank Faces Run On Deposits As Stock Price Tumbles

Largest Bank Failure Since 2008 Sparks Market-Wide Fear

The latest broader market selloff has everyone scrambling to make sense of what’s going on, especially with the latest news that Silicon Valley Bank (SVB) was forced to close today, resulting in an FDIC-created deposit insurance bank to take on all their deposit liabilities. SVB is the bank of choice for much of the American venture capital and startup world and is the 18th largest U.S. bank by size of total assets. SVB’s demise would make it the second largest bank failure in U.S. history.

Why does this matter? The collapse of SVB follows just days after the liquidation of Silvergate Bank and there’s been a few other large, regional banks that are shedding equity value today amid more concerns around contagion in the banking sector.

From the FDIC press release, the amount of uninsured deposits is still unknown:

“As of December 31, 2022, Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At the time of closing, the amount of deposits in excess of the insurance limits was undetermined. The amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.”

Yet in SVB’s year-end report for 2022, they disclose that they have around $151 billion in uninsured deposits as their base is largely composed of institutional clients. That detailed report can be found here and Joseph Wang explains it more in-depth here.

The overall impact is that those who have their money with SVB will lose access to uninsured funds for the time being, impacting the ability of many startups and businesses to access their capital, thus increasing default and bankruptcy risks. There is some nuance for uninsured depositors, as the FDIC stated that it will pay uninsured depositors an advance dividend and receivership certificate for the remaining amount of their uninsured funds. While the exact meaning of this is uncertain, the likely scenario is that uninsured depositors aren't made whole but don’t completely lose all of their capital held at the bank. All of this may change if a larger bank buyer steps in to acquire SVB over the next few days or weeks.

“All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.”

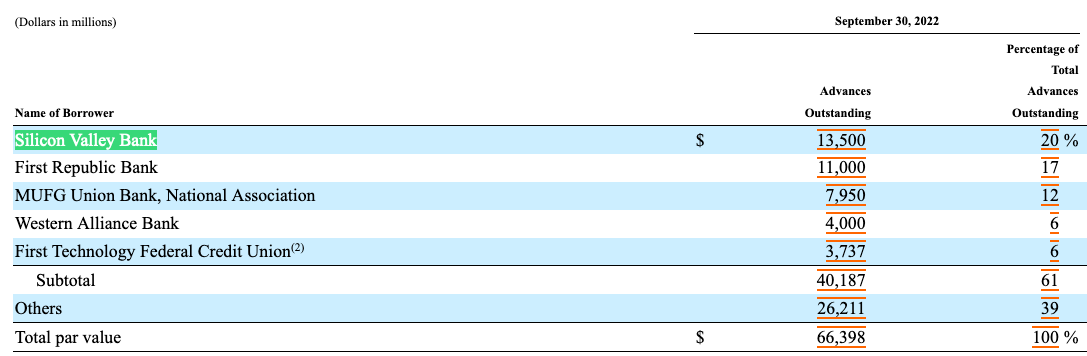

On the banking side, SVB received loans from the San Francisco Federal Home Loan Bank (FHLB) making up 20% of their loan book. Other regional banks in this list are some of the stocks losing the most value in market trading today.

Source: FHLBank San Francisco 10-Q

Source: Charlie Bilello

SVB showed that they had $180 billion in liquidity just 10 days ago.

The following is a summary of events for these regional banks that are seeing their share prices plummet, including what previously happened with Silvergate Capital and is now in the process of playing out with Silicon Valley Bank:

These banks catered to venture capital and crypto companies so their deposits went exponential during the post-2020 bubble.

As short-end rates were pinned at 0% due to zero-interest-rate policy, these banks were suddenly flush with deposits and decided to make investments in long-duration securities in a bid for yield.

As the bond bubble burst, these firms faced massive unrealized losses that were forced to be realized in the case of mass withdrawals.

As the banks sold their bonds, the unrealized losses were crystallized, which led to panic from equity investors and depositors in a reflexive cycle which then led to a death spiral for the bank.

Bitcoin 2023 ticket prices increase TONIGHT at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

Limited-time offer: Industry Passes come with a 6-month PRO subscription!

An Important Distinction

With many banks coming under severe pressure in recent days and weeks, it is important to make a key distinction between today and the Great Financial Crisis in 2008.

