PRO Market Keys Of The Week: 3/6/2023

Exchange flows see a slight return as some investors cash in. Lightning Network continues to grow at an impressive pace and dollar cost averaging proves to be the best accumulation strategy.

Relevant Past Articles:

State Of The Mining Industry: Public Miners Outperform Bitcoin

No Policy Pivot In Sight: "Higher For Longer" Rates On The Horizon

What We’re Watching

Upcoming Economic Calendar:

March 7, 2023

10:00 a.m. EST, Fed Chairman Powell Testimony, Semiannual Monetary Policy Report to the Congress.

9:30 a.m. EST, Oral arguments in Grayscale’s lawsuit against the SEC.

March 8, 2023

8:30 a.m. EST, U.S. Balance of Trade, Forecast: -$68.9 billion.

10:00 a.m. EST, U.S. JOLTs (Job Openings and Labor Turnover Survey) Job Openings, Forecast: 10.5 million.

10:00 a.m. EST, Fed Chairman Powell Testimony, Semiannual Monetary Policy Report to the Congress.

March 9, 2023

10:00 a.m. EST, Vice Chair for Supervisor of the Federal Reserve speaking on Crypto to the Peterson Institute.

Bank of Japan Interest Rate Decision, Forecast: -0.1%, Prior: -0.1%.

March 10, 2023

2:00 a.m. EST, U.K. Month-over-Month GDP data release, Forecast: 0.1%, Prior: -0.5%.

8:30 a.m. EST, U.S. Non Farm Payrolls data release, Forecast: 200,000; Prior, 517,000.

