The Daily Dive #120 - On-Chain Mining And Public Miner Performance

In today’s Daily Dive we will be evaluating the state of the mining industry, looking at both the performance of publicly-traded mining firms as well as analyzing the on-chain mining data.

Bitcoin Mining Update

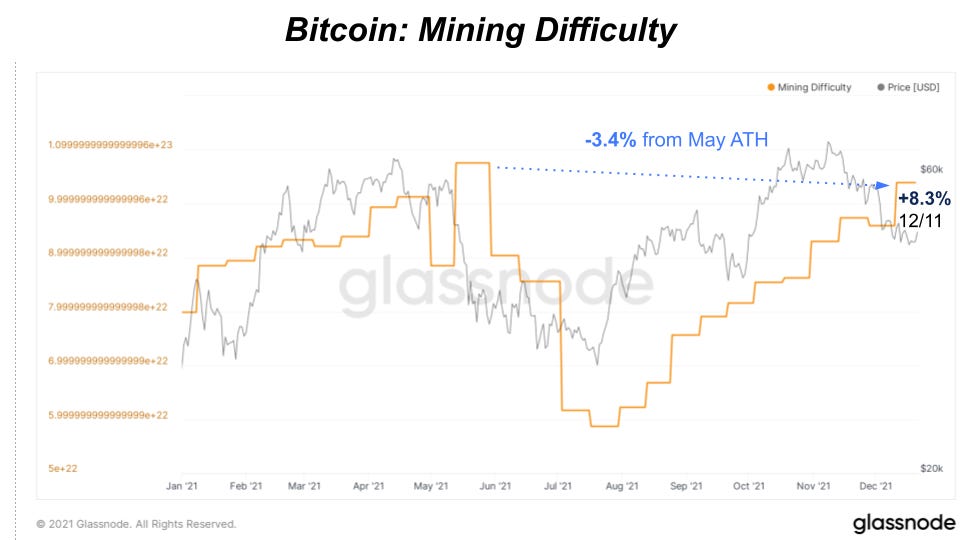

After hitting a new all-time high on December 9, hash rate has fallen nearly 8% since to 167.39 EH/s. The significant rise in hash rate sped up block production which sparked a positive difficulty adjustment of 8.3% just two days later. The rise in mining difficulty put downward pressure on miner profitability, incentivizing miners to turn off less profitable machines and lowering overall hash rate in response.

Current mining difficulty is only 3.4% away from May all-time highs. The next difficulty adjustment is expected to be a downward adjustment of 1.5% on Christmas day which should incentivize more hash rate to come back online.

