BM PRO Mining Dashboard Release!

We are excited to announce the release of Bitcoin Magazine PRO’s Mining Dashboard with data specific to bitcoin mining and publicly traded mining equities. For paid subscribers only. Live access soon!

See Also:

Bitcoin Magazine PRO Mining Dashboard Release

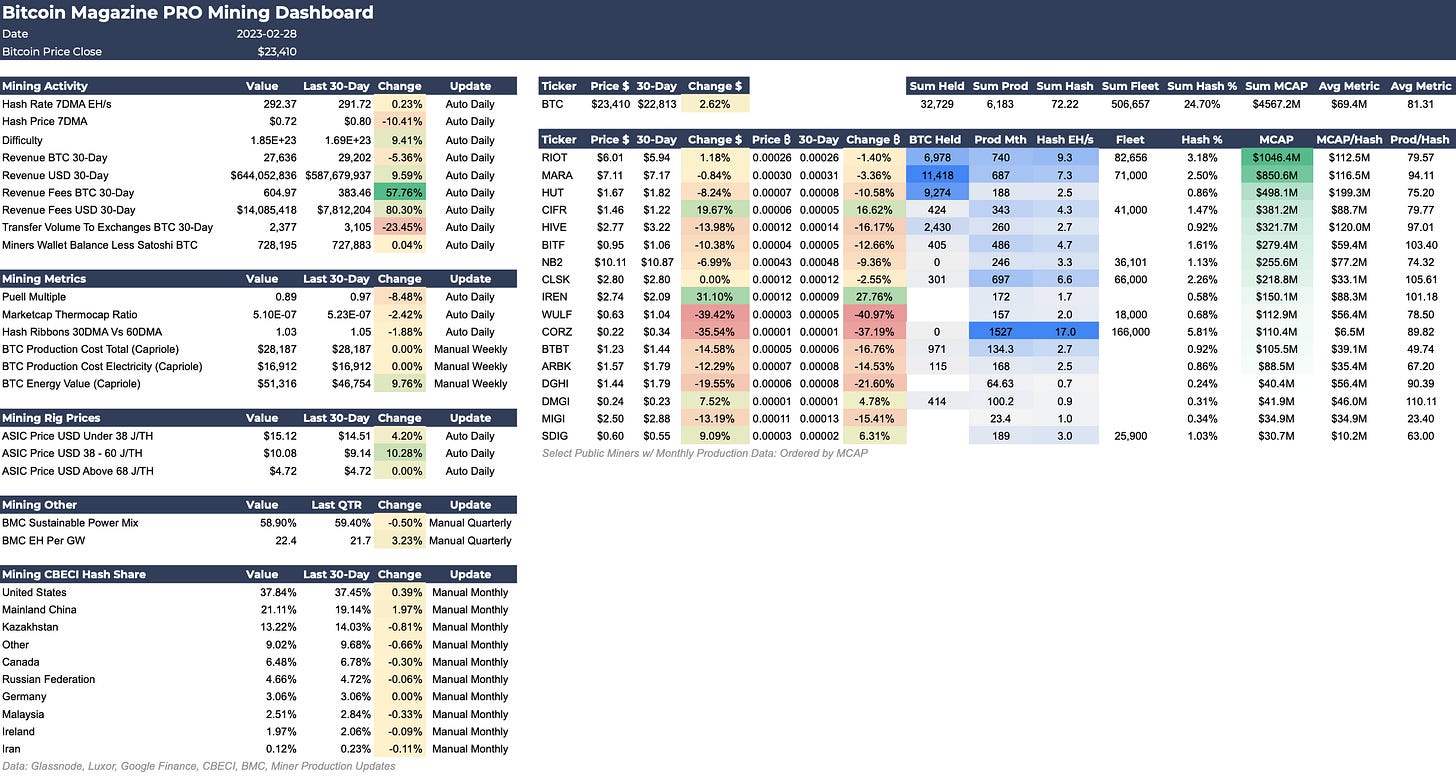

Today, we’re announcing a new feature for paid subscribers: the Bitcoin Magazine PRO Mining Dashboard. After getting positive feedback on the Market Dashboard, we decided to add a new dashboard with even more useful data. The dashboard is designed to actively track important metrics specific to bitcoin mining and publicly trading mining companies. It covers data across hash rate, revenue, mining rigs, geographical hash share and mining-related equities. These are several of the key metrics we track on an ongoing basis and find them useful to assess the current state of bitcoin mining.

We will be releasing a password-protected website for live access to both this Mining Dashboard and our already released Market Dashboard on Thursday, March 2. In today’s piece, we will cover this dashboard with a short explanation of the different metrics. We want to hear from our readers about other mining data you would like us to track, so please respond to the poll at the bottom of the article. As always, we welcome your feedback on this new feature.

The current dashboard snapshot is included below along with a downloadable PDF link. To see all of the information clearly, it’s best to click the image to zoom in on the individual metrics or download the PDF to get a closer look.

