The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount

The exchange war has begun. The Binance CEO and FTX co-founder publicly duke it out as rumors of financial distress on the part of FTX and Alameda Research fly.

Relevant Past Articles:

The Exchange War

In Friday's article, The Bigger They Are, we briefly discussed the details around Alameda Research’s balance sheet and highlighted some questions surrounding the amount of FTT tokens they own in their asset holdings.

In short, it was revealed by CoinDesk that Alameda Research, a proprietary trading firm co-founded by FTX co-founder Sam Bankman-Fried, has a large amount of its net equity tied up in FTX’s native exchange token.

It didn’t take long before it became a much bigger deal in the rest of the market with CEO of Binance, CZ, telling the public yesterday that Binance intended to liquidate all of their FTT holdings from their books, approximately $580m worth, at the time of writing.

The CEO of Alameda Research, Caroline Ellison, responded with the following:

Those comments, and responses from the heads of FTX and Alameda Research, have generated two reactions from the market:

A bank run on assets sitting on the FTX platform.

An explosion in open interest from speculators around the value of the FTT token.

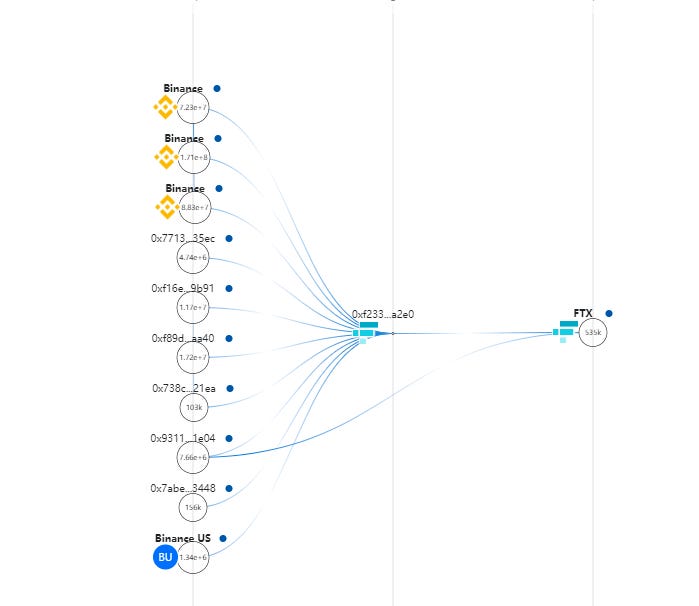

Whether strategic or not, FTX is one of Binance’s largest competitors and in just one day, those comments and Binance’s sale of FTT holdings have started a chain of second and third order effects. Most importantly is a wave of panic taking shape that questions the solvency of both FTX and Alameda Research. As a result, we’ve seen nearly $1 billion in assets and token values fly out of known FTX and Alameda addresses over the last week. That data is compiled by Larray Cermak, VP of Research at The Block.

In case you missed it: Bitcoin Magazine PRO hosted special guest Joe Consorti of The Bitcoin Layer to discuss the FTX situation in-depth. Click below to listen to the recording.

Sam Bankman-Fried responded early this morning to try and calm markets and FTX customers highlighting the platform’s ability to cover all client holdings, as well as its excess cash position. Bankman-Fried also responded to the reduced pace of customer withdrawals from FTX.

These events are developing in real-time and could easily change quickly by tomorrow. As of now, stablecoin balances on FTX have been depleting at a rapid pace as customers move to get funds off the platform. Stablecoin balances coming into FTX look to be nearly depleted, likely as funds are moved around (from other FTX and Alameda sources) to address the amount of withdrawals faced by the exchange. The second chart below shows this dynamic over the last few hours (at the time of writing).

Source: CryptoQuant

It’s a stark difference to see $451 million in stablecoins flow out of FTX over the last 7 days versus the $411 million that have flowed into Binance. That tells anyone in the market that the exchange giant (Binance), which already has approximately 60% of the volume in the entire space across both spot and derivatives markets, is out for blood and stands to gain during this FTX situation.

What this means now is that between FTX and Alameda, there are not only withdrawals to cover but also capital that needs to be deployed to defend the FTT token value. More on that below. While in theory FTX and Alameda are two separate entities, there has been increasing chatter and worry about the potential interdependency of the two firms on each other. This would be the worst possible scenario for FTX users and market participants.

There’s a broader risk to the market here as we see Alameda unwind many other positions across tokens and bitcoin that will be used to raise additional capital. Don’t forget that this duo is one of the most vital institutions in the space, especially when it comes to providing market making and liquidity for the entire market. We’re just in the beginning stages on what may play out here.

