Time-Based Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market Apathy

Interest in bitcoin is currently in the doldrums. The brunt of the price-based capitulation has already been felt, while the real pain ahead is a waiting game for the market to finally turn around.

Relevant Past Articles:

Time-Based Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market Apathy

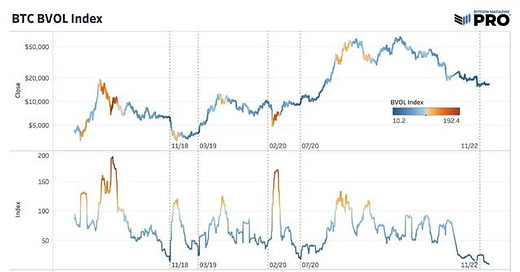

As we head into 2023, we want to highlight the latest state of bitcoin’s volume and volatility after a recent wave of capitulation. Last time we touched on these dynamics was in “The Bitcoin Ghost Town” in October, where we highlighted that an extremely low volume and low volatility period in bitcoin price, GBTC and the options market was a concerning sign for the next leg lower. This played out in early November.

Fast forward to today and the trends of declining volume and low volatility are back once again. Although this could be indicative of another leg lower to come in the market, it’s more likely indicative of a complacent and decimated market that few participants want to touch.

Even during the November 2022 capitulation period, there was a historically low period of volatility. Sometimes the most market pain can be felt when having to wait for a clear change in trends. The bitcoin price is providing that pain as we’ve yet to see the type of explosion in market volatility that has defined market pivots and major directional moves in the past. We were incorrect in our views that a pivot would come in 2022. The risk still remains for an overhang of broader equity market volatility (measured by the VIX).

Note that the bitcoin BVOL index is looking at past 30-day volatility while the VIX measures forward-looking volatility over the next 30-days.

We can turn to the much more nascent options market in bitcoin for a similar look at the implied (expected) volatility over the next 30-days. One-month implied volatility for bitcoin is at its lowest level in the history of the data — which only goes back to 2021.

The lack of expected volatility is not just a near-term expectation; six-month implied volatility is at its lowest recorded level as well. A simple explanation is that there just aren’t many large players left in the market, which were the source of the tremendous levels of volatility throughout the bull market.

Volumes across spot and futures markets are telling a similar story. While there are many different ways to define, classify and estimate bitcoin volume in the market, they all show the same thing: September and November 2021 were the peak months of action. Since then, volume in both the spot and perpetual futures markets have been in steady decline with a notch down in December and what looks like a continued trend headed into this month.

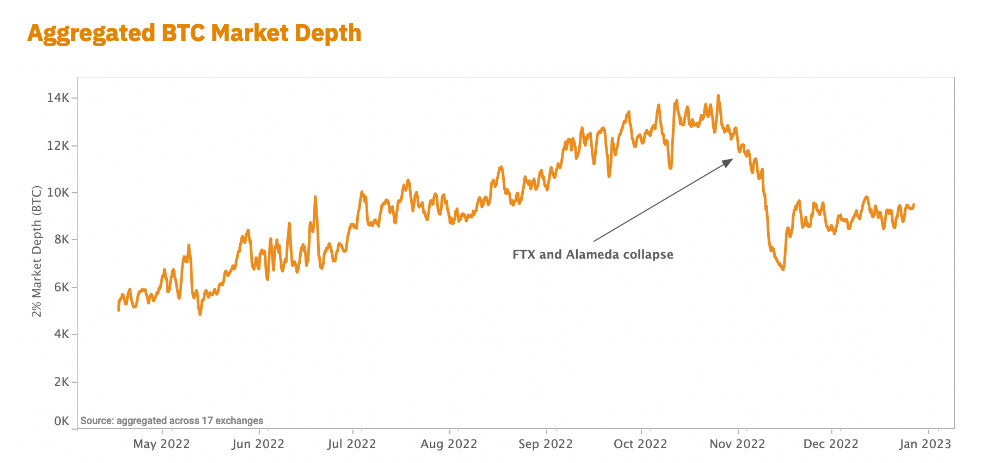

Overall market depth and liquidity has also taken a major hit after the collapse of FTX and Alameda. Their destruction has led to a large liquidity hole, which is yet to be filled due to the lack of market makers currently in the space. The market makers that weren’t wiped out are taking more precautions to keep assets further away from exchanges and are raising more cash instead of providing liquidity.

