In today's Daily Dive we will take an in-depth look at Reserve Risk.

Reserve Risk is a metric founded by Hans Hauge, and it is a cyclical market indicator which aims to quantify the risk-reward of allocating to bitcoin based on the conviction of long-term holders. Simply, Reserve Risk is a ratio between the current price of bitcoin and the conviction of long-term holders. The current price can be thought of as the incentive to sell, and the conviction of long-term holders/investors can be quantified as the opportunity cost of not selling.

We will more thoroughly describe and quantify these metrics further along in the piece.

The following is an excerpt from Glassnode Insights,

The general principles that underpin Reserve Risk are as follows:

Every coin that is not spent accumulates coin-days which quantify how long it has been dormant. This is good tool for measuring the conviction of strong hand HODLers.

As price increases, the incentive to sell and realise these profits also increases. As a result, we typically see HODLers spending their coins as bull markets progress.

Stronger hands will resist the temptation to sell and this collective action builds up an “opportunity cost.” Everyday HODLers actively decide NOT to sell increases the cumulative unspent “opportunity cost” (called the HODL bank).

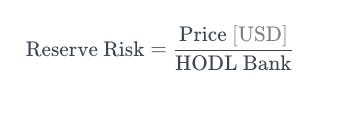

Reserve Risk takes the ratio between the current price (incentive to sell) and this cumulative “opportunity cost” (HODL bank). In other words, Reserve Risk compares the incentive to sell, to the strength of HODLers who have resisted the temptation.

Reserve Risk is low when HODLer conviction is high (unspent opportunity cost is high and increasing), and price is low.

Reserve Risk is high when HODLer conviction is low (unspent opportunity cost is low) and price is high.

Reserve Risk Calculation

As shown in the graphic above, Reserve Risk is defined as “price” divided by “HODL bank.” While price obviously doesn't need an explanation, what is HODL bank, and what signal does it provide?

As stated earlier, Reserve Risk is a ratio of the incentive to sell and the opportunity cost of not selling. HODL bank quantifies this “opportunity cost of not selling.”

Coin Days Destroyed

In prior Daily Dives, we have covered coin days destroyed (CDD) as an on-chain metric, so we won’t cover it extensively here, but readers can find additional information on CDD here.

Essentially, with the complete transparency of the bitcoin blockchain, one can see how many days each and every coin has been held and/or spent. When there is a large number of CDD on a particular day, it shows old coins are being spent/changing hands. Further, if we divide CDD by circulating supply, we can standardize the metric for an increasing circulating supply over time.

While the stand-alone metric of supply-adjusted CDD itself doesn't provide much signal if any, it serves as a key input for Reserve Risk, and here's how:

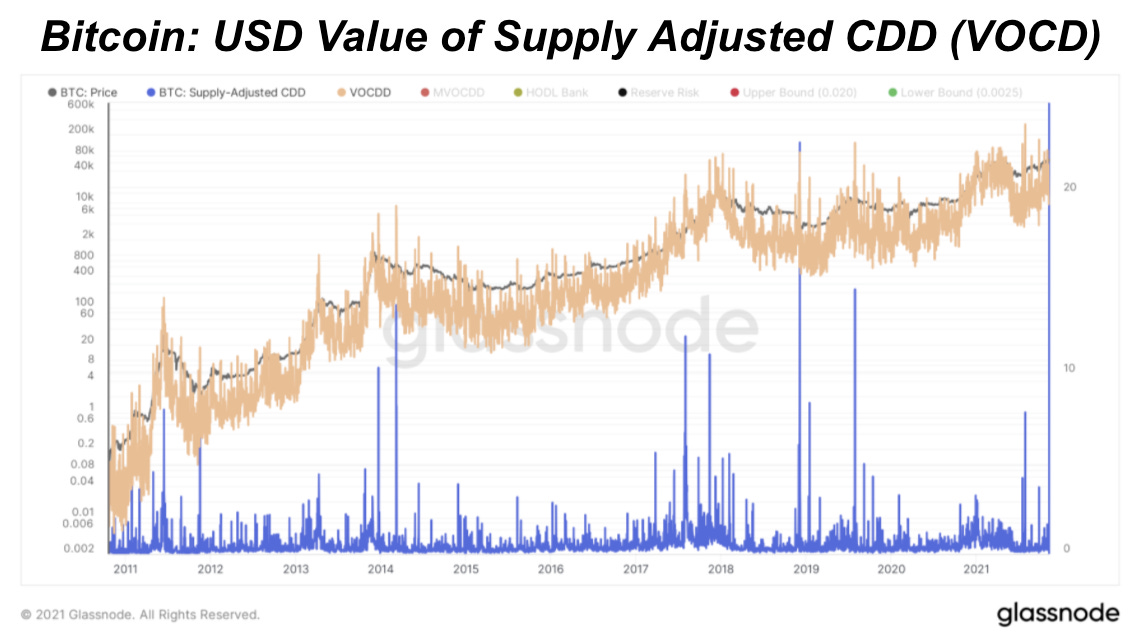

If you take the USD value of the supply-adjusted CDD (VOCD), it maps very similarly to the bitcoin price over time. Displayed above is the supply-adjusted CDD in blue, with orange displaying VOCD and grey showing the bitcoin price. It is immediately clear that there is plenty of variance in the metric, but one can notice that during bitcoin cycle “tops,” VOCD spends more time above the price of bitcoin (i.e., old coins are changing hands much more frequently than average).

The most simple way to think of this is that when VOCD (the value of supply adjusted CDD) is greater than price, more coin days are being destroyed than created on that given day (i.e., more coins are being spent rather than HODLed).

For greater clarity and to reduce variance that comes from uneconomic bitcoin spends (such as large internal wallet transfers on exchanges), we instead can take the 30-day median of VOCD.

Each day that MCOVD does not exceed the price of bitcoin, more coin days are being created then destroyed. One can think of this as the opportunity cost of the HODLer. If the price of bitcoin is $66,000 and a person decides to not sell, they are forgoing $66,000 to continue to HODL.

HODL Bank

Now, to get back to HODL bank. Using MVOCD, we identify the opportunity cost of the HODLer. HODL bank is simply a calculation of the lifetime cumulative sum of the daily difference between price and MVOCD (median value of coin days destroyed).

In layman's terms, HODL bank is the cumulative sum of deferred HODLer opportunity cost of not selling bitcoin. Every day that a coin is HODLed is a vote of confidence in the future value of bitcoin in the eyes of the HODLer.

So what can HODL bank tell us? If we revisit the beginning part of the article, we can see that Reserve Risk is defined as the price of bitcoin divided by HODL bank.

Reserve Risk

To bring it all together, if you divide the bitcoin price by HODL bank, you calculate Reserve Risk, which quantifies the risk-reward of allocating to bitcoin based on the conviction of long-term holders (smart money).

Think about it, when is the best time to buy bitcoin? The best time to buy bitcoin is when confidence from owners of the asset is very high, but price is low, and the worst time to buy is when confidence from owners of the asset is low, but price is high. With Reserve Risk, this is all incorporated into a single metric.

Every tradeable asset with a market has a price, but no other asset (not including other crypto assets that utilize public ledgers) offers a transparent view of the moves of every holder of the asset, which is what makes bitcoin on-chain analytics so unique and insightful.

State of the Market Today

Reserve Risk is currently indicating we are in the early/middle stages of a bull market cycle, and that currently the price is far from being overheated. It should be noted that during reflexive bitcoin bull cycles, parabolic price action serves as a trigger for old coins to be spent/sold, which is why Reserve Risk goes parabolic, as both the numerator (price) is increasing, as well as the denominator (HODL bank) decreasing (if MVOCD is greater than price).

In summary, Reserve Risk is one of the best and most all encompassing indicators in the bitcoin market, and it currently is telling us one thing:

We haven’t seen anything yet.

love and appreciate the education!

another great article. Thanks for sharing your thoughts and insights.