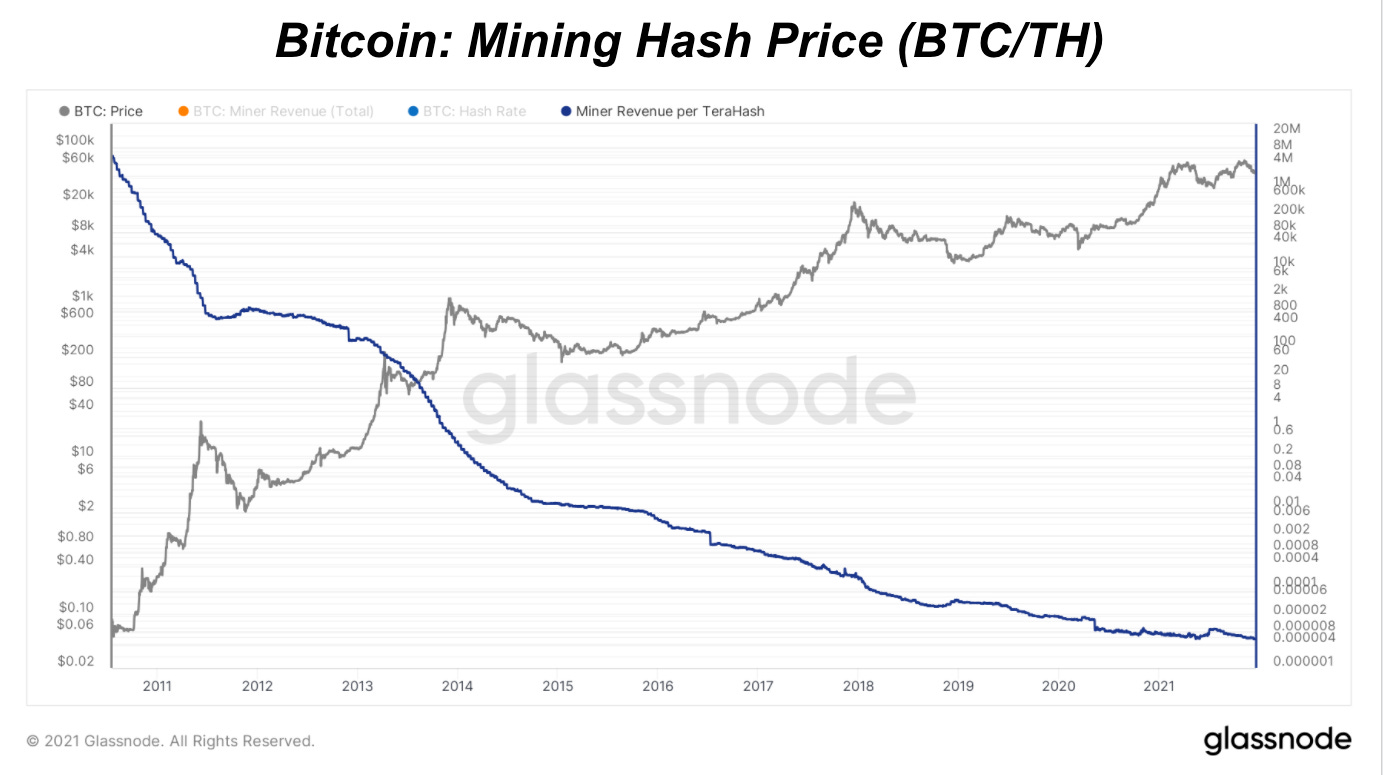

It’s still a great time for bitcoin miner profitability right now with hash price (USD revenue per terahash) still up 44% from last year. However, hash price continues to fall over the last month with price falling in tandem.

The result is that miners are currently taking in $41.62 million in revenue per day to secure the network. Over the last four months, miners have been taking in over $40 million per day which would estimate the industry around a $14.6 billion per year pace.

In fact, total mining revenue this year is higher than that pace, approximately $16.24 billion with the rest of December remaining. Total mining revenue in Bitcoin’s history is just shy of $40 billion with 43% of that revenue coming from 2021.

Another key trend continuing to play out in the second half of this year is the increase in miners holding their bitcoin versus selling it. One way to view that trend is to look at estimates for miner transfer volume sent to exchanges, which are hitting multi-year lows. The rise in hash price, miner profitability and a growing trend of large scale miners either leveraging cheap debt or yield on their bitcoin to fund operations, puts less pressure on miners to force sell their holdings.

Publicly-Traded Miners’ Performance

In regards to the performance of publicly traded miners, we will be looking at their performance since the start of 2020 in both USD and BTC terms.

RIOT, MARA, BITF, and HUT will be examined specifically, but more firms will be included in the all-time performance charts (more on that below).

Since the start of 2020, these four companies have outpaced the performance of bitcoin, and there's a few key reasons why. Namely, publicly-traded equities are often valued using a multiple of their current earnings/cash flows.

Towards the last quarter of 2020, miner hash price started to explode, and thus the revenue and subsequently public miner market capitalizations followed. Hash price is quantified by dividing hash rate by miner revenue (dollar per terahash in particular).

Since the hash price bottomed in October of 2020, miners have outperformed BTC by a wide margin, due to hash price increasing by as much as 400% during the time period.

What you should gather from evaluating the performance of publicly-traded miners against bitcoin itself is that due to the capital structure of their business and the valuations present in equity markets, miners can and likely will outperform bitcoin over periods when hash price rises significantly.

However, over the long term the revenue in bitcoin terms for every mining company is guaranteed to decrease in bitcoin terms, and due to the excessively large earnings multiples that companies currently trade with in equities markets in a zero interest rate world, even bitcoin mining equities trend to zero over time in bitcoin terms (once again, due to the equity multiples assigned in a zero interest rate fiat-denominated world).

Bitcoin-denominated hash price is programatically trending towards zero as hash rate rises and as issuance declines with each subsequent halving.

Thus, it will continue to be awfully challenging for publicly-traded companies in general to outperform bitcoin during its monetization phase if it does not hold a similarly-sized bitcoin position as a percentage of their total market capitalization.

Check out the performance of the largest publicly-traded mining companies against bitcoin since their IPO:

Nice write up but I dont think its fair to compare the price performance of those miners vs bitcoin since their inception..back then they were just a name and a website; compared to now where you have companies like MARA routinely occupying sizeable chunks of the global hash power. maybe the very long term future is uncertain for these companies, but for at least the next few years they seem primed to literally print money....i invest in bitcoin also but I do dig a couple of these miners

Great article!! Thanks!!