State Of The Mining Industry: Public Miners Outperform Bitcoin

Even with the recent rise in the bitcoin price, public bitcoin mining stocks start the year with more impressive gains than the asset itself. Hash price rebounds but difficulty keeps climbing.

Relevant Articles:

Time-Based Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market Apathy

This Time Isn’t Different: Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle

Hash Rate Hits New All-Time High: Implications For Mining Equities

Upgrade to paid to see the PRO Market Dashboard and read a summary of current market sentiment at the bottom of the article!

Public Mining Update

It’s been a few months since our last update of publicly traded bitcoin mining companies. Now that the latest round of production updates for January are published, let’s dive in.

Looking at the high-level view of bitcoin holdings, we’ve seen a declining trend in holdings across public miners throughout 2022, from 46,930 BTC at peak in April 2022, to 31,892 in January 2023 — a 32% decline in 10 months. With Bitfarms, Core Scientific and Northern Data shedding their bitcoin, holdings across public miners are now largely concentrated in Marathon Digital, Hut 8 and Riot Platforms. These three miners make up nearly 87% of all bitcoin holdings on this list. Adding HIVE Blockchain makes that 94% across just four public miners.

Although public miners are estimated to make up over 20% of overall hash rate, their 31,892 bitcoin is relatively small compared to the estimated 723,000 bitcoin in all miner addresses today (4.4%). To get that estimate, we’re using Glassnode’s bitcoin balance in all known miner addresses today, less an estimate for Satoshi Nakamoto’s 1.1 million coins.

The trend of hash rate expansion is “up only” with public miners growing their hash rate by 129% over the last year. This growth has been a significant driver of overall hash rate expansion with the network hash rate recently reaching 300 EH/s and public miners making up nearly 25% of all hash rate on a given day. That percentage is understated as we’re not including all public miners, like Cipher and TeraWulf.

Mining Production Update Notes

Marathon made a statement about their choice to sell some bitcoin that the company mined, “With bitcoin production increasing and becoming more consistent, we made the strategic decision to sell some of our bitcoin, as previously planned, to cover some of our operating expenses and for general corporate purposes. We intend to continue to sell a portion of our bitcoin holdings in 2023 to fund monthly operating costs.”

In their announcement, they shared about places for further hash rate expansion. “The company still expects to have approximately 23 EH/s of capacity installed near the middle of 2023.”

Similarly, HIVE’s production update informed shareholders about bitcoin sales, “HIVE sells all of the Bitcoin earned from our GPU mining hashrate, with a focus to HODL the green Bitcoin mined from ASICs.”

Riot Platforms announced a delayed timeline for growing their hash rate, “Unfortunately, as a result of this damage, our previously announced target of reaching 12.5 EH/s in total hash rate capacity in Q1 2023 is expected to be delayed. We will provide additional updates as we obtain greater clarity on the impact to our planned deployment schedule. In the meantime, the remaining infrastructure build-out at our Rockdale Facility continues to progress, with Building E now at 50% completion and on track to be fully completed this quarter, and we are continuing to execute on the expansion at our Corsicana Facility.”

Iris Energy increased its mining capacity from 2.0 to 5.5 EH/s by using prepayments to acquire new miners.

In other public mining news, Hut 8 shared about a recent merger and their HODL strategy:

“On February 7, 2023, Hut 8 announced a merger of equals with U.S. Data Mining Group, Inc. dba US Bitcoin Corp (‘USBTC’) which is expected to establish the combined company as a large scale, publicly traded Bitcoin miner focused on economical mining, highly diversified revenue streams, and industry-leading best practices in ESG.

“We have been intentional and strategic in pursuing our HODL strategy: by building a large, unencumbered stack, we have afforded ourselves the optionality to strategically use a portion of it to cover operating expenses rather than having to seek other financing options with less attractive terms,” said Jaime Leverton, CEO. “I am confident that selling production while we focus on closing the merger with USBTC is the right approach, as we expect to create a strong self-mining, hosting, managed infrastructure operations, and HPC organization in the long term.”

