Banking Troubles Brewing In Crypto-Land

Silvergate Bank clients flee as stock price plummets and regulatory questions mount across the industry. The dwindling options for crypto banking partners is a key risk factor to watch.

Relevant Past Articles:

The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount

Genesis Files For Chapter 11 Bankruptcy, Owes More Than $3.5 Billion To Creditors

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

To help all of our subscribers navigate the market, we have removed the paywall for this article. Consider subscribing to Bitcoin Magazine PRO to stay up-to-date on everything unfolding in the crypto-banking sector

Banking Troubles Brewing

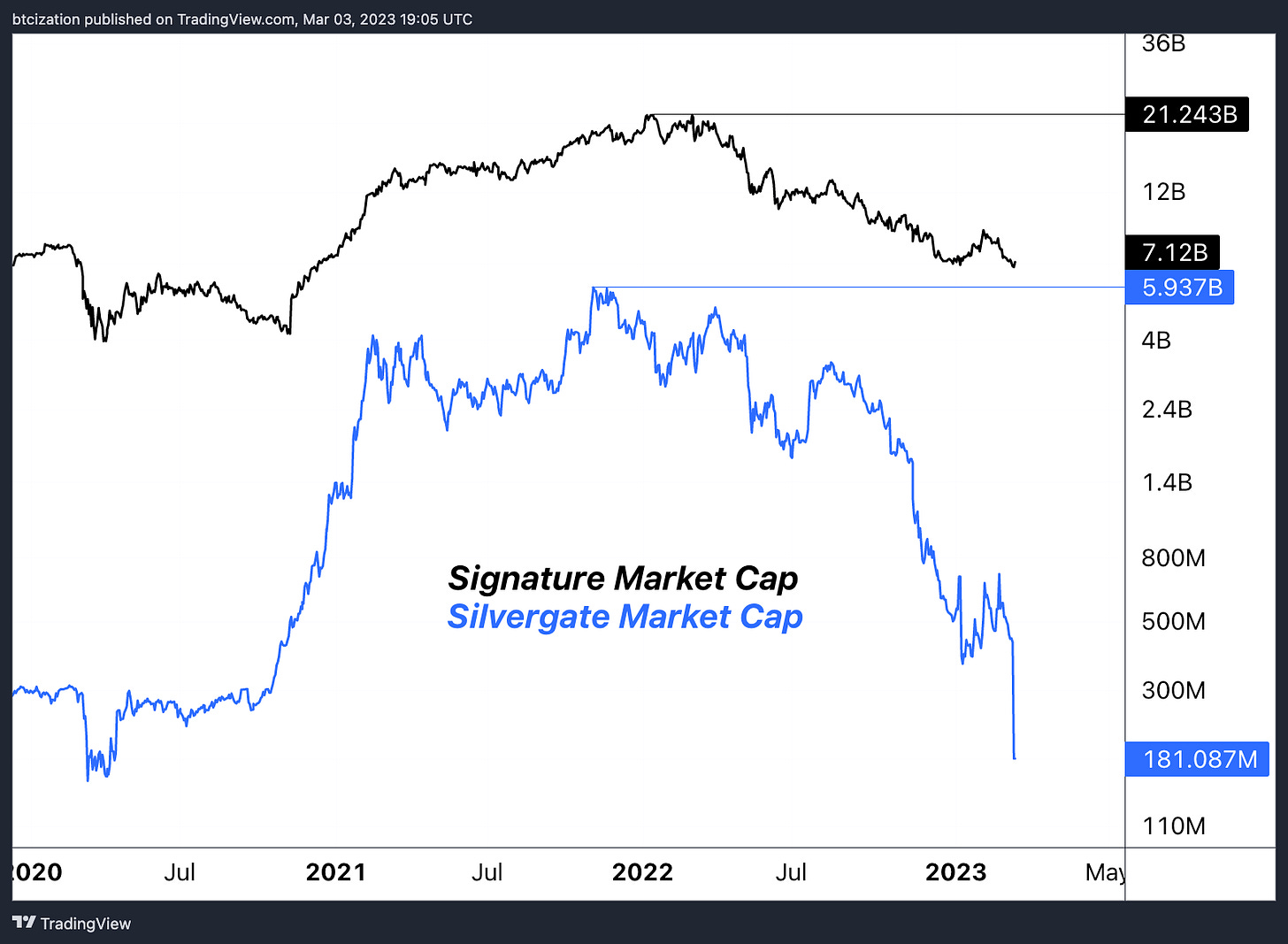

Developments around crypto on- and off-ramps have heated up in recent days, as Federal Reserve Member Bank Silvergate Capital watched its depositors flee and its stock price plummet. Along with Signature Bank, Silvergate is the other key U.S. bank that works closely with the crypto sector.

The reason for the extreme concentration of banking interests that are willing to deal in the crypto sector is the general lack of regulation around know-your-customer and anti-money laundering (KYC/AML) policy that exists in the industry for offshore entities, as well as the issues with the broader industry being rife with unregistered security offerings and plenty of fraud.

Of course, we believe there is a clear distinction between bitcoin and the broad term colloquially referred to as “crypto”, but the lines remain blurred for many regulators and government agencies.

Thus, there have historically been very few entities in the regulated U.S. banking system that have been willing to work with crypto firms to access established USD on- and off-ramps, which presents a unique challenge to companies who are in the business of moving money and/or processing payments and transactions.

In regard to Silvergate, we have been monitoring the situation closely since November — after the collapse of FTX — as it became apparent that Silvergate played a role in serving FTX and Alameda by giving them access to USD rails.

Related:

As we wrote on November 17, (emphasis added)

“Who else is at the center of many institutions in the market? Silvergate Bank is one of those. Since the beginning of November, their stock is down nearly 56%. Silvergate Bank is at the nexus of banking services for the entire industry, servicing 1,677 digital asset customers with $9.8 billion in digital asset deposits. FTX accounted for less than 10% of deposits and the CEO has tried to