The Big Question

Two things that aren’t known, and remain the biggest questions are:

What are Alameda’s liabilities, in what currency, and lent from whom?

Does FTX have significant counterparty exposure to Alameda, given the companies’ extremely close and often opaque relationship between each other.

The rapid increase in withdrawals by FTX users reflect the uncertainty to the answers of both of these questions.

In regard to the second question, wallet movements from Alameda yesterday night certainly don’t inspire confidence.

Source: Wu Blockchain

Source: Wu Blockchain

CZ Stoking the Flames

As FTT’s exchange rate began to plummet, CZ took to twitter to stoke the flames even further, responding to a tweet that asked “with what money?” in response to Alameda’s supposed offer to buy all their FTT stake for $22 each with a shrug emoji.

The Co-CEO of FTX Digital Markets, Ryan Salame, then took to twitter to state his thoughts on the matter in a quote tweet directly to CZ, seemingly irritated that CZ would rather sell his token on the free market instead of negotiating an OTC deal.

The Speculative Attack

As FTT token started to sell off, the real worry for Alameda became more than simply absorbing the approximately $500 million in spot selling pressure that is coming from Binance, but also the pressure from hoards of speculators that began piling in via the futures market.

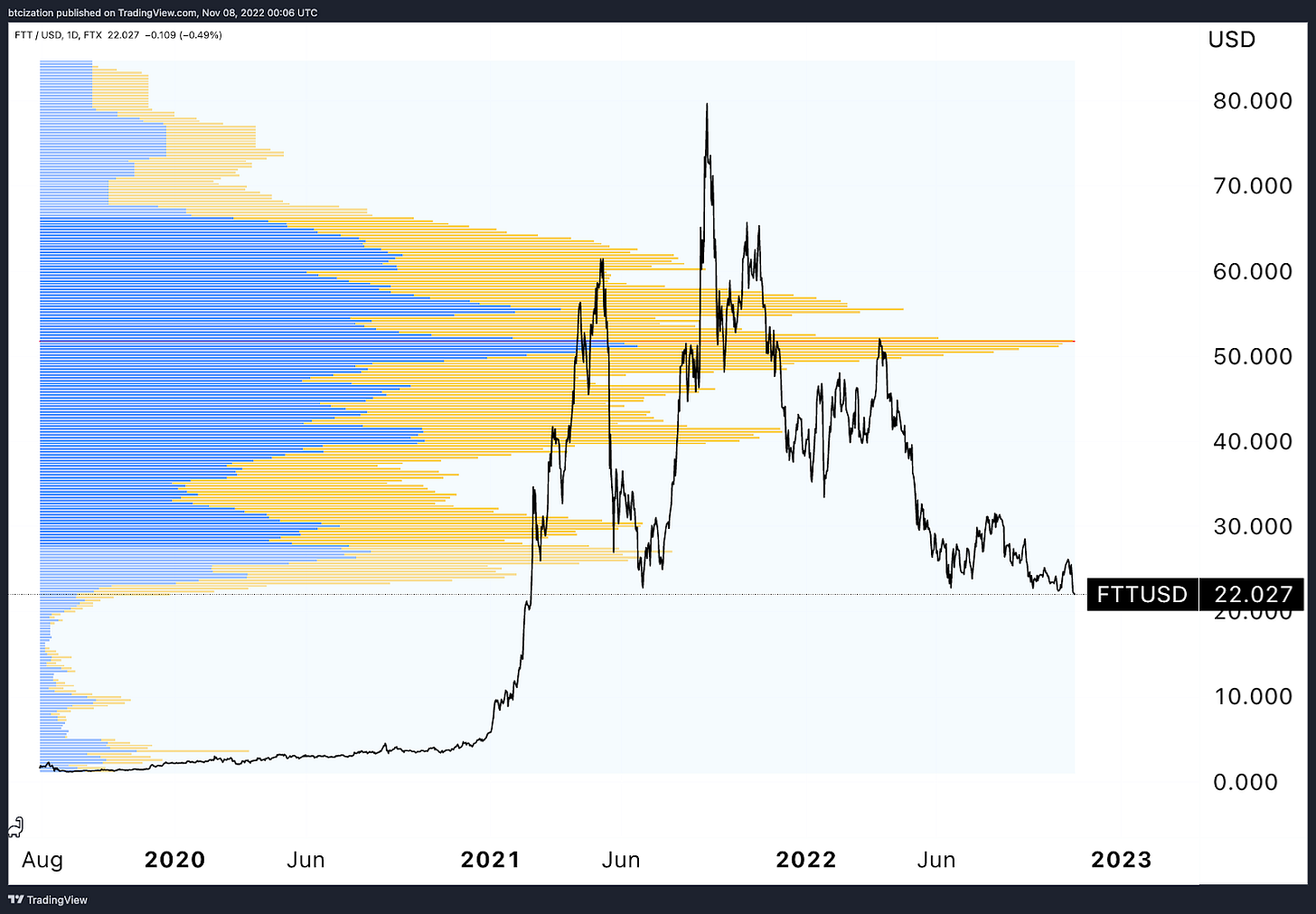

Shown below is the FTT exchange rate with futures open interest in both FTT and USD terms respectively. Over the last 48 hours, open interest has absolutely exploded.

