BM Pro Market Dashboard Release!

We are excited to announce the release of Bitcoin Magazine PRO’s Market Dashboard that includes various metrics and whether they signal bullish, bearish or neutral momentum. For paid subscribers only.

Bitcoin Magazine PRO Market Dashboard Release

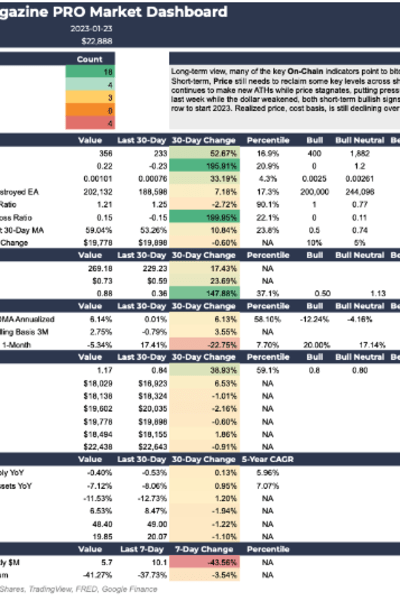

Today, we’re releasing a new feature for paid subscribers: the Bitcoin Magazine PRO Market Dashboard. The dashboard is designed to actively track 29 major market indicators and provide readers with a data-driven view of the market. It covers metrics across on-chain, derivatives, mining, price, fund flows, macroeconomic and correlation data. These are several of the key indicators we track on an ongoing basis and find them useful to assess the current state of the bitcoin market.

We are planning to release a complete snapshot of the dashboard every week along with a market summary of how we interpret the data. In today’s piece, we will cover the dashboard, the definition of each indicator, the criteria used for getting a signal and our rationale for choosing these specific indicators. We’re always looking for ways to improve in order to bring more value to our subscribers and we welcome your feedback on this new feature.

The current dashboard snapshot is included below along with a downloadable PDF link. To see all of the information clearly, it’s best to click the image to zoom in on the individual metrics or download the PDF to get a closer look.

Market Summary

Looking at historical data, this latest price rally is starting to check many of the boxes of a cyclical low. Most on-chain indicators are still in some of their lowest percentiles with some even moving out of the lowest ranges.

Price has reclaimed the key on-chain realized price levels and has shown strength above the 200-day moving average (DMA). We’ve yet to see growth in realized price over the last 30 days but it is becoming less negative. Although less so over the last 30 days, bitcoin high-beta and SPX correlations are still relatively strong.

For macro, although major indicators are all still declining year-over-year, the overall trend is less negative growth. Liquidity tides look to have shifted over the last couple months and these tides are now the key trend to watch to see if it sustains. Still up YoY, the DXY continues to fall and remains below its 200 DMA.

Recently, the GBTC discount widened to below 41% and there is no sign of a resolution in the Digital Currency Group saga. Fund flows have been positive over the couple of weeks after weeks of deeply negative outflows. Overall, data is pointing to a largely bullish view in the short-term, but readers should stay cautious for a potential fake out over the next couple weeks. There are many upcoming and important economic data releases and the SPX is hovering at a major trend line of this bear market.

Click the image to zoom in on the Market Dashboard.

Download the PDF version of the Market Dashboard below.

