Bitcoin Short Sellers Get Squeezed

Short squeezes unfold across the market. Equities are rallying higher and bitcoin is going with it. Open interest has yet to fall.

Bitcoin Squeezed Past $23,000

Short squeezes unfold across crypto markets. In yesterday’s piece, we highlighted how the bitcoin (and more broadly, crypto) derivatives market was stoked with a massive buildup in open interest, and given the market’s overall trend of serving as beta to equity markets, if equity markets continued their risk-on rally, crypto markets were set to break out with a large amount of volatility.

At the time of writing bitcoin has broken out of the range it has been trading in for over a month’s time, trading approximately at $23,400.

Interestingly, bitcoin has appeared to be the laggard in a broader rally led by ether, which rose as much as 44% from the local bottom relative to bitcoin itself, as shown by the ETH/BTC trading pair.

It is worth noting that given Ethereum’s relative size to Bitcoin (approximately 42% of its market cap), it is more volatile and easier to move with an equal amount of capital. Also, ETH has notably higher historical volatility relative to BTC, meaning that when broader capital markets are green, its beta can often result in relative outperformance.

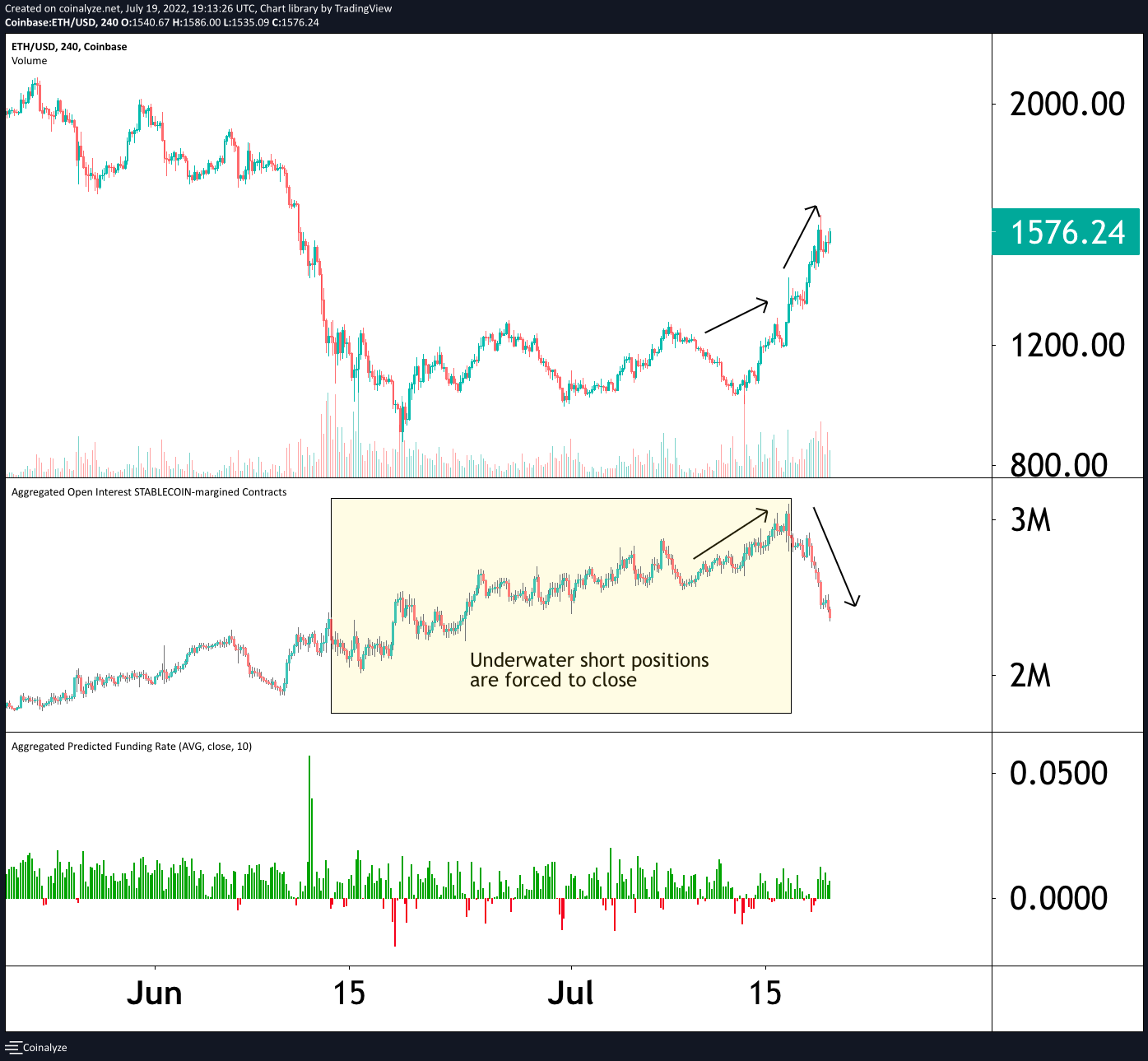

Given that perpetual futures open interest hit an all-time high relative to its market cap, as markets began to move upwards, a cascade of short covering took place, reflexively pushing the market higher and higher. Ether’s relative outperformance makes sense given that it has already squeezed a significant amount of open interest from the market.

While ether open interest has fallen dramatically following a monster short squeeze, bitcoin has lagged behind in regards to its price action, but most interestingly, its open interest is still near all-time highs in market capitalization terms as it consolidates around $23,400. Both ETH and BTC saw all-time high perpetual futures open interest relative to market cap during the latest consolidation phase.

As the S&P 500 melts up into today’s close, bitcoin looks prime for a large short squeeze higher, in short order.

Here is the price action of ether and its open interest