Upcoming Macro Data to Watch

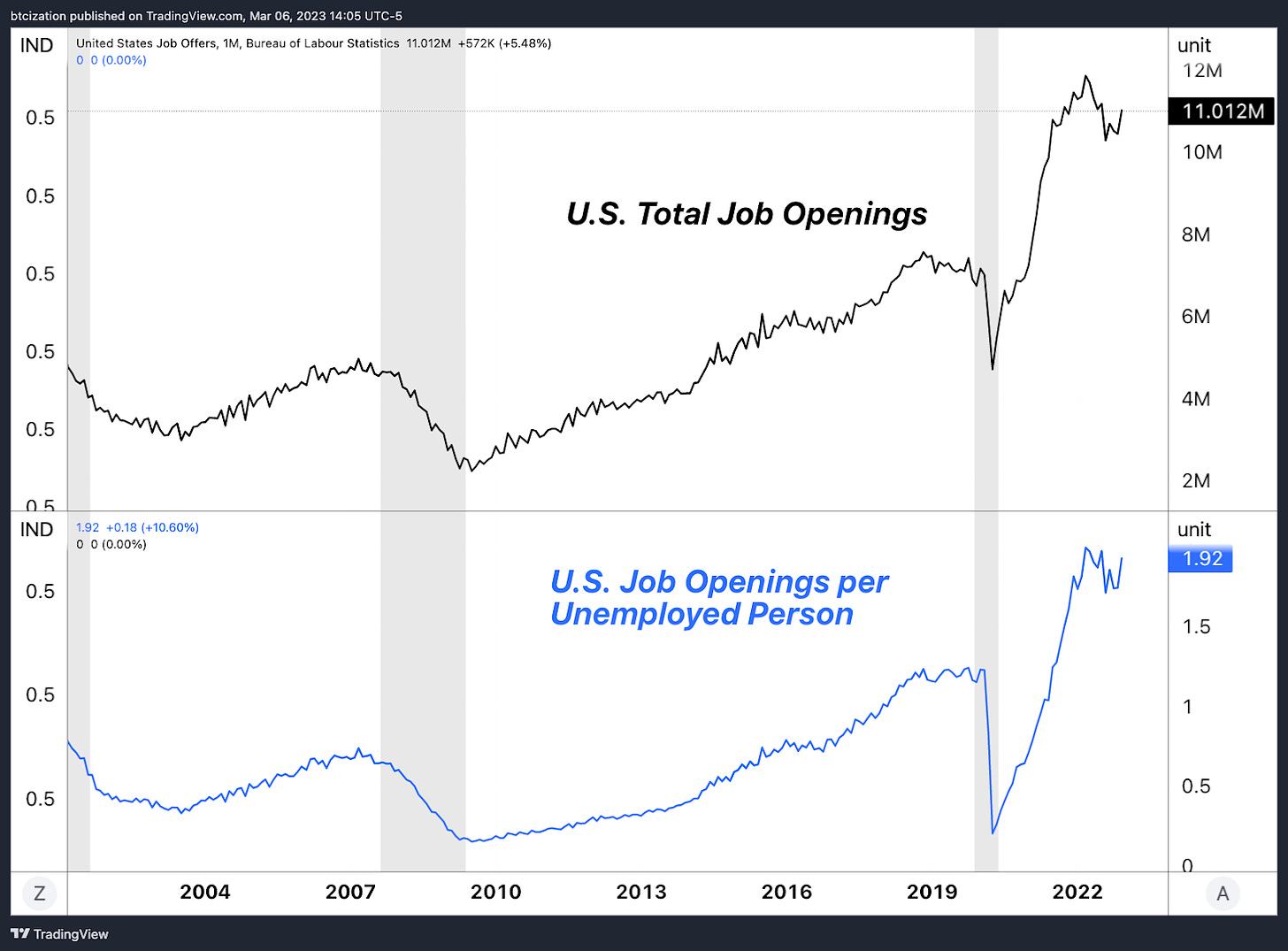

This week brings two important releases in particular: the U.S. JOLTs (Job Openings and Labor Turnover Survey) and Non Farm Payrolls data coming in on Wednesday and Friday morning, respectively.

The reason for the data’s relevance is the historically tight labor market conditions currently in place, with nearly two job openings for every one unemployed person in the U.S. labor market. The historically tight labor market is one of the conditions that gives the Federal Reserve the go-ahead to continue with their tightening regime.

The current forecast for Wednesday’s JOLTs release is 10.5 million. A beat to the upside is likely to place pressure on markets, as a resilient labor market would again reinforce the incumbent monetary tightening regime to continue.