Indicator Criteria

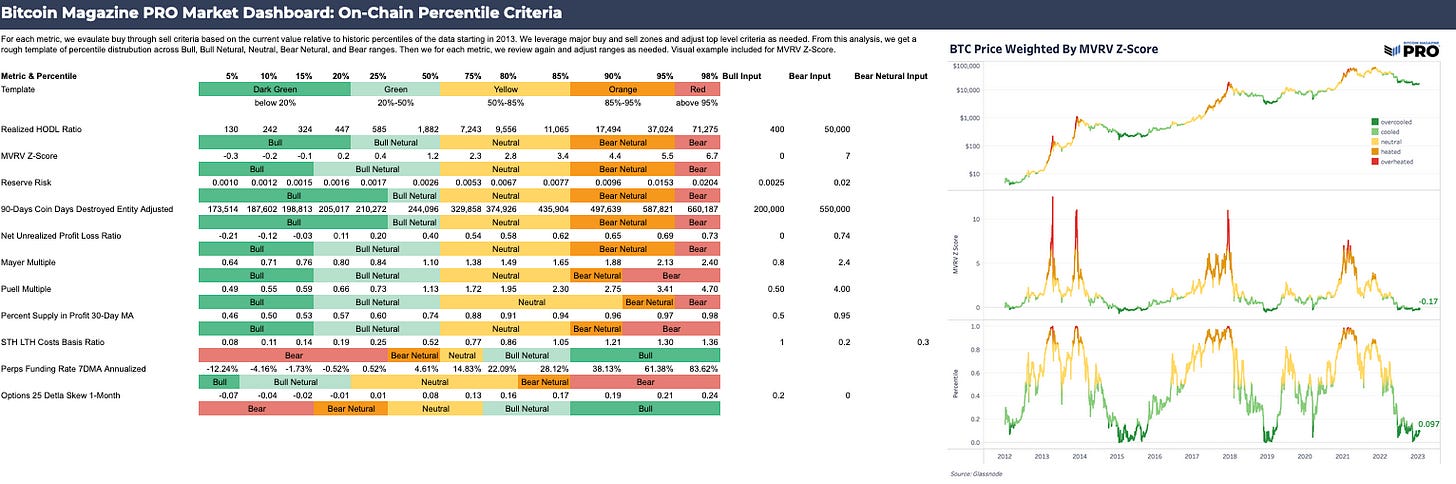

There’s criteria for each indicator to assess whether it’s more bullish, neutral, bearish or in between. Each indicator gives us a Bull, Bull Neutral, Neutral, Bear Neutral, or Bear signal. All indicators have an equal weighting. By observing all these signals, we can get a high-level view of the momentum in the market. We will explain the criteria for different signals below.

For many on-chain cyclical indicators, we have used a simple percentile analysis since 2013. This compares the current indicator value to all previous historical values.

This method helps identify extremes in previous tops and bottoms in the market. For example, many on-chain indicators will be in their lowest percentile (dark green or bullish) near bottoms in price and in their highest percentile (dark red or bearish) near tops in price. We start with a basic percentile template and adjust the thresholds for each metric individually based on historical performance.

Indicators using this analysis are much more useful when they are at their extremes and when it’s expected the market is following historical cycles and previous patterns. We also apply this analysis to the futures’ perpetual funding rate and options 25 delta skew indicators.

For other indicators, we largely look at the annual change compared to the annual change from the last 30 days. The change in money supply is a good example of this. Bitcoin performance has had a high correlation with the change in M2 money supply, so if the money supply is expanding at a faster rate than it was 30 days ago, this would be a bullish signal in our criteria. The chart below emphasizes how this simple criteria comparison can be useful.

We use the same criteria for tracking the change in global central bank balance sheets, U.S. net liquidity, the U.S. dollar index (DXY), hash rate, hash price and the annualized rolling 3-month basis for futures.

For price metrics, it’s a fairly simple criteria to compare current price against a specific indicator. Is the price above the 200-day moving average or above the short-term holder’s realized price? If so, that’s a bullish sign. If not, then a bearish one. The Mayer Multiple uses the percentile analysis mentioned above.

For other metrics like the U.S. ISM manufacturing index, also known as the purchasing managers index (PMI) and the VIX, we do a simple comparison to the previous 30-day value and not the annual change. Is the PMI showing a higher index level relative to last month or further contraction? Is the VIX higher or lower than it was 30 days ago? In these cases, a higher PMI print is a bull signal while a higher VIX reading is a bear signal. We know bitcoin has acted as inverse to VIX at many times over the past two years while it has also followed larger economic expansion and contraction cycles.

Other indicators shown above are the weekly bitcoin investment vehicle fund flows and the current GBTC discount or premium. It’s a bull signal if investment flows were positive over the last week. It’s a bear signal if the GBTC discount falls relative to value 7-days ago.

Lastly, readers will find criteria for “backtest thresholds” where we haven’t used a percentile analysis or an annual change, but rather thresholds we’ve backtested and find useful in providing a specific signal. The two indicators using this criteria are the 30-day change in realized price and the 1-month options 25 delta skew.