Mining Pool Stats: 1 Week

Mining Pool Stats: 1 Year

In case you missed it: Bitcoin Magazine PRO hosted Preston Pysh to discuss all things macro, bitcoin-native capitulation, ordinals’ impact on bitcoin fungibility.

Hash Rate All-Time Highs

With some help from cost-sensitive miners turning rigs back on, Bitcoin’s mean 7-day hash rate has once again broken to new all-time highs, with a weekly average of 303 EH/s.

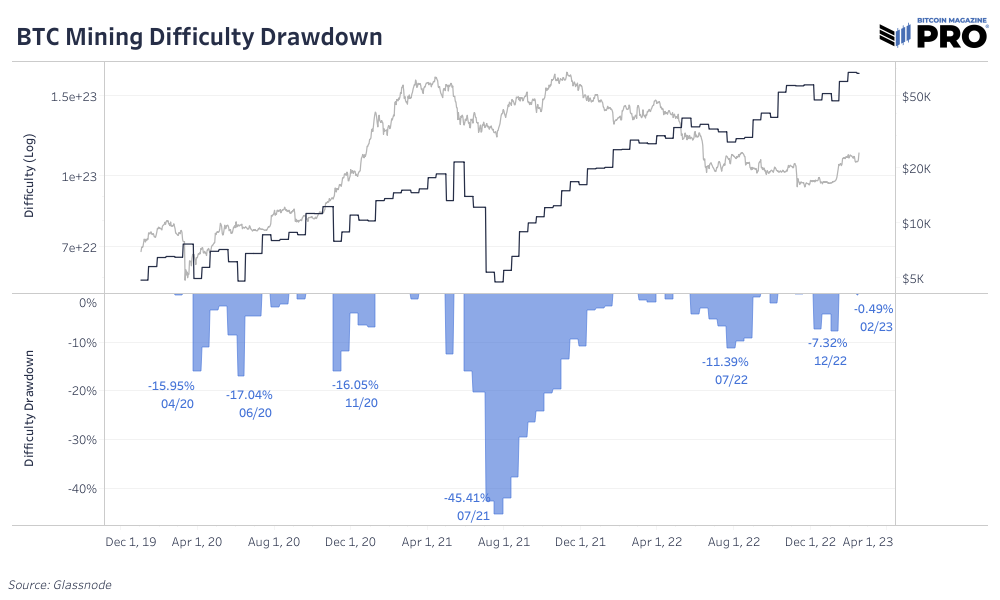

Bitcoin’s mining difficulty, which adjusts to variable hash rate every 2016 bitcoin blocks, or approximately every two weeks, last adjusted downward by 0.49% on February 12.

