Silvergate Bank Faces Run On Deposits As Stock Price Tumbles

Silvergate Bank is an important fiat-to-crypto on-ramp, but it’s currently under mounting pressure as investors worry about the bank’s recent financial reports and potential regulatory scrutiny.

Relevant Articles:

The FTX Ponzi: Uncovering The Largest Fraud In Crypto History

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Silvergate Bank Faces Run On Deposits As Stock Price Tumbles

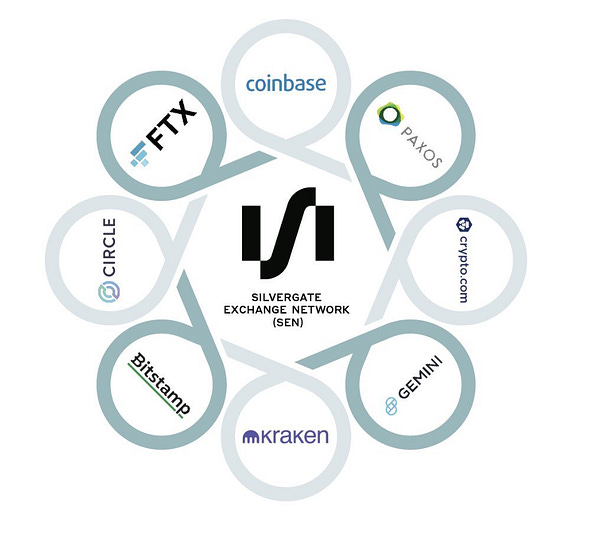

The story in crypto circles over the last few days has been the massive plunge in shares of Federal Reserve Member Bank Silvergate Capital. One of the most crypto-friendly banks in the world, Silvergate saw its business success rise throughout the boom cycle of 2020 and 2021, with deposits soaring as a result of its in-house Silvergate Exchange Network (SEN), which is a payment platform developed by Silvergate that enables companies to transfer money to each other across the bank’s own rails. SEN is only available for transactions in U.S. dollars and euros — virtual currency transactions do not take place on the platform. The growing utilization of SEN was a huge boon for the Silvergate business as it gave the bank an almost-free method of funding its activities because the platform does not pay out interest on deposits on SEN. The platform grew in such an explosive manner due to the difficulty that traditional crypto firms had with finding reputable banking partners in the United States.

“The Silvergate Exchange Network (SEN) enables our digital currency and institutional investor clients to send U.S. dollars and euros 24 hours a day, 7 days a week, 365 days a year between their Silvergate accounts and the accounts of other Silvergate clients. This can be done via our proprietary API or our online banking portal, enabling near real-time transfers and immediate availability of funds.” — Silvergate website

Following the collapse of FTX, we began to monitor Silvergate closely and investors began to ask questions about the role that Silvergate may have played in enabling the illicit financial scheme for which Sam Bankman-Fried and his associates are charged.

In a now-deleted page on their website, Silvergate displayed the following quote from Sam Bankman-Fried:

As details emerged regarding the Silvergate operation, specifically in regards to the relationship with FTX — the fact that deposits to FTX were routed to the Alameda Research bank account at Silvergate — some investors began worrying about impending regulatory clampdown due to seemingly lax compliance and the possibility of anti-money laundering violations. As a result of this concern, the share price of Silvergate started to aggressively slide. Since the collapse of FTX, shares have fallen by nearly 80%.

The worry for Silvergate following the collapse of FTX was unlike many of the crypto-native firms that went bust over the course of 2022. Some of the issues we saw that led to other blowups were sour crypto-native loan books and large directional exposure to faltering crypto assets. As a traditional fractional reserve bank, the largest worry for SIlvergate was having a run on its deposits, which is exactly what happened when Silvergate announced its quarterly report, leading to shares plunging by more than 40% in a single trading day.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Scrutiny and warnings from the Federal Reserve about risks cryptocurrencies pose to banking institutions.

What makes SEN useful and why its loan books are important to industry players.

How the negative news cycle is a potentially bullish signal for bitcoin.