The 30-day change in realized price acts as a proxy for capital inflows and outflows. Bull, neutral and bear thresholds are better visualized below.

Indicator Definitions & Rationale

On-Chain Indicators

Realized HODL Ratio

The Realized HODL Ratio is a market indicator that uses a ratio of the Realized Cap HODL Waves. In particular, this RHODL Ratio takes the ratio between the 1-week and the 1-2 years RCap HODL bands. In addition, it accounts for increased supply by weighting the ratio by the total market age. A high ratio is an indication of an overheated market and can be used to time cycle tops. Read about the Realized HODL Ratio in this article.

Market Value to Realized Value Ratio Z-Score

The MVRV-Z Score is used to assess when bitcoin is overvalued or undervalued relative to its “fair value.” When market value is significantly higher than realized value, it has historically indicated a market top (dark red), while the opposite has indicated market bottoms (dark green). Technically, MVRV-Z Score is defined as the ratio between the difference of market cap and realized cap, and the standard deviation of market cap, e.g., (market cap – realized cap) / std (market cap).

Reserve Risk

Reserve Risk is defined as the price divided by HODL Bank. It is used to assess the confidence of long-term holders relative to the price of the native coin at any given point in time. When confidence is high and price is low, there is an attractive risk/reward to invest — Reserve Risk is low. When confidence is low and price is high then risk/reward is unattractive at that time — Reserve Risk is high. Read Reserve Risk Overview.

90 Day Coin Days Destroyed EA

Coin days destroyed (CDD) for any given transaction is calculated by taking the number of coins in a transaction and multiplying it by the number of days it has been since those coins were last spent. 90-day CDD is the rolling sum of CDD over 90 days and shows the amount of coin days that have been destroyed over the past year. This version is age-adjusted, meaning that we normalize by time in order to account for the increasing baseline as time goes by. This version is entity-adjusted, meaning that transactions within addresses controlled by the same network participant are discarded, as well as age-adjusted in order to account for the increasing baseline as time goes by. Read Coin Days Destroyed Overview for more information.

STH:LTH Cost Basis Ratio

Ratio of the cost basis of short-term holders (STHs) to long-term holders (LTHs). When trending upwards, the cost basis of STHs is appreciating relative to that of LTHs, a bullish market dynamic. When trending downwards, the cost basis of STHs is falling relative to that of LTHs, which is a bearish market dynamic. The STH:LTH Ratio is historically one of the most accurate signals in a bitcoin market cycle. Read about the Short-Term:Long-Term Cost Basis Ratio here.

Net Unrealized Profit/Loss Ratio

Net Unrealized Profit/Loss is the difference between Relative Unrealized Profit and Relative Unrealized Loss. Relative Unrealized Profit is defined as the total profit in USD of all coins in existence whose price at realization was lower than the current price normalized by the market cap. Relative Unrealized Loss is defined as the total loss in USD of all coins in existence whose price at realization time was higher than the current price normalized by the market cap.

Percent Supply In Profit 30-Day MA

The percentage of circulating supply in profit, i.e. the percentage of existing coins whose price at the time they last moved was lower than the current price.

Realized Price 30-Day Change

Realized price can be thought of as bitcoin’s average cost basis. We find the 30-day change in realized price as a useful proxy for tracking the rate of capital inflows and outflows — cost basis is rising or falling. Negative realized price growth over the last 30 days is a bearish sign whereas strong positive growth is more bullish.

Mining Indicators

Hash Rate 7 DMA EH/s

The 7-day moving average of network hash rate to smooth out daily fluctuations in hash rate. Rising hash rate shows more demand from miners to produce bitcoin.

Hash Price 7 DMA

The 7-day moving average of the network’s total daily mining revenue in USD over hash rate. Hash price is a key measure of relative miner profitability. Hash price is in a long-term downtrend as mining continues to become increasingly competitive.

Puell Multiple

The Puell Multiple is calculated by dividing the daily issuance value of bitcoin (in USD) by the 365-day moving average of daily issuance value.

Mayer Multiple

The Mayer Multiple is an oscillator calculated as the ratio between price and the 200-day moving average. The 200-day MA is a widely recognised indicator for establishing macro bull or bear bias. The Mayer Multiple therefore represents a measure of distance away from the long-term average bitcoin price as a tool to gauge overbought and oversold conditions.

