Bitcoin Price Falls Below $63,000

As published in yesterday’s The Daily Dive #096, bitcoin was up 3.9% in one hour after the Consumer Price Index reading, only to fall again in a series of BTC-margined long liquidations. Total long liquidations for the day were some of the largest liquidations over the last few months but pale in comparison to the liquidations in March through April earlier this year.

Let’s dig into some of the leverage dynamics that led to the sharp fall from all-time highs back down to $62,800.

Futures Open Interest

Among the most important things to understand about bitcoin derivatives is the types of collateral that can be used. In bitcoin derivatives markets, you can either use crypto margin (overwhelmingly BTC but certain platforms allow various altcoins to be used as collateral) or dollars/stablecoins as collateral. When entering a derivatives contract with bitcoin as collateral, if you are going long (speculating on price to rise), then you are left exposed if price declines to both a declining PNL (profit/loss) as well as collateral that is declining in value. Thus, bitcoin-margined derivatives are often the culprit in large market drawdowns and liquidation events.

Leading up to yesterday’s all-time high, the aggregate futures open interest for bitcoin-margined spiked in a huge way (in BTC terms, which normalizes for dollar volatility), touching 191.2K BTC, up from the 150k BTC range that was seen the first time bitcoin broke above $65,000, showing that traders were aggressively levering up:

Below is the same chart but denominated in dollars instead, showing the total open interest in bitcoin-margined futures declining by more than $1 billion from yesterday:

Displayed above is the aggregate open interest (in bitcoin terms) by exchange for context. The most obvious trend is the increasing dominance of Binance in the futures market (more on this in a moment).

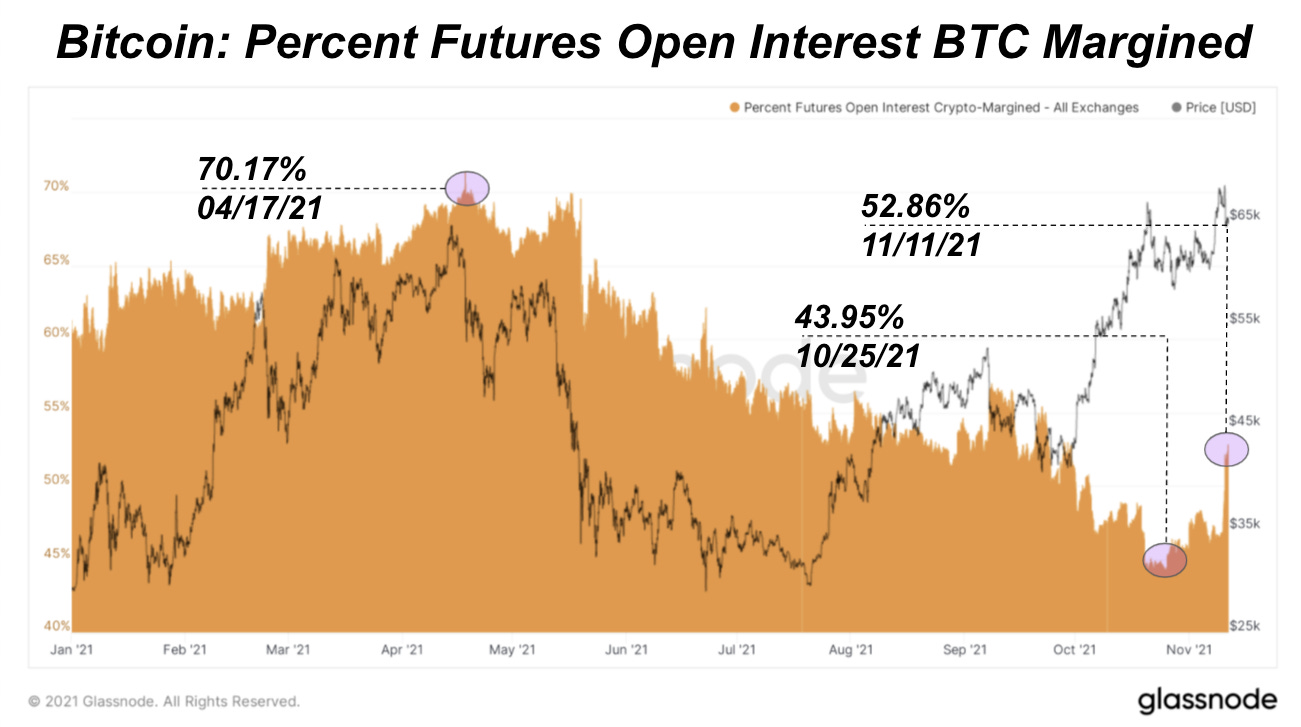

Futures Market By Collateral Type

When looking at the total futures market, bitcoin-margined open interest as a percentage also rose in a noticeable manner, currently at 52.86% of aggregate open interest.

While this is a trend that bulls would like to see reverse, the current market makeup is still favorable compared to earlier in 2021, where bitcoin-margined derivatives made up 70% of the total market.