In a press release of its fourth quarter financials, Silvergate announced that due to a large run on the firm’s crypto deposits — to the tune of approximately $8.1 billion — the bank was forced to sell $5.2 billion of debt securities at a loss of $718 million as the rise of interest rates led to market losses for long duration assets.

“In response to the rapid changes in the digital asset industry during the fourth quarter, we took commensurate steps to ensure that we were maintaining cash liquidity in order to satisfy potential deposit outflows, and we currently maintain a cash position in excess of our digital asset related deposits,” — Silvergate CEO Alan Lane

The firm now has more cash on hand than the entirety of its digital asset deposits, yet increased regulatory scrutiny is likely to remain and potentially increase over the near term.

Just this week, the Federal Reserve published a Joint Statement on Crypto-Asset Risks to Banking Organizations, which outlined the following risks of the banking sector dealing with the crypto industry:

Risk of fraud and scams among crypto-asset sector participants.

Legal uncertainties related to custody practices, redemptions, and ownership rights, some of which are currently the subject of legal processes and proceedings.

Inaccurate or misleading representations and disclosures by crypto-asset companies, including misrepresentations regarding federal deposit insurance, and other practices that may be unfair, deceptive, or abusive, contributing to significant harm to retail and institutional investors, customers, and counterparties.

Significant volatility in crypto-asset markets, the effects of which include potential impacts on deposit flows associated with crypto-asset companies.

Susceptibility of stablecoins to run risk, creating potential deposit outflows for banking organizations that hold stablecoin reserves.

Contagion risk within the crypto-asset sector resulting from interconnections among certain crypto-asset participants, including through opaque lending, investing, funding, service, and operational arrangements. These interconnections may also present concentration risks for banking organizations with exposures to the crypto-asset sector.

Risk management and governance practices in the crypto-asset sector exhibiting a lack of maturity and robustness

Despite the massive flight of crypto-related deposits, SEN continues to see use as a settlement rail between firms in the industry, with Silvergate reporting average daily volume totaling $1.3 billion during the fourth quarter of 2022, compared to average daily volume of $1.2 billion in the third quarter of 2022. While one could certainly infer that volumes declined post FTX collapse, it clearly remains useful to exchanges and stablecoin issuers such as Circle.

Source: USDC by Circle Blogpost from November 2022

In no way is Silvergate’s existence a make-or-break for the functioning of Bitcoin as a network (obviously), but we do believe that the role that Silvergate plays as an on- and off-ramp for fiat-to-crypto transfers is significant.

Similarly, the SEN Leverage platform is important because it is one of the largest and most reputable ways for public firms to get access to loans using bitcoin as collateral. As of December 31, 2022, SEN Leverage commitments declined to $1.1 billion, compared to $1.5 billion on September 30, 2022, with the outstanding balance of SEN Leverage loans at $328 million, compared to $308 million in the third quarter of 2022.

Two notable names that have used SEN Leverage to get access to USD financing are Marathon Digital (MARA) and MicroStrategy Inc (MSTR). Just recently, Marathon announced it had paid down $30 million in revolver loans, freeing up 3,615 BTC worth of collateral that had been pledged with Silvergate. As for MicroStrategy, the firm currently has a $205 million outstanding loan with Silvergate, with the collateralized bitcoin currently being held by a collaborative third party. As per its most recent quarterly report, the firm has pledged 14,890 BTC so far, with approximately another 85,000 BTC left unencumbered.

While the bitcoin pledged by MicroStrategy is not directly held by Silvergate, increasing deposit outflows from the bank and/or further regulatory scrutiny could lead to a decreasing level of aggregate liquidity in the bitcoin and crypto ecosystem. With all things being equal, this would be short-term bearish for the bitcoin exchange rate.

We will continue to monitor the Silvergate situation closely, and will periodically update readers on any important information as it arises to the surface.

Final Note:

On a more positive note, the onslaught of negative news around the crypto space looks to be reaching a peak and at a certain level, forced sellers will eventually simply just run out of ammunition and buy side liquidity will be the dominant force. We don’t necessarily believe that we are there yet, but the type of events that have occurred over the past year are everything that you would look for if you were looking for a massive cleanse of alleged criminality, speculative leverage and weak industry players.

Steady lads.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!