PRO Market Keys Of The Week: 2/13/2023

Paxos facing lawsuit over BUSD as regulation intensifies. The BNB price reacts to market concerns. Tomorrow’s CPI release may push expectations for a Fed policy pivot further into the future.

Relevant Past Articles:

What We’re Watching

BUSD Stablecoin Issuer Faces SEC Lawsuit

TLDR: No more BUSD is being issued, for now. The SEC has claimed BUSD is an unregistered security and is coming after Paxos, the stablecoin’s issuer and owner. Paxos licenses the BUSD stablecoin brand to Binance. In the past, Gary Gensler has said that stablecoins can resemble bank deposits or market mutual funds.

User deposits are typically backed by cash-equivalent assets like short-duration U.S. Treasuries. What’s interesting with BUSD is that the majority of assets backing the stablecoin are long-term maturity U.S debt instruments in reverse repo agreements, and account for 76% of the collateral. It’s unclear if this case against BUSD is Binance specific, BUSD specific or a broader pushback against stablecoins at large.

There were a few noteworthy statements in the New York State Department of Financial Services (NYDFS) announcement, in particular the distinction between Paxos-issued BUSD on Ethereum and other forms of “pegged BUSD.”

Excerpt from NYDFS release,

“DFS has ordered Paxos to cease minting Paxos-issued BUSD as a result of several unresolved issues related to Paxos’ oversight of its relationship with Binance in regard to Paxos-issued BUSD. In response, on February 13, 2023, Paxos notified customers of its intent to end its relationship with Binance for BUSD.

“The Department is monitoring Paxos closely to verify that the company can facilitate redemptions in an orderly fashion subject to enhanced, risk-based, compliance protocols.

“It is important to note that the Department authorized Paxos to issue BUSD on the Ethereum blockchain. The Department has not authorized Binance-Peg BUSD on any blockchain, and Binance-Peg BUSD is not issued by Paxos. There is currently no restriction on the listing or exchange in New York of existing Paxos-issued BUSD by DFS-licensed entities.”

The checkered past of the BUSD token peg came to our attention in early January when Bloomberg reached out to Binance for an official statement on their reserve collateral.

Source: Bloomberg

Below is a snapshot of the dislocation between the pegged BUSD on Binance Smart Chain and the issued supply:

For a full breakdown of the dislocation, read the analysis from DataFinnovation, “Binance-Peg BUSD Was Often Undercollateralized.”

BUSD has grown to be a significant share of the entire stablecoin supply (currently around 12%) and makes up 35% of trading volume on Binance. In response to the NYDFS order, Paxos will cease issuance of BUSD and allow for redemptions from BUSD to their Pax Dollar (USDP) which is regulated in the United States. Looking at Tether (USDT) charts on a shorter time frame, we’re seeing a rise in demand for USDT as markets shift away from BUSD exposure.

Source: Kaiko Research

We also learned that Circle — issuer of competing stablecoin USDC — alerted the NYDFS in 2022 about BUSD’s insufficient reserves.

Upgrade to paid to get the PRO Market Dashboard with 30 different bitcoin metrics and a summary of current market sentiment each week!

Below is just a taste of one of the many sections of the PRO Market Dashboard.

This comes after Binance decided to aggregate stablecoin liquidity under BUSD in autumn 2022. With this NYDFS decision, Binance now has to decide the future fate of its trading engine and order book aggregation, given the integral role that BUSD has played over the past two quarters.

Source: Binance to Auto-Convert USDC, USDP, TUSD to BUSD (Binance USD)

BUSD now can be described as a reverse “Hotel California,” where money can check out any time you like, but is barred from entering. With this, expect the market cap of BUSD to fall drastically in the coming weeks ahead.

Upcoming Twitter Spaces: Bitcoin Magazine PRO will host Preston Pysh on Thursday, February 16 at 4:00pm ET for a discussion on all things Bitcoin and macro. Be sure to set a reminder so you don’t miss it!

One could imagine the firm will look to fall back on USDT, after attempting to diversify away from the stablecoin and into BUSD in previous years. This comes at a time where despite the overall stablecoin market cap continuing to bleed value, USDT has seen a reemergence as a dominant market leader, once again approaching 50% market share in total stablecoin market cap.

Join the Bitcoin Magazine PRO team at Bitcoin 2023--the world’s LARGEST Bitcoin conference. Use code “BMPRO” for 10% off your tickets.

