Every issue this week has been focused on the contagion developing around the bitcoin/crypto lending market, given the recent insolvency of notorious hedge fund Three Arrows Capital (3AC) and the suspension of withdrawals by custody/lending platform Celsius.

Monday’s issue - Celsius Exchange Halts Withdrawals: What Went Wrong?

Tuesday’s issue - Celsius And stETH - A Lesson On (il)Liquidity

Wednesday’s issue - Three Arrows Capital Faces Liquidation

Thursday’s issue - Fears of Further Contagion

Yesterday’s issue, Fears of Further Contagion, ended with the following,

“Over the coming days/weeks, there likely will be more information as to the damage done. Balance sheet contagion, while natively a byproduct of traditional finance and fractional reserve banking, has hit the bitcoin/crypto market.

“This means that large amounts of dollar-denominated obligations exist against a fixed amount of crypto assets that can be pledged as collateral/sold. This is particularly why the market has plunged in the weeks following the crash of UST, and now the failure of Celsius and 3AC.

“While bitcoin is already down 70% from its all-time high, the increasingly volatile nature of the legacy financial system recently along with the contagion risk spreading around the crypto market signals that more pain is likely to come.”

It looks like another lending firm, Hong Kong-based Babel Finance, has suspended withdrawals from its platform, citing liquidity pressures as the reason for the decision, in an official statement posted on the company website.

“Dear Customers,

“Recently, the crypto market has seen major fluctuations, and some institutions in the industry have experienced conductive risk events. Due to the current situation, Babel Finance is facing unusual liquidity pressures. We are in close communication with all related parties on the actions we are taking in order to best protect our customers. During this period, redemptions and withdrawals from Babel Finance products will be temporarily suspended, and resumption of normal service be notified separately. We apologize sincerely for any inconvenience caused.”

Babel is one of Asia’s largest crypto lending firms, and it is reported that this isn't the first time the firm ran into trouble during a major crash. Accusations were made against the firm back in 2020 that the firm was insolvent during the March 2020 crash, and illicitly leveraged traded client funds during the market recovery to bail itself out.

While the firm denies these allegations, apparent whistleblowers and with leaked audio tapes claim otherwise. Regardless of the past allegations, Babel is in trouble, and the continued balance sheet impairment across the industry confirms our fears of further contagion in the market.

The firm also has engaged in partially collateralized loans to miners backed by bitcoin, with the machines purchased with the loan proceeds serving as the underlying collateral for the rest of the value of the loan. In a bull market for bitcoin (and for hash price), where miner profitability soars, this is a feasible and very profitable strategy.

During a market downturn, where both bitcoin and ASIC miners decline in value (especially as hash rate and subsequently miner difficulty continue to increase), this strategy has the potential to turn disastrous.

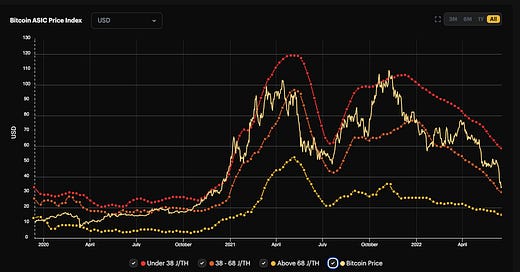

Shown below is the price of ASIC machines with varying levels of efficiency alongside the price of bitcoin since 2020. Given the illiquidity of ASIC machines (relative to liquid bitcoin), this is partially where Babel began to run into trouble.

Source: Hashrate Index

It is also likely that Babel had some exposure to 3AC in some form, and has suspended withdrawals in an attempt to bolster liquidity and maintain solvency. Worsening signs of contagion among crypto native lenders doesn't paint a bright picture over the short term.

A side note on miners:

In the coming weeks/months ahead, it will be key to watch how miners react to the plunge in market prices, and which operations can sustainably manage their risks and maintain profitability.

The depths of bear markets offer the best opportunities to purchase both the underlying ASIC machines and private/public bitcoin mining operations with the goal of achieving a positive return on investment in bitcoin terms.

GBTC Discount Plunges To New Lows

In today’s trading session, the Grayscale Bitcoin Trust plunged to a new low relative to NAV (net asset value). Shares of the trust, which trade OTC (over the counter), have had the exact opposite effect on the market throughout much of 2021 and 2022 then they had previously, as the market arbitrage that existed with GBTC premium added significant spot buying pressure as shares were created into the trust locking in bitcoin. Now, with the shares trading at a significant discount to NAV, the trust has siphoned institutional demand for bitcoin at the margin.

With the shares trading at a record discount, it would seem the market is scared of the potential forced liquidation of 3AC’s GBTC position, as the firm was previously the largest holder of the trust, with 5.6% of outstanding shares.

Source: tier10k

The Block’s Frank Chaparro reported earlier this afternoon that 3AC was pitching the GBTC discount to investors the week before the fund’s insolvency as an arbitrage trade, where investors would give the fund bitcoin in return for a 12-month promissory note.

“‘They pitched to so many people,’ said a person familiar with the trade pitch.

“Another source, who shared the investment deck, told The Block that the Three Arrows team began circulating the deck on June 7, noting that, in hindsight, the pitch was perhaps a last-ditch effort to save the company after a series of crypto bets soured.

“As for the arbitrage opportunity, the firm said that Three Arrows could lock up BTC with TPS for 12 months and receive a promissory note in return for the bitcoin.” - The Block

The pitch by 3AC looks to confirm that the fund still has large exposure to GBTC, which is far less liquid than bitcoin the asset itself. If 3AC still is in possession of a large amount of GBTC that has yet to be liquidated, the discount could widen even further, presenting a huge opportunity for investors. Currently, shares of GBTC are trading equivalent to bitcoin at $13,300, approximately a 35% discount.

At a 35% discount, if a shares returned to net asset value with an eventual conversion to a spot ETF, GBTC shares would return approximately 54% against bitcoin itself in short order. For investors with funds in a traditional brokerage account, there are few opportunities that offer greater upside potential in native BTC terms.

Final Note

The theme of the week in our issues has been clear.

Contagion.

Take possession of your own bitcoin, and eliminate counterparty risk where possible. The only thing worse than becoming a forced seller due to your own leverage, is becoming one due to risks of a counterparty you entrusted.

And they said to one another, Come, let us build a city and a tower, whose top may reach unto heaven; and let us make a name for ourselves, lest we be scattered abroad upon the face of the whole earth

Appreciate you guys having your finger on the pulse this week