The Daily Dive #151 - Higher Volatility And Less Liquidity

Rising Economic Uncertainty

The FRED Equity-Related Economic Uncertainty Index reached its sixth-highest reading ever today, as liquidity continues to dry up for risk assets. Spikes in this index typically coincide with significant drawdown periods in the S&P 500 Index.

As inflation has reached 40-year highs in the U.S. (as well as high readings throughout the rest of the world), investment-grade bonds essentially ceased to exist with nominal yields far below the inflation rate without accounting for credit (default) risk whatsoever.

We have continued to state in The Deep Dive that bitcoin’s monetary competition isn’t just gold, but rather the monetary premium that has nestled itself into global bond and even equity markets amidst the everything bubble.

The Everything Bubble

We continue to use the term “Everything Bubble” in The Deep Dive to frame the state of the international monetary system, but what do we actually mean?

The Federal Reserve Board, and their actions as “lender of last resort” for the U.S. dollar (with the dollar serving as the world reserve currency) have acted as a volatility suppression scheme for decades.

Most notably starting with Alan Greenspan and the “Greenspan put” (later to be known as the Fed put), financial markets came to learn that the Fed would save the day by bailing out credit markets and keeping the easy money flowing. Now in 2022, with the Fed’s fund rate still at the zero lower bound, the Fed has become a political liability, and is caught underprepared attempting to tighten as liquidity across financial markets is pulling back.

In The Daily Dive #142 we discussed the implications of the current credit market sell-off:

“The consequences of the falling prices in debt instruments is higher financing costs in the broader economy, as a forty-year high in the consumer price index along with a slightly hawkish Federal Reserve Board has lenders looking for higher yields.

“What should be watched going forward is how credit markets trade, as this has a direct impact on equity markets from a corporate financing perspective but also a market valuation perspective.

“This is something we will keep a very close eye on over the coming months, into a potential Fed rate hike cycle.”

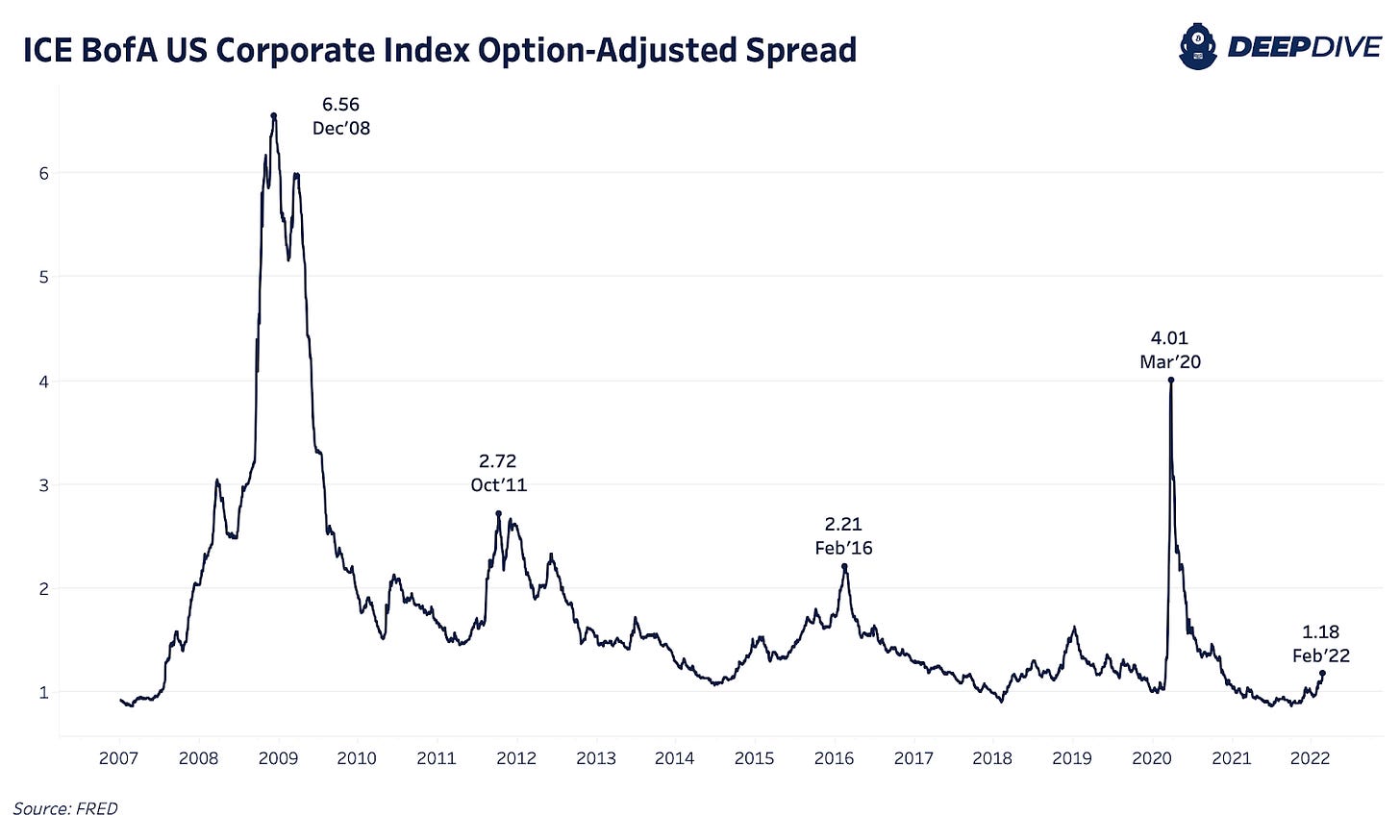

Corporate Credit Market Liquidity

The chart below shows the spread in yield between U.S. corporate debt and U.S. Treasurys, which is in the process of a large breakout. This is at a time when Treasurys are selling off in tandem, meaning that corporate financing is increasing in a feverish manner at the same time that household margins (and subsequently their spending) are getting squeezed.