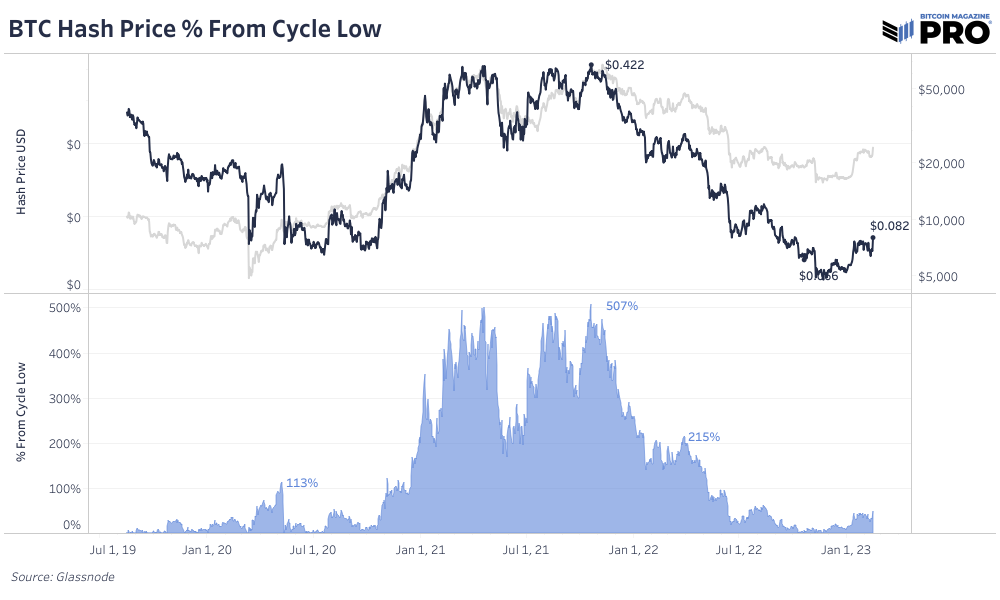

Hash price, which is miner revenue per terahash — one of our favorite tools to evaluate the status of the mining cycle — has rebounded nearly 50% off its cycle lows, With network hash rate pushing to new highs, the next difficulty adjustment is projected to be +12.0%, likely occurring on February 25.

Source: https://www.bitrawr.com/difficulty-estimator

The expected ratchet upward in mining difficulty will take away some of the relief that operations were feeling in recent weeks, due to the increase in USD-denominated revenue. Miner revenue denominated in bitcoin terms will once again head to new lows.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

How recent hash price affects bitcoin miners. ⛏️

Public Bitcoin miner performance analysis. 📊

Framework for investing in publicly traded mining companies. 📚

Hash Price Rebounds From Cycle Lows

The improvement in hash price that was fueling miners’ relief is the largest rebound in the metric since the start of the mining bear market in 2021. The real test for the recent uptick in hash rate past 300 EH/s will come following the next difficulty epoch. We can reasonably assume that at least a partial amount of the growth in hash rate is older generation machines who resumed hashing due to the recent rally in the price of bitcoin.

As hash rate, and subsequently mining difficulty, continue to stretch toward highs, older generation machines and inefficient operations will continue to get squeezed at the expense of more efficient businesses with newer generation mining machines.

As shown by Luxor’s Hashrate Index ASIC Data, ASICs (in dollar terms) are a form of a bitcoin derivative that take into account increasing mining difficulty and a decreasing block subsidy over time. In simple terms, expect ASIC valuations denominated in USD to trend with bitcoin’s exchange rate, with a slight depreciation over time. However, in bitcoin terms, this depreciation takes place steadily to the downside as the ASICs are producing bitcoin-denominated revenue. This form of economic calculation is crucial to understand when navigating the bitcoin cycle, and in particular when focusing on mining equities.

Source: Hashrate Index ASIC Data

Source: Hashrate Index ASIC Data

Public Miner Performance

Public miners have been among the best performers in the equities markets year-to-date, with shares of Iris Energy leading the way at an impressive 255% gain, and shares of Bitfarms, Hut 8 and HIVE Blockchain following.

These companies’ performance against bitcoin is equally as impressive because every major public miner in our closely followed basket has outperformed their baseline (BTC) to start 2023. This dynamic perfectly reflects the reality of the hash price bull and bear cycle that we often reference.

Many readers wonder about the optimal time for investing in publicly traded bitcoin miners. An extremely simplified framework for investors is:

Hash price bull market = Bitcoin miners outperform bitcoin

Hash price bear market = Bitcoin miners underperform bitcoin

While the recent outperformance by miners is impressive, it is important to note that many crypto equities were near the top of the list in terms of short interest, fueling the flames for this explosive rally.

