Digital Currency Group Breaks Silence As Market Hangs In The Balance

News breaks that Genesis is headed toward potential bankruptcy. The market hangs on the edge of new lows as many await the impact of the contagion. Coinbase equity and debt trade in the market showing

Relevant Past Articles:

The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Previously, we told subscribers that we would release an in-depth FTX contagion report on Friday, November 18. As more details and news continue to surface along with the ongoing Digital Currency Group developments, we’re delaying the release of the report until early next week. Our continued analysis of these rapidly changing market dynamics in real-time will allow us to provide a more detailed and thorough report. Thank you for understanding the delay.

If you want to receive this report when it goes live, claim your 30 day free trial of Bitcoin Magazine Pro’s paid tier.

Digital Currency Group And Genesis Saga Continues

Before we get into today’s piece, it’s important to remember that there is an alarming amount of speculation versus actual information in the market discussion right now. This includes our own speculation while trying to analyze this situation in real-time. It’s not our intention to fuel fear or FUD in the market but rather lay out facts, data, analysis and potential scenarios as we see it.

Last week, we highlighted the ongoing situation with Genesis, which is owned by parent company Digital Currency Group (DCG). Read The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block. Genesis was looking for a $1 billion credit facility by yesterday for their lending division. Shortly after Monday’s close, news broke that Genesis is on the path toward bankruptcy after failing to raise the cash at this time. It was also announced that they approached Binance and Apollo for a potential deal and that Genesis is now seeking $500 million instead of $1 billion. Digital Currency Group followed up with their own letter today detailing liabilities between the two companies.

DCG and Genesis are closely linked and it makes sense that DCG has likely tried to take necessary steps to potentially save Genesis. Genesis and Grayscale are the key players in their portfolio. DCG is at risk of going down if a deal can’t be worked out with Genesis. Yet, we only have a few news headlines and sparse information to go on for now. More details will come out in the following days surrounding details about Genesis, DCG’s potential moves and the full extent of exposure. Here’s the optimistic case for a resolution.

There’s still many contagion scenarios that can play out on the news. We now know that Genesis has $2.8 billion in outstanding loans on its balance sheet while DCG has a liability of $575 million to Genesis due in May 2023. In under two weeks, Genesis went from announcing no material credit exposure, to losing $7 million, to announcing $175 million stuck with FTX, to halting withdrawals and new loans, to needing $1 billion and now potential bankruptcy. Latest news is that the company is still attempting to fundraise by Wednesday this week, but has hired a team to explore a bankruptcy path as well.