During the GFC, total liabilities in the banking system relative to cash on hand hit absurdly high levels, otherwise known as leverage.

Liabilities relative to cash on hand hit 33x, compared to just 6.5x today. While there is obviously still leverage — as the banking industry is built upon the concept of a fractional reserve — the chances of a full-blown systemic banking crisis similar to the Great Financial Crisis don’t exist in the same way today. Following the GFC, new regulations were put into place to better control bank leverage and liquidity.

However, the prevalence of bad apples — specifically those who are heavily exposed to long-duration investments — are real, and this leaves the potential for more blowups in the future, with a particular eye on the worst performers in the financial industry in recent days. The pervasiveness of too-big-to-fail has not been eliminated, but exists in a different way than it did in 2008, due to the underlying conditions of the banking system.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Why investors are spooked by Circle and USDC is fighting to keep its $1 peg. 💵

The makeup of the Curve pool and the flight to certain stablecoins. 🛫

USDC redemptions and what to watch going into the weekend. 🏃♂️

Counterparty Exposure

Something on which to keep an extremely close eye following the failure of Silicon Valley Bank are any firms with counterparty exposure. The most relevant and obvious party with potential known exposure is the USDC stablecoin issuer Circle, who reported having eight banking partners in its monthly attestation conducted back in January.

As per the Circle website, as of March 9, the firm has $43.5 billion in reserves, with $11.1 billion of that held in reserve banks and the rest parked in short-duration U.S. Treasuries at the Circle Reserve Fund with BlackRock.

Regarding banking partners, Circle has disclosed that its banking relationships are the following:

“Cash held at U.S. regulated financial institutions: Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, a division of Flagstar Bank, N.A., Signature Bank, Silicon Valley Bank and Silvergate Bank.” — USDC Reserve Report

While Circle’s relative level of banking diversification would mean that most of the USDC reserves remain safe and liquid, a small impairment loss could theoretically lead to a “run on the bank” style redemption for USDC, dwindling reserves down until all that is left in circulation is unbacked. We are not saying this is our base case, but the lack of communication on behalf of Circle today is a bit worrisome.

According to the Block, Circle was the only major stablecoin that didn’t publicly announce their exposure to Silicon Valley Bank.

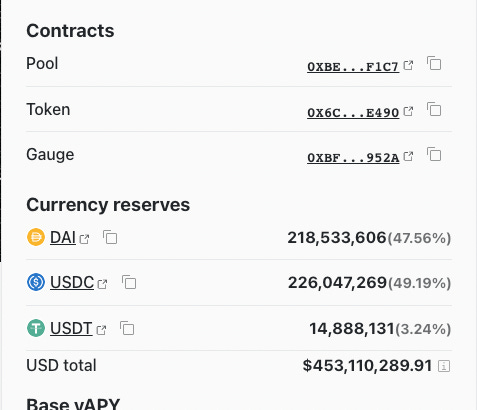

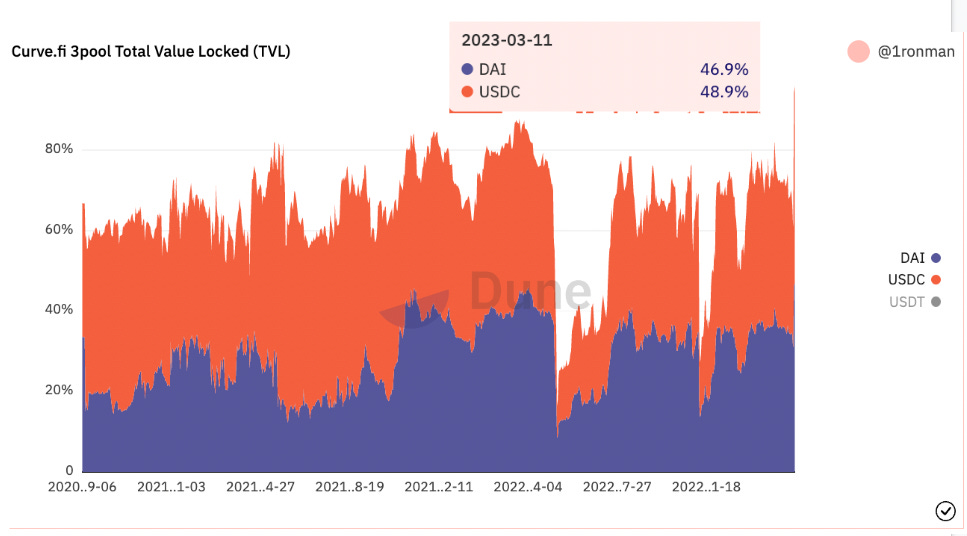

As the market weighs the odds of potential Circle exposure to Silicon Valley Bank, participants have begun fleeing from USDC and DAI (which is partially backed by USDC) to USDT issued by Tether.

