PRO Market Keys Of The Week: 2/6/2023

Stablecoin supply has gone from contracting to nearly constant. Bitcoin miners are getting some relief with the increase in exchange rate. Global liquidity and higher interest rates are on our radar.

Relevant Past Articles:

A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

Bitcoin Rips To $21,000, Shorts Demolished In Biggest Squeeze Since 2021

No Policy Pivot In Sight: "Higher For Longer" Rates On The Horizon

The Bond Market Meltdown Continues: Where Are The Buyers For ‘Risk-Free’ Government Debt?

What We’re Watching

Stablecoin Growth Flat

With the latest rally from upper $15,000 lows, the 30-day growth of circulating stablecoin supply across USDT, USDC and BUSD went from contracting 3.62% to presently being just shy of 0%, meaning stablecoin supply remains nearly constant. Stablecoins have mostly been flat through the start of the year with supply of the major three at $126 billion. Likely, the next strong momentum move in the bitcoin price will be accompanied by sustained, positive growth in the supply of circulating stablecoins.

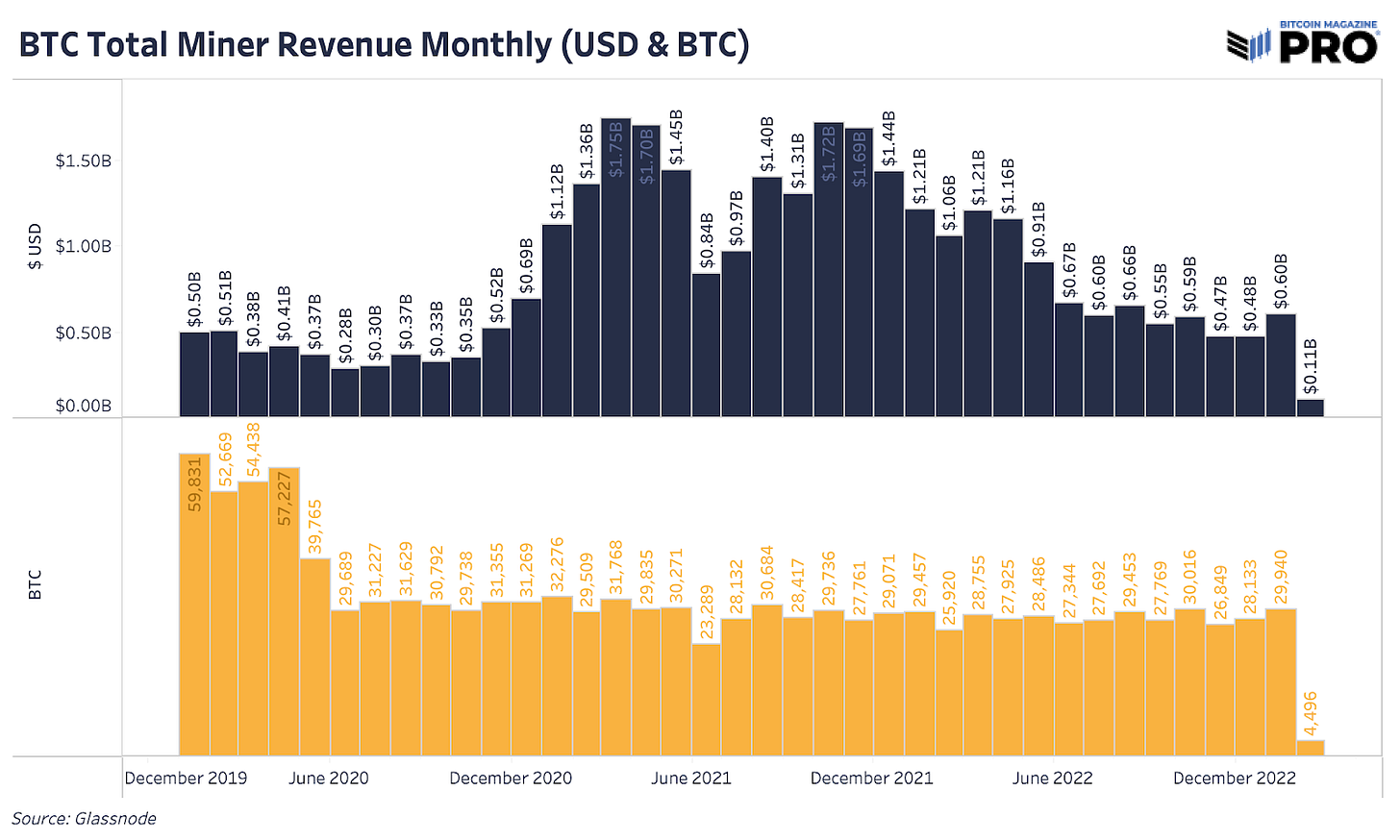

BTC Miners Catching Some Relief

Even if the price rally proves to be short-lived, total miner revenue bounced to over $600 million in January, which is the highest it's been since August 2022. Miners are catching some short-term relief here. However, bitcoin miners are still under immense pressure in current market conditions with a lack of access to financial capital, rising energy prices, increasing mining difficulty and high interest rates with no signs of letting up.