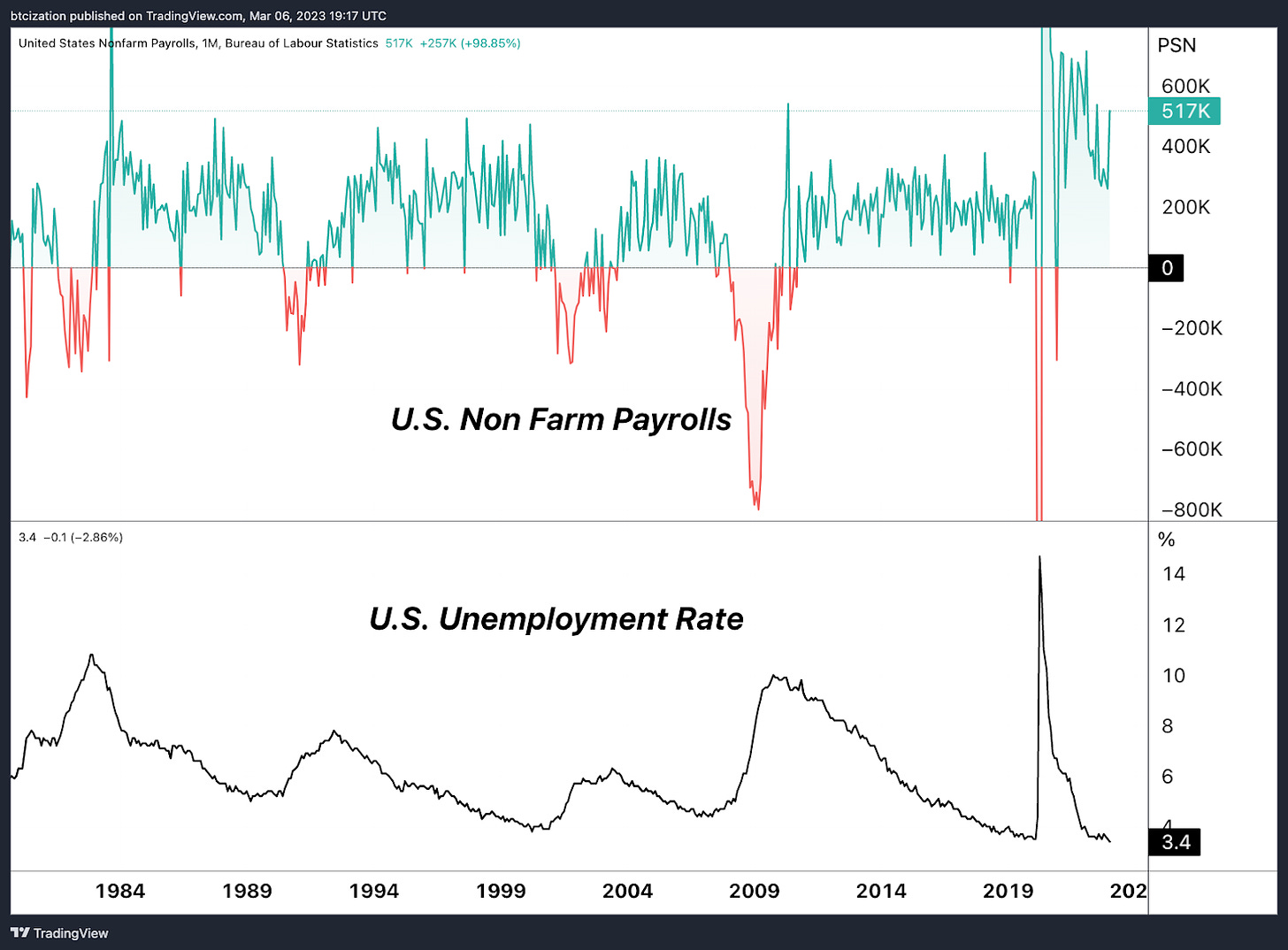

Similarly, with Friday’s 8:30 a.m. release of U.S. Non Farm Payrolls data forecasting +200,000, the market expects the labor market to remain red hot. (Non Farm Payrolls release shows the month-over-month change in non-farm jobs across the country.) Any reading over 200,000 would place pressure upon global stock and bond markets, with the reverse likely being true over the interim.

The real story in the intermediate term is the domestic economy’s current resilience to interest rate levels not seen in over a decade. Given the Fed’s intent to manifest slack across the labor market (read: The Fed wants you to lose your job to lower the inflation rate), expect this tightening cycle to continue until the unemployment rate begins to turn.

