Earlier Than You Think: An Objective Look At Bitcoin Adoption

How many bitcoin users are there? How should we define a bitcoin user? We cover our preferred ways to categorize and track user growth then compare it to other available estimates.

Relevant Articles:

Bitcoin Rips To $21,000, Shorts Demolished In Biggest Squeeze Since 2021

Time-Based Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market Apathy

Bitcoin User Adoption

One of the strongest cases for bitcoin is its growing network effects. For bitcoin to continue to grow in the future, it needs adoption and demand. That demand comes from either growth in more capital flowing into the network and/or growth in its number of users.

Yet, defining someone who uses the Bitcoin network or is a user of bitcoin the asset is incredibly difficult and can have many definitions depending on whom you ask. This piece aims to aggregate and analyze the various definitions and estimates for bitcoin users, define our preferred view of bitcoin adoption and make our own estimations for current bitcoin users.

How Do You Define A Bitcoin User?

There’s no “right” answer in defining a bitcoin user but we considered the following questions when coming up with our definition:

Is someone who is storing bitcoin on an exchange considered a user or should we only count those who have some form of self custody?

What’s the nuance between counting on-chain addresses versus accounts or entities?

Is there a threshold of bitcoin ownership that we should consider for adoption? Is that threshold denominated in bitcoin, fiat currency or as a share of net wealth?

Is a user defined as someone who just holds bitcoin or do they need to actively transact on-chain or on Lightning?

Would a merchant who uses the Lightning Network payment rails because of the cheaper fees but elects to immediately convert funds to fiat currency be a user?

Does a user need to run a node?

It’s likely best to think about bitcoin user adoption in stages or as different buckets. In bitcoin’s current adoption stage, we know that the main use case is storing value with users predominantly investing/holding the asset. As adoption progresses, we’re likely to see a growing case for medium of exchange use but we’re still incredibly early on that path. Some rough categories to think about different user types:

Casually Interested: User owning any amount of bitcoin or bitcoin-related product. This could be someone with $5 in an old wallet, a share of GBTC or someone who dabbled with buying a small amount of bitcoin once on Coinbase.

Allocator/Investor: User who purchases bitcoin or bitcoin-related products on a recurring basis. Primarily interested in making financial gain on bitcoin’s potential price appreciation. May or may not self custody or use a custodial solution. Likely has 1-5% allocation of their net worth in bitcoin/bitcoin products.

Heavy User: User who stores a significant portion of net worth in bitcoin through self custody and/or actively engages in on-chain or Lightning transactions. Someone primarily interested in using a separate form of money and monetary network. Likely has more than 5% allocation of their net worth in bitcoin.

Many of the eye-popping adoption numbers that we see today tend to track all these categories together. Maybe that’s the right approach for a high-level view of potential adoption and the first touchpoint, but it doesn’t tell us much about the number of users using bitcoin for its primary purpose: decentralized peer-to-peer cash where users can store and transact value on a separate monetary network. Ideally, we want to track the growth of heavy users to reflect meaningful adoption of bitcoin.

The below table aggregates some of the key bitcoin user estimates that have been published over the last six years to give you an idea of how varying these estimates can be. Looking at casually interested users, numbers from 2022 range from 200 to 800 million users. These are counts from survey samples, data from on-chain analytics and includes exchange users. All of these studies have different definitions and methodologies for calculating adoption, showing how difficult it is to compare estimates out there today.

