PRO Market Keys Of The Week: 2/27/2023

Discussion about the target inflation rate heats up as the 2% goal drifts further out of reach. Net liquidity approaching 2022 lows and important bitcoin range levels to watch.

Relevant Past Articles:

No Policy Pivot In Sight: "Higher For Longer" Rates On The Horizon

On-Chain Data Shows 'Potential Bottom' For Bitcoin But Macro Headwinds Remain

Not Your Average Recession: Unwinding The Largest Financial Bubble In History

In last Friday’s piece, we covered the evolving macroeconomic picture regarding the resurgence of the domestic U.S. economy, which has recently caused short-term interest rate expectations to reprice significantly higher.

Morgan Stanley strategist cites further headwinds in U.S. equity market. The recent rally is a “bull trap” and valuations remain broadly elevated. Valuations are high as 12-month earnings expectations have stemmed from a downtrend. Earnings threaten stocks, so downgrades are likely to resume.

Strategists at Credit Suisse Group AG are also cautious on stocks, saying there are a lot more negative tactical and technical indicators than positive ones for global equities. The team led by Andrew Garthwaite wrote in a note that they expect a downgrade of another 5% to 10% in earnings estimates and recommend selling into rallies.

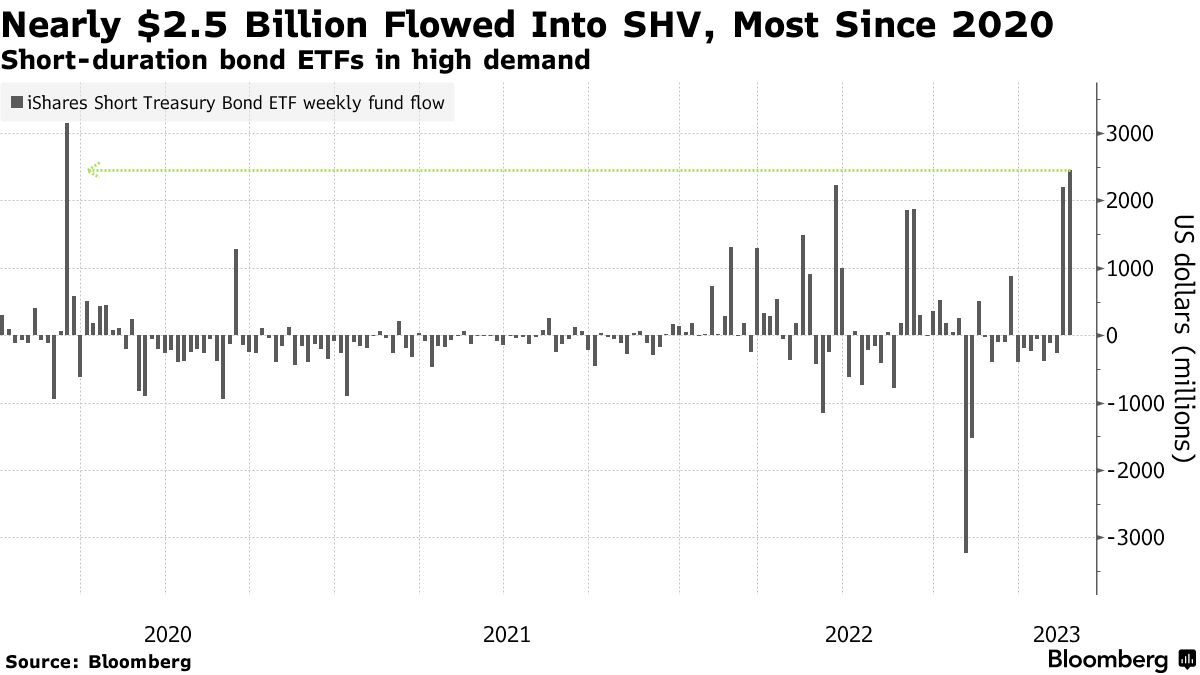

Source: Cash-Like ETF Attracts $2.5 Billion in Biggest Haul Since 2020

For a closer look at market sentiment with 30 important indicators and a market summary, upgrade to paid to get full access to the PRO Market Dashboard.