The latest monthly production update from Marathon Digital shows the company sold 1,500 bitcoin in January to help fund operating costs. Those that have built up large bitcoin treasuries now have the option to sell down those holdings at a relatively higher exchange rate in order to keep their businesses afloat. After a period of many public miners deploying a strategy to HODL all produced bitcoin, the tides are shifting to a more hybrid, flexible approach.

Bitcoin 2023 ticket prices increase this Friday at MIDNIGHT! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Use code “BMPRO” for 10% OFF.

China Liquidity Injections

The work of Michael Howell at CrossBorder Capital points to a shift in global liquidity that turned around in October 2022, with the People’s Bank of China liquidity injections being a significant factor in this change. That pace has slowed and may well point to a larger slowdown in world GDP growth on the horizon.

Source: CrossBorder Capital

Comparing Bitcoin’s Explosive Rally

Is this the largest rally of all bear market rallies or the beginning of a new trend? A rally of 50% from market lows is the highest rally we’ve seen so far in this bear market with 35.54% and 28.44% being the second and third largest. We’ve seen similar moves across all “risk-on” type assets throughout January with eye-popping gains that are fairly normal for asset prices down over 70%, primed for volatility and heavily shorted. Bitcoin has yet to break out of its range highs and is hovering around the same price it was seven months ago when we published “Caution: Bear Market Rallies.” Until we see a stronger, sustained break out, it’s still a game of waiting, patience and caution.