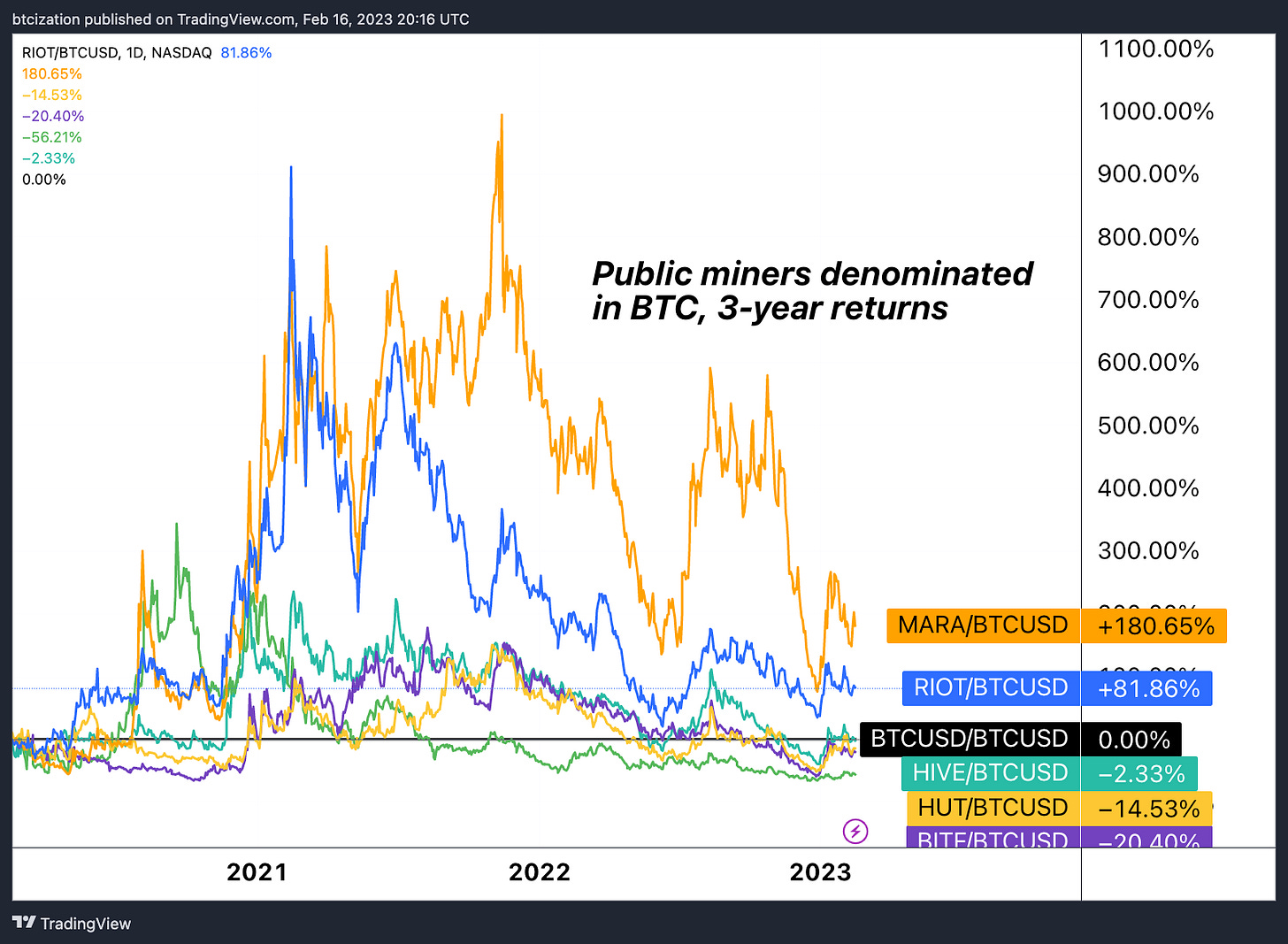

On longer time horizons, we find bitcoin outperformance to be a very tall order, given the ruthless competitiveness of the global mining industry, coupled with a programmatically decreasing block subsidy that continues to occur every 210,000 bitcoin blocks — approximately once every four years.