Live Dashboard coming soon. 👀

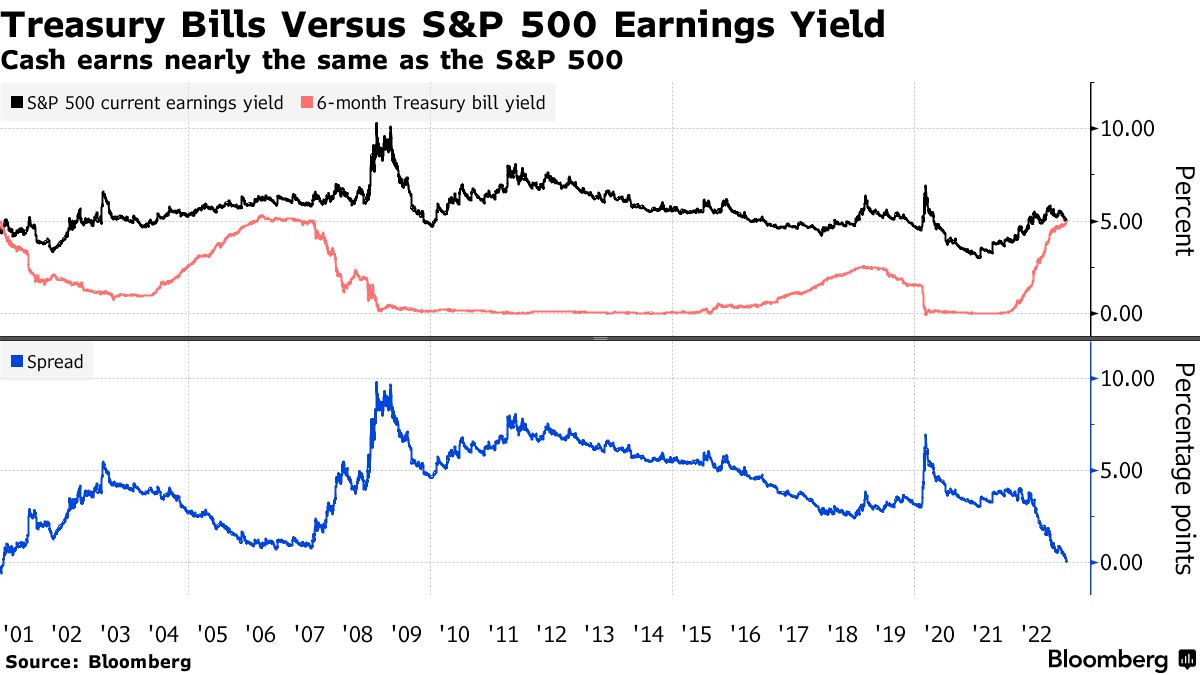

Just as our latest release, “The Big Flip: Interest Rate Expectations Repricing Upward,” referenced the historically small equities risk premium — the difference between nominal risk free U.S. Treasuries and the expected yield offered in U.S. equity markets — we see record inflows into short-duration fixed income ETFs.

“The number one question that we get, especially once that six-month T-bill crossed over that 5% threshold, is why wouldn’t I sit this out and hang out in T-bills?” Bitterly, head of North America investments at Citi, said in a Bloomberg Television interview on Friday. “We don’t think there’s really any need to stretch in terms of yield. You don’t have to go into high yield, you can certainly take advantage of those short-duration T-bills.” — Cash-Like ETF Attracts $2.5 Billion in Biggest Haul Since 2020

This is not a coincidence and these marginal flows should be monitored closely. The important thing to remember in the current economic order is the Treasury gets funded first — always. Any liquidity dynamics that are foreseen by the market participants at any point in the future should understand that the marginal flows will first come from global risk assets.

This is the particular reason why the spread in yields is so notable.

Source: S&P 500 Haters Now Make Enough in Treasuries to Bid Stocks Farewell.

“‘We think we’re headed into economic deterioration and the current volatility in the market is enough for us to be very cautious in equities, and you’re getting paid in the meantime to wait with cash,’” said Jerry Braakman, chief investment officer of First American Trust. ‘So we do think it’s an attractive space to be in fixed income versus equities at this point.’” — S&P 500 Haters Now Make Enough in Treasuries to Bid Stocks Farewell.