BNB Token Reacts to BUSD Announcement

Immediately after the Paxos announcement was released, the price of Binance exchange token BNB aggressively sold off, with the token now down more than 7% against BTC.

In an earlier article “Not Binancial Advice,” we raised questions about the valuation of the BNB token, which had seemingly looked disconnected from the rest of the crypto market, appreciating by nearly an order of magnitude against bitcoin since the start of 2021.

With the market cap of BNB still priced at more than two million bitcoin, we expect headwinds for BNB to increase in the future, and for the recent underperformance against bitcoin to continue on a longer time frame.

The SEC is increasing their clampdown on crypto firms for alleged securities violations at the same time as we’re seeing a crackdown on access to U.S. banking rails for non-compliant firms. We firmly expect exchange tokens to underperform relative to a permissionless bearer asset, such as bitcoin.

We have yet to see what continued BNB underperformance would mean for Binance, but it is something that crypto natives should be on the lookout for.

U.S. CPI Tomorrow

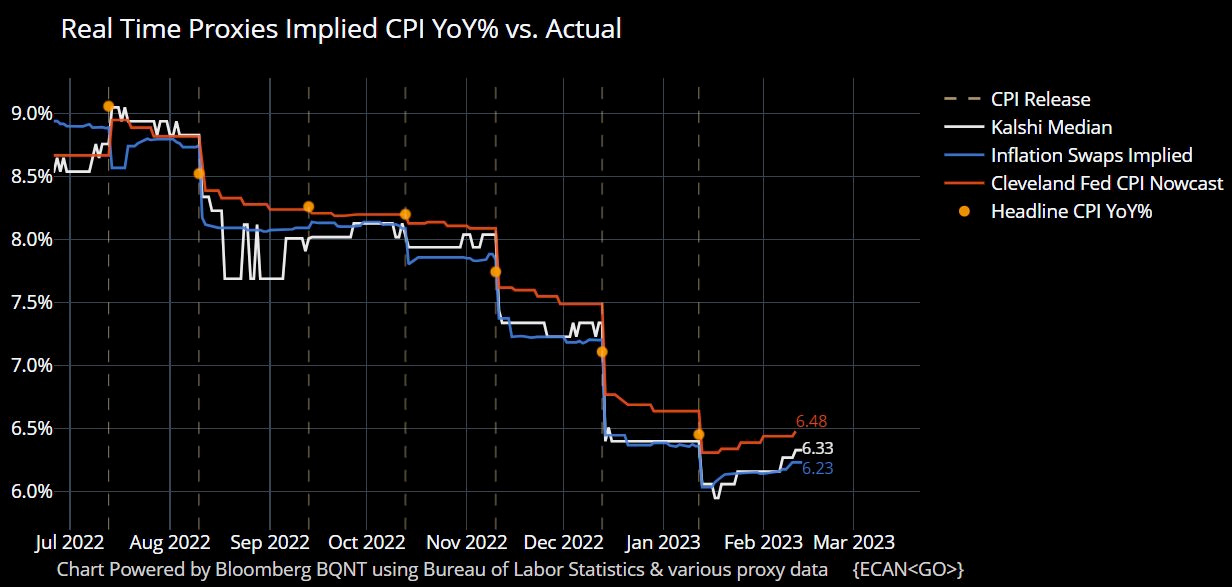

Although we’ve seen a recent trend of disinflationary pressures, it’s not so clear that inflation is headed straight back to 2% without a major recession. Many key proxies of headline CPI have been trending higher this month with consensus now at a 6.2% headline and a Core CPI monthly change at 0.4%.

January saw an increase in the Manheim Used Car Index, which CPI typically lags, and energy prices are rising again as seen via retail gasoline prices. University of Michigan’s one-year consumer expectations of inflation actually increased to 4.2% in January from 3.9% alongside rising consumer sentiment. Similarly, we’ve yet to see inflationary pressures cool off in Europe, with January expectations at 8.5% headline year-over-year, slightly down from December 2022. The latest China data also showed another month of headline CPI acceleration to 2.1%, a rising trend over the last few months.

Source: Michael McDonough, Bloomberg

After a few months of inflation cooling off, a short-term reversal is the largest factor to damper market expectations for lower interest rates and a pivot in Federal Reserve policy. In fact, the market continues to understate the Fed’s expected path with every new release of economic data points. The implied rate for July of 2023 is now 5.17%, as the market attempts to gauge just how restrictive the Fed will be on their path to squash inflation.

Source: Michael McDonough, Bloomberg

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

How do we access the dashboard?