A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

Bitcoin correlates with high-beta stocks in the recent move upward. Global liquidity is increasing and China leads the way. The Bank of Japan meets tomorrow to discuss policy about defending the yen.

Relevant Past Articles:

A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

An independent bitcoin rally or a high-beta move? Either way, bitcoin holders are celebrating the latest action to start 2023. Bitcoin has shown some significant momentum and has powered through every key short-term price level across daily moving averages and on-chain realized prices. In fact, every major high-beta play in the market is showing the same strength which gives us more caution than confidence in this latest short squeeze highlighted last week in “Bitcoin Rips To $21,000, Shorts Demolished In Biggest Squeeze Since 2021.”

Ethereum, high-beta semiconductor indexes, stocks like Advanced Micro Devices Inc and NVIDIA Corporation, the Russell 2000 index, high yield corporate debt and even Dogecoin are all coming in hot to start the year. The winner though is the WGMI ETF, which is full of bitcoin mining stocks and is up over 100% in the last 30 days. As much as we would like to see an independent bitcoin move higher, there’s plenty of signs in the market showing the opposite is likely.

We’ve seen a relatively meaningful bounce in the most oversold names of 2022, with a short squeeze and subsequent round of FOMO off the 2022 lows.

Across a basket of high-beta risk assets, the market was historically oversold and had a burst of speculative investment.

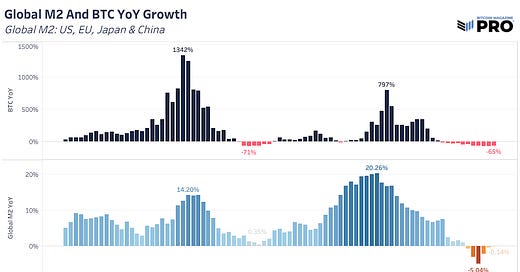

This recent risk rally has seen implied equity market volatility drift to new lows as the U.S. dollar continues to weaken over the short-term, National Financial Conditions Index (NFCI) loosens and global M2 money supply contracts at a much slower pace relative to the last few months.

Source: FRED

Source: Bloomberg

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Net liquidity and its impact on this upward move in the bitcoin price. 📊

What to watch for with the Bank of Japan’s monetary policy. 💹

How the carry trade may affect both the U.S. dollar and global equity markets. 💵

Net liquidity, a model we highlighted in our previous piece, shows a contraction compared to last year but hasn’t changed much over the last few months. If we’re to see a sustained rally continue, we’d like to see growth in net liquidity over the next couple of months to be the main driver accompanying this move. We’re no experts on liquidity dynamics but Michael Howell of CrossBorder Capital is. His work points to the fact that global liquidity from central banks is back on the rise with China leading the way.

A resurgence in global liquidity opens up upside potential for bitcoin in the short term.

In their recent meeting minutes, members of the Federal Reserve expressed concern about the “unwarranted easing in financial conditions” caused by the run-up in risky assets and subsequently hindering their efforts to cool inflation. With the recent stock market rally creating over $1 trillion in fresh investor wealth, debates about the inflationary impact of buoyant markets have become one of the Fed’s bigger issues. The NFCI, which measures strain across asset classes, is now at looser levels than before the Fed's interest rate liftoff last March.

What to Watch For:

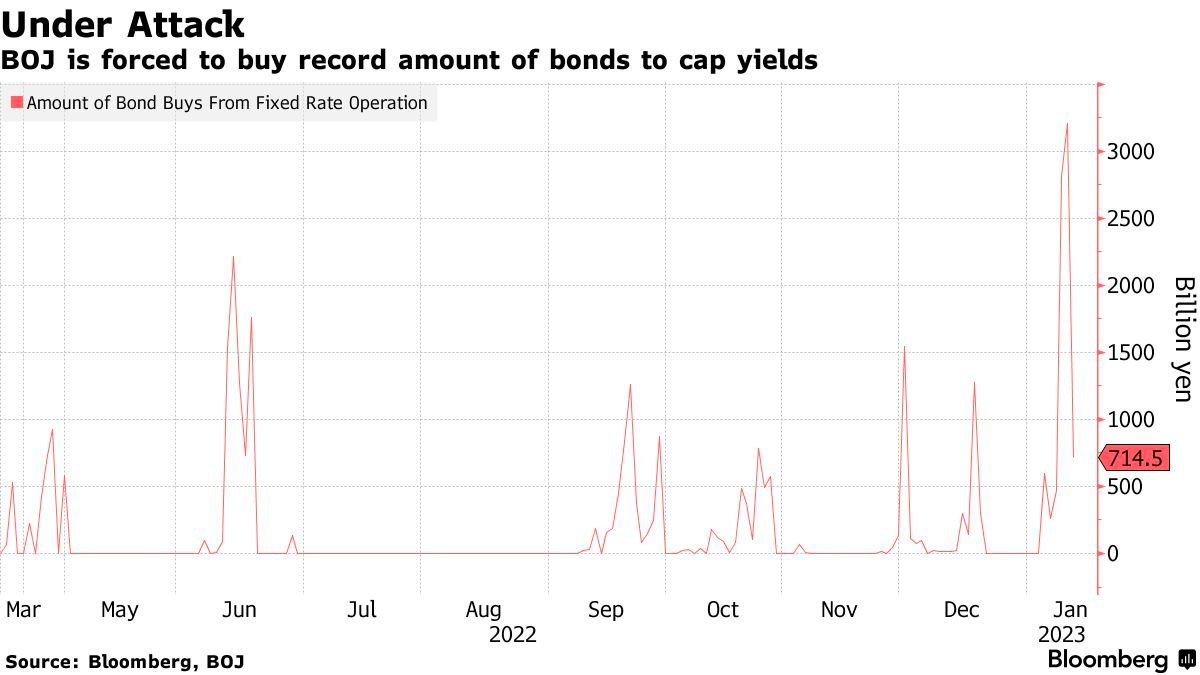

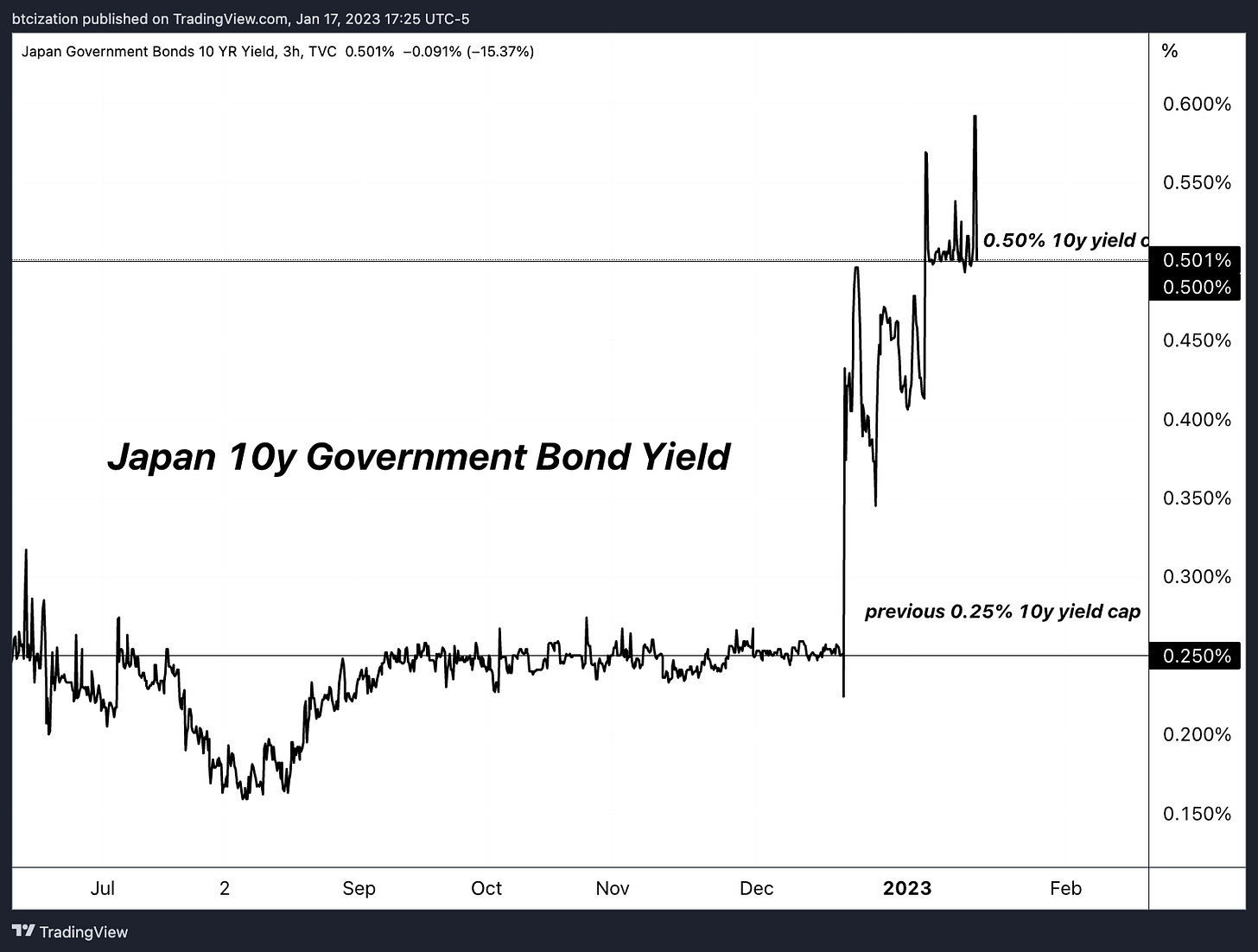

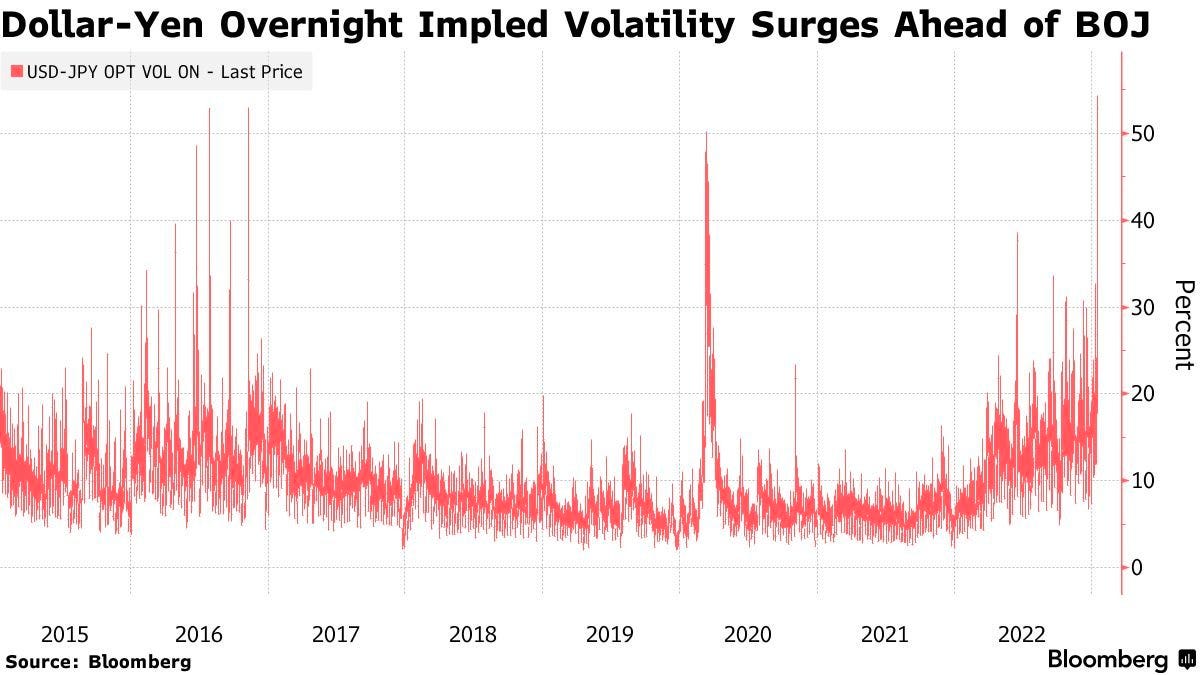

Tomorrow, the Bank of Japan is going to make a decision about its current monetary policy. Many rate traders are betting via the swaps market that the BoJ will further retract upon their interest rate suppression scheme.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

If the BoJ decides to continue printing yen with fervor to defend the 10-year bond in Tokyo, an easing of global financial conditions will be a likely positive externality. However, a shock would come to markets if the Bank of Japan decides to let the 10-year bond appreciate to 1.00%, as this would reprice global sovereign debt immediately lower (meaning higher rates) causing the yen carry trade to unwind.

The carry trade is a strategy where people borrow money in a currency with a low interest rate — like the Japanese yen — and use that money to invest in something that has a higher interest rate, like U.S. dollars. As rates in the bond market repriced, so would subsequent currencies, weakening the dollar and repricing the yen.

We view this to be one of the few ways where both the dollar could fall at the same time as global equity markets weaken, with equities repricing due to rising costs of U.S. capital.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Great write up. Enjoyed the depth on YCC with the BOJ - some people got crushed in looking at how their bonds traded over the past 24hrs.