Liquidity, The Central Bank Balance Sheet & Bitcoin

The global reduction in liquidity has sent assets to new lows and continues to drive wealth destruction. From central bank balance sheets to M2 money supply, how is bitcoin affected?

Relevant Past Articles:

Liquidity Is In The Driver's Seat

By far, one of the most important factors in any market is liquidity — which can be defined in many different ways. In this piece, we cover some ways to think about global liquidity and how it impacts bitcoin.

One high-level view of liquidity is that of central banks’ balance sheets. As central banks have become the marginal buyer of their own sovereign debts, mortgage-backed securities and other financial instruments, this has supplied the market with more liquidity to buy assets further up the risk curve. A seller of government bonds is a buyer of a different asset. When the system has more reserves, money, capital, etc. (however one wants to describe it), they have to go somewhere.

In many ways that has led to one of the largest rises in asset valuations globally over the last 12 years, coinciding with the new era of quantitative easing and debt monetization experiments. Central bank balance sheets across the United States, China, Japan and the European Union reached over $31 trillion earlier this year, which is nearly 10X from the levels back in 2003. This was already a growing trend for decades, but the 2020 fiscal and monetary policies took balance sheets to record levels in a time of global crisis.

Since earlier this year, we’ve seen a peak in central bank assets and a global attempt to wind down these balance sheets. The peak in the S&P 500 index was just two months prior to all of the quantitative tightening (QT) efforts we’re watching play out today. Although not the only factor that drives price and valuations in the market, bitcoin’s price and cycle has been affected in the same way. The annual rate-of-change peak in major central banks’ assets happened just weeks prior to bitcoin’s first push to new all-time highs around $60,000, back in March 2021. Whether it’s the direct impact and influence of central banks or the market’s perception of that impact, it’s been a clear macro-driving force of all markets over the last 18 months.

One of the macroeconomic experts on global liquidity is CrossBorder Capital, founded by Michael Howell. They take the definition of liquidity far beyond that of central bank balance sheets showing the deep, sophisticated data and flows relationships that reveal just how much valuations depend on global liquidity. The vacuum sucking liquidity out of the system is destructive for global wealth across all financial assets and housing, not just bitcoin. And it’s not over yet.

At a market cap of just fractions of global wealth, bitcoin has faced the liquidity steamroller that’s hammered every other market in the world. If we use the framework that bitcoin is a liquidity sponge (more so than other assets) — soaking in all of the excess monetary supply and liquidity in the system in times of crisis expansion — then the significant contraction of liquidity will cut the other way. Coupled with bitcoin’s inelastic illiquid supply profile of 77.15% with a vast number of HODLers of last resort, the negative impact on price is magnified much more than other assets.

Source: CrossBorder Capital

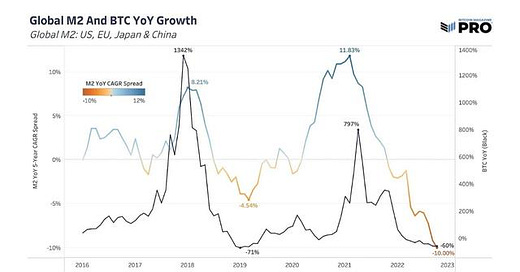

One of the potential drivers of liquidity in the market is the amount of money in the system, measured below as global M2 in USD terms. M2 money supply includes cash, checking deposits, savings deposits and other liquid forms of currency. Both cyclical expansions in global M2 supply have happened during the expansions of global central bank assets and expansions of bitcoin cycles.

This one chart is a key reason to view bitcoin as a monetary inflation hedge (or liquidity hedge) rather than one against a “CPI” (or price) inflation hedge. Monetary debasement, more units in the system over time, has driven many asset classes higher. Yet, bitcoin is by far the best-designed asset in our view and one of the best-performing assets to counteract the future trend of perpetual monetary debasement, money supply expansion and central bank asset expansion.

The below chart shows the significant supply contraction we’ve seen over the past five years. The colored line is the difference between the annual growth rate of M2 and the five-year CAGR (compound annual growth rate).

Taking the liquidity definition a bit further and more actionable, it can be useful to look at a measure called Net Liquidity, which tracks the Federal reserve’s balance sheet less the combination of the U.S. Treasury General Account and Reverse Repo facility. Outside of the Fed balance sheet, both of these variables have changed massively since 2020 and have had a much larger impact on the system’s liquidity (amount of money available to circulate in the economy) than they did before.

We won’t get into all of the details here but rather want to highlight just how important liquidity has been to driving asset prices this cycle. It’s been a primary asset driver for decades; for a more detailed explanation of Net Liquidity, check out this thread. The chart below shows just how interlinked Net Liquidity and the S&P 500 index has been over the last year and as we know, bitcoin has followed equities on almost every move. Unless we see major changes to the Treasury General Account and Reverse Repo facility over the next few months, the Fed’s continued balance sheet unwind path will only drain more liquidity out of markets for the rest of the year.

Source: Max Anderson

All that being said, it’s unclear on how long a material reduction in the Fed’s balance sheet can actually last. We’ve only seen an approximate 2% reduction from a $8.96 trillion balance sheet problem at its peak. Eventually, we see the balance sheet expanding as the only option to keep the entire monetary system afloat, but so far, the market has underestimated how far the Fed has been willing to go.

The lack of viable monetary policy options and the inevitability of this perpetual balance sheet expansion is one of the strongest cases for bitcoin’s long-run success. What else can central banks and fiscal policy makers do in future times of recession and crisis? But in the short term, we’re in uncharted territory and would rather first let the liquidity dynamics and trend run their course to a conclusion — or at least a major turning point.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Thank you for writing these articles. Very insightful to what is going on in the market right now. Everything I read in other places is speculation and makes no sense. I like the hard data and analysis you provide 🤜🤛

Grateful if you can please do a tether write up. It will implode at one point and would be interesting to show what effect that will have on BTC.