It’s important to remember that we don’t necessarily know the exact terms of Alameda’s finances. However, we have seen their determination to defend the $22 level as well as its significance as support in the below chart. This provides a strong confluence of variables.

Alameda would likely not have such a vested interest in defending this level if it was not leveraged. Otherwise, they would let the market fall as much as it wants and simply acquire FTT at a lower price.

To display the historical significance of the $22 level, let’s have a look at the spot volume profile of FTT. Notably, there is an absolutely miniscule amount of historical volume that has exchanged hands below this level.

If Alameda has collateralized their FTT position, there are no large buyers to serve as buy side liquidity.

As reported by Dirty Bubble Media, the dynamic between FTX and FTT token looks awfully similar to that of Celsius Network and its token, CEL.

“The basic architecture of a flywheel scheme”

Source: Dirty Bubble Media

To quote Dirty Bubble Media’s latest piece,

Create a token: Tokens are literally just bits of code on a blockchain. Program that sucker up and get rolling. Make sure you retain the majority of those tokens on your balance sheet for maximum flywheeling.

Pump the token’s price: Retain a “market maker.” Buy tokens using your customer’s assets. Wash trade it to infinity. Do whatever it takes to drive that price sky-high! And since you kept most of the tokens for yourself, there’s that many fewer tokens out there to pump.

Mark those babies to market: That’s right! Now you reap your rewards; at least, on paper. Now you can show billions of dollars in “assets” on your balance sheet.

Show off your success: Now’s the time to cash in. Hook some savvy investors (suckers), like pension funds, into massively overpaying for your equity or into making you big loans collateralized by your token.

Keep that flywheel spinning: Now you have real dollars. Buy yourself something nice, like stadium naming rights, politicians, or failed crypto companies. But don’t forget: If the flywheel stops spinning, you’re gonna have a bad time.

With the developments that have occurred over the recent few days, it looks as if the apparent scheme that utilized FTT token to bolster the FTX/Alameda balance sheet is now under tremendous stress.

The Battle of The Order Books

We can see the defense being mounted currently on the respective exchanges. The exchange rate differential between the FTT price on FTX vs. Binance has pushed to historic highs as Alameda and crew attempt to defend their token. Meanwhile, CZ and an army of speculators have begun to sell and go short FTT.

We appear to be watching a classic speculative attack unfold. The best case for Alameda (and the market in general) is that the liabilities have been severely reduced since the end of the second quarter, and they are merely buying their token to prop up the market to inspire confidence.

In our view, this is unlikely, and we believe with an increasing level of confidence that there is a much more important battle going on, and the FTT exchange rate is a matter of solvency for Alameda.

Final Note:

Industry titans have begun to battle. What began as passive aggressive comments on social media has turned into outright market based financial warfare. While Alameda attempts to defend the FTX exchange token FTT with its spare capital, CZ looks to be rejoicing in the moment as speculators pile on short, thus increasing the downward exchange rate pressure.

To prepare, readers should thoroughly evaluate the risk/reward tradeoff with holding funds on FTX for the time being. If FTX is a fully reserved exchange as they claim to be, there is absolutely no trouble, and this too shall pass. However, if there are indeed strong financial ties between Alameda and FTX and the market’s suspicions are true, the result could be quite an ugly one.

When the solvency of a bank/exchange itself or their close counterparty comes into question, vigilant market participants take action.

We are not implying FTX is insolvent, nor are we encouraging a run on its reserves. Simply, we are monitoring the current state of events and putting our best interpretation forward for our readers.

As of now, we are left with more questions than answers as to the state of Alameda’s financial standing, and this uncertainty has subsequently introduced tail risk into having funds on FTX for the time being.

We will update our readers when more relevant information emerges.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

BTC-USD 8500-9000 bottom this cycle. Then 200k in 2025

https://open.substack.com/pub/finiche/p/flash-market-update-bitcoin-tanks?utm_source=direct&r=1s05vd&utm_campaign=post&utm_medium=web