reassure markets that their current loan book has faced zero losses or liquidations so far. Leveraged loans are collateralized with bitcoin that can be liquidated as necessary. Yet, the ongoing risk is a complete bank run on Silvergate deposits.. Although the CEO’s comments sound reassuring, the stock performance over the last two weeks tell a much different story.” — The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Since the implosion of FTX, shares of Silvergate Capital have fallen by 83%, putting the current drawdown from the all-time high price at an eye-watering 97.3%.

As referenced in the November 17 article, Silvergate’s share price isn’t imploding due the performance of a crypto token as was the case for many companies in the crypto winter of 2022, but rather from a deposit exodus that has forced the firm to liquidate long-duration securities at a loss in order to remain liquid.

As a traditional fractional reserve bank, Silvergate took client deposits — which drastically increased in 2021 — and lent them out over a long duration, into U.S. Treasury bonds, in particular. In practice, firms would lend their money to Silvergate by depositing at 0% in order to utilize their Silvergate Exchange Network (SEN), and Silvergate would then lend out those same dollars at a higher interest rate over a long period of time. This is a great business model — as long as your loans don’t fall in value at the same time as clients go to withdraw their funds.

“Customers withdrew about $8.1 billion of digital-asset deposits from the bank during the fourth quarter, which forced it to sell securities and related derivatives at a loss of $718 million, according to a statement Thursday.” — Silvergate Tumbles After FTX Implosion Prompts $8.1 Billion Bank Run

As commentary has ramped up about the incompetence and irresponsibility of Silvergate’s management, we need to interpret some of the nuance surrounding the situation.

A majority of Silvergate’s deposits came during a world of zero-interest-rate policy, where short-duration Treasury securities offered 0% yield. This phenomenon is one of the core reasons why Silvergate invested in longer-duration instruments. The bonds fell in value as global interest rates rose throughout 2022.

With long-duration debt securities, money isn’t lost in the case of rising interest rates as long as the bond is held to maturity (and not defaulted upon), but in the case of Silvergate, fleeing deposits forced the firm to realize the unrealized losses on their securities portfolio — a nightmare for a fractionally reserved institution.