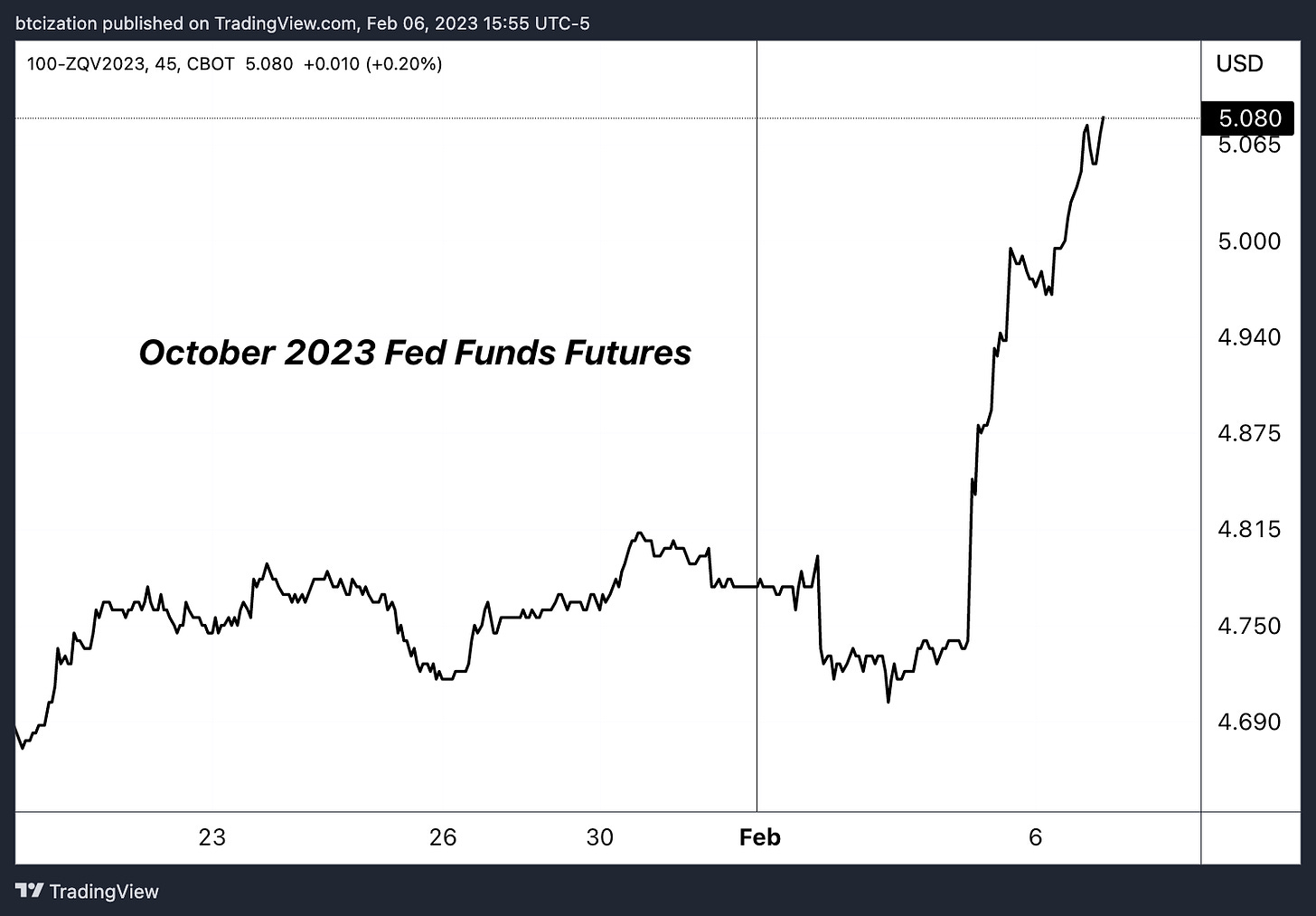

Disappearing Expectations For Rate Cuts In 2023

On January 31, we wrote a FOMC primer, “No Policy Pivot In Sight: ‘Higher For Longer’ Rates On The Horizon,” discussing the current dynamics priced into interest rate futures markets.

“With inflation abating and policy rates staying elevated, the market believes that a ‘sufficiently restrictive’ policy will manifest in 2023, with 1.31% worth of cuts coming in 2024…

“… We do believe that ‘higher for longer’ is a tone that the Fed will continue to communicate with the market. In that regard, it’s likely that those attempting to aggressively front-run the policy pivot may once again get caught offside, at least temporarily.

“We believe that a readjustment of rate expectations higher is possible in 2023, as inflation remains persistent. This scenario would lead to a continued ratcheting of rates, sending risk asset prices lower to reflect higher discount rates.”

Since the time of writing, expectations for rates in 2023 and early 2024 have begun to reprice dramatically, wiping approximately 0.40% of expected cuts to the Fed Funds Rate.

With a dramatic repricing that is currently occurring in the short-term interest rate market, yields on sovereign debt are catching notice, with short duration U.S. Treasury yields looking likely to break 2022 highs.

Paid subscribers now have access to our new Bitcoin Magazine PRO Market Dashboard. Each week, we share an overview of many metrics including: realized price, percent supply in profit, changes in hash rate, various moving averages, Mayer Multiple, M2 money supply, net liquidity, and more! Below is only a glimpse of the macro section. Be sure to upgrade to paid to see the whole thing!

A Strong Dollar Remerges

Along the same lines of short-term interest rates, the bull trend in the dollar could be making a reemergence as the market begins to realize the Fed was serious in their stated intentions of restrictive monetary policy for 2023.

Both the yen and euro have experienced significant counter-trend reversals in recent days, weakening against the dollar and giving up nearly all 2023 gains. If the reversal has legs and the dollar begins to squeeze higher against major foreign currencies, liquidity dependent assets would face headwinds.

Upcoming Twitter Spaces: Bitcoin Magazine PRO is hosting special guest Croesus on Thursday, Feb 9 at 4:00 pm ET to talk about bitcoin adoption. Click below to set your reminder so you don’t miss out.

The Bond Market Is Not Buying The Equity Market’s Story

The story of 2022 was the duration trade. As long-end bond yields dramatically repriced higher, asset valuations everywhere begin to implode — most notably in the tech sector, where company valuations are priced the furthest out on the premise of future growth. As discount rates rise, relative valuations fall for riskier assets.

With that being said, the most recent price action in the rates market is something we are watching closely, both on the short end (as covered earlier) and on the long end, where rates have started to climb higher as bond bulls look to be currently exhausted.

With much of the risk-on rally in financial assets being supported by a bond market bid in recent months, a reversal in bonds lower (yields higher) could once again reintroduce headwinds in a regime where stock/bond correlations are still very strong.

Given that much of the bid in fixed income has come at a time with ever lower bond market volatility. If the long end of the Treasury curve continues its recent short-term trend, expect stocks to follow.

Shown below are historical periods of positive rolling stock/bond correlations — green when stocks and bonds are appreciating, red for when both are falling in tandem.

Final Note

Over the short-to-medium term, inquisitive investors should keep their eyes peeled on rates and the FX market for the keys as to the next direction for both equities and bitcoin as 2023 Fed cuts get rapidly priced out.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Enjoyable reading and analysis fellas! While I wish Bitcoin was an uncorrelated asset to the fiat market (FM), it appears it is becoming tightly knitted to the price action of the S&P.

I look forward to the potential decoupling from the FM in the next 18-24 months, we will then learn if the halving cycle has legitimacy and legs.

I suppose as long as the Lightning Network gains adoption and momentum month over month, & year over year, that will become the trigger for BTC to reach escape velocity.

keep up the great research. Its always a treat to read your work.

Hey how can we access the dashboard? No seeing it on the homepage. TIA