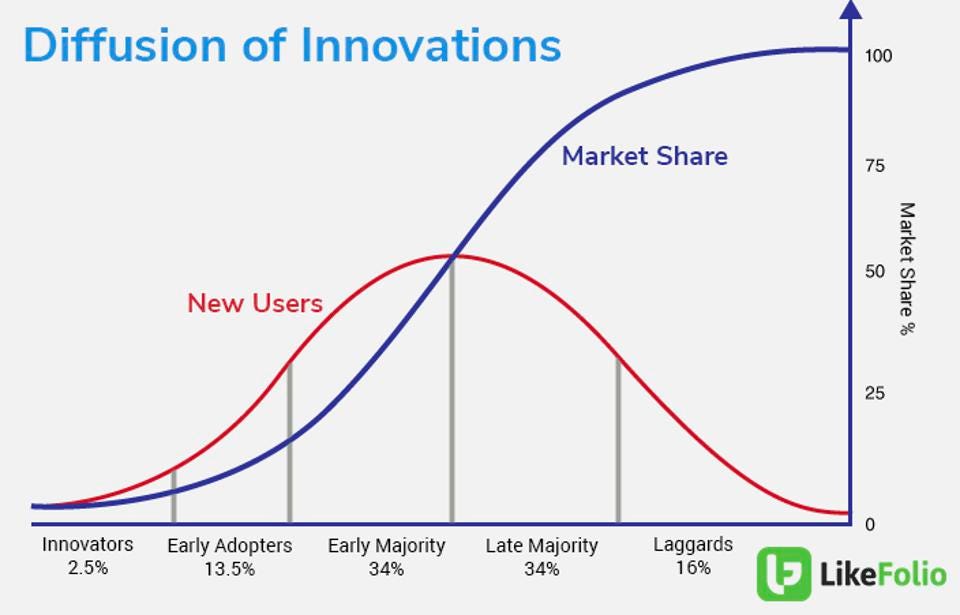

Technology Adoption S-Curve: Internet Versus Bitcoin

New technologies typically go through an S-curve cycle as they gain market share. Adoption by the population falls into a typical statistical bell curve. An S-curve just reflects the typical adoption path for innovative technologies over time.

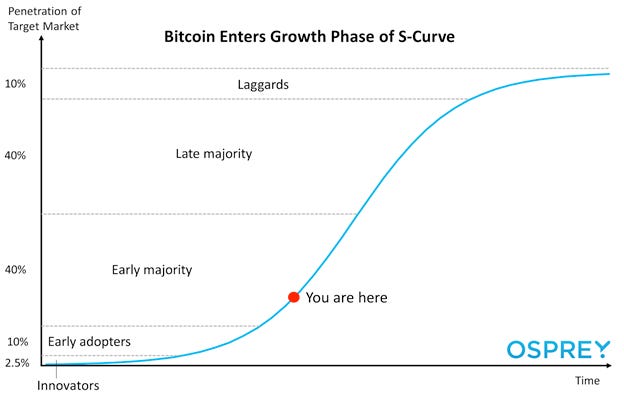

Many of the classic projections for S-curve adoption use a more high-level view of the casually interested users to track bitcoin growth compared to internet adoption. Basically, these estimates track interested users of all types: those who have had any touch points with bitcoin from buying a little bit on an exchange, having a wallet with $5 worth of bitcoin to the bitcoin user storing greater than 50% of their net worth in self custody.

Tracking casually interested users would give people a ballpark estimate of around the same adoption curve as the internet. However, if we’re really interested in tracking meaningful, lasting bitcoin adoption then we would argue that tracking the number of heavy users is a better measure for the current state of bitcoin adoption and emphasizes just how early in Bitcoin’s lifecycle we are. When looking at the more popular analysis comparisons that have previously circulated (included below), they paint a picture that bitcoin adoption is much further along than we calculate it to be.

Upcoming Twitter Spaces: Bitcoin Magazine PRO will sit down with Croesus to discuss bitcoin adoption on Thursday, February 3 at 4:00 pm ET. Click below to set your reminder so you don’t miss out.

In 2020, Croseus wrote a thread that analyzes bitcoin adoption in a similar way that we set out to do in this piece. He outlined the adoption curves across four different user groups and focused on a preferred view of a similar group as our bucket of heavy users, though his category of full bitcoin adoption is even more strictly defined. He uses a creative way to categorize significant adoption by loosely calculating based on sales of “The Bitcoin Standard” by Saifedean Ammous, Bitcoin Maximalist Twitter accounts and on-chain data. His conclusions show a similar view to our own: Significant bitcoin adoption is much lower than the estimates of 10-15% penetration or roughly 500 million users that are commonly thrown around today. In fact, he suggests that bitcoin adoption by what we would consider “heavy users” is at 0.01% penetration of the global population.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

In-depth analysis of bitcoin users using addresses and entities. 📫

Our calculations for current bitcoin adoption by the global population. 🌎

Bitcoin Magazine PRO’s New Market Dashboard. 📊

Addresses and Entities

The easiest place to start with estimating users is on-chain addresses. Addresses don’t translate to the number of users, but can act as a rough proxy for overall growth. Unique addresses with bitcoin amounts can be growing as new users acquire bitcoin or as current bitcoin holders use many unique addresses to spread out their holdings — a common privacy practice.