The larger the market share for stablecoin-margined derivatives, the better, but the current reading of 52.86% is still not large enough to sound the alarms in terms of a broader market top in our judgment.

Perpetual Swaps Funding

The perpetual swaps market plays a very large role in the bitcoin futures and derivatives market, and are by far larger and more liquid than monthly or quarterly futures markets.

A perpetual swap contract is a futures contract that never expires, but simply rolls over. To keep the perpetual swaps market tied to the underlying spot bitcoin market, a funding rate is introduced to offer an economic incentive to keep the market aligned.

For example, if the perpetual swap market separates meaningfully from the spot market to the upside, the funding rate will spike which offers an economic incentive to short and collect a premium.

Funding on most exchanges is paid every eight hours; if funding is 0.039% (as it was yesterday), then it means that long positions are paying 42.7% of their notional position to shorts on an annualized basis. This is what makes periods of very high or deeply negative unsustainability.

When looking at the average funding rates across exchanges, the increase in bitcoin price was coupled with a rising funding rate, which shows that derivatives played a large role in driving the upwards price action.

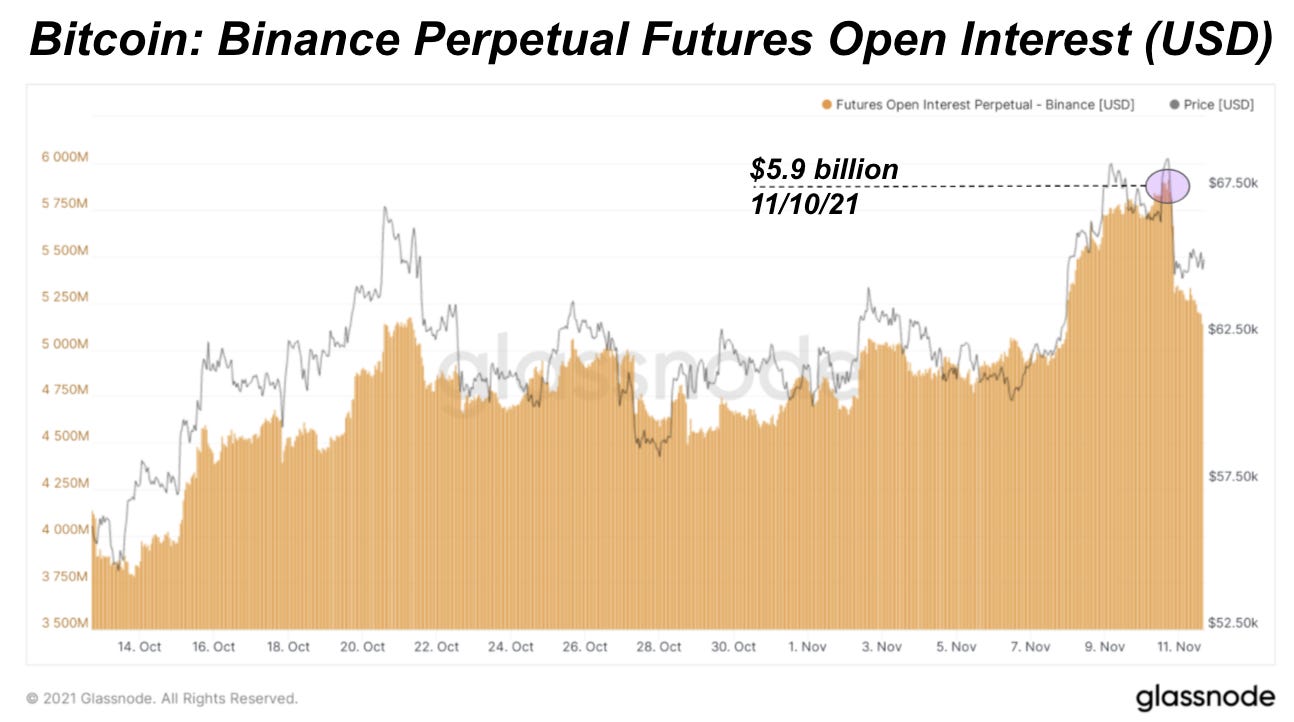

In particular, when looking at the largest perpetual futures market by open interest (Binance), extremely large spikes in funding rate were coupled with local market tops over the last month.

When looking at the aggregate open interest for Binance perpetual swap futures (containing two markets, BTC/USDT stablecoin margined, BTC/USD perp bitcoin-margined), there was a sharp rise to nearly $6 billion in open interest coupled with the large spikes in funding.

What was the result? A flush of over-leveraged longs came to the party late. There is no free lunch or bailouts in bitcoin, and any dislocations will be ruthlessly purged through volatility and price discovery.

Final Note

All of the signs are still pointing towards a bitcoin bull run through the end of 2021 and into 2022, from a macro perspective and bitcoin on-chain point of view. Nothing has changed on that front, yet the derivatives market loves to whipsaw the price up and down in the meantime.

definitely saw this and felt it; i levered a bit this past weekend myself so this was a real (but small) psychological tests for me and my personal wealth system (i am 100% bitcoin standard). all good. no sweat.

brilliant explanation!