Counterparty Risk Happens Fast

There are decades where nothing happens; and there are weeks when decades happen. That’s what we just saw for the Bitcoin industry. Watch the second- and third-order effects that come next.

Relevant Past Articles:

The Bigger They Are

“There are decades where nothing happens; and there are weeks when decades happen.”

It’s been one of those weeks. There’s been a wave of new developments since our piece released on Monday night, The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount. We highlight some of those developments and what they might mean for Bitcoin.

The TLDR, as you probably know, is that FTX and Alameda Research are insolvent. This will be a historic stain on the broader industry and many are feeling the pain right now as a result.

In our issue released last Thursday, “The Bigger They Are…,” we warned readers of the potential spillover effects for the market price.

“With the FTT market still extremely bloated relative to 2020 valuations, it’s possible that the concentration and liquidity risk will lead to some forced deleveraging.”

“We covered and tracked similar dynamics in regard to Celsius and LUNA. While those were completely different and tangential to the bitcoin market, this speculative excess and balance sheet leverage/concentration in general can lead to market-wide sell pressure native to crypto markets.”

“The biggest risk inherent to the bitcoin market today remains the weak players hanging by a thread underneath the surface. The lack of meaningful price volatility in this $20,000 range is certainly encouraging from the standpoint of buyers and sellers finding a temporary equilibrium. But as the frequency of miner troubles continues to rise, along with the possibility of more fund-based leverage still in the market, max pain unequivocally is lower for industry participants. The brunt of the selling has taken place with bitcoin now at $20,000, but one has to question whether the marginal buyer is of sufficient size to stem the potential selling pressure on the horizon.”

In regards to FTX halting withdrawals, we also posted a warning to users on the eve before the collapse,

“To prepare, readers should thoroughly evaluate the risk/reward tradeoff with holding funds on FTX for the time being. If FTX is a fully reserved exchange as they claim to be, there is absolutely no trouble, and this too shall pass. However, if there are indeed strong financial ties between Alameda and FTX and the market’s suspicions are true, the result could be quite an ugly one.

When the solvency of a bank/exchange itself or their close counterparty comes into question, vigilant market participants take action.” - The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount

Now let’s discuss some possible implications going forward.

FTX and Alameda together (at this point we can consider them one and the same) were one of the largest exchanges and market makers in the space. There are few players in the space who had absolutely zero exposure to either of these firms so be cautious of additional fallout risks arising in the coming weeks. It turns out that there were many headline warning shots of this happening but few could really predict how bad of a hole FTX had gotten itself into — nearly $6 billion. FTX used $4 billion of customer funds to keep Alameda afloat when the fund was on the verge of blowing up just like everyone else this past summer. One of their largest investors, Sequoia Capital, has marked down their investment to $0. Yet, The FTX balance sheet hole is the one that matters across potential impairment losses to all creditors and depositors. Customer claims are trading for pennies on the dollar with a potential impairment rate of over 90%. Latest news has FTX seeking $9.4 billion.

For example, following the bankruptcy of Voyager in the summer, it was found out that Alameda was a creditor to the tune of $376 million. What other firms lent Alameda capital that now has a massive balance sheet impairment to handle? At this point, we can’t know for certain.

There will be no Binance bailout and the bankruptcy route is the likely option for FTX as they scramble to find a capital raise from anyone. We don’t know yet for sure as FTX could find a surprise funding option somewhere to make (or partially make) people whole.

This is a Long-Term Capital Management and Lehman Brothers-style moment, and is potentially larger in magnitude than what happened with the previous market contagion. There will be more names and bodies to surface in the aftermath. All eyes are now on the counterparties of Alameda, all other exchanges in the space, stablecoin operators and highly connected companies in the ecosystem:Genesis, Silvergate, Galaxy Digital, CoinShares and BlockFi are a few examples.

We don’t intend to fuel any additional FUD (fear, uncertainty and doubt) on the fire, but once again, the contagion will spread and there will be second- and third-order effects to play out. For Silvergate, FTX was their largest customer; they announced a change in executive management just a few days ago, the stock is down over 31% in just five days and are in the midst of bleeding customer deposits. Even worse, they issued a statement highlighting that “they have the ability to borrow from the Federal Home Loan Bank to strengthen liquidity.”

For others, Galaxy Digital had $76.8 million in exposure to FTX with their stock down similar to Silvergate’s. FTX’s credit line and original bailout to BlockFi is now in question, along with questions around Alameda exposure, while BlockFi has announced their products are still fully functional. Genesis announced a $7 million loss across all counterparties including Alameda. Asset manager CoinShares, has over $31 million in pending withdrawals from FTX.

Even amid all this and the near radio silence from FTX and Alameda, there was some on-chain activity spotted to show a potential Alameda play to depeg Tether (USDT) in order to make money back in other plays. So far, the peg briefly dropped to around $0.97 but has since been recovering. This is some of the most pressure the peg has faced since 2018. Tether has always been a scapegoat for critics outside the space but has yet to fail. On the same day, Tether was asked by law enforcement to temporarily freeze $46 million from a wallet that belongs to FTX, as an investigation is ongoing.

Sam Bankman-Fried tweeted earlier today his apologies around the lack of liquidity issues during a high-withdrawal period but has said nothing publicly about the claims and information around the hole on the balance sheet and the use of customer funds to Alameda. He also didn’t address the entire FTX international customer base that has its money tied up in the withdrawal process or likely gone.