Once we release the live dashboards, we will send a weekly email with a dashboard snapshot and the updated password for paid subscribers to use.

Download the PDF version of the Market Dashboard below.

All Visuals, No Summary

The Mining Dashboard is different from the Market Dashboard as it aims to show relevant mining market data rather than a bullish, neutral or bearish view on bitcoin price. Some of this data changes on a daily basis, like on-chain mining activity and equity prices relative to bitcoin performance, while other public miner production metrics change every month. There are many different mining data sets and metrics we can analyze further and we aim to make iterations of the dashboard in order to find the most useful information for paid subscribers. Below we will highlight some of the data and metrics we’re currently using.

Indicator Overview

In Mining Activity, you will find simple metrics like hash rate, hash price, difficulty change and cumulative miner total revenues and fee revenues in both BTC and USD over the last 30 days. You will also find Glassnode data for the change in miner transfer volume to exchanges and total known miner wallet balances that track short-term changes in miner accumulation or selling activity.

In Mining Metrics, we’ve included the Puell Multiple which is also highlighted in the Market Dashboard. We added the Market Cap to Thermocap Ratio. This ratio is another popular cyclical indicator to track bitcoin price relative to total security spend.

“The Market Cap to Thermocap Ratio is simply defined as Market cap / Thermocap, and can be used to assess if the asset's price is currently trading at a premium with respect to total security spend by miners. The ratio is adjusted to account for the increasing circulating supply over time.”

You will also find popular momentum and valuation metrics by Charles Edwards of Capriole Investments. The first is Hash Ribbons which track the 30-day moving average in hash rate versus the 60-day moving average in hash rate. There is a more in-depth article here. A more positive momentum signal is when the 30-DMA crosses over the 60-DMA (above 1). Vice versa, a more negative momentum signal is when the 30-DMA falls below the 60-DMA (below 1).

We also included models for BTC Production Cost across total and electricity costs as well as the model for BTC Energy Value and will update these on a weekly basis. These models aim to find an average mining cost of the entire network and a fair value for bitcoin price based on a function of energy output and other variables. More on the production cost estimates can be found here, while the methodology for the energy value model is here.

In Mining Rig Prices, you will find the Luxor and Hashrate Index data for Bitcoin mining rigs across efficiency types priced in USD. We find it useful to track changes in rig prices to assess the change in the overall demand for bitcoin and mining bitcoin. More on that can be found here and below:

“Our ASIC Price Index reflects the current price per TH of different Bitcoin mining ASICs grouped by three efficiency tiers. The ASIC Price Index is measured in both US dollars (USD) and bitcoin (BTC).

“Hashrate Index collects the price, hashrate, and electricity usage for dozens of SHA-256 miners over time. We leverage multiple sources including forums (Bitcoin Talk, Reddit), broker-dealers (websites, telegram channels), manufacturers’ websites, and Luxor's ASIC Trading Desk.

“We calculate the ASIC Price Index by averaging each unit price based on its nominal hashrate output. We group together different ASIC models into different efficiency tiers based on their power efficiency and display each efficiency in terms of $ per TH or BTC per TH. Each Bitcoin mining ASIC listing we use in the index is vetted through a confidence interval using previous index values and our proprietary algorithm.”

In Mining Other and Mining CBECI Hash Share, we’ve included external data sources for the Bitcoin Mining Council’s quarterly estimates on total network sustainable power mix and network efficiency looking at EH per GW. Although difficult to estimate, the Cambridge Bitcoin Electricity Consumption Index provides a view of Bitcoin network and country shares that are updated monthly.

As for public mining equities, we’re aiming to track most public miners in the market who provide some level of monthly production data across holdings, hash rate, monthly production and fleet size. For now, we’ve just included some simple metrics to view hash rate and production relative to overall market capitalization along with equity performance relative to bitcoin performance on a 30-day basis. Prices, market cap and relative performance change daily, while production metrics are collected directly after new production reports are released at the beginning of each month. We’ve also included aggregate totals for those metrics across miners.

This is a prime area where we can be doing more in-depth public miner analysis based on subscriber demand. Further examples would be collecting SEC filing reports to incorporate key quarterly metrics like Enterprise Value, Debt-to-Equity ratios, implied miner breakeven cost for mining bitcoin and much more. If there are certain metrics, data sets, detailed analysis or other feedback you would like to provide, let us know and we will work to incorporate those into new versions of the dashboard. Some potential iterations could include:

Poll 1:

Poll 2:

Upcoming Twitter Spaces: Bitcoin Magazine PRO will host Joe Consorti on Thursday, March 2 at 4:00pm ET for a discussion about credit spreads, Fed policy, and macroeconomic trends.

The LIVE version of the Dashboards will be released on Thursday, March 2!

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

good job guys. great dashboard

Thank you for the great job regarding the mining industry. Could you add the mining cost per BTC for each miner too? It would give a clear view up to what btc price their business is sustainable economically. Also if you could add the debt to be repaid within the next 12 months so that we could have a quick insert of their “bankruptcy risk”.