3pool uses an automated market maker called Curve, which allows users to effortlessly swap their stablecoins for one another. However, the system is built upon the assumption that all token values are equal. In theory, there should be a relatively similar amount of each stablecoin token in the pool at any given time.

Explainer on Curve from Gemini:

“How Automatic Market Makers Work

Automated market makers allow digital assets to be traded permissionlessly and automatically by using liquidity pools instead of trading between buyers and sellers. At its core, a liquidity pool is a shared pot of tokens. Users supply liquidity pools with tokens, and the prices of the tokens in the pool are determined by a mathematical formula. By tweaking the formula, liquidity pools can be optimized for different purposes. Anyone with an internet connection and some ERC-20 tokens can become a liquidity provider by supplying tokens to an AMM’s liquidity pool. Liquidity providers normally earn a fee (paid by traders who interact with the liquidity pool) for providing tokens to the pool.

“Stable Liquidity Pools

Curve was launched in 2020 with the intention of creating an AMM exchange with low fees for traders, while providing an efficient fiat savings account for liquidity providers. By focusing on stablecoins, Curve allows investors to avoid more volatile crypto assets while still earning high interest rates from lending protocols. Compared to other AMM platforms, the Curve model is particularly conservative in that it avoids volatility and speculation in favor of stability.”

Source: Dune Analytics

Currently, the share of USDT in 3pool is at historically low levels, signaling the market’s unease around USDC reserves as participants flee to Tether USDT. Similarly, there are the first signs of major USDC redemptions, with approximately $750 million of USDC being burned at the Circle treasury.

Readers can get a live view of ongoing USDC redemptions here.

Extras:

While Circle has ample reserves, the unknown exposure to Silicon Valley Bank along with the market’s positioning as the day went on put us on high alert. We believe there is a nonzero chance of an acceleration of redemptions along with a possible depeg from $1.00 during the weekend, barring any announcement from Circle denying exposure to the defunct bank.

Our base case is not total armageddon, but we have seen these types of developments before. Counterparty risk happens fast, and in the (unconfirmed) case of a nontrivial amount of exposure, spooked holders of USDC and advantageous speculators looking to profit on the short side could introduce dynamite to the usual calm waters of weekend price action.

