The Bank Of Japan Blinks And Markets Tremble

The Bank of Japan sent shockwaves through global capital markets as it announced an increase in its targeted rate for yield curve control, sending global bond yields soaring.

Relevant Past Articles:

The Bitcoiner's Guide To Yield Curve Control & The Fiat End Game

Not Your Average Recession: Unwinding The Largest Financial Bubble In History

The Everything Bubble: Markets At A Crossroads

Bank Of Japan Raises Cap On Yield Curve Control

The macro story of the day was a shocker out of Tokyo.

Late Monday evening, the Bank of Japan (BOJ) announced it had increased its cap on 10-year bond yields from 0.25% to 0.5%, while keeping short- and long-term interest rates unchanged.

The cap at the 0.25% level had been suppressing global bond markets with the use of an unlimited money printer for Japanese debt. This in turn caused a significant deterioration of the yen against the dollar, while the BOJ used its immense pile of Treasurys to occasionally defend the currency against speculators.

We have written about this policy and its impacts on global markets many times before:

7/23/22 - The Unfolding Sovereign Debt & Currency Crisis

7/28/22 - The Bitcoiner's Guide To Yield Curve Control & The Fiat End Game

8/10/22 - Just How Big Is The Everything Bubble?

10/7/22 - Not Your Average Recession: Unwinding The Largest Financial Bubble In History

12/1/22 - The Everything Bubble: Markets At A Crossroads

In case you missed it: Bitcoin Magazine PRO hosted Matthew Pines to discuss the current geopolitical landscape and how to think about the next decade with shifting power structures.

While absolutely massive in its change for market dynamics, the move still leaves the BOJ far below its peers in terms of policy rate, which is mainly due to the demographics of Japan and its debt-to-GDP statistics.

This yield-cap increase, which was unexpected by economists surveyed by Bloomberg, caused an immediate jump in the yen and a slide in global government bonds, sending shockwaves through global financial markets. It also led to a surge in Japanese bank stocks, as investors anticipated improved earnings for financial institutions.

So we’ve seen how this surprise affected the Japanese market, but what impact will the Bank of Japan’s decision have on global bond markets?

Bank of Japan Governor Haruhiko Kuroda laughing as he hikes rates for the world.

As discussed on Oct. 8, with Lyn Alden on Twitter, given that sovereign debt can be synthetically fungible in terms of its rates due to the existence of currency basis swap contracts, U.S. Treasurys immediately gapped lower.

As the BOJ tightens policy, Japanese debt becomes relatively more attractive and the yen appreciates. This causes rates to tighten in U.S. markets, but causes the dollar to weaken relative to foreign exchange markets.

While Japan can’t let long-term interest rates rise meaningfully more than their newly imposed 0.5% cap for 10-year bonds, the move does erode the central bank’s credibility in the eyes of market speculators. This indecisiveness could bring future speculators in both its bond and its currency market.

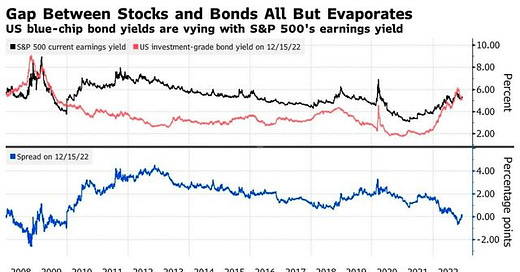

As we continue to refer to the sovereign debt bubble, readers should understand what this dramatic upward repricing in global yields means for asset prices.

As bond yields remain at elevated levels far above recent years, asset valuations based on discounted cash flows fall.

While many market participants are waiting for the return of 2021-like conditions for various financial markets, understanding how the change in debt markets affects all other liquid markets and relative valuations is key. For example, below is the market cap of global tech monopoly Apple:

First-level thinking may have you thinking that Apple is cheap because its market cap is down an extraordinary $881 billion since it became the world's first $3 trillion company in the first days of 2022.

It was not so long ago that Apple became the first company to surpass $1 trillion in market cap. The meteoric rise from $1 trillion in 2018 to over $3 trillion in 2022, now has apple shedding nearly $1 trillion in less than a year. Just five years ago, this level of absolute market cap drawdown in a single name would have been entirely unfeasible.

Just as it is key to compare relative rates of return across a single asset class, it is also important to examine this relationship across asset classes. Relative to risk-free government Treasury securities — in nominal terms, of course — this is the most expensive Apple stock has been in a decade.

While the mega tech companies dominate stock indices, the story is larger than any individual name or even geopolitical player. A historic interest expense shock is occurring in tandem with the largest absolute drawdown in asset prices ever. We expect the turbulence only picks up from here.

As market participants continue to attempt to front-run a pivot in global monetary policy conditions, the piping hot real economy has begun to decelerate and inflation is still far above most arbitrary central bank targets.

While the bitcoin market has had a massive deleveraging of its own already, the “pain trade” (as many think of it) could simply be an extended period of sideways consolidation as the legacy market dominos start to fall at an increasing frequency.

We expect the next secular bull market to be spurred by accommodative monetary policy responses to the conditions that are developing now. Global financial market liquidity conditions, credit worthiness and asset price valuations likely fall further from here — until the fiat monetary overlords decide to start debasing. For better or worse, this is the name of the game on the fiat monetary standard.

We are firmly in step three. Steady lads.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!