If we exclude exchanges and institutions holding bitcoin on behalf of others, addresses can act as a ceiling to estimating the number of users out there, especially those holding their own keys. We’ve seen an explosion in address growth since 2012 from just under 1 million to nearly 42 million unique addresses today. Let’s say we use an assumption for average addresses per person to be 10 — which is just a rough guess — then the ceiling of bitcoin users who have their own addresses is around 4.2 million.

Breaking that down further, we can see the amount of unique addresses holding a certain threshold of bitcoin denominated both in BTC and USD. Again, if we exclude those who keep their bitcoin on exchanges or with a custodian who uses addresses on behalf of many users, then there are only 4.2 million unique addresses holding at least 0.1 bitcoin.

From a USD perspective, there are only 5.3 million addresses holding at least $1,000 worth of bitcoin. Using our rough assumption of 10 addresses per person again then we’re under 1 million users with $1,000 worth of bitcoin. With a global median wealth per adult of $8,360, a bitcoin allocation of $1,000 would make up a significant share of nearly 12%. A relatively small allocation for some, but considering bitcoin is global and has higher adoption rates in less wealthy countries, the benchmark seems fitting.

Using our definition of “heavy user” to calculate, if we use addresses with a certain threshold of BTC or USD and make some rough assumptions around addresses per person along with not counting exchange users or addresses holding bitcoin on the behalf of others, then this approach estimates only 593,000 bitcoin users, or only a fraction of the world population. Using the global population data from the “BTC Adoption Estimates” chart above, that puts bitcoin adoption at 0.0074%. Even if we’re to cut the world population in half using that same data and assume the total addressable market for bitcoin adoption is much lower, then adoption would still be shy of 0.02% penetration using this method.