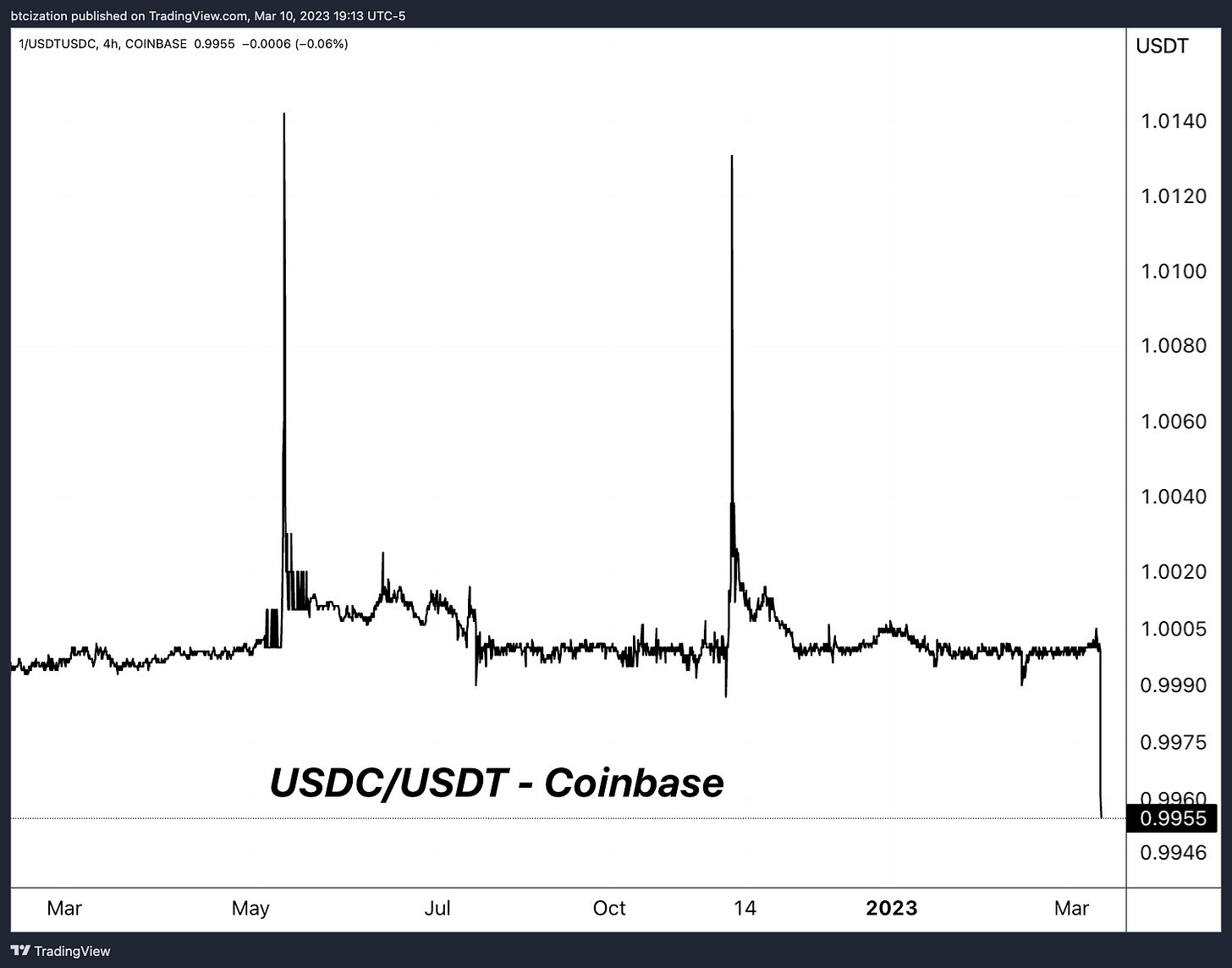

Although on relatively low volume, USDC has fallen to $0.995 against USDT on Coinbase at the time of writing, a notable yet not existential move that is most definitely being caused by speculators. The worrisome scenario is a sustained period of USDC trading below the $1 par, which would accelerate any potential redemptions.

It should be reiterated that as of now, Circle’s exposure to Silicon Valley Bank is currently unknown, but the lack of denial is spooking the market.

Final Note

The largest bank failure since 2008 has sent shock waves through the tech and venture capital world, and many people are already clamoring for a bailout. Expect many firms and companies to announce their exposure to Silicon Valley Bank over the following days. In our estimation, it is likely there will be a state-funded depositor bailout.

Similar to our tune in regards to Silvergate and Signature over the past week, any sustained issues with USDC would likely be a net negative over the short-to-intermediate term for bitcoin, while simultaneously highlighting the exact value proposition of a bearer asset with zero counterparty risk or third-party liability.

Update: As our team was in the process of publishing this issue, Circle issued the following statement

Since the release of the statement, the depeg of USDC relative to USDC has intensified, with the USDC/USDT exchange rate currently floating at $0.9860.

As such, the spread across all actively traded assets that have both USDC and USDT denominations have begun to deviate, with the current BTC/USD exchange rates on Coinbase greater than $200 higher than the exchange rate for BTC/USDT.

It is important to note that in June 2022, Coinbase made the decision to combine USD- and USDC-denominated order books and client account balances, which increased the liquidity and depth of the order book as well as improved user experience.

But this also places USD holders on Coinbase in a tricky situation if the issues with USDC and Circle deteriorate further.

As this unfolds, Binance has come forward and announced that it has re-segregated order book liquidity between USDC and BUSD, effectively detaching its brand and liquidity from the Circle debacle, while sending a strong message under the name of “risk-mitigation.”

Update: Immediately after publishing this article, Circle made another announcement clarifying their holdings at SVB:

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!