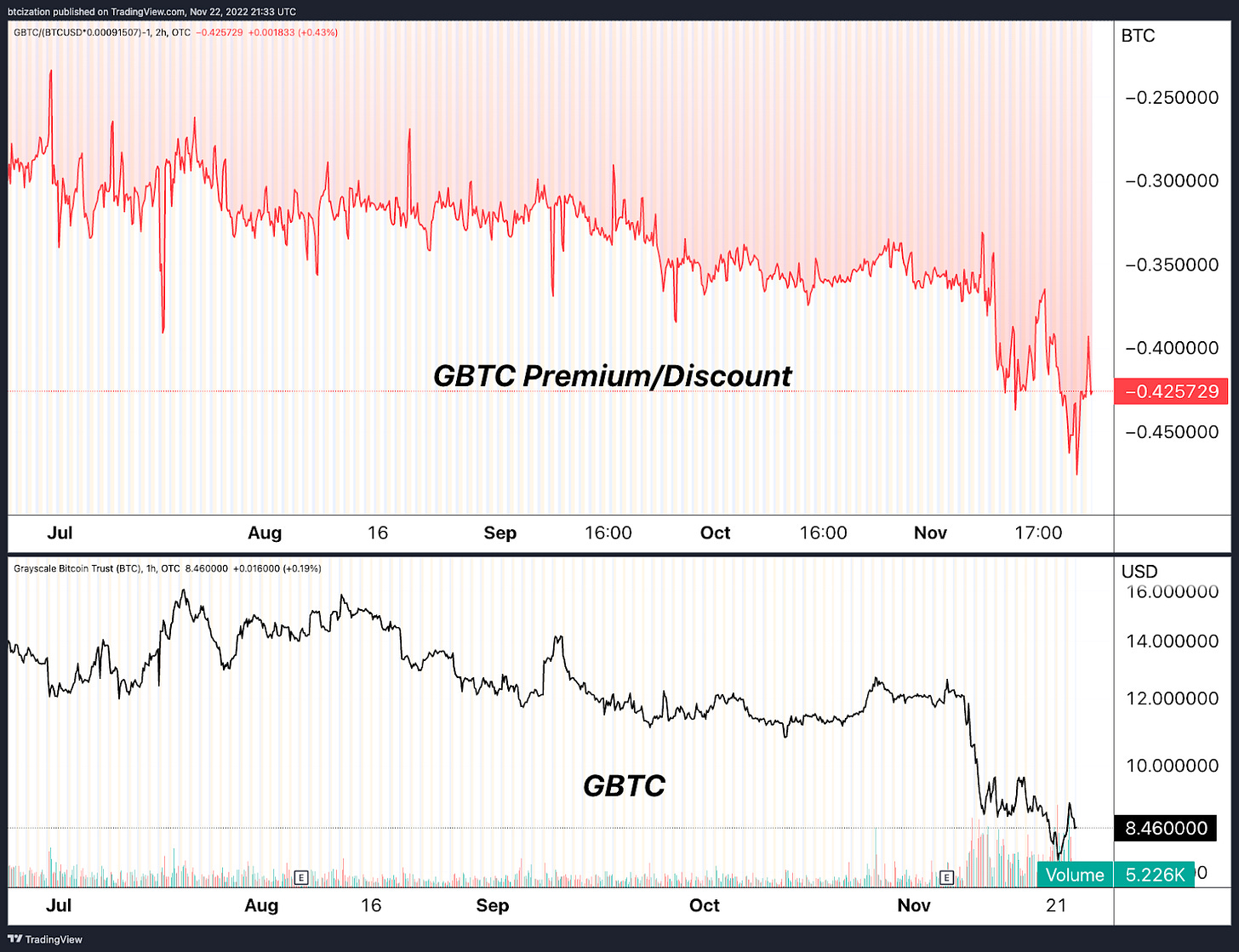

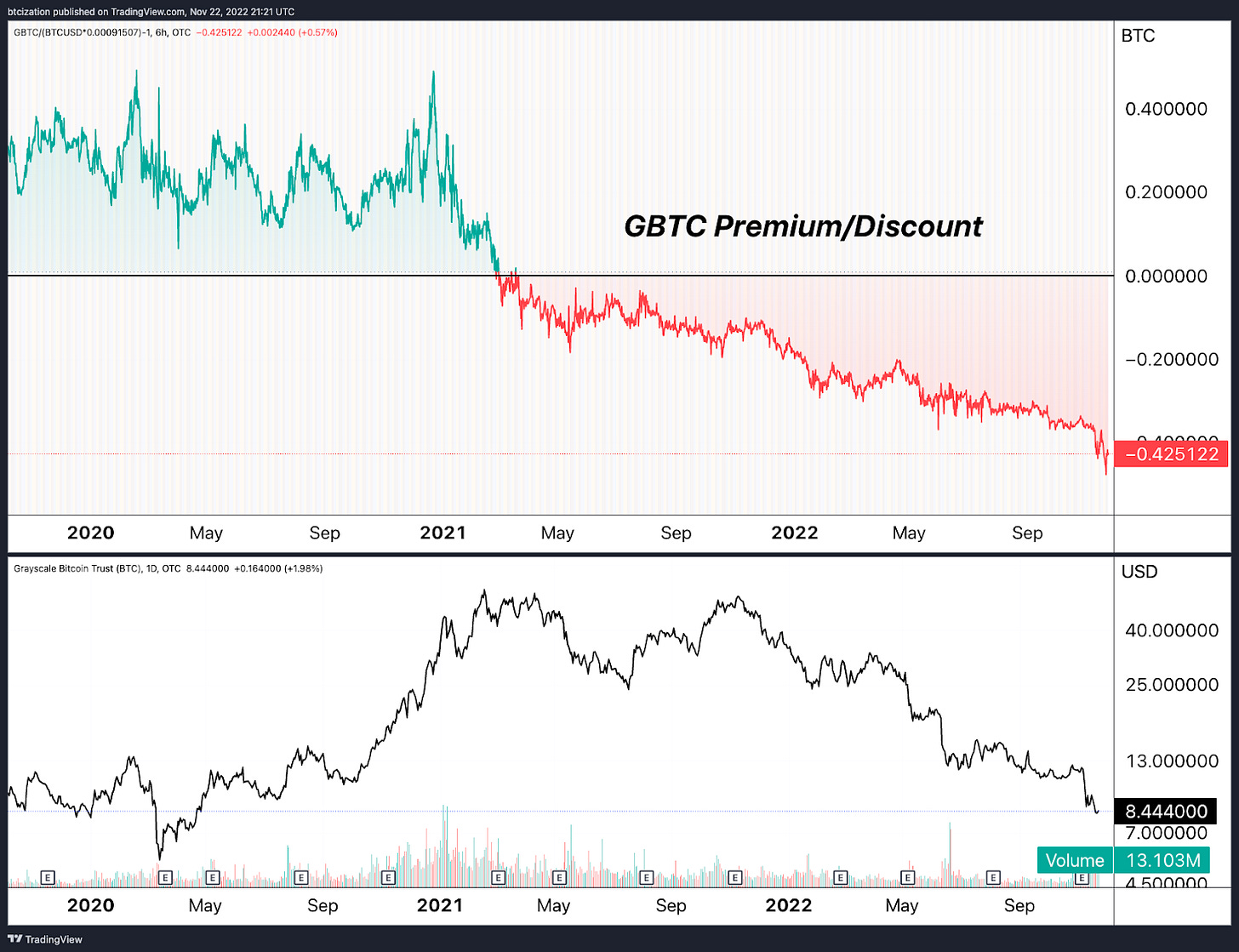

One of the scenarios to potentially save Genesis or to just raise liquidity, may include Genesis and DCG selling their GBTC holdings to raise additional funds. In fact, it’s pretty clear that someone with size has been selling GBTC holdings. In less than a week, GBTC is down over 23% in a fairly illiquid market (nearly double bitcoin’s drawdown). We know that DCG is the largest holder of GBTC making up nearly 10% of shares in the latest Q3 filing. At the same time, GBTC had been selling off and the discount reached 50%, Cathie Wood and ARK Invest ended up buying an additional 176,945 shares yesterday.

Source: Alex Thorn, Bloomberg

As fears have been rising over the last few days questioning and speculating around broader contagion risks, it’s been almost radio silence on the issue from DCG, Genesis and Grayscale until this afternoon. In an effort to calm the market and investors, Grayscale announced that all GBTC holdings are with Coinbase Custody and are not lent, pledged, hypothecated or rehypothecated. Yet, they don’t release the public information around on-chain wallet addresses for the bitcoin in the trust due to security reasons.

That can seem odd to the market especially when the Osprey Bitcoin Trust revealed their wallet address at Coinbase Custody this morning. Coinbase also announced that they have zero exposure to Genesis Trading. Coinbase is known to have a completely opaque wallet and address system that lacks transparency compared to every other exchange in the market. It would be FTX-level fraud and negligence to not have the assets there and secure on the platform as they say they do — an unlikely chance. Yet, in times like these, it’s the erosion of trust and counterparty risk in the market that many still fear. “Trust me” is not a good answer right now.