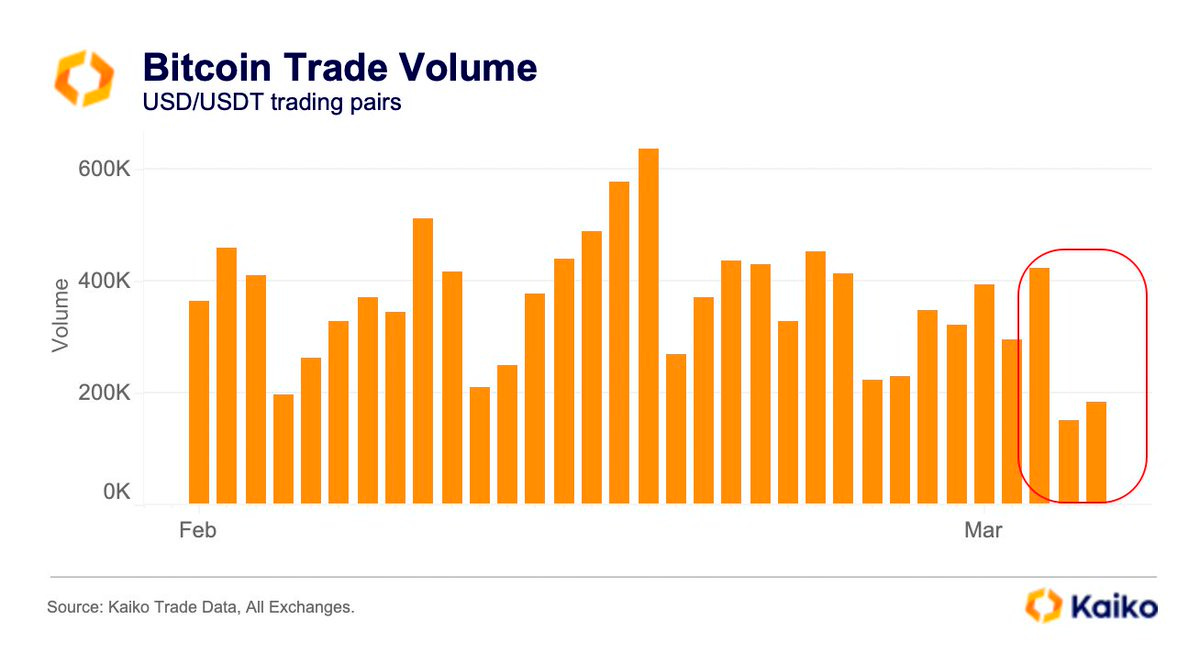

Bitcoin Liquidity Takes Another Hit

Used widely by exchanges and market makers, the Silvergate Exchange Network (SEN) has been a key on-ramp for U.S. dollars moving in and out of bitcoin markets. Trading volume immediately dropped this weekend after a run on Silvergate deposits. We highlighted this in-depth last week in “Banking Troubles Brewing In Crypto-Land.” Liquidity drying up and rapidly fleeting the market is another major risk and concern as regulatory pressures continue.

Source: Kaiko Research

Bitcoin 2023 ticket prices increase FRIDAY at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

Limited-time offer: Industry Passes come with a 6-month PRO subscription!

Bitcoin Relative To S&P 500

In the latest round of long liquidations, bitcoin price has started to turn over while S&P 500 chops around 4,000. This has been essentially the same level in the market since the federal funds rate started to materially rise in May 2022. In our view, little has changed from our belief that the current rally is an explosive bear market rally for risk assets. Bitcoin will likely follow any larger equity move to the downside. Currently, bitcoin’s realized price has been stagnant around $19,800 and will be a key support and retest level if price breaks lower.