By far, bitcoin is still the most liquid market of any other cryptocurrency or “token,” but it’s still relatively illiquid compared to other capital markets since the whole industry has been crushed over the last few months. Lower market depth and liquidity means assets are prone to more volatile shocks as single, relatively large orders can have a greater impact on market price.

Source: Kaiko Q4 Report

Source: Kaiko Q4 Report

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Analysis: Whether moving averages over various periods is telling us if interest in bitcoin is increasing or decreasing.

What data shows about seller exhaustion and why this is an important signal.

Which other metrics might be important to watch over the coming weeks and months. 👀

On-Chain Apathy

As expected in today’s environment, we’re also seeing more market complacency when looking at on-chain data. Although continuing to rise over time, the number of active addresses — unique addresses active as either a sender or receiver — remain fairly stagnant over the last few months. The chart below highlights the 14-day moving average of active addresses falling below the running average over the last year. In previous bull market conditions, we’ve seen growth in active addresses outpace the existing trend fairly significantly.

Since address data has its flaws, looking at Glassnode’s data for active entities shows us the same trend. The estimated number of entities in the market remain somewhat flat over the last year, and are turning over as of late. Overall, bear markets reversing are the result of many factors, including growth in new users and an increase in on-chain activity.

Throughout 2022, transaction fees in USD continued to decline other than a surge over the last two months, which was likely driven by forced liquidations. This comes at a time when Bitcoin’s total transfer volume in USD terms has fallen well below the trend over the last year.

We can look at the moving averages of transfer volume across various time periods to see whether on-chain activity and momentum is increasing or decreasing relative to the trend. In past bear market cycles, on-chain activity begins to pick up relative to trend before the exchange rate recovery cycle is in full effect.

Today’s trend shows a diminishing level of on-chain transactional activity when comparing the 30-day and 365-day moving averages. While this is not to say that there is a certainty of lower prices and worsening conditions for the asset, it is saying that a meaningful change in trend has yet to occur.

Lastly, we can look at the seller exhaustion constant metric, which takes the percentage of the bitcoin supply in profit and multiplies it by the 30-day realized volatility. The metric’s name states its intention perfectly: an attempt to quantify when sellers may be exhausted, given low levels of profitability and historically low levels of volatility in tandem.

Using this metric has mixed results. The previous times this signal flashed occurred at or very near market cycles bottoms, but there have also been times where the bitcoin price had further to fall. Shown below are periods where the metric was at or below the level it is today.

While barely 50% of coins moved across the network were done so in profit in USD terms and record low levels of implied and realized volatility are being witnessed, we have a few near term signs that there is a level of apathy in the bitcoin market that would signify the worst has already arrived.

In our July 11 release “When Will The Bear Market End?”, we made the case that the brunt of the price-based capitulation had already been felt, while the real pain ahead was in the form of a time-based capitulation.

“A look at previous bitcoin bear market cycles shows two distinct phases of capitulation:

“The first is a price-based capitulation, through a series of sharp selloffs and liquidations, as the asset draws down anywhere from 70 to 90% below previous all-time-high levels.

“The second phase, and the one that is spoken of far less often, is the time-based capitulation, where the market finally begins to find an equilibrium of supply and demand in a deep trough.”

We believe time-based capitulation is where we stand today. While exchange rate pressures can certainly intensify over the short term — given the macroeconomic headwinds that remain — the conditions that look likely to persist over the short and medium term look to be a sustained period of chop with extremely low levels of volatility that leave both traders and HODLers questioning when volatility and exchange rate appreciation will return.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Great article, guys! I love the concept of time-based capitulation, which you articulated well.