On a three-year timeline, only shares of Marathon Digital and Riot Platforms have outperformed bitcoin, with shares of HIVE Blockchain slightly underperforming at minus 2%.

In regards to the forward-expected returns for public miners, as well as general mining infrastructure as an investment, we fully expect another mining “gold rush” phase to emerge, where hardware and mining infrastructure are in short supply while the bitcoin exchange rate explodes upward, giving deployed miners the opportunity for outsized gains. Despite the impressive outperformance in recent months, we do not think the gold rush has fully arisen just yet. Because of the large amount of ASIC machines that exchanged hands during the crash in 2022 — partially due to ASIC-collateralized loans — we expect many of these machines to be deployed at extremely low-cost sites across the globe, which will take some time as the dust still settles from numerous mining companies going under.

Infrastructure build-out takes time, but the sheer amount of ASICs that remain undeployed despite the average hash rate above 300 EH/s shows the tremendous amount of investment and technological innovation that has occurred around the mining industry in recent years. We can see Moore’s Law in action by looking at a chart of ASIC efficiency by Luxor’s Hashrate Index.

Source: Luxor’s Hashrate Index

The sheer efficiency of these new machines gives us reason to believe that idle hash rate already is, or will soon be on standby, waiting for higher prices and/or lower mining difficulty to start hashing.

For these reasons, our estimate for the short-to-intermediate time is that growth in hash rate will accompany the potential appreciation in the BTC/USD exchange rate in 2023, with the real boom cycle likely to occur in the post-halving period during 2024.

The recent months have brought about a mini mining “gold rush” phase, where both hash rate and bitcoin’s exchange rate are appreciating in tandem. Given the scale and scope of the capitulation that has already occurred in the mining sector, a case could be made that the cycle is already in the top right quadrant.

The mining framework above is purposefully simplistic. The more nuanced take is that the state of the cycle is somewhere in the middle of the four quadrants, as the lag time from displaced ASICs returning to hashing will continue throughout 2023, while bitcoin looks to retake much of the gains given up in 2022.

Regardless of the next direction taken by bitcoin or equity markets more broadly, mining equities will continue to offer investors volatility galore, with the right market conditions presenting much of that volatility in the form of upside appreciation.

Final Note

Global investors will be hard-pressed to find anything on the planet that continues to flourish and grow at a comparable pace to the bitcoin hash rate. The story here that has been unfolding for more than a decade’s time is the evolution of the strongest, decentralized computing force the world has ever seen, yet most miss the forest for the trees.

Short-term market correlations and exchange-rate performance aside, bitcoin remains the world’s singular best chance at achieving a globally neutral, monetary protocol for final settlement.

In fact, this reality already exists — it has already arrived. However, a widespread understanding of the network’s unparalleled strength, resilience and antifragility is just not evenly distributed.

This is where the opportunity lies.

PRO Market Dashboard

Market Summary

There’s little change to last week’s bearish signal increase as bitcoin price faces another critical level at the 200 WMA again around $25,000. With rising U.S. dollar strength, a window for a reversal in compressed equities volatility and no new significant expansion in the liquidity measures we’re tracking, we’re still cautious on a bear market rally and reversal here. Taking the other side, a significant breakout above $25,200 likely takes bitcoin up to $30,000 next. Over the last week, there’s been significant change in rate expectations in 2023H2 and caution around a resurgence in inflation which confirm the “higher for longer” view. After a couple weeks of strong bitcoin fund inflows into the rally (over $160M), we saw slight fund outflows this week of $10.8M. Thursday of this week was the highest perpetual funding rate we’ve seen in since the November 2021 top at a 18.6% annualized rate alongside rising open interest in USD terms. Potentially another sign that long speculators are getting overextended here. GBTC discount has seen some improvement over the last week but remains below 40%. Correlations to risk remain weaker on shorter time frames relative to long-term trend.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!