As per Coinbase Q3 filings, there are $101 billion in assets on their platform. 39% of those assets are bitcoin. Using the filing date for September 30, and the closing bitcoin price of $19,431, that would imply Coinbase has around 2,027,173 bitcoin on their platform. We can assume that includes all bitcoin across their retail, institutional and custody products. That’s 10.58% of all bitcoin supply using circulating supply on the same date as the filing. With those numbers, the Grayscale Bitcoin Trust holdings of 635,000 bitcoin would account for 31.32% of all bitcoin on Coinbase.

Source: Coinbase Quarterly Report

Although Genesis is only one company, DCG has 165 companies in their portfolio spanning the entire industry. We just don’t know the extent of DCG’s exposure and risk to Genesis and that can spark cause for concern across a much broader systemic risk unfolding. Maybe they are fine; maybe they aren’t. Again, we’re in speculation territory. Some tweets for thought are Barry Silbert’s thoughts on aggressively allocating to Zcash (ZEC) back at the top of the cycle.

Let’s say in the scenario that DCG is under liquidity stress and has to sell down their GBTC holdings and that’s not enough capital. Then there’s the case for the potential dissolution, liquidation or sale of Grayscale (DCG subsidiary) and the Grayscale Bitcoin Trust in the worst case scenario. Grayscale’s 2% annual fee is a cash cow making hundreds of millions in revenue per year so any path to give up the trust would mean that the company has no other choice but capitulation.

In that case, DCG could sell the entire (or partial) trust to another willing buyer. Complete liquidation of the trust is the least viable option, but it’s not off the table. A path toward redemptions and the closing of the discount is another path, but that all depends on the current state of DCG, a potential next buyer of the trust and SEC regulation approval for redemptions. In a potential DCG bankruptcy or insolvency, the trust may be dissolved and liquidated for cash or bitcoin.

