State Of The Mining Industry: Survival Of The Fittest

Hash rate had its first major drawdown since July 2021. Difficulty adjustment hits a record low. Public miners are feeling the pressure as the tough conditions may last for a sustained period of time.

Relevant Past Articles:

This Time Isn’t Different: Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle

Hash Rate Hits New All-Time High: Implications For Mining Equities

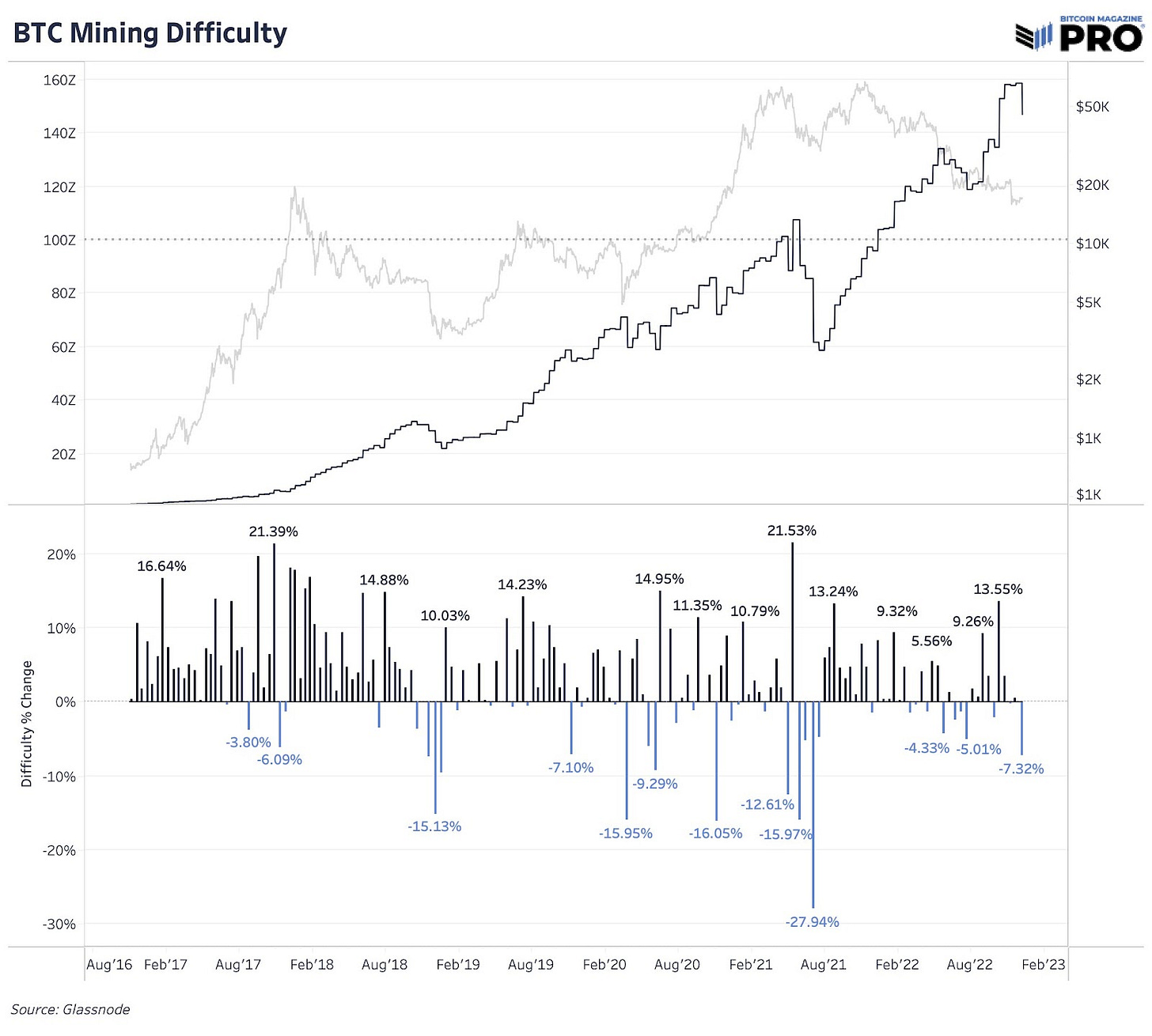

Record Downward Difficulty Adjustment