Inflation Target Talk

Some dissenting voices have arisen in recent weeks in regards to the Fed’s arbitrary 2% inflation target. In “What If We’re Aiming for the Wrong Inflation Goals,” Economist Mohamed El-Erian was quoted as questioning the effectiveness of such a number.

“The idea that the Federal Reserve and other central banks must anchor inflation at a targeted level has been a central plank of economic policy since the 1990s, when New Zealand pioneered the technique. Central banks around the world adopted the approach, and the concept of inflation targeting moved from policy wonk world to the real world. The Fed, for example, is mandated by Congress to keep price gains limited to 2%.”

“If people sat down today they would not come up with 2%, they would come up with 3% to 4%,” Mohamed El-Erian, the chairman of Gramercy Funds and a Bloomberg Opinion columnist told Bloomberg Television.”

To respond to the increasingly floated idea of a raised target inflation rate, Fed speakers Philip Jefferson and John Williams came out in support of the target.

“Changing the FOMC's longer-run inflation objective would introduce an additional risk by calling into question the FOMC's commitment to stabilizing inflation at any level because it might lead people to suspect that the target could be changed opportunistically in the future.” — Federal Reserve Governor Philip Jefferson

The president of the Fed Bank of New York disagrees with raising the target.

“Federal Reserve Bank of New York President John Williams said it’s critical the US central bank remain committed to its 2% inflation goal, and emphasized monetary policy must bring supply and demand into better balance to lower inflation.

“At the end of the day our job is clear,” Williams said Wednesday at a conference held at the New York Fed. “Our job is to make sure that we restore price stability which is truly the foundation of a strong economy.” — Fed’s Williams Says 2% Inflation Goal Key to Taming Prices

As the Federal Reserve embarks upon its tightening regime, expect this debate to heat up as they battle their first inflationary spike since Alan Greenspan's Great Moderation.

Bitcoin Range Levels

BTC/USD exchange rate is still range bound, with daily momentum falling off recent highs at $25,000 resistance with the next local support level at $22,800, followed by the strong volume areas of $20,500-21,500. However, relative strength is much weaker on a daily time frame than it was in late January.