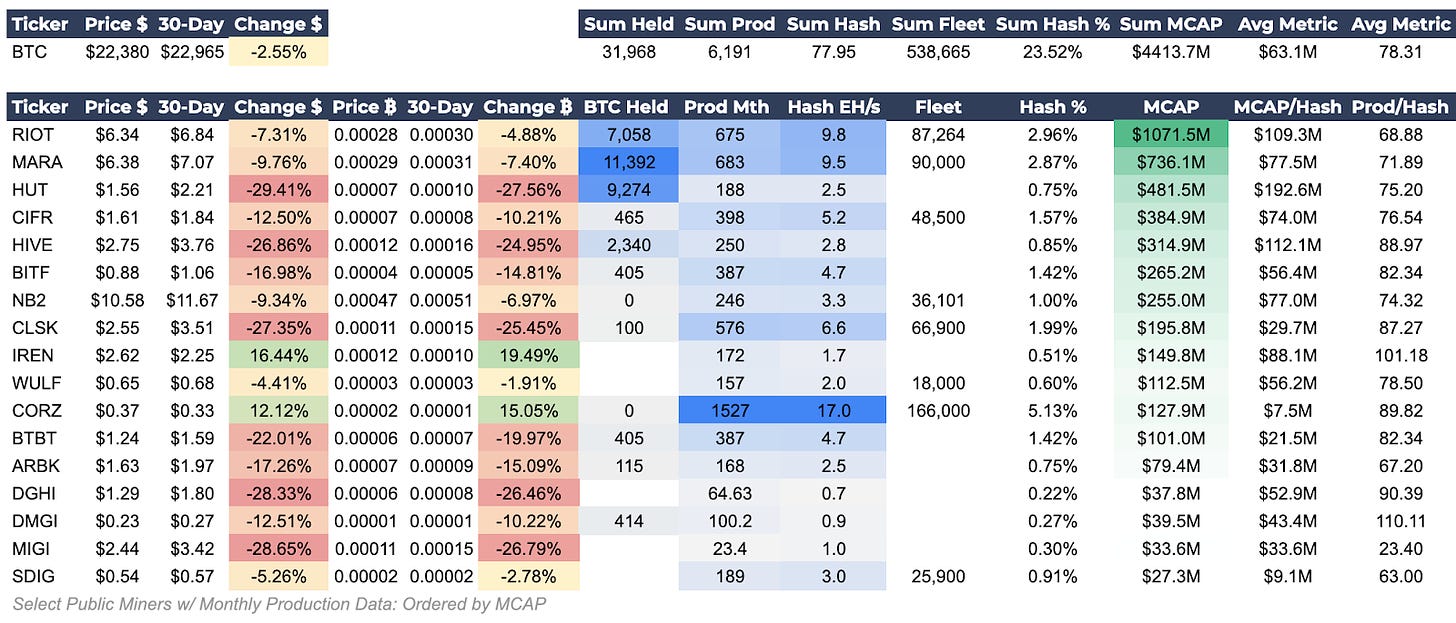

Public Miner Equities

As we’ve highlighted in many of our previous pieces, public mining equities outperform bitcoin in bull markets and underperform in bear markets. After the broader rally to start this year, with some public miners returning over 100% from new lows, nearly all public miners are back to underperforming bitcoin over the last 30 days.

Related: State Of The Mining Industry: Public Miners Outperform Bitcoin

The latest round of production updates from public miner production are starting to come out this week and are showing continued expansion in hash rate. This has helped the overall network hash rate hit new all-time highs of 330 EH/s. As a rough estimate, this select group of public miners make up around 23% of total hash rate. Data below is from our live Bitcoin Magazine PRO Mining Dashboard available to paid subscribers.

LIVE Market Dashboards!

Reminder: Paying subscribers now have access to the live versions of the Market and Mining Dashboards. Details here.

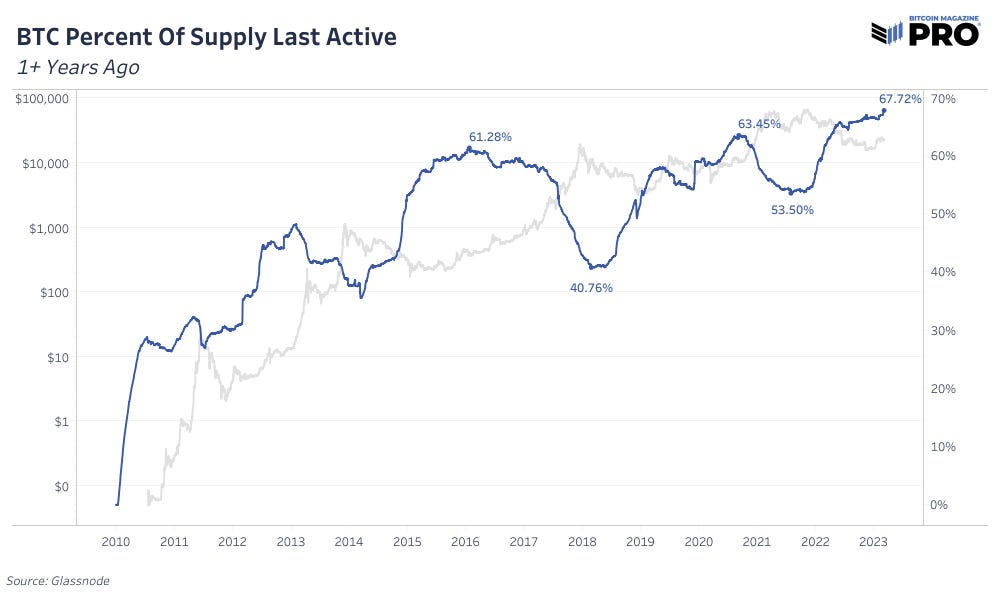

Bitcoin HODLer Strength At All-Time Highs

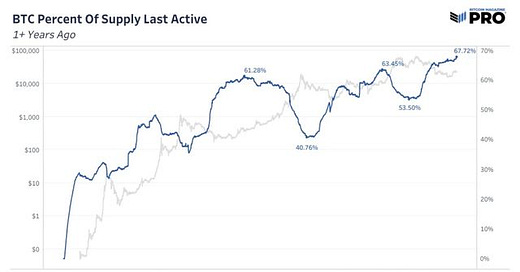

Bitcoin dormant for over one year has reached a new all-time high in both absolute terms and as a percentage of total circulating supply — demonstrating the relentless accumulation that continues to occur from the cohort of price agnostic HODLers/investors. While the one-plus year threshold is very simplistic in nature, the metric strongly demonstrates the conviction of the investors who are holding a majority of the circulating bitcoin supply.

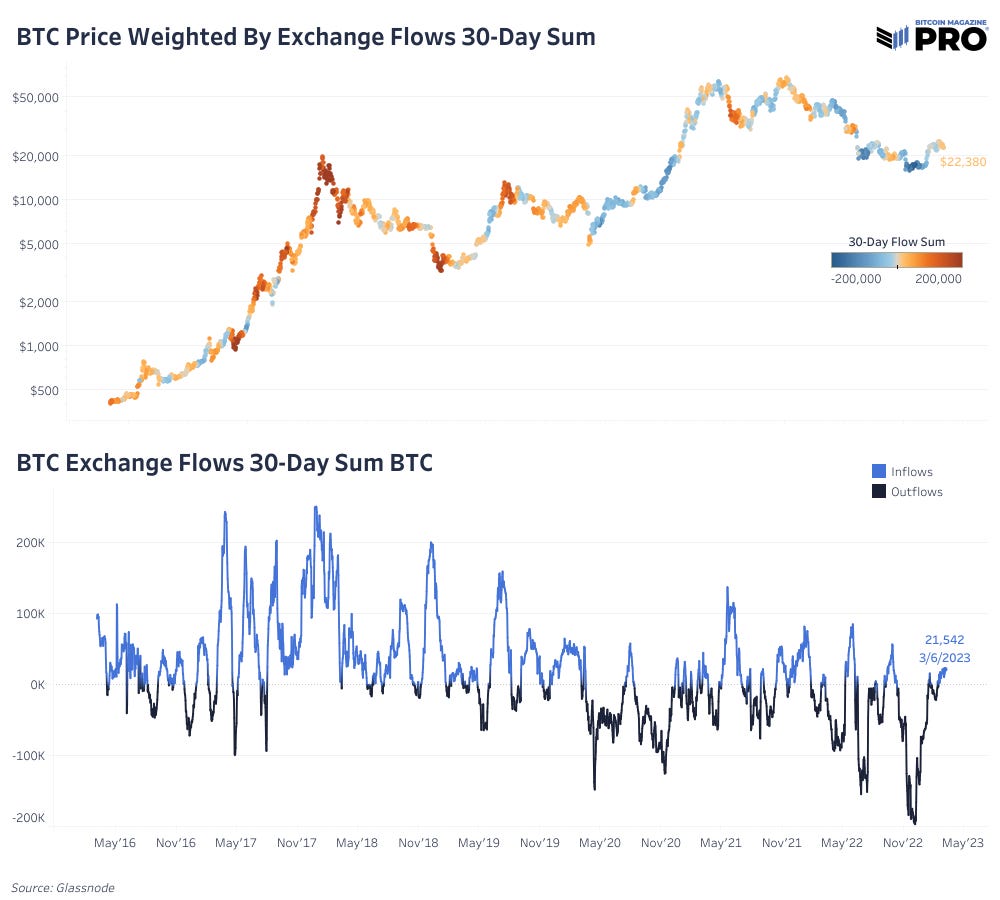

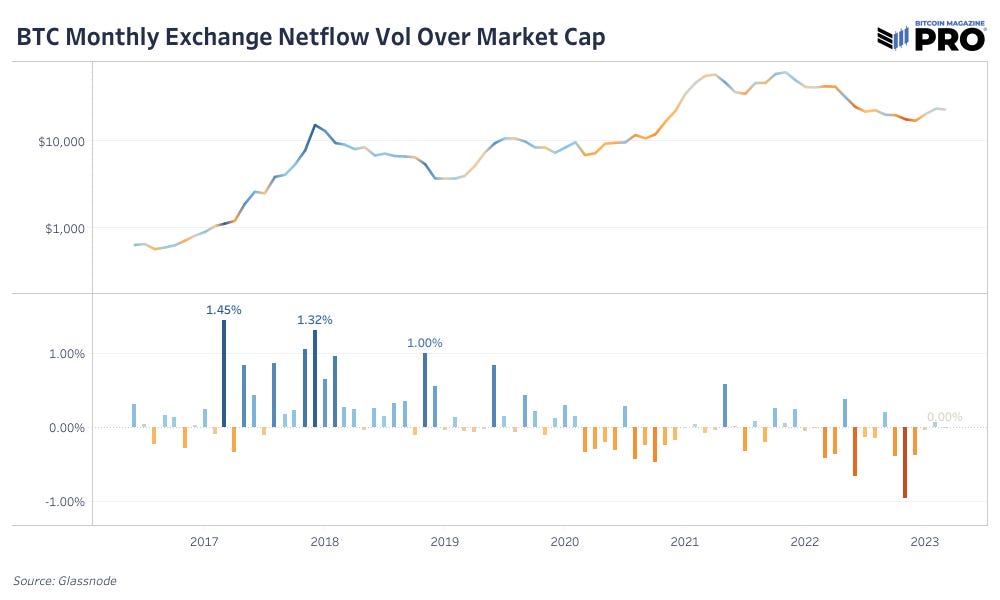

Exchange Inflows Stage A Slight Return

Following the collapse of FTX, the bitcoin ecosystem witnessed the largest exodus from exchanges in history, as investors fearing counterparty risk and further marketwide contagion embraced the mantra of “Not your keys, not your coins.” Now, following an exchange rate relief rally, we see the sustained return of net exchange inflows on a monthly time frame for the first time since October as traders look to cash in on the recent bear market rally.

While 30-day exchange net flows are positive to the tune 21,542 BTC, it pales in comparison to the inflows witnessed during earlier eras in bitcoin’s history, in both relative and absolute terms.

Exclusive Bonus For Paid Subscribers!

Bitcoin Magazine PRO is excited to launch an exclusive promotion for our paid subscribers! Login to the Bitcoin Magazine store with your BM PRO Paid Subscriber email and use code BM-PRO for 15% off ALL items. Includes conference tickets, magazines, art and more!

Note: The code will only work with the same email that is connected to your Substack subscription and is not valid for free trials.

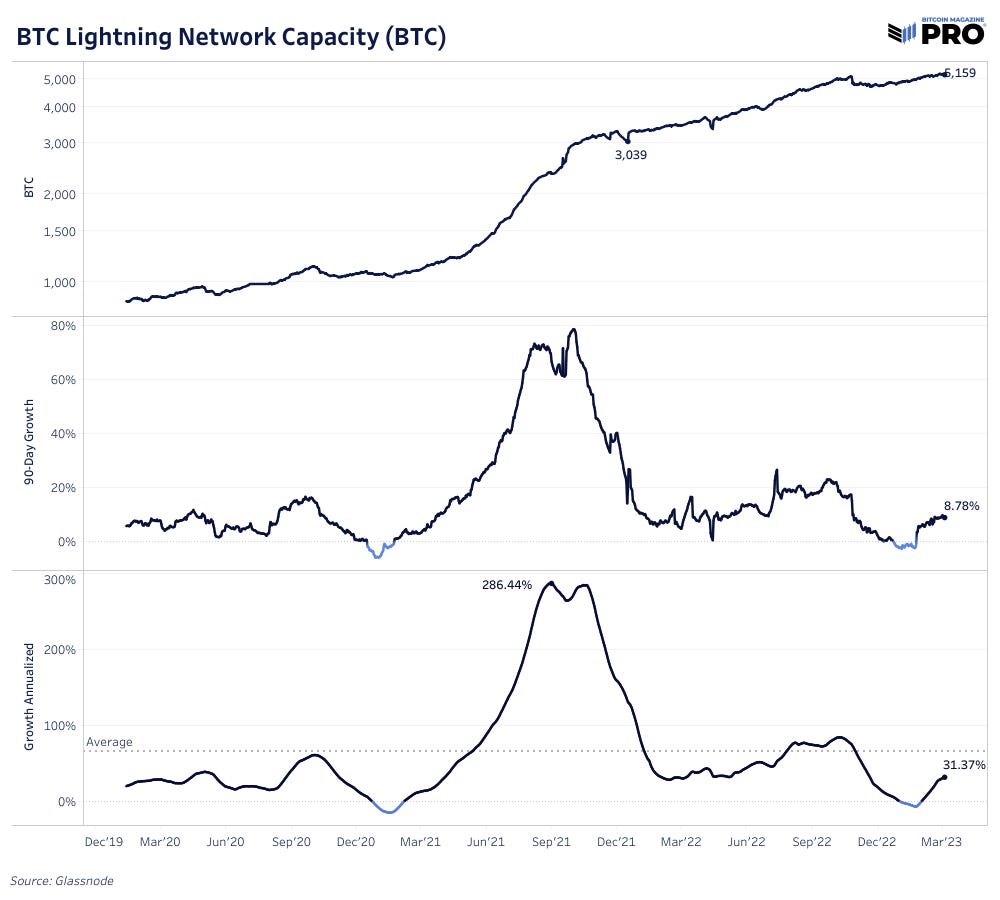

Lightning Network Quietly Continues To Grow

One of the most underrated and least appreciated aspects of the Bitcoin ecosystem is the continued proliferation and growth of the Layer 2 Lightning Network. The peer-to-peer channel-based network enables cheap and near-instantaneous transactional use of bitcoin. With public channel capacity now having surpassed 5,100 BTC, we see this Layer 2 as one of the most exciting aspects of the bitcoin ecosystem, despite its minuscule size as a percentage of total supply.

Public channel capacity has grown at annualized rates of 8.78% and 31.37% over the last 90-day and one-year timeframes, respectively.

Low-Time-Preference Investing

While bitcoin’s current -67% drawdown from all time highs garners all the headlines, a passive approach to bitcoin investment often yields more optimal results. Hypothetically, if one bought $10 of bitcoin every day since the exact $69,000 market peak, the cumulative $4,820 invested would leave you with 0.1867 BTC, for a current return on investment of -13.32%. While a negative return is by no means optimal, it shows the difference between cherry picking headlines and the actual reality that many passive bitcoin investors/HODLers actually experience.

Long term accumulation for the win.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!