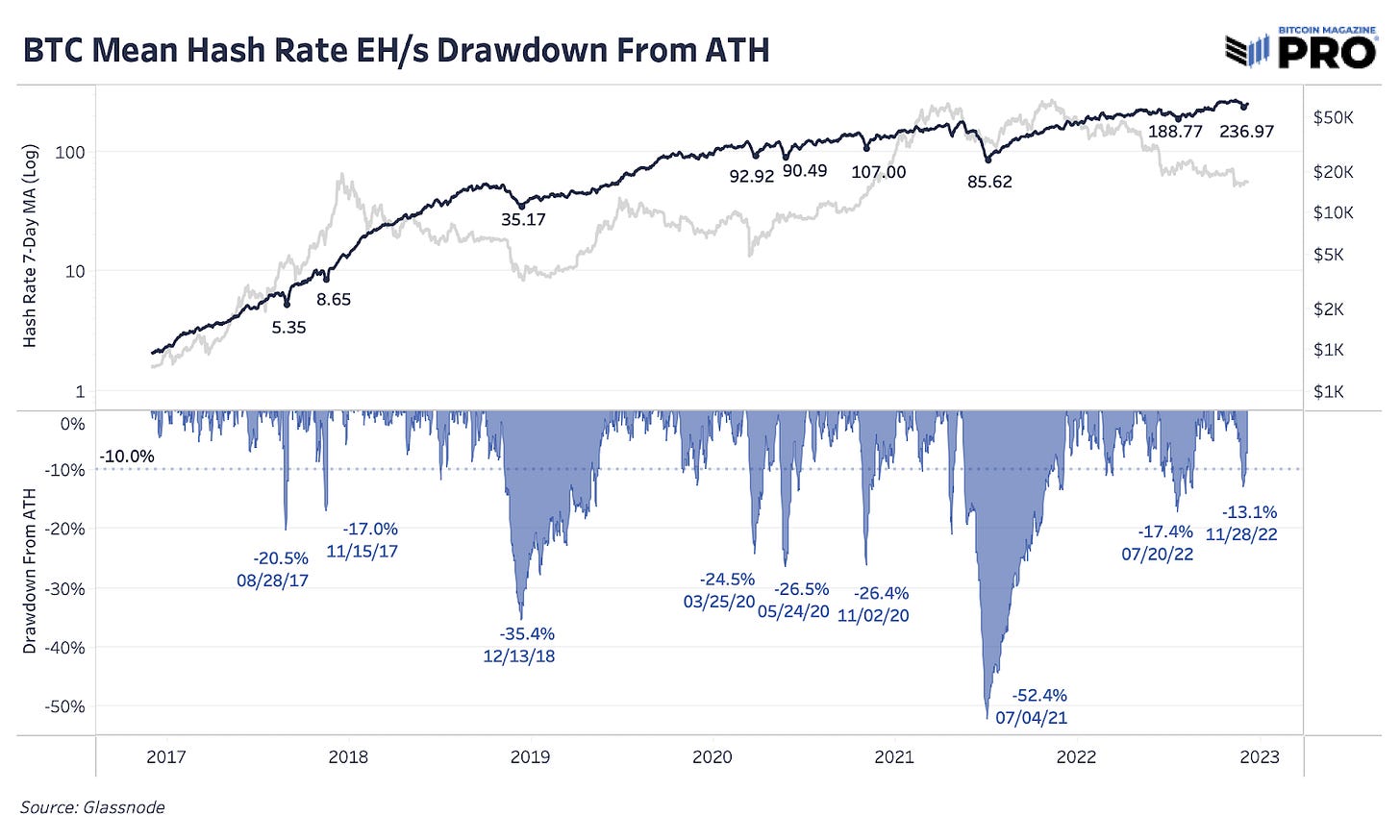

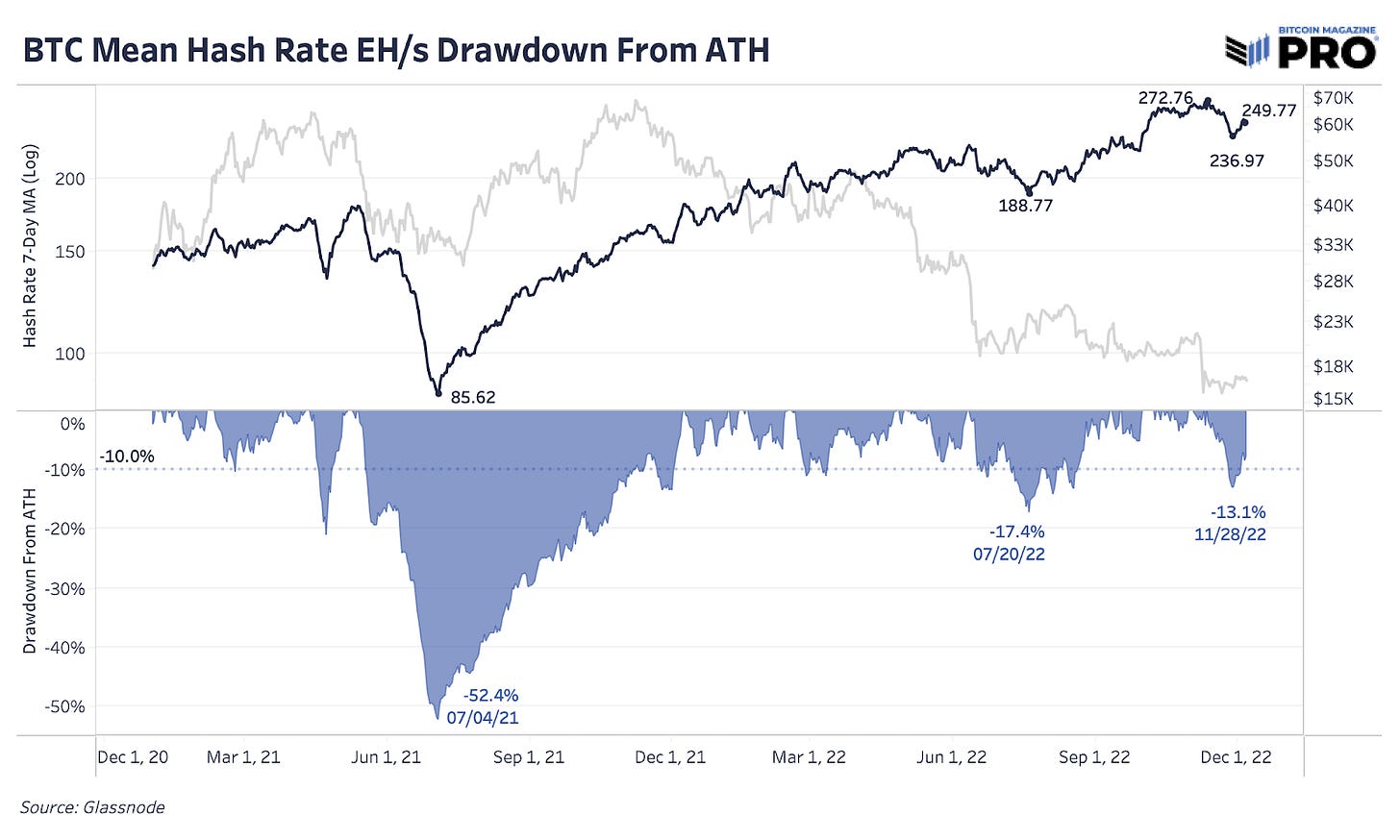

The mining industry continues to take a beating as rising energy inflation, debt burdens and depressed bitcoin prices take their toll. At the end of November, we saw a 13.1% decline in hash rate from all-time highs. However, of the major hash rate declines since 2016, that’s still relatively small compared to the handful of down periods over 15% during that time.

The latest 7.32% downward difficulty adjustment is a direct response to all of that hash rate going offline. As we stand today, the hash rate is right around 250 EH/s and down 7.84% from its all-time high of approximately 273 EH/s. This is the largest downward difficulty adjustment we’ve seen since July 2021, when we saw a series of downward difficulty adjustments following the Chinese mining ban. This should bring some temporary relief to current miners, but it's too early to say if this trend in declining hash rate has already concluded.