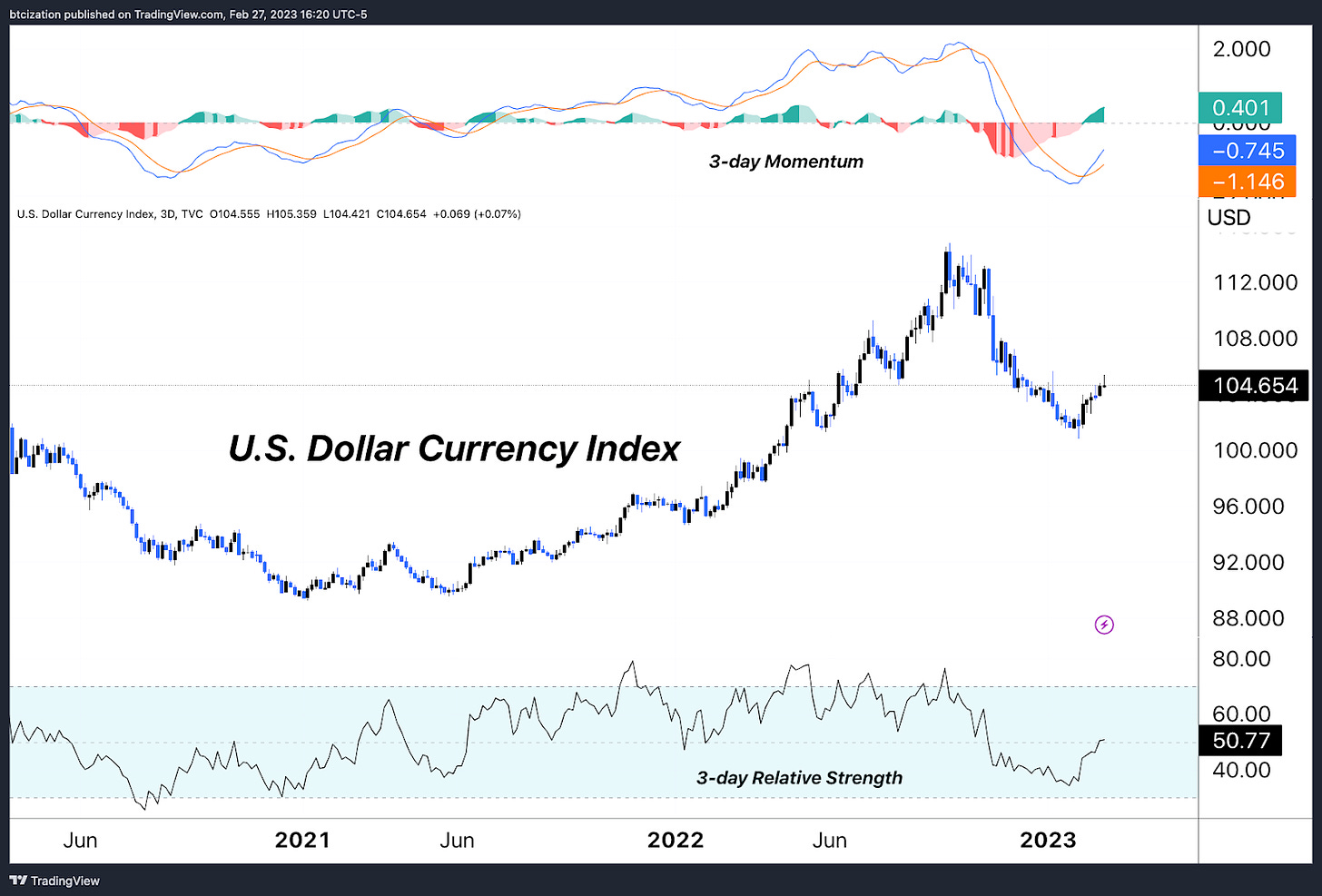

Dollar Uptrend Remains Key For Direction Of Risk Assets

The path of max pain remains higher for the dollar, with euro and yen weakness being the story throughout February. A structural USD bull market would continue to place marginal pressure on risk assets.

Divergence Between Equities And Corporate Credit Risk

A key macro variable to watch over the next few quarters will be whether credit spreads begin to widen once again. As fixed income has faced structural headwinds and earnings expectations decline, watch out for deteriorating credit markets in regard to risk-taking prevalence as this is a reflection of broader liquidity dynamics.

Related: Looming Credit Default Risk And The Fall of Zombie Companies

As yields in U.S. bond markets reach highs not seen since 2009, credit risk remains contained — for now. One can expect that higher-for-longer monetary policy will eventually be a catalyst for this risk to be recognized.

Upcoming Twitter Spaces: Bitcoin Magazine PRO will host Joe Consorti on Thursday, March 2 at 4:00pm ET for a discussion about credit spreads, Fed policy, and macroeconomic trends.

Spreads blowing out can reflect one or both of the following: a decrease in market risk appetite from debt investors and/or a decline in credit quality as the economy decelerates/eventually contracts. The relationship between the VIX and spreads illuminate these dynamics.