With solvency worries mounting in recent months — of which severely escalated in the last few days — companies frontran speculation about exposure to the bank, with names such as Coinbase, Paxos, Circle, Galaxy Digital, CBOE and others communicating about their banking relations with Silvergate. Coinbase explicitly announced their move to Signature bank.

“We are facilitating fiat withdrawals and deposits using Signature Bank, effective immediately.” — Coinbase memo

Related: Coinbase, Galaxy, Paxos Stop Accepting Transfers Via Silvergate Network

One concern is that many of these firms are turning solely to Signature bank, which further centralizes the off- and on-ramps currently utilized by the crypto industry, even though Signature has a much larger market capitalization and more diversified depositor base than Silvergate.

As per Signature’s recent 10-K annual report, the bank had a total of $110.36 billion in assets, $88.59 billion in deposits, $74.29 billion in loans, $8.01 billion in equity capital and $5.17 billion in assets under management at the close of 2022. Of the bank’s $88.59 billion in deposits, approximately 20% of those were relating to digital assets, totaling $17.79 billion.

The current state of Signature’s digital asset deposit base is unknown, as the firm communicated its desire to reduce reliance on crypto-related deposits in early December.

“Signature Bank (SBNY) will shrink its deposits tied to cryptocurrencies by $8 billion to $10 billion, signaling a move away from the digital asset industry for the bank that until recently had been one of the most crypto-friendly companies on Wall Street.

“We are not just a crypto bank and we want that to come across loud and clear,” Signature Bank’s CEO Joe DePaolo said at an investor conference in New York hosted by Goldman Sachs Group on Tuesday.” — Coindesk

The timeline of these events is important because of the recent developments regarding the industry’s flight from Silvergate coming at the same time that Signature appears to be handcuffing the use of its rails with key industry players. On Wednesday, global cryptocurrency exchange Kraken announced that non-corporate clients will no longer be able to make dollar deposits or withdrawals using Signature. Deposits are being phased out on March 15, while access to withdrawals will end on March 30.

Similarly, in late January, Binance announced that Signature had imposed transactional transfer minimums of $100,000 USD for all customers:

“One of our fiat banking partners, Signature Bank, has advised that it will no longer support any of its crypto exchange customers with buying and selling amounts of less than 100,000 USD as of February 1, 2023. This is the case for all of their crypto exchange clients. As a result, some individual users may not be able to use SWIFT bank transfers to buy or sell crypto with/for USD for amounts less than 100,000 USD,” — Binance Says Signature Sets Transaction Minimum Amid Pullback

Then on February 6, it was announced that Binance was suspending all withdrawals and deposits for USD to bank accounts, presumably because the exchange was cut off from its banking relationship with Signature due to increasing regulatory scrutiny.

Subsequently, on February 13, Binance stablecoin issuer Paxos announced it would stop minting BUSD following guidance from the New York Department of Financial Services. Just yesterday, a bi-partisian letter was released from U.S. Senators Elizabeth Warren, Chris Van Hollen and Roger Marshall that was directed at Binance CEO Changpeng Zhao, in which they heavily scrutinized Binance as a “hotbed of illegal activity.”

“Mr. Zhao’s assertion that Binance.US is fully independent is eerily similar to claims Sam Bankman-Fried made regarding the distinction between FTX US and FTX – claims that appear to be false, given that FTX US has filed for bankruptcy, its users have lost access to their funds, and its new CEO has declared that it is, in fact, insolvent,” the senators wrote. “With this scheme in place, and in pursuit of profits, Binance has intentionally allowed US-based users to illegally access and trade unregulated products on the main exchange.”

The claims are undoubtedly strong, and they highlight the increased level of scrutiny and regulatory pressure regarding the crypto industry in the U.S.

Final Note

Following a disastrous 2022, regulators are ramping up their careful examination of the crypto sector, and one of their main targets is the connection between the industry and the legacy banking system. As Silvergate looks to be all but dead in the water with nearly every major industry player announcing plans to sever ties, the increasing reliance on Signature Bank, a bank that has announced its intention to distance itself from the space, remains… worrisome.

