Major news shuttered crypto markets late Tuesday night, as alleged rumors of insolvency at Three Arrows Capital, a giant in the crypto fund space, look to be confirmed to be true. This is following the Celsius debacle, which we have documented in the latest two issues of Bitcoin Magazine Pro.

Read the Monday and Tuesday issues here.

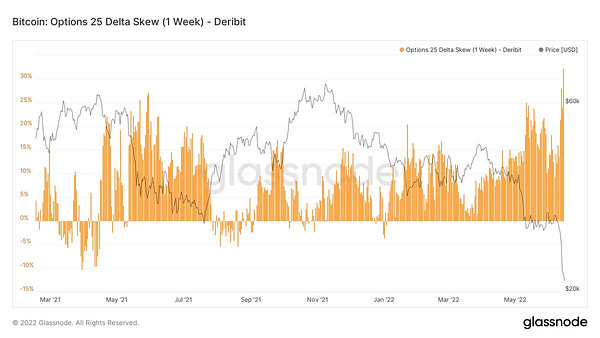

With the price of bitcoin plunging close to its 2017 all-time high of $20,000, a cascade of liquidations looked increasingly feasible, and traders in the bitcoin options and derivatives market scrambled for protection.

1-week implied volatility in the options market briefly touched an astounding 216% as the market hovered above the liquidation of many risk models that had assumed a retouch of previous cycles highs was not likely (given its lack of occurrence throughout the history of bitcoin).

In particular, put options garnered a massive premium, given the increasing likelihood of a market wide liquidation event below $20,000 BTC and $1,000 ETH.

Ultimately, bulls look to have just barely escaped before a cascade could begin. Along with the late scramble for downside protection in the options market, traders in the futures market shorted heavily into the lows, with a sharp rise in open interest accompanied by deeper levels of perpetual funding rates showing that derivatives were a driving force in the price action.

As large spot buyers defended support at 2017 highs and the market bounced off the lows, late shorts got squeezed resulting in stablecoin margin open interest falling more than 26,000 BTC since its intraday high at the time of writing.

As mentioned in the previous two issues, the counter-party risk of a major exchange/lending platform going under (Celsius) has massive implications for the rest of the market. Now, we have another industry player in Three Arrows Capital that has gone under, and is unable to meet margin calls.

Three Arrows is rumored to have exposure to most of the major lending desks in the industry, and an insolvency would mean that the equity cushions for these desks would take a major hit. The likely response to this event would be an even further increase in defensive position and a contraction of market liquidity in an increasingly illiquid and volatile market.

The collapse of LUNA/UST, and now the insolvencies of Celsius and Three Arrows Capital look to be crypto’s version of Bear Stearns’ and Lehman Brothers’, with forced unwinds and damaged balance sheets leaving even the largest players reeling.

The market crash and insolvencies not only damage lending desks and leveraged funds, but also the mining industry.

While the market bounced off strong support, many signs point to lower prices and a purge in excessive leverage and weak industry players/miners.

Final Note

The number one rule of bitcoin is don’t become a forced seller. As price hovers above $20,000 ($22,400 at the time of writing), it looks increasingly likely that a test below the key level will be made, testing the stop loss and liquidation levels of many.

Survive. There are no bailouts, just liquidations.

This is a feature of the system, not a bug.

Back to back to back bangers - you've got your work cut out for you. Well done, Dylan!