Public Miner Capitulation: Core Scientific On The Ropes

Miner capitulation is here. Core Scientific talks potential bankruptcy, says cash resources will be depleted by year's end. Rising electricity prices and equity share dilutions remain major risks.

Relevant Past Articles:

In case you missed it:

In Tuesday’s issue, This Time Isn’t Different: Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle, we took an in-depth look at the state of the bitcoin mining industry, highlighting the 2018 cycle comparison of stagnating price while hash rate soared.

Core Scientific Capitulation

We’ve been highlighting the case for more public miner capitulation over the last few months. Blockbuster news out today shows that Core Scientific, the largest publicly traded mining company by hash rate and miner fleet, now may face bankruptcy. The highlights from their recent SEC filing are the following:

Core Scientific is halting all debt service payments.

Bitcoin holdings are now 24; they sold 1,027 over the last month.

Cash resources will be depleted by the end of the year or sooner.

Core Scientific claims Celsius owes them $5.4 million.

A giant in the mining space, holding over 9,600 bitcoin at its peak, Core Scientific has now nearly depleted its entire treasury. Month-over-month growth in holdings is now worse than the summer capitulation and selloff we saw back in June. Yet, in June the selloff was much larger in size (6,099 bitcoin). It’s not necessarily the Core Scientific treasury we are concerned about now but rather the treasuries and holdings of all other bitcoin miners if this is a bigger warning sign for the industry.

Core Scientific was able to drive higher bitcoin production and share of the hash rate by having the largest debt-to-equity ratio in the space at 3.5. Now that debt is coming due during the worst time to try and raise more equity, with depressed prices and lack of financial appetite in the market.

Currently, the company’s liquidity situation is dependent on two variables: the bitcoin price going higher and electricity costs coming down. Our view is that it will be incredibly lucky for either to materialize as a stagnating bitcoin price (with a decent probability of more downside) continues and electricity prices, especially for hosting bitcoin miners, is only trending higher. Looking at Q2 earnings, Core Scientific’s cost of revenues went from 67% to 92% compared to last year. Higher power consumption costs played a significant factor.

Bitcoin Magazine PRO hosted a Twitter Spaces with special guest James Lavish (author of The Informationist newsletter) today Oct 27. We covered the larger macroeconomic landscape, equities, bonds and of course the Core Scientific news. Click here to listen to the recording.

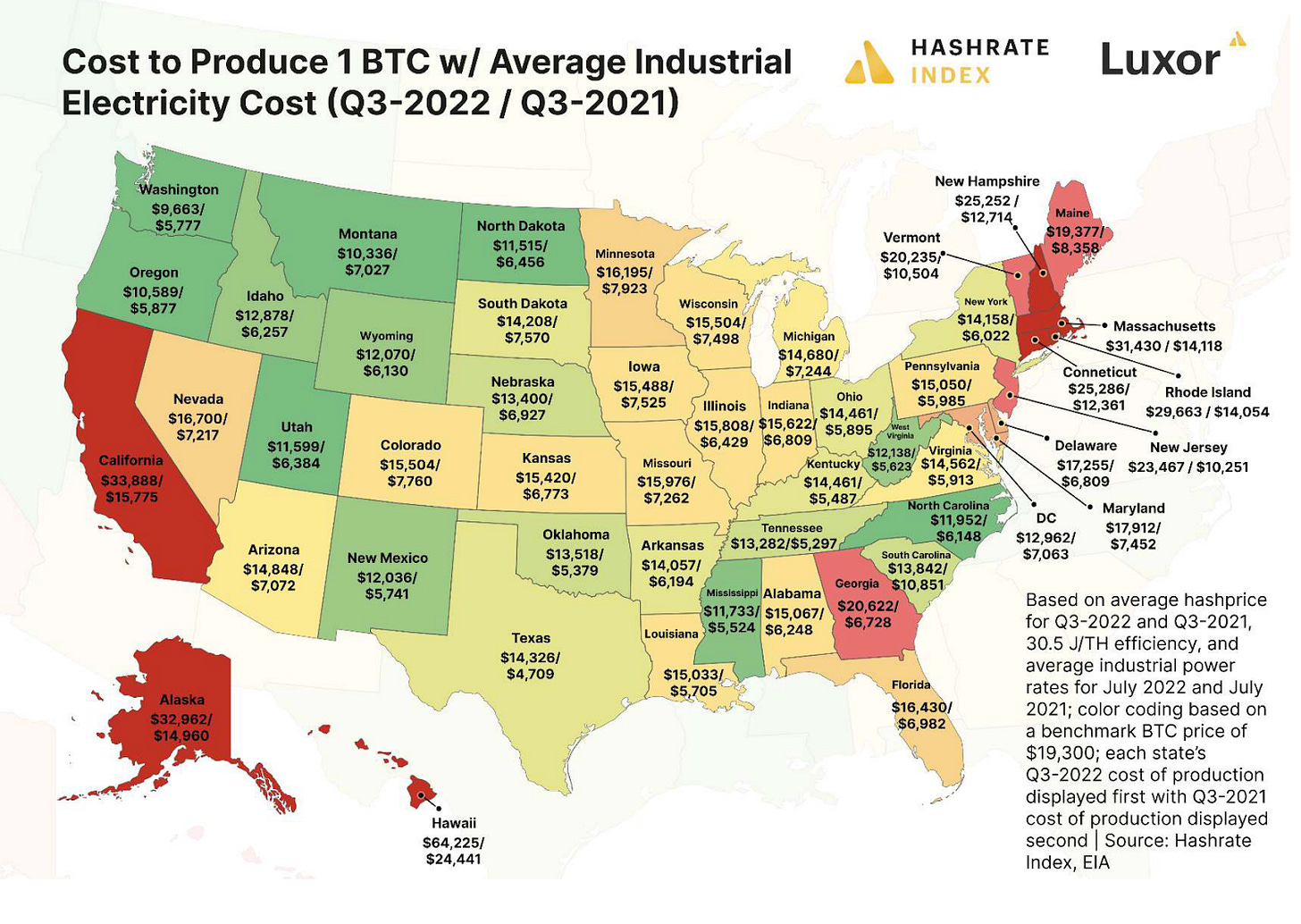

In their recent Q3 report, Hash Rate Index (Luxor) quantifies bitcoin production costs across states showing that production costs are soaring across the board relative to 2021. One of the significant factors is the rising power costs: in the most outlier states costs to produce 1 bitcoin are over double what they were last year. There are many ways that miners can hedge against rising power costs but that’s not always the case for individual players.