Realized Price

The average on-chain cost basis for the network where unspent transaction outputs (UTXOs) are valued at the price where they last moved on-chain.

STH Realized Price

The average on-chain cost basis of Glassnode’s short-term holders cohort. Typically, we see more bullish price momentum with price above STH realized price and more bearish with the price below.

LTH Realized Price

The average on-chain cost basis of Glassnode's long-term holders cohort. Typically, we see more bullish price momentum with price above LTH realized price and more bearish with the price below.

Derivatives Indicators

Perps Funding Rate 7 DMA Annualized

A futures contract that never expires but rolls over every eight hours. Created by Arthur Hayes, founder of BitMex. The perpetual swaps funding rate is a periodic rate that is paid between longs and shorts based on the relative positioning of the perpetual swap market relative to a spot index price. Positive funding rates mean longs pay shorts, and vice versa. Funding payments are paid every eight hours. Averaging over 7 days to smooth out daily fluctuations. Extreme funding rate periods have proven to mark local tops and bottoms. Read Derivatives Market Breakdown to learn more.

Futures Annualized Rolling Basis 3-M 7 DMA

This metric measures the annualized yield that can be had by buying spot and simultaneously selling a futures contract that expires in three months. Historically, the annualized rolling basis rises and falls with price momentum and reflects current sentiment in the futures market.

Options 25 Delta Skew 1-Month

In simple terms, the delta skew shows the market’s demand for puts relative to calls. High levels of skew show a large demand for protection in the form of puts and a negative reading shows a lack of demand for puts, with traders reaching for upside exposure in the form of call options instead.

Macro Indicators

Global M2 Money Supply YoY

Monthly updated data that tracks the change in M2 money supply from the United States, China, Japan and the eurozone all converted to U.S. dollars. Rising and falling M2 money supply — which increase or decrease overall liquidity — have a high correlation to bitcoin performance.

Global Central Bank Assets YoY

Weekly updated data that tracks the change in central bank assets from the United States, China, Japan and the eurozone all converted to U.S. dollars. Rising and falling central bank assets — which increase or decrease overall liquidity — have a high correlation to bitcoin performance.

Net Liquidity YoY

Adopted from Darius Dale at 42 Macro, net liquidity is defined as the Federal Reserve Balance Sheet less the sum of both the U.S. Treasury General Account and Reserve Repo Facility. Since March 2020, this model has proven to be useful in tracking a form of U.S. liquidity while leading both S&P 500 and bitcoin performance as liquidity-driven assets.

DXY YoY

The year-over-year change in the U.S. dollar index. Historically peaks and troughs in bitcoin performance correlate to relative dollar strength and weakness. The DXY contains six component currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

U.S. ISM PMI

The ISM manufacturing index, also known as the purchasing managers index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It’s a key indicator to track the state of the U.S. economy. Expansions and contractions in U.S. economic conditions have a high correlation with bitcoin performance.

Other Indicators

BTC Fund Flows Weekly $M

Weekly U.S. dollar flows into bitcoin investment fund vehicles across Grayscale, CoinShares, Purpose, 21Shares and others. Data from CoinShares. Fund flows track institutional demand for bitcoin.

GBTC Discount/Premium

GBTC discount or premium to net asset value (NAV). Bitcoin has a high correlation with GBTC price as it is the largest bitcoin institutional investment vehicle on the market and holds over 600,000 bitcoin.

Correlation Comparisons

We highlight 30-, 60- and 90-day correlations of single-day returns across interesting investment vehicles or asset classes compared to bitcoin. Currently included are comparisons to small caps stocks, big tech, high-yield corporate debt, gold, bitcoin short ETF, long-term Treasuries, GBTC and the DXY. Historically, bitcoin performance has been the most correlated with high-beta and high-yield corporate debt investments.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

How can we access the latest report?

Thanks… dashboard is great - consistency of having the data / historical picture, with the added context from your summary. Also think the signal count is good stuff - would be very interested to see what the count (% bull for instance) looked like at major tops / bottoms. Selfishly, maybe a future post??