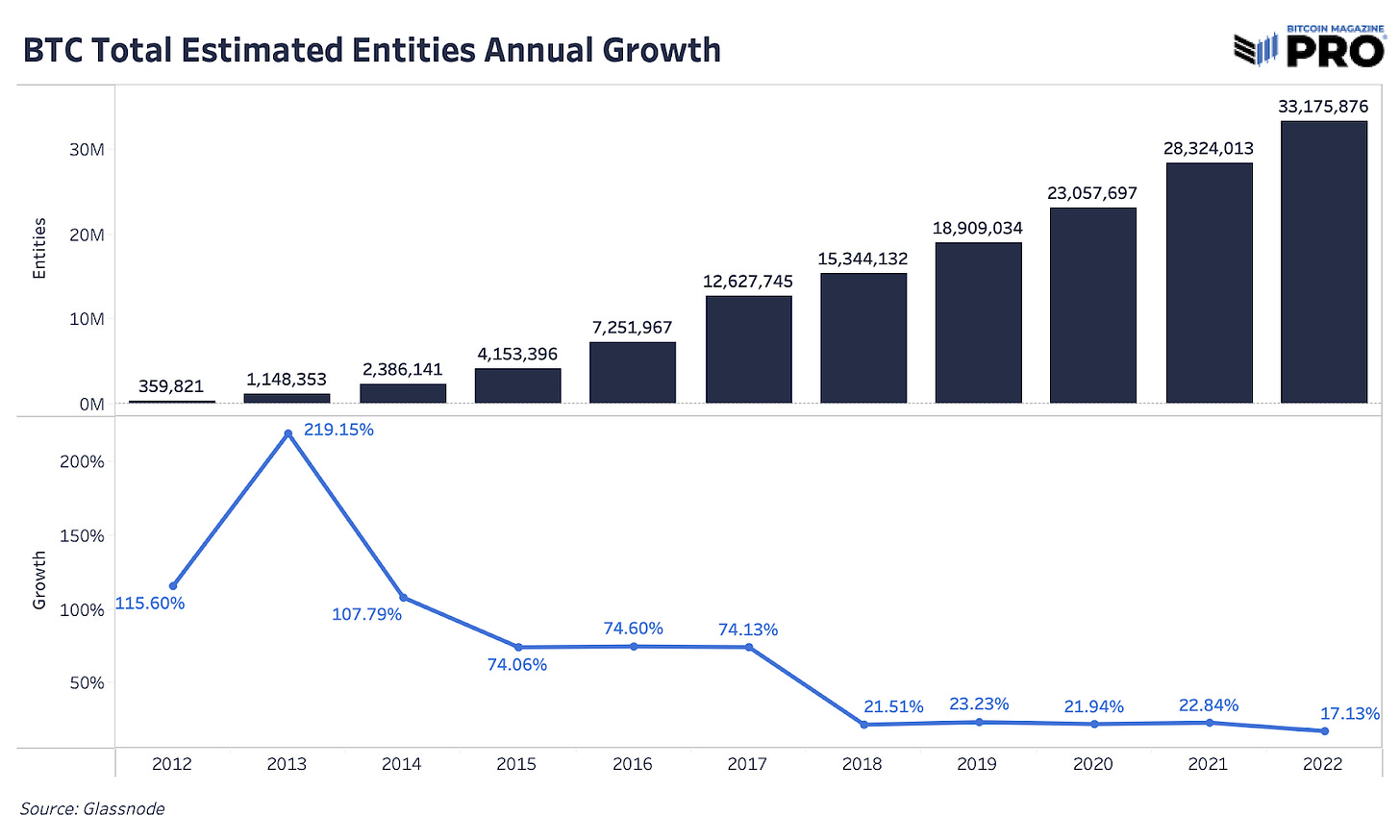

Consider Glassnode Entities

Showing just how varied these calculations can be, Glassnode’s estimated entities data gives us a drastically different result than our estimated 593,000 heavy bitcoin users. Using proprietary data science and clustering techniques to differentiate between addresses and bitcoin users, Glassnode has turned addresses into estimated entities. These entities can reflect an exchange, an individual user, a custodian on the behalf of others and more. Although still imperfect, it gives us a cleaner picture of what user adoption size and growth may look like. With consistent double-digit annual growth of over 20% the last five years, estimated total entities are around 33 million.

If we focus again on the idea of heavy users, those that self-custody and have a significant portion of their net worth in bitcoin, then entities’ data works nicely since we don’t have to apply any additional estimates to count users connected to an exchange or other institution. Using this data would roughly show only 0.42% penetration of the total world population in 2022.

Taking this further, if we apply the same criteria for addresses holding a certain threshold of bitcoin ($1,000) to entities data, then current penetration is even lower. Of the 33 million entities estimated by Glassnode, if only 15.5% of addresses hold more than $1,000 worth of bitcoin, the resulting calculation is just 5 million entities that fit our definition of heavy users — or 0.06% of the global population, using the same population data from the chart above.

No matter which way you cut the data, there is not a large amount of the worldwide population who would be considered heavy users who self-custody a significant threshold of bitcoin.

Conclusion

High-growth estimates of hundreds of millions and even billions of users sounds catchy and exciting for those of us who are looking forward to global adoption and life on a bitcoin standard. By many popular estimates, there are at least millions and maybe even billions of eyeballs on bitcoin and the broader cryptocurrency industry today. These statistics are a great marketing tool that draw attention, but tell us little about the meaningful adoption of bitcoin that heavy users should care the most about. The analysis in this article is meant to highlight how difficult it is to define and track bitcoin user growth in a reliable way.

We are highlighting a lower penetration of adoption not to dissuade readers from the growth of bitcoin’s network effects so far, but rather to highlight the substantial opportunity of its potential growth in the future. We may still be in an extremely early phase of adoption where estimates of large adoption numbers mostly focus on retail speculation or investors and allocators that are primarily focused on financial gain, but that also means that there is a major opportunity for the early adopters who see bitcoin’s potential as a store of value that cannot be debased by money printing or even the chance of it becoming a reserve currency in the future.