Equities are selling off as the market adjusts to a higher cost of capital, with earnings multiples pulling back over recent months. This has led to a regime of higher market volatility, and the ripple effects are being felt across asset classes.

During moments of high equity market volatility, bitcoin has recently been selling off in tandem.

So why is bitcoin, as a pure monetary asset responding in tandem? It is because the fiat monetary system is built upon the implicit short dollar trade. Every dollar in circulation is created through credit extension, and thus during periods of declining (or even decelerating) market liquidity, asset classes will sell off in tandem.

It appears for the time being we are in a paradigm of increasing equity and bond market volatility.

Bitcoin will respond by doing what it always does: credibly enforce an absolutely fixed terminal supply cap, while giving its adopters property rights which are digitally enforced by cryptography, not bureaucrats.

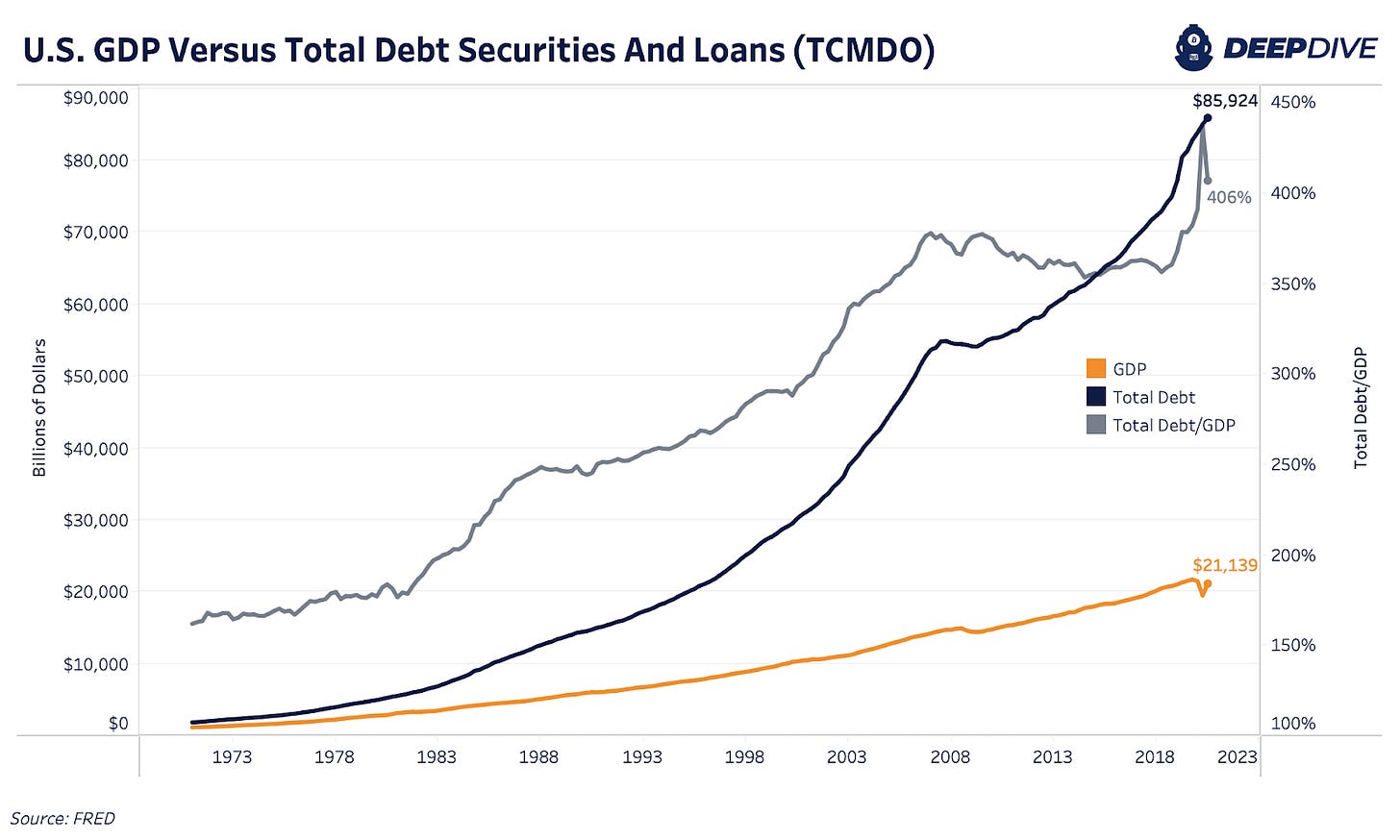

Total U.S. debt-to-GDP ratio is approximately 400%, meaning for every $100 of productivity there is $400 of debt actively accruing interest.

TLDR: Any attempt at tightening will fail eventually.