Source: Hash Rate Index Q3 Report

In Tuesday’s piece, we hinted at the coverage of specific names, and as promised, we will dig into this a bit today.

The first order of business is to revisit our basic metric for evaluating the bitcoin mining investing cycle.

When is the optimal time to invest in publicly traded bitcoin miners?

An extremely simply framework for investors is:

Hash price bull market = Bitcoin miners outperform bitcoin

Hash price bear market = Bitcoin miners underperform bitcoin

Hash price divides miner revenue by hash rate (daily miner revenue per 1 TH/s, as first coined by the team at Luxor).

On a long enough time frame, as hash rate continues to rise in a brutally capitalistic fashion, mining equities are trending lower against bitcoin. Shown below is a chart of mining equities denominated in bitcoin terms since 2018.

Across a shorter time frame, miners can perform exceptionally well in bitcoin terms — with this holding especially true in hash price bull markets, when the price of bitcoin appreciates by more than the hash rate. In this market scenario, miners are (digital) gold mines.

So let’s evaluate what miners have done especially well (or poorly) in bitcoin terms since the start of 2022 and since the July local market bottom in bitcoin.

Since the start of this year, the best performers for mining equities have been Marathon Digital (MARA), CleanSpark (CLSK) and Riot Blockchain (RIOT).

Since the summer market bottom in bitcoin, the performance leaders were MARA, RIOT, HUT and HIVE.

This relative performance can give us some insight into how the market views these various industry players. Interestingly, equity performance — whether justified or not — directly impacts the future probability of success for a company.

Various public posts about relative performance between mining equities (with CORZ being a glaring outlier) showed to be a precursor to what was to come for the stock.

The biggest risk associated with mining equities and the rising hash rate is not only if companies can survive and get to the other side; some will and some won’t. Rather, the question you need to ask yourself as an investor is whether your stake in the company will get significantly diluted along the way.

As debt financing rates are no longer optimal (compared to 2021 rates), companies will increasingly turn to share dilution to fund their operational and capital expenditures.

Shown below are two charts from Jaran Mellerud, writing for Hash Rate Index on public mining equity market share dilution.

Core is obviously an outlier in debt-to-equity ratio, but share dilution is a sneaky force that leads to long-term underperformance. Below we display the fully diluted share count for many of the leading publicly listed mining firms.

Our advice, which of course is not of the financial sort, is to stay patient when allocating to mining firms, especially in this time of distress. Many of these firms, whether due to rising network hash rate, the future Bitcoin halving coming in 2024, or share dilution, will likely underperform bitcoin itself for the time being.

We believe we are still in an environment where hash rate growth outpaces price growth until the data says otherwise. This is not an environment where mining equities thrive.

What readers should look for is the companies that do well in bitcoin terms over various short-term and long-term periods that also do not partake in large-scale share dilutions.

We will stay up to date with all the developments in the space and will be ready to inform our subscribers of these developments and insights when they arrive.

For now, we think broad-based underperformance of miners relative to bitcoin itself can be expected.

Let’s now turn our attention to the potential for a capitulation across the ASIC market, as Core Scientific, the world’s largest publicly traded mining firm by hash rate faces liquidity/solvency worries.

Even without recent developments, ASIC prices were already in fire sale-like territory and are at new all-time lows. Luxor’s Hash Rate Index shows just how depressed prices have become across machine efficiency types in the chart below. As miners have gone to the latest, more efficient rigs, that’s put further downward price pressure on older mining models. As there’s more demand for newer rigs like the S19 XP and other brand new hardware to stay competitive, selling pressure rises for older models that are unviable or unprofitable even with the cheapest energy costs. In the worst case, older machines are just given away for free.

Although Core Scientific will have many options such as debt restructuring, Chapter 11 bankruptcy or a potential merger on the table; selling off and liquidating a part of their 130,000 miner fleet may be another option. Increased selling pressure by miners will only add more strain to depressed prices. Further declines in ASIC prices also impact all miners who are collateralizing or financing their ASICs as the value of ASIC prices can drop further. Now, we await what strain this will have on hash rate over the medium term and if we’re to see a significant falloff in hash rate over the next three to six months. We do not believe this cycle ends without a 20% fall in peak-to-trough hash rate.

Final note: Bitcoin mining is a brutal business, and the current state of these conditions is the last remaining bear to slay in regards to the conclusion of this bear market cycle and the rebirth of the next bull market.

These things take plenty of time, and in the process, bitcoin as a monetary asset will harden like never before.

Mining difficulty at all-time highs.

Miner revenue per terahash at all-time lows.

Bitcoin and ASIC values falling dramatically from all-time highs.

Only the strong will survive.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Great work and commentary. The present bitcoin cycle will challenge us all for at least another 2 years. (hang tight is all I can contribute.) Going forward we will need to have and be proven correct that the 4 year cycle always turns up and rises above prior highs. In the meantime we should keep searching for and supporting the new ideas layered on top of the bitcoin financial framework.