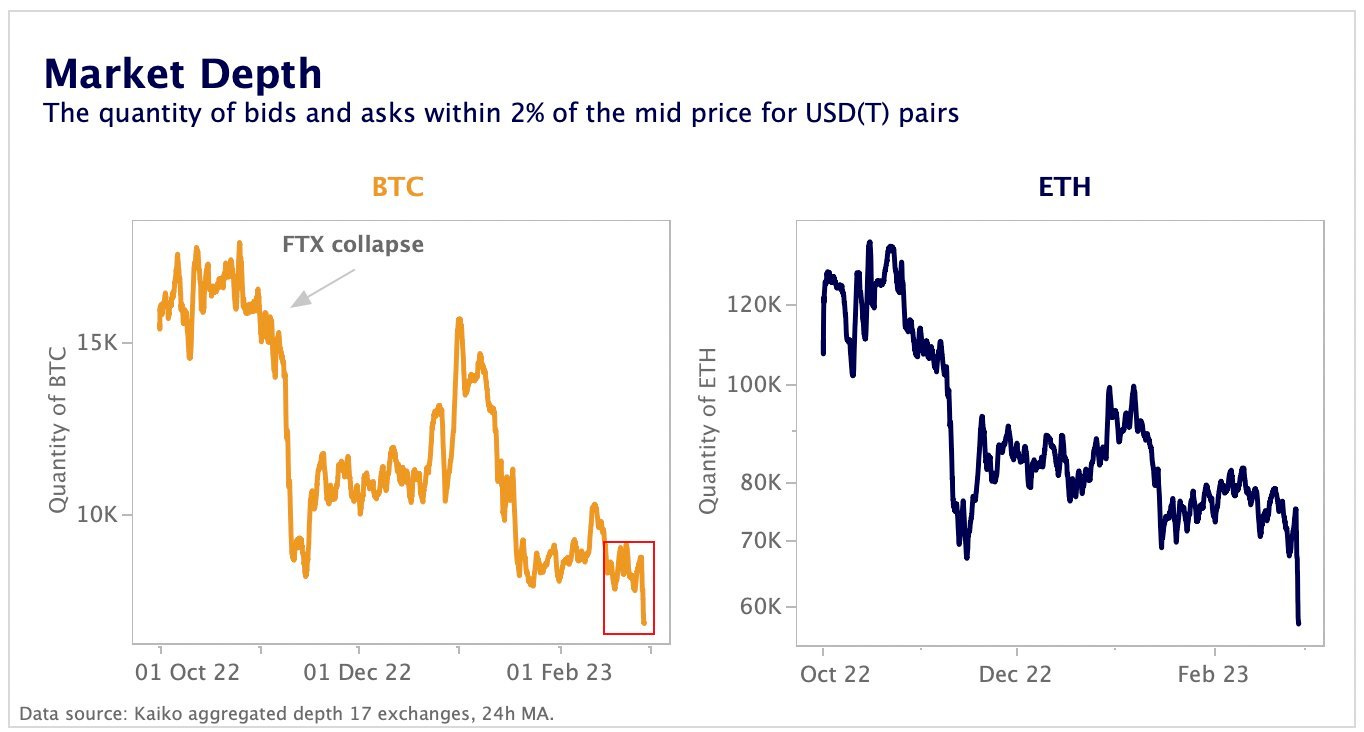

While this poses no fundamental risk to the functioning of the Bitcoin network or its properties as an immutable settlement layer, the clampdown and increasing centralization of USD on- and off-ramps is a key risk for short-to-intermediate term liquidity in the bitcoin and broader crypto market.

Broader macroeconomic conditions aside, these developments remain an important factor to monitor throughout the course of 2023 and beyond, especially considering the fact that the market is even more illiquid than it was directly following the collapse of FTX.

Source: Kaiko Data

Exclusive Bonus For Paid Subscribers!

Bitcoin Magazine PRO is excited to launch an exclusive promotion for our paid subscribers! Login to the Bitcoin Magazine store with your BM PRO Paid Subscriber email and use code BM-PRO for 15% off ALL items. Includes conference tickets, magazines, art and more!

Note: The code will only work with the same email that is connected to your Substack paid subscription and is not valid for free trials. If you have any issues with the code, please email craig.deutsch@btcmedia.org

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!