Monitor Financial Conditions

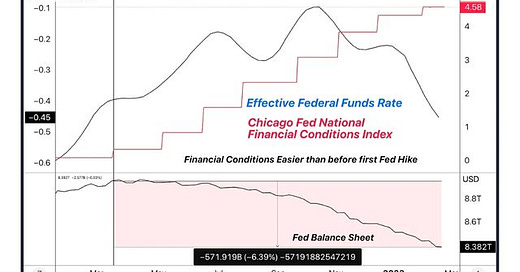

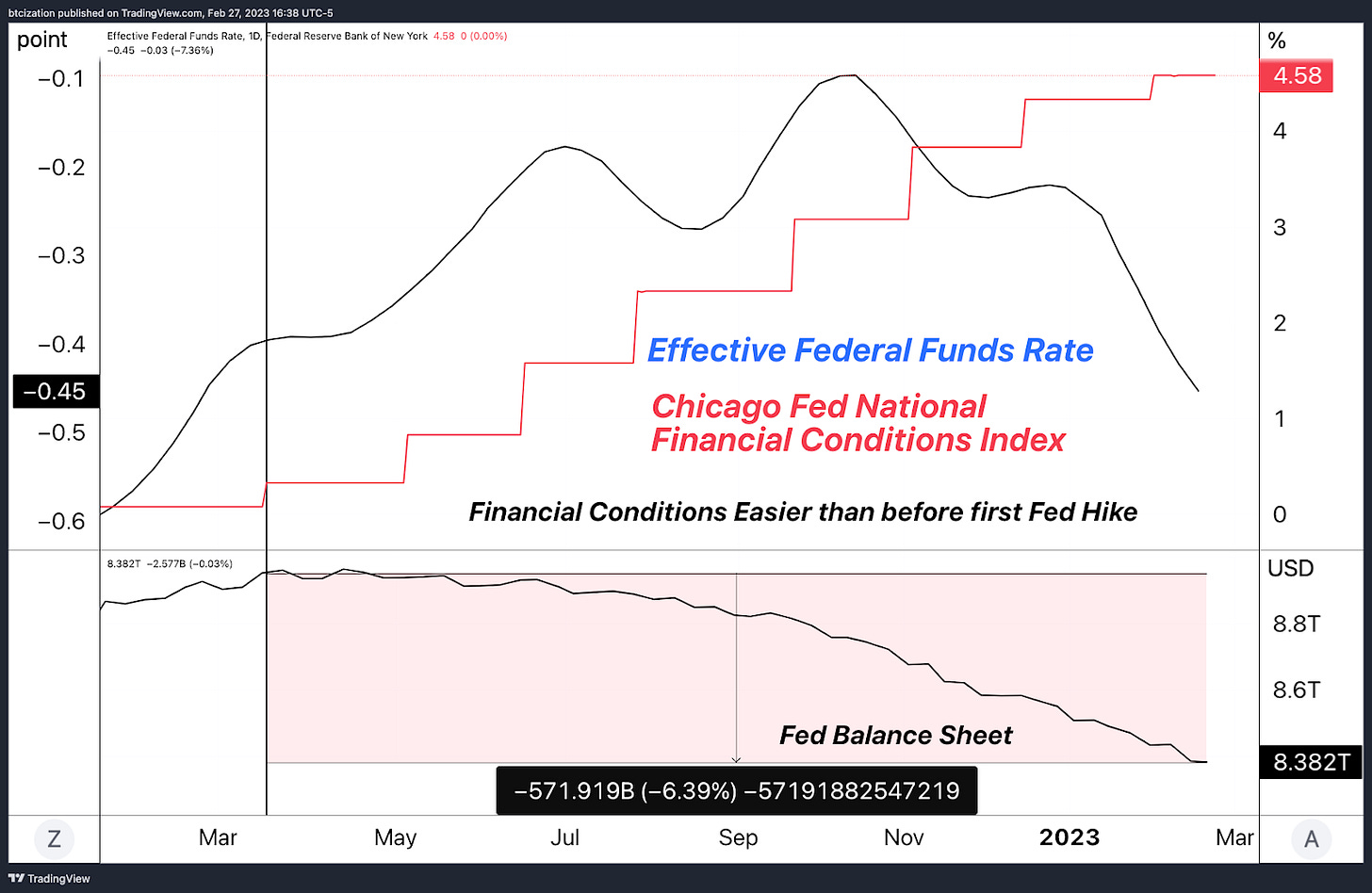

As the STIR (short-term interest rate) market has repriced, financial conditions have been seemingly blissfully unaware of this reality, with conditions now easier than before the Fed’s first rate hike and $500 billion of quantitative tightening.

Net Liquidity Nearing 2022 Lows

Created by Darius Dale of 42 Macro, the net liquidity equation — Fed balance sheet minus the Treasury General Account and Reverse Repo facility — fully encompasses the scale of government involvement in broad market liquidity. As money flows out of the Reserve Repo and the Treasury General Account experiences outflows (money being spent into the economy), the Fed’s quantitative tightening program can be offset at the margin.

Net liquidity has closely mirrored risk-asset markets since the monetary and fiscal response to the pandemic.

Final Note

While this bitcoin-first newsletter has been focused on many seemingly esoteric (yet important) macroeconomic variables in recent months, it’s important to focus on the long game. If we add the balance sheets of the European Central Bank, Bank of Japan, and the Bank of China, we can comfortably state that Bitcoin remains a mere drop in the bucket amid an ocean of global fiat.

In our view, Bitcoin adoption is still in its nascency. Short-term economic headwinds aside, bitcoin remains primed to thrive long-term as the most certain aspect of an increasingly uncertain global future.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Really appreciate you analysis.Well worth the Sub!

Well written