While we doubt the fallout from a potential Genesis — and possibly DCG — bankruptcy would have a similarly outsized effect on the market compared to the LUNA/3AC or FTX meltdown. This fear of further deleveraging and balance sheet impairment is clearly keeping the market on edge.

Coinbase Stock Falling

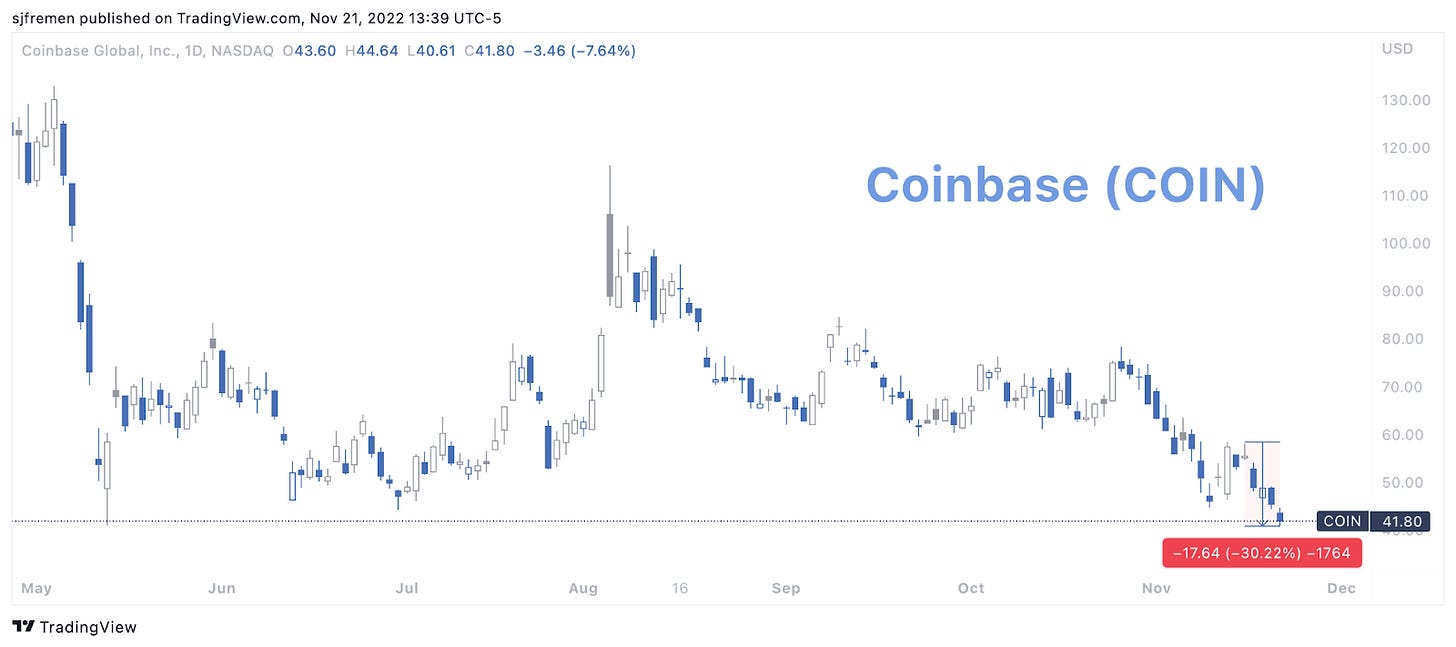

What’s worse than the GBTC drawdown over the last week? Coinbase equity. Coinbase is down 30% over the last week while their 2028 bonds are now yielding 17.77% priced at $0.50 on the dollar. Investors and appetite in the space are running away from everything touching a bitcoin or crypto company right now, especially exchanges. That even includes CEO Brian Armstrong who has been offloading his Coinbase shares, selling more than $1.6 million last week. Like most exchanges, Coinbase’s business model thrives off of high growth projections for retail users, trading fees and speculation. Now, nearly all of those factors are gone and Coinbase equity is in freefall.

Likely the repricing is a mix of heightened risks, investor appetite to quickly get out of the space and the 51% annual decline in retail trading volume heading into the depths of the bear market, per their latest quarterly earnings. In terms of competition, that’s also a concern. We don’t have a measure for Binance equity, but they are certainly picking up the bulk of FTX market share.

Source: Coinmetrics

Source: Coinbase Quarterly Report

While the market continues to hang in the balance with questions surrounding Genesis and DCG and Coinbase stock plummets without new retail users, speculation abounds for what will happen next. At this time, we are watching closely and will continue to update subscribers with the full FTX report early next week.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Excellent, as always