Genesis Files For Chapter 11 Bankruptcy, Owes More Than $3.5 Billion To Creditors

The company’s bankruptcy filing leaves many wondering how much more bad news is in store for investors. The future of GBTC remains unknown, but some activists are taking matters into their own hands.

Relevant Past Articles:

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Digital Currency Group Breaks Silence As Market Hangs In The Balance

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

Genesis Files For Chapter 11 Bankruptcy

After a year full of infamous liquidations and high-profile bankruptcies, it was reported in November that Genesis Global was looking for a $1 billion liquidity injection to keep the company afloat.

Today, the company filed for Chapter 11 bankruptcy protection, owing over $3.5 billion to 100,000-plus creditors. As expected, Gemini is the largest creditor with an unsecured claim of $765.9 million. Other notable creditors include Mirana Ventures (the investment arm behind Bybit), MoonAlpha (the team behind Babel Finance) and VanEck’s New Finance Income Fund.

VanEck’s New Finance Income Fund is one example of an institutional product that was created to capture short-term lending, which was a high-yield opportunity in the digital asset and crypto space. In July 2022, they announced a $35 million commitment from the Fairfax County pension plan, showing that it’s not just larger institutions that took high-risk, speculative bets on an arbitrage play that are now owed money, but also everyday retail market participants and pension funds that were involved in this game.

Following Gemini, we don’t know who holds the next few largest unsecured claims for $462 million and $230 million.

Source: Genesis Bankruptcy Protection Filing

Source: alphaketchum Twitter

Filing for Chapter 11 bankruptcy is only the beginning of a full resolution. Genesis is owned by Digital Currency Group (DCG) and the two companies’ finances are closely intertwined. We have written about this relationship in more detail in “Digital Currency Group Breaks Silence As Market Hangs In The Balance.”

Cameron Winklevoss says he is “preparing to take direct legal action against Barry and DCG” unless DCG offers a fair deal to creditors and Gemini Earn users. This likely will be only of many pending legal actions and lawsuits coming down the pipe for the DCG enterprise.

The following is a glimpse of our new Bitcoin Magazine PRO Market Dashboard that will be released to paid subscribers next week. Some of the metrics that are analyzed are: realized price, percent supply in profit, changes in hash rate, various moving averages, Mayer Multiple, M2 money supply, net liquidity, and more! By upgrading to a paid subscription, you will get exclusive access to this new Markets Dashboard along with explanations of these insightful metrics.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Potential ripple effects of the Genesis bankruptcy filing. 🌊

The big questions surrounding DCG and Genesis. ❓❓

What investors should look to for clues about potential developments in the GBTC saga. 🔎

One of the biggest open questions is the $1.1 billion promissory note from DCG to Genesis that’s due in 10 years, but is allegedly listed as a “current asset” on the Genesis balance sheet. How this note was presented to creditors is key to understanding Genesis’ accounting fraud allegations. Many other creditors are backing the Winklevoss claim of the misrepresentation of balance sheet assets and liabilities that proved that Genesis was solvent at the time.

In an open letter tweeted by Cameron Winklevoss on January 10, he accused DCG and Genesis of accounting fraud due to the misrepresentation of the promissory note, as the term of the loan allegedly spans across a 10-year period.

Source: Cameron Winklevoss

While the Genesis bankruptcy filing seems to have been in the works since the company halted withdrawals and new loan originations months ago, the company's fall from grace cannot be understated. At one point, Genesis had over $16 billion worth of active loans outstanding. With new information that has recently arisen, we now know that much of that notional value was from the participation in the GBTC arbitrage trade.

This circular logic of financial leverage on a closed-end trust led to the ultimate demise of Genesis, while punishing the price of GBTC shares in the process.

Source: Genesis Q4 2021 Report

As per their Q3 2022 report, Genesis’ active loans outstanding fell materially, at the same time as loans across the crypto borrowing/lending ecosystem were called in following the contagion events that began to transpire in June.

Read Bitcoin Magazine PRO’s Contagion Report for more information about these events

Source: Genesis Q3 2022 Report

Similarly, there are potential ripple effects across the Digital Currency Group empire that have yet to play out, including the potential sale of DCG subsidiary CoinDesk and other private assets.

“Crypto Media Outlet CoinDesk Taps Bankers for Potential Sale” — Wall Street Journal

As Digital Currency Group attempts to shield itself from the downfall of Genesis and the gaping balance sheet hole that they dug for themselves, it will be very interesting to monitor what they can do to garner liquidity, given the loan agreements in place between the two companies. The claims of fraud by industry players like the Winklevoss twins are serious allegations and it will take time to see how regulators and bankruptcy courts will handle the situation.

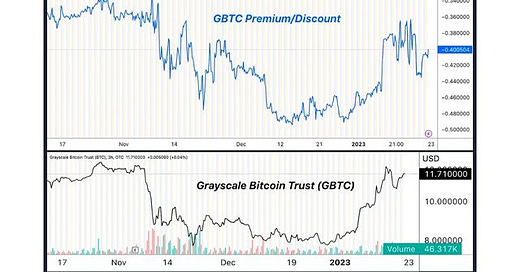

In the meantime, readers should look to the GBTC premium/discount as a sign of potential developments happening under the surface, given the scrutiny that the DCG empire is currently facing, alongside the grassroots activist campaigns that are developing to open the Grayscale Trust products up for redemption.

Given the perpetual 2% annual fee on the more than $10 billion worth of assets under management in the Grayscale family of trust products (predominantly in GBTC & ETHE), we expect no friendly cooperation from Grayscale to redeem shares of the trust and willingly slaughter their golden goose.

We will update our readers as we gain more information on the state of any legal proceedings, developments on the Grayscale Bitcoin Trust, and any news of the activist campaigns currently underway.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

If I were to have some GBTC...or you had some GBTC...what would you do with it? Hold and pray for a BTC Spot ETF? Liquidate for real satoshis placed in your own cold wallet?