Bitcoin Price

As for the price, $15,000 may be a dream allocation for many at previous $69,000 highs, but bottoms and consolidations can take weeks and/or months to play out. On top of that, bitcoin is likely going to be relatively “cheap” for some time as macroeconomic headwinds only intensify. This is a blood-in-the-streets type of week but it may not be the only one we have in front of us this cycle.

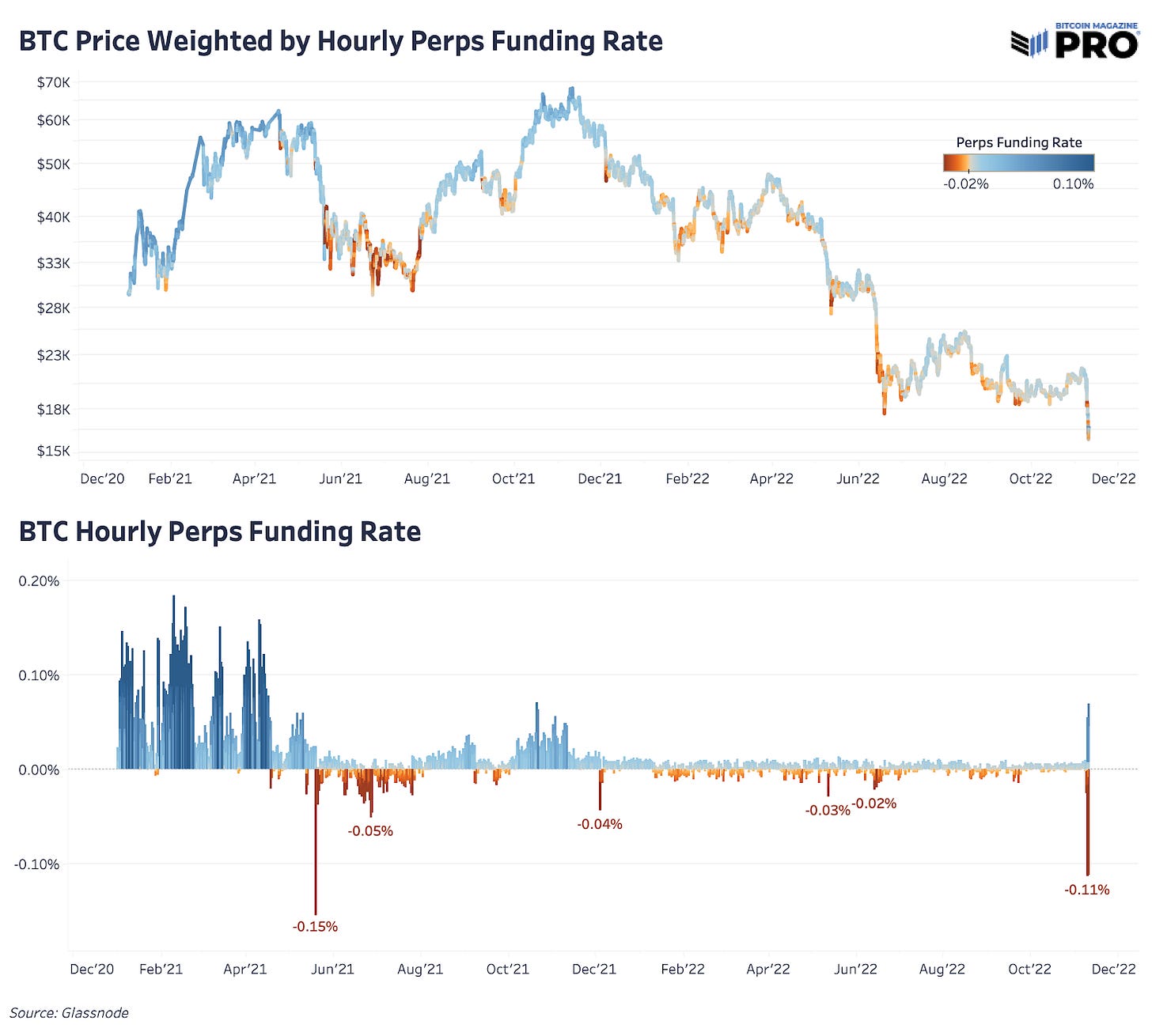

We finally saw the funding rate for the derivatives market reach some pretty historically low levels — an initial sign of capitulation taking place and forming as traders pile on to over-short bitcoin in waves.

With that being said, we are encouraged by the negative derivative positioning in tandem with a panic-style credit crunch — perhaps a catalyst for a macro bottom forming. While the global economy is still in the driver’s seat for all asset classes, the derivative positioning following this event, if sustained, is encouraging from a bitcoin-native perspective.

The latest price move comes with higher volatility and likely future volatile swings both ways over the next 30 days. Price flew down over 14.4% in just one day while the bitcoin volatility index is starting to pick back up. Expect vicious moves both to the upside and downside as the market figures out if this is a potential floor or something else. Price rejected heavily off the 100-day MA, and with shorts piling in we’ve already seen an initial squeeze move to take them out with today’s latest consumer price index data print. Expect to go through a few whipsaw-type actions, especially as even more liquidity has left the market completely.

From a price analysis standpoint, the market breakdown — while vicious and seemingly arriving “out of nowhere” — was rather unsurprising considering the circumstances we have been highlighting since early summer.

We have been notably bearish in the short term, and for better or worse we have been vindicated in those views. These events are how long-term bottoms are formed — once all irresponsible leverage has been wiped from the asset class.

Final Note:

Steady lads.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Excellent analysis as always

Absolutely loving your content Dylan and Sam, would you be open to allowing us to share it with our 60k+ audience as well?