PRO Market Keys Of The Week: 2/20/2023

Highest bitcoin trading volumes in spot and futures markets since November 2022. Another week of bitcoin fund outflows as price retests the 200 WMA. Market expectations for higher for longer rates.

Relevant Past Articles:

For a closer look at market sentiment with 30 important indicators and a market summary, upgrade to paid to get full access to the PRO Market Dashboard. Released weekly.

What We’re Watching

Higher Bitcoin Trading Volume

This past week was one of the highest trading volume weeks for both spot bitcoin and perpetual markets since the market lows in November 2022. The latest rally has enticed players back into the market as the bitcoin price faces another critical test at range highs and its 200-weekly moving average. We’re expecting the next move to be sharp and violent whichever way the price breaks.

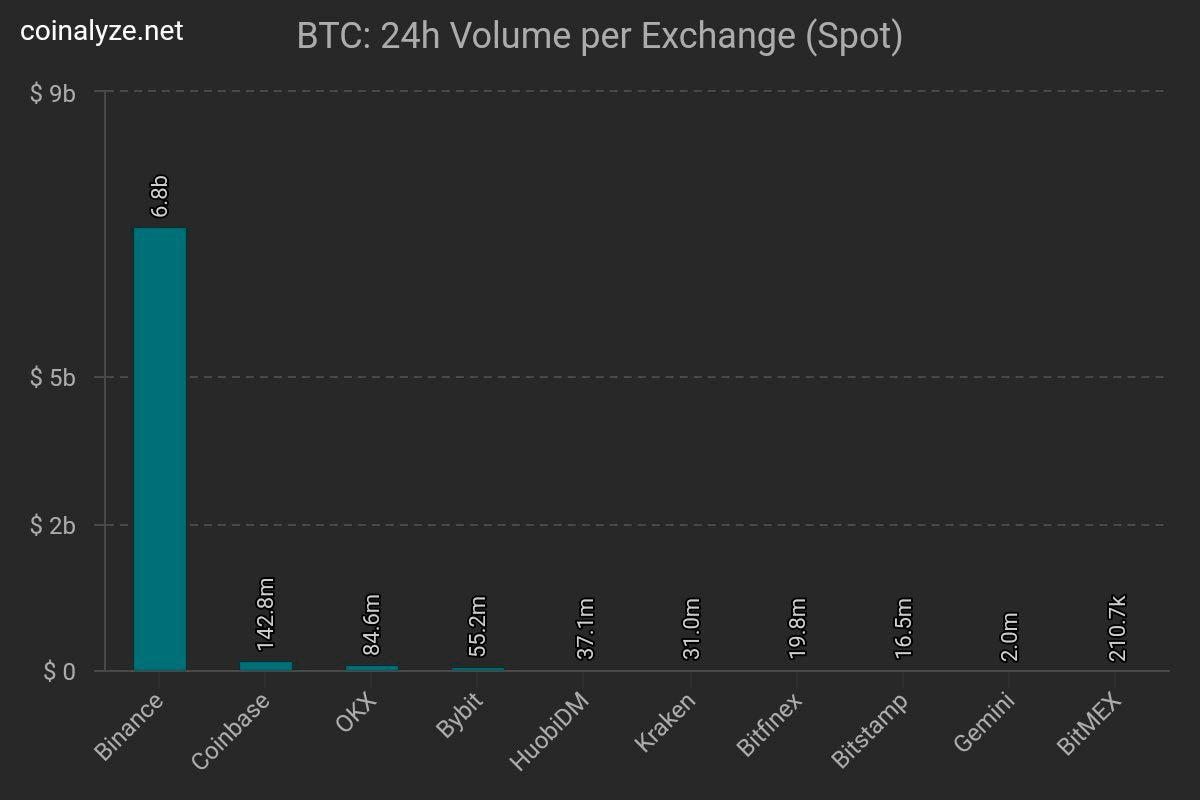

Binance still makes up the lion’s share of all traded volume in the market, higher than 60%, or more than 80% depending on what volume metrics you can look at. Even if you adjust for zero trading fees and wash trading volume, Binance still remains the central hub for the majority of bitcoin trading volume and price discovery.

Source: Coinalyze

Bitcoin Fund Flows Go Negative

After weeks of strong fund inflows from market lows and the subsequent price rally, market investment products saw a decent week of outflows measured in millions of dollars. Bitcoin outflows were $24.8 million this past week after $10.8 million in the week prior. CoinShares highlights their opinion on the new reversal in outflows. “This is due to ETP investors being less optimistic on recent regulatory pressures in the US relative to the broader market.” There’s been a wave of negative sentiment in western regulatory announcements across Kraken, BUSD, Binance, Custodia and the emergence of claims that an Operation Choke Point 2.0 is underway to continue limiting financial access to the broader cryptocurrency industry.

Source: CoinShares Weekly Fund Flows

Join the Bitcoin Magazine PRO team at Bitcoin 2023--the world’s LARGEST Bitcoin conference. Use code “BMPRO” for 10% off your tickets.

Bitcoin Perps Funding Rate

After a period of deep shorting and speculation at the recent bitcoin bottom, bias and positioning in the derivatives market has shifted a more slightly bullish, long bias with a sustained rise in the perpetual funding rate. At this major level for price, longs may be getting over extended here when taking the view that this is prime reversal area for a bear market rally to end. The level of speculation has been rising via open interest in both BTC and USD terms and may be due for a washout soon.

Upcoming Twitter Spaces: Bitcoin Magazine PRO will host Jaran Mellerud of Luxor Mining and Hashrate Index on Thursday, February 23 at 4:00pm ET for a discussion about bitcoin mining data. Be sure to tune in!

FOMC March Rate Hikes

The market expectations of a 50 basis point hike continues to rise for the next FOMC March meeting, now just shy of 20% (shown below in red). The idea of lower future rates, a soft landing and the transitory goldilocks-style regime we’ve seen over the past couple months look to be coming to an end. Although bitcoin correlations with risk-on assets have weakened noticeably over the last 30 days, we’ve seen many liquidity-driven, higher beta and risk-on assets rise since the beginning of the year.

By many estimates of liquidity, the rally so far looks to have been driven by a bottoming in liquidity back in October 2022, and higher expectations of a soft landing outcome.

Source: CME FedWatch Tool

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!