Inflationary Bear Market Spells Trouble For Investors

More good news is bad news jobs data. Sovereign debt yields rise especially in Europe. Inflationary bear markets send equities and bonds correlation into positive territory.

We have some exciting changes coming to Bitcoin Magazine PRO!

It is our goal to provide you with the best possible insights to navigate the market and to do that, we believe it is important to have skin in the game.

With this in mind, we are happy to announce the addition of Dr. Jeff Ross who will be managing the new Bitcoin Magazine PRO Fund beginning in early September!

Dr. Jeff has extensive experience managing capital through his firm Vailshire Capital Management and is a highly-respected voice in the Bitcoin space. He will be making long/short calls, actively managing risk, and giving you actionable trade ideas, all while updating you on the performance of the Bitcoin Magazine PRO Fund.

Paid subscribers will receive these updates, in-depth market commentary from our research team, and will continue to receive early access to our monthly market research reports as they are released.

We will continue to release details as the launch approaches, thank you for supporting Bitcoin Magazine PRO!

Rates On The Rise

Today’s initial jobless claims data release came in below expectations, signaling a stronger labor market which is another “good news is bad news” signpost.

We can see some of these developments play out via the Eurodollar Futures curve where the market’s expected federal funds rate is steepening (more rate hikes), now expected to be over 4% in the second half of 2023. That’s in line with the Federal Reserve’s own projections that they’ve told the market:

The S&P 500 Index now faces its fifth consecutive daily red candle and sits below some key technical areas that were holding as support.

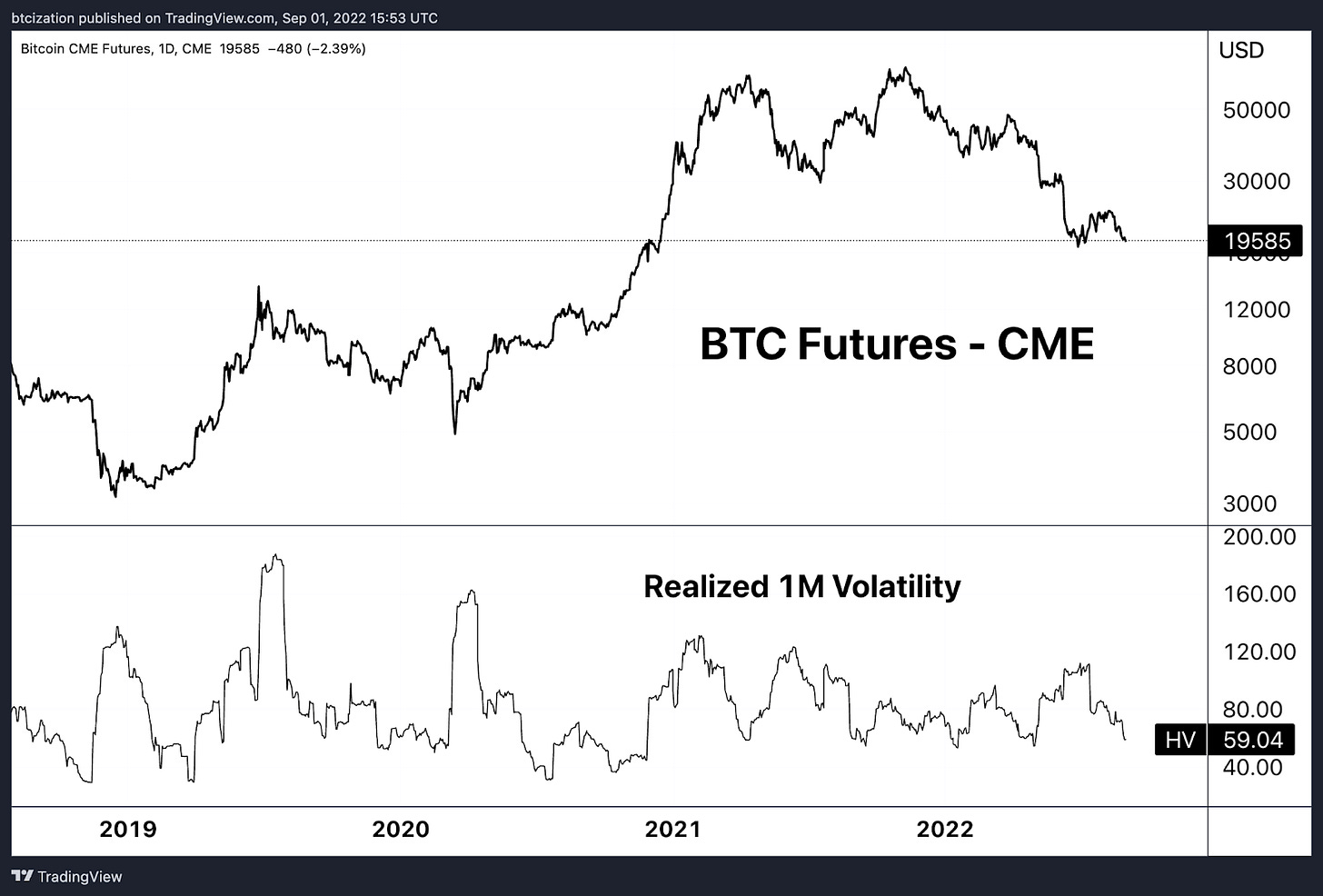

After months of compression, volatility is also on the move with the VIX starting to climb higher alongside higher 1-month realized volatility across bitcoin, equities and Treasury bond futures.