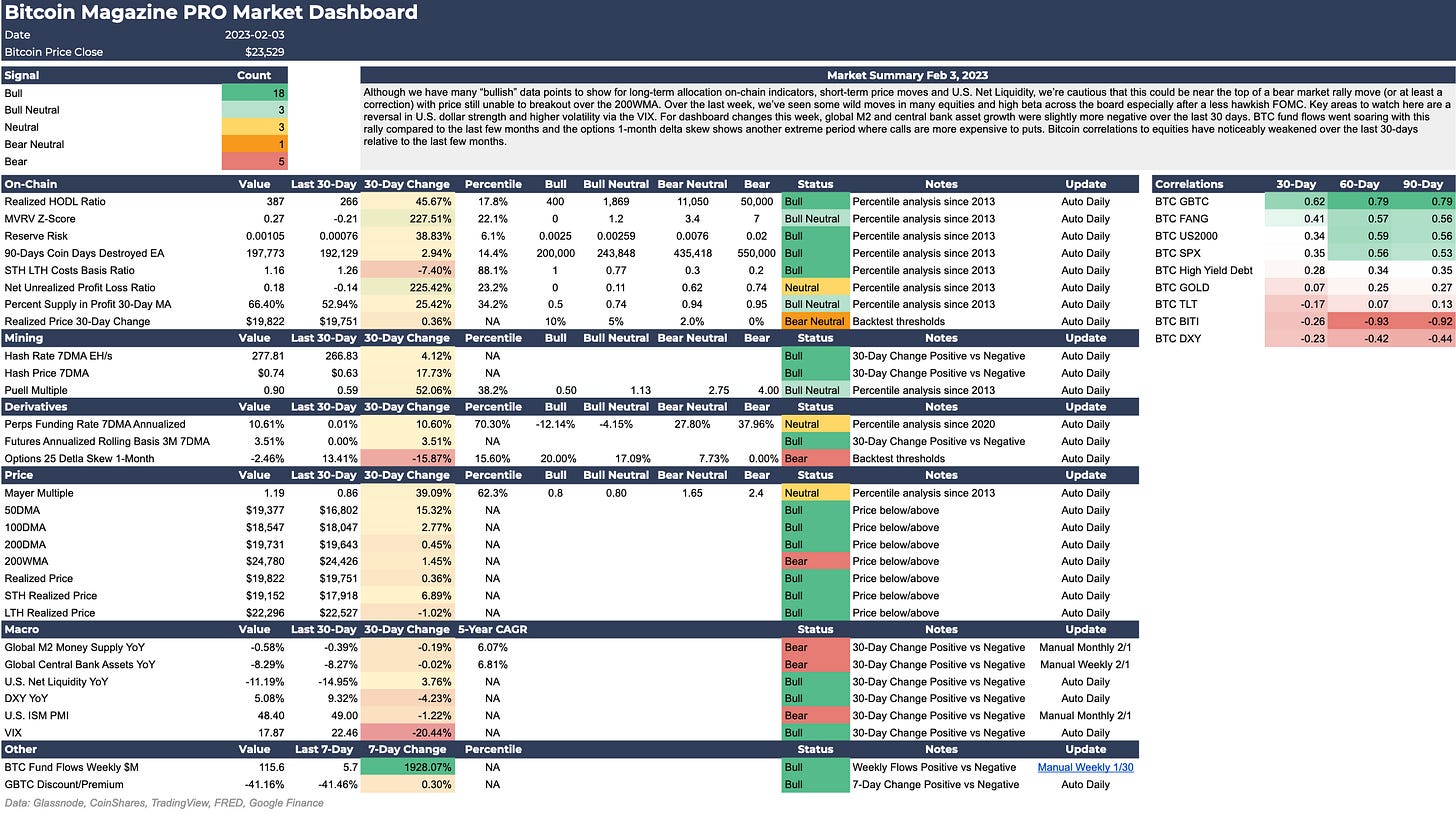

BM PRO Market Dashboard

Market Summary

We have many “bullish” data points to show for long-term allocation using on-chain indicators, short-term moves in price and U.S. net liquidity, but we are cautious that this could be near the top of a bear market rally with price still unable to break out over the 200-week moving average (WMA). Over the last week, we’ve seen some wild moves in many equities and high beta across the board, especially after a less hawkish FOMC. Key areas to watch are a reversal in U.S. dollar strength and higher volatility via the VIX. For dashboard changes this week, global M2 and central bank asset growth were slightly more negative over the last 30 days. BTC fund flows went soaring with this rally compared to the last few months and the options 1-month delta skew shows another extreme period where calls are more expensive than puts. Bitcoin correlations to equities have noticeably weakened over the last 30 days relative to the last few months.

Dashboard note: We added the 200 WMA which has acted as a key level for longer-term trend support and resistance. It currently sits at $24,780.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Great stuff, Sam. Thanks.

Thanks Sam (and Dylan). Dashboard is great - consistency of having the data / historical picture, with the added context from your summary. Also think the signal count is good stuff - would be very interested to see what the count (% bull for instance) looked like at major tops / bottoms. Selfishly, maybe a future post??