Upcoming Twitter Spaces: Bitcoin Magazine PRO is having a roundtable discussion with special guest Magoo Ph.D. today Thursday, Dec 8 at 4:00 pm ET. Click below to set your reminder so you don’t miss out.

Even with the latest drawdown in hash rate, we’re not seeing announcements come from major public miners. Most public miners’ hash rate is either flat or is growing over the last month. The elephant in the room is still Core Scientific and what’s to come of their self-mining hash rate of 14.40 EH/s and total hash rate, including hosted hash rate of 24.4 EH/s. On the brink of bankruptcy and after losing $1.71 billion in 2022, cash will likely be depleted soon and the company will need more liquidity to continue. The below chart shows maximum installed capacity of hash rate, which can vary from a miner’s operating hash rate.

From those who have provided monthly production updates so far, bitcoin holdings are largely rising from the biggest three treasuries across Riot, Marathon and Hut 8 accounting for 27,579 bitcoin. Bitfarms sold a meaningful amount from their treasury which is likely related to paying down their current debt facilities.

Mining revenue pressures relative to recent trends can be easily viewed through the Puell Multiple, capturing a ratio of current daily revenue over the last 365-days moving average daily revenue. Daily revenues are still fairly depressed from the one-year trend and look more akin to the 2015 cycle where it stayed this way for many months to come. The fall in revenue comes at the same time as miners facing a regime shift to higher energy costs with rising electricity prices across the board. A look at cumulative 30-day miner revenue shows the same pressures with 30-day cumulative well below what we saw back in July 2021 capitulation.

In bitcoin terms, miners' stock performance continues to fall this year when looking at year-to-date returns versus bitcoin performance. The hash price bear market is alive and well, which has been a core thesis for us when evaluating the current prospects of investing in public miners versus bitcoin. Any miner outperformance in bitcoin short-term has proven to be an opportunity in the market to reprice the equity lower.

Looking at the market caps of a proxy basket of six public bitcoin miners shows just how much value has been wiped out from 2021. After a 452% rise in value to its November 2021 peak of $19.1 billion, the market wiped out 90% of value in less than a year. Data is largely impacted by Marathon and Riot performance which account for the majority of market share across this group of miners. Not many public miners existed at the start of 2021.

While the worst of the drawdown of public miner market capitalizations and hash price (miner revenue per tera hash) has already taken place, we expect that the tough conditions can last for a sustained period of time, squeezing many market participants along the way. The recent downward difficulty adjustment brought about some relief, but it is barely sufficient for many miners who purchased the bulk of their machines in 2021, expecting $30,000 as their “worst-case scenario.”

Throw in an environment where global energy prices and interest rates have skyrocketed and many operations are facing immensely difficult circumstances — particularly hosting facilities where companies serve as intermediaries for customers looking to reap the benefits of mining bitcoin. The elephant in the room for the state of the mining industry is the reality that some of the industry’s biggest hosting facilities are either already bankrupt, teetering on the edge of bankruptcy or are completely out of deployable hash rate for idle ASICs.

The previously second largest North American miner Compute North has already filed for bankruptcy and is currently working through court proceedings. Core Scientific recently raised its hosting rates to approximately 10 cents per kilowatt-hour as it faces rising energy costs, declining margins and mounting debt burdens. (Per the company’s earnings reports, the firm is bleeding millions of dollars via its hosting facilities.)

Similarly, Bitcoin infrastructure giant Blockstream recently announced it had raised an unspecified amount of funds at an approximately $1 billion valuation, with part of those funds going to expand their hosting division, as per the firm’s CEO Adam Back. The decision is said to be due to a general lack of hosting rack space available across the industry.

We will be intently watching hash rate and the state of the mining industry going forward. Although the industry has been bludgeoned over the course of 2022, we suspect it isn’t out of the woods quite yet.

The beauty of bitcoin and capitalism is that only the strong will survive. Regardless, blocks will continue to be mined every approximately 10 minutes.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and comment if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!

Grateful if you can do an article on the inevitable tether collapse and it's effects on Bitcoin price.