As we head into another long holiday weekend, it’s been an eventful day in the market with weakness and increased selling pressure showing up in a number of asset classes. Some of the most important moves have been continued DXY strength as major market currencies continue to bleed against the U.S. dollar and the rise in sovereign debt yields with the U.S. 10-year over 3.25%. Yields across major European economies (Germany, Italy, Spain and Greece) are moving higher as well.

The argument for “rates have peaked” has so far been a wrong or at least, early call, as the market has walked back their consensus expectations for a Federal Reserve pause or pivot timeframe into early 2023. The thesis of a deflationary bust and quick return to a 2% inflation target continues to look further away as many of the Federal Reserve board members are publicly emphasizing the need to stomp out inflation at all costs on a media show-like tour, acknowledging that core problems have not abated. Jerome Powell’s Jackson Hole speech and Neal Kashkari’s recent Oddlots appearance are clear examples of this.

Inflationary Bear Market

Comparisons to 2008 are misguided, due to the different inflationary outlook and macroeconomic backdrop.

2008 was a credit-financed boom turned deflationary bust. 2022 is an inflationary bear market, where both equities and bonds have sold off in tandem. Much of the legacy financial and portfolio allocation is built upon the assumption that bonds and stocks won't carry a positive correlation to the downside, and portfolio managers “diversify” accordingly.

Equities and bonds have been positively correlated over the last year during a period where equities went down. This is a first for the post quantitative easing fiat currency era.

The positive correlation to the downside occurred again today, as bonds got smoked on a massive move to the downside. At the time of writing U.S. Treasury bond futures are -1.99% for an asset that traded with a volatility of 15.54% over the last month.

For context, bitcoin futures traded nearly four times the amount of volatility over the last month while U.S. futures traded.

It is important to remember how large the global bond market is in terms of market cap and “paper wealth.” A few basis point moves in the bond market impacts can evaporate hundreds of billions if not trillions of dollars worth “wealth” across the globe.

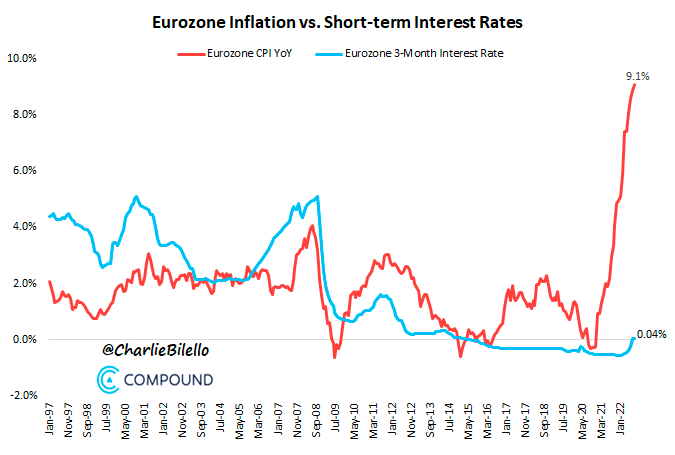

Yields in U.S. debt markets are soaring while the Fed doubles down on its hawkish stance and other major central banks remain overly dovish. While the European Central Bank has their policy rate 900 basis points below annualized inflation and the Bank of Japan pledges to defend 0.25% on its 10-year bond with an unlimited printing press.

The dollar is soaring, and it will present the global economy with many troubles.

Shown below is the dollar against its largest component currencies, the euro, yen, and pound:

In annual percentage change, the last time the dollar increased at this rate was the Great Financial Crisis and 2015, where the global economy underwent a recession and U.S. equities plateaued.

Meanwhile over in Europe, the energy crisis (read “Energy, Currency & Deglobalization Part 1”) is resulting in soaring bond yields, which could help to reignite a sovereign debt crisis as the economy plunges into a recession.

It's increasingly likely that the following conditions lead to a 1.0 correlation moment across asset classes, as the world plunges into a real earnings recession due to the energy shortage and other factors.

A dollar shortage begets a credit crisis, and that's what's in the early/middle stages of happening.

During a 1.0 correlation moment, long volatility and U.S. dollars are the only places to hide. Prepare your shopping list for the possibility of the event, and understand that dollars can have short-term asymmetry in asset terms during this next phase of the cycle.

The unwind of the credit-based system in no way damages the long-term outlook or prospects of bitcoin, the monetary asset. If anything, it is acting how it should, as a stateless currency meant as a check on the irresponsibility of the Federal Reserve (along with other monetary authorities).

If the Fed is attempting to gain even a shred of credibility back by tightening global financial conditions to the point of causing “pain,” the put option on global central banking might sell off momentarily.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

When Dylan posted those juicy charts today I knew a fatty article was coming. Guess its time to look through the old hashrate index to see what's on the shopping list.

Great insight Dylan! keep it coming