Futures ETF Has Record Day

ProShares bitcoin Futures ETF under the ticker $BITO hit the market for a historical move in bitcoin’s history today. It turned out not to be a “sell the news” type event as bitcoin price hovers around $64,000 right under the previous all-time high.

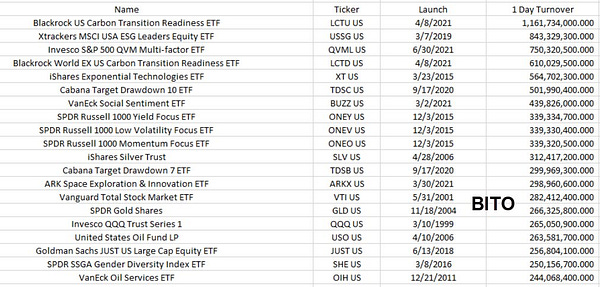

The fund traded $280 million worth of shares in the first 20 minutes putting it in the top 15 opening-day launches of all-time. The current level of volume traded for the entire day settled around $993 million.

On the same day, Barry Silbert and Grayscale filed to convert their Grayscale Bitcoin Trust vehicle (GBTC) with $41.4B (value at $64,000 price) into a bitcoin spot ETF. Although a bitcoin spot ETF will be a better vehicle for bitcoin exposure relative to a futures ETF, Gary Gensler has reiterated his support for futures ETFs that register under the Investments Company Act of 1940 which he says “provides significant investor protections” that come with Commodity Futures Trading Commission regulation and oversight.

He has not iterated support for the spot ETF products filed under the Securities Act of 1933 in a separate approval process, indicating we could be far off from a spot ETF until this position changes.

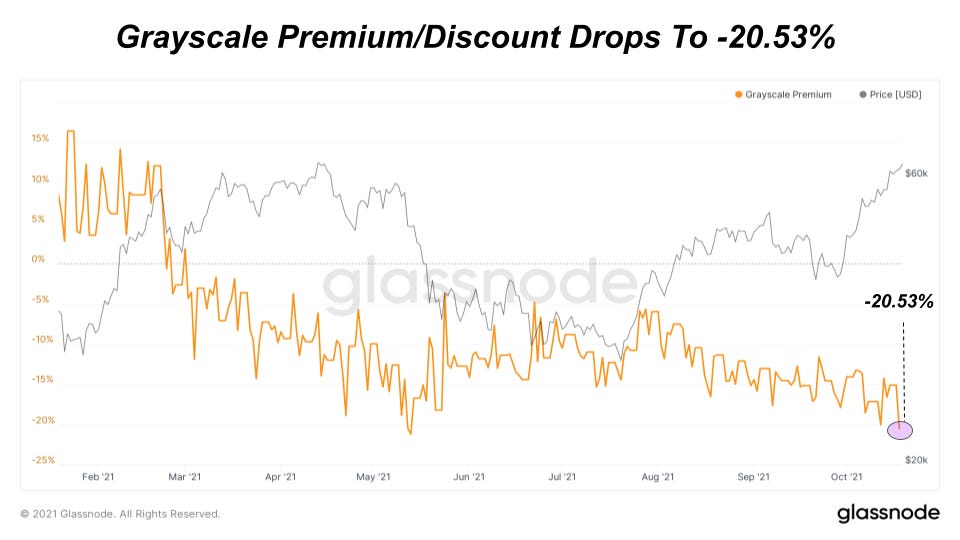

The market’s expectations on if we are getting a spot ETF can be tracked via proxy through the Grayscale Bitcoin Trust premium/discount rate. As the likelihood increases of a spot ETF coming to market, we would expect to see the current significant discount of 20.53% move closer to 0. If Grayscale is able to convert their trust into a spot ETF, which has been their long-term strategy, investors have additional upside to the bitcoin price through buying these discounted shares. But since July, the discount has been in decline and fell an additional 5.4% this week.

Coin Days Destroyed Overview

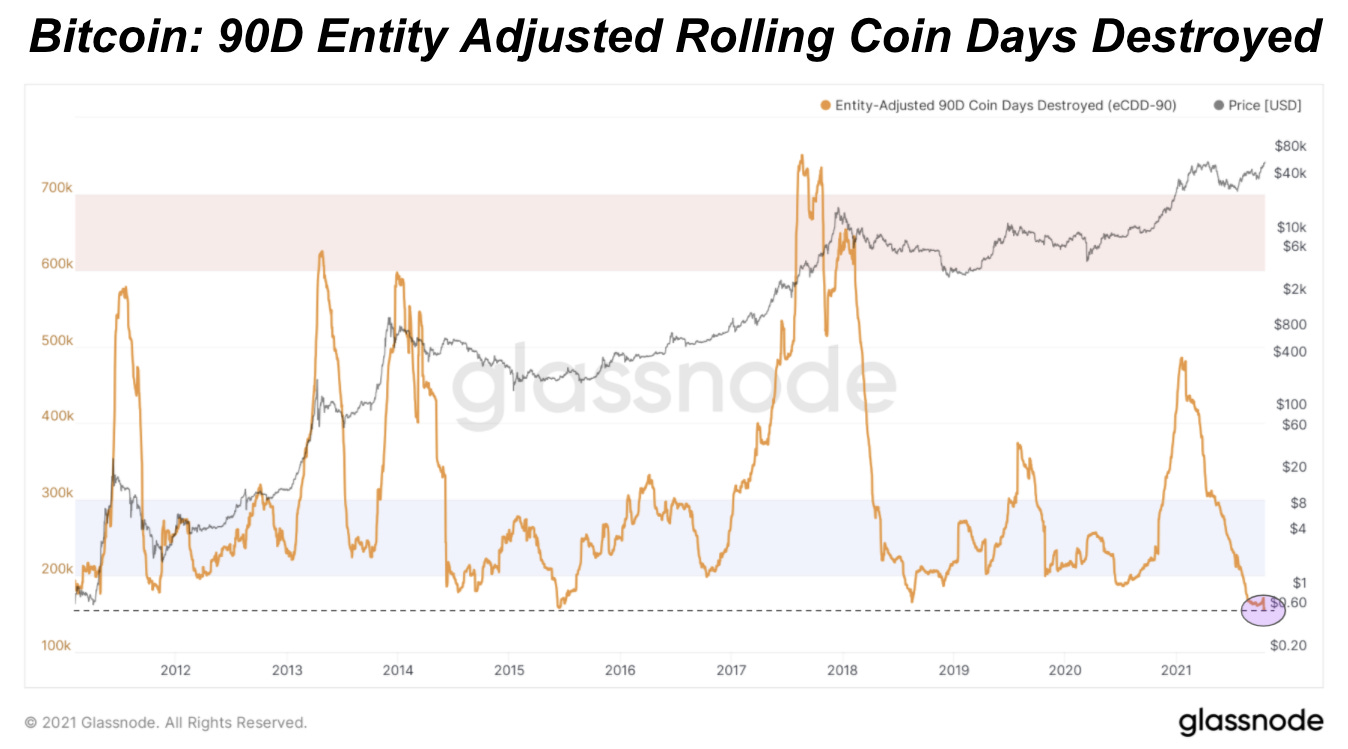

Coin days destroyed is calculated by multiplying the number of coins in a transition by the number of days it has been since said coins were last moved. Coin days destroyed can provide insight as to how “old” the on-chain transaction volume is, and whether old holders are “cashing out” or HODLing strong.

The Deep Dive previously covered coin days destroyed as a metric on August 25th in The Daily Dive #050. In the issue, we said the following in regards to the strong accumulation metrics shown on chain:

“Investors are sitting tight and not aggressively selling the bounce to use as “exit liquidity.”

“We have covered the heavy bitcoin accumulation extensively in The Deep Dive previously, but the significance of these accumulation trends in regards to the bitcoin price action is real. If we continue to witness aggressive accumulation by new and incumbent participants alike without a bounce in coin days destroyed, the market will be fighting for a small free float of bitcoin available for sale, in which parabolic price action should be expected.

“A dichotomy between coin days destroyed continuing to remain suppressed with a retest and break from all time highs over the following months would be among the most bullish signs the market could give, and it is entirely possible.” - The Daily Dive #050

Well here we are two months later, flirting with an all-time high bitcoin price, and what do we see? Let’s dig in.

Shown above is the daily chart for coin days destroyed (CDD), which clearly does not provide much signal. However, when using a moving average or a rolling total, the insight provided by the metric is very strong. Instead, if we use the 30-day moving average, we can see periods of time when old coins were spent with much greater clarity. The chart belows shows CDD with a 30-day moving average since 2020, which shows a lot of old coins being spent early in 2021 when the price broke its previous all-time high and went on a parabolic run.

Going further, if we use a 90-day rolling sum of coin days destroyed, the metric is at the lowest point since early 2011.

What does this mean in layman’s terms? The amount of bitcoin being spent in terms of age and quantity (with the two figures multiplied together) over the last three months is at decade lows, showing how truly strong the recent accumulation dynamics have been. New money looking to secure a bitcoin position is having to competitively bid bitcoin and chase price, with limit orders continuing to be moved up hoping to catch dips.

This tweet from nine days ago still holds true.

Bitcoin is currently in the midst of its strongest accumulation periods ever, with no signs yet of this trend not continuing, with the $64,800 high falling any moment. Unbelievably bullish.

Final Word

As we were finishing up the writing of today’s Daily Dive, the market cap of bitcoin just broke its previous all time high! Onwards and Upwards!

Let’s go!!! *DJ Khaled Voice*