No Policy Pivot In Sight: "Higher For Longer" Rates On The Horizon

The market is nearly unanimous in expecting a 0.25% rate hike during tomorrow’s FOMC meeting, yet many expect a “pause” shortly thereafter. We beg to differ.

Relevant Articles:

On-Chain Data Shows 'Potential Bottom' For Bitcoin But Macro Headwinds Remain

Not Your Average Recession: Unwinding The Largest Financial Bubble In History

We are less than 24 hours away from tomorrow's FOMC meeting, where the Federal Reserve will determine their next policy decision regarding interest rates. Today’s piece covers how the market expects the Fed to respond, what readers should watch for regarding changes in the expected path and the potential second-order effects of said changes.

While we are a bitcoin-focused publication, the path of monetary policy is the single biggest determining factor for the strength or weakness of the U.S. dollar against all other financial assets and currencies.

For our latest bitcoin-specific analysis, read “Bitcoin Rips To $21,000, Shorts Demolished In Biggest Squeeze Since 2021.”

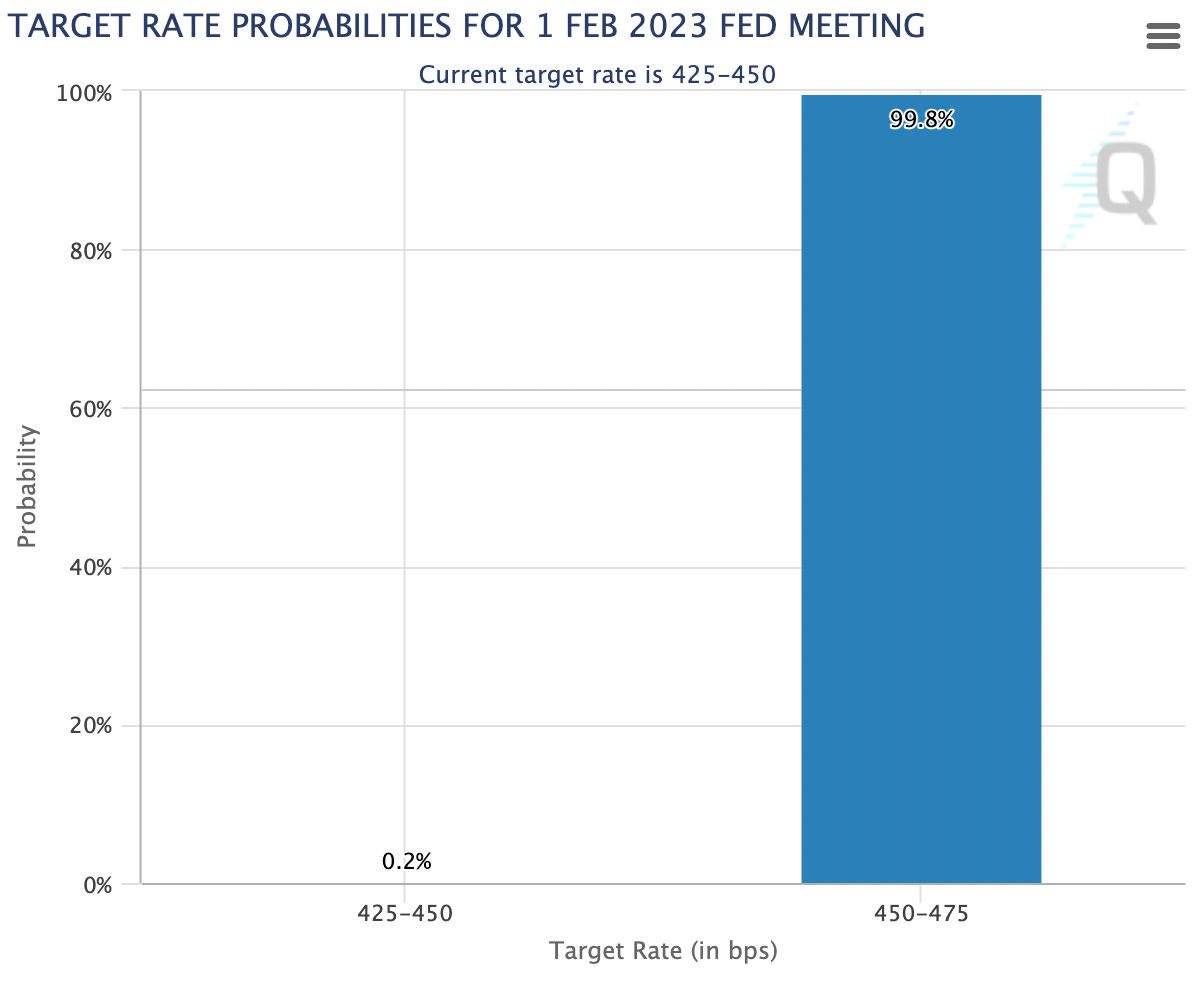

The current expectation for tomorrow is an interest rate hike of +0.25%, with the market assigning a near 100% certainty of this outcome, setting the policy rate to 4.5%-4.75%.

Source: CME FedWatch Tool

The Fed’s expected course for 2023 is to keep rates elevated, with several Fed Governors recently stressing the need to keep policy rates sufficiently restrictive in order to make sure inflation does not stage a comeback after initial signs of slowing, like it did in the 1970s.

Source: CME FedWatch Tool

Source: CME FedWatch Tool

In Jerome Powell’s December 14 press conference, he said the following (emphasis added):

“So, as I mentioned, it is important that overall financial conditions continue to reflect the policy restraint that we’re putting in place to bring inflation down to 2 percent. We think that financial conditions have tightened significantly in the past year. But our policy actions work through financial conditions. And those, in turn, affect economic activity, the labor market, and inflation. So what we control is our policy moves in the communications that we make. Financial conditions both anticipate, and react to, our actions.

“I would add that our focus is not on short-term moves, but on persistent moves. And many, many things, of course, move financial conditions over time. I would say it’s our judgment today that we’re not at a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes would be appropriate.”

Pricing In The Transitory Inflation

Global risk assets have been in rally mode to start the year, as market participants increasingly expect the inflationary scare that rattled financial assets in 2022 to abate in 2023 and beyond. The Fed’s median projections see year-over-year core PCE to come in at 3.5% for the fourth quarter of 2023, while Blue Chip consensus expects an even lower reading of 2.9%. While the optimistic expectations for abating inflation would certainly be bullish for risk-assets — given that it would lead to the return of lower interest rates — one would be wise to keep in mind the frivolous nature of inflation forecasting from the Fed, as shown below. A return to the 2% target is nearly always the expectation.

Source: Robin Brooks

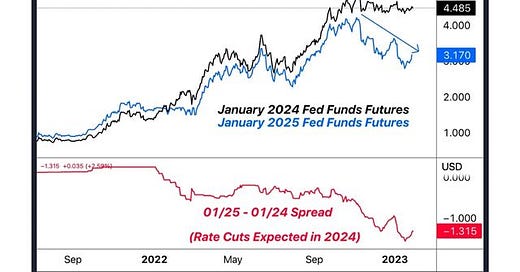

With inflation abating and policy rates staying elevated, the market believes that a “sufficiently restrictive” policy will manifest in 2023, with 1.31% worth of cuts coming in 2024.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

The economic data that is key to watch. 👁️

Our view of the Fed’s potential policy path. 🚧

The U.S. Treasury’s public debt projections.💰

What will be key to watch in the economic data will be whether inflation remains higher than anticipated due to a tight labor market, even as short-term inflationary pressures from supply chain disruptions due to COVID lockdowns and the Ukraine conflict temporarily ease.

Once inflation becomes entrenched into consumer expectations and labor markets, history has shown that it takes a monumental effort from central banks tightening policy rates in order to squash the inflation.

As the flexible component of the inflation measure is now showing deflationary readings on an annualized basis over the last 1- and 3-month periods, what should be watched closely is the annualized prints for inflation in the “sticky” bucket.

Note: The sticky-price index measures inflation in goods and services where prices tend to change more slowly.

Flexible Consumer Price Index - Source: Atlanta Fed

Sticky Consumer Price Index Readings - Source: Atlanta Fed

Sticky Consumer Price Index Readings - Source: Atlanta Fed

In our view, until there is meaningful deceleration in the 1-month and 3-month annualized readings for measures in the sticky bucket, Fed policy will remain sufficiently restrictive — and could even tighten further.

Source: Atlanta Fed Inflation Dashboard

Consumer expectations from the University of Michigan have 1-year ahead inflation measures at 3.9%. University of Michigan consumer inflations expectations led bond market expectations post 2020, thus readers should note the resilient expectations as we head into 2023.

Source: Greg Daco

As noted by Liz Ann Sonders of Charles Schwab, the 6-month change in inflation expectations is the largest it’s been since 2011, an indication that monetary tightening has begun to work its way into the real economy.

Source: Liz Ann Sonders

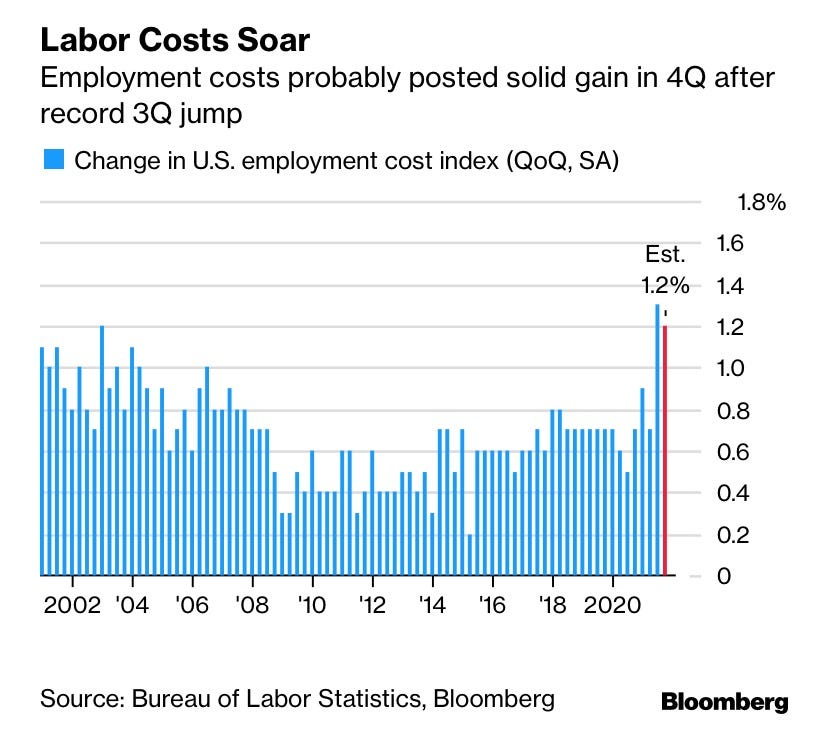

Along similar lines, as traders keep their eyes peeled for any signs of cooling inflation across markets, fourth quarter results came in for the U.S. Employment Cost Index.

Cost rose 1.0% quarter-over-quarter (QoQ), which was slightly cooler than the +1.1% expectation, and down from the +1.2% QoQ in Q3. However, the print still was good for an all-time record for the index, which should give the Fed plenty to think about regarding the policy stance going forward into 2023 and beyond, i.e., don’t pause or cut rates too early.

Source: ZeroHedge

Source: Bloomberg

With a rate hike of 25 basis points all but confirmed tomorrow, the market will pay close attention to the content and tone of Chairman Powell’s speech in regards to the future path of policy rates. While it is likely not in the interests of most passive market participants to dramatically alter the asset allocation of their portfolio based on the tone or expression of the Fed Chairman, we do believe that “higher for longer” is a tone that the Fed will continue to communicate with the market.

In that regard, it’s likely that those attempting to aggressively front-run the policy pivot may once again get caught offside, at least temporarily.

Source: Fidelity’s Jurrien Timmer

We believe that a readjustment of rate expectations higher is possible in 2023, as inflation remains persistent. This scenario would lead to a continued ratcheting of rates, sending risk asset prices lower to reflect higher discount rates.

Sufficiently tight monetary policy is mathematically impossible over the long term due to the debt dynamics and obligations of the federal government. If the economy and inflation still look to be running hot over the next 12-18 months and the Fed seems determined to send a message to those not respecting their credibility after completely botching the infamous transitory call regarding inflation in 2021, they will likely continue raising rates.

To reiterate, monetary policy is likely to be restrictive throughout 2023.

This will probably translate to some weakness in the labor market until inflation abates. A stronger dollar and weaker real economic growth are likely to be the result over the short term.

However, on a long enough timeline, the inevitable outcome is clear. Just ask the U.S. Treasury for their projections…

Chart Source: U.S. Treasury

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

"the path of monetary policy is the single biggest determining factor for the strength or weakness of the U.S. dollar against all other financial assets and currencies." so true!

Looking forward to seeing how rate expectations change based on J Powell's press conference yesterday.

How much longer can the Treasury continue to provide QE, countering the Feds QT? So far, net liquidity has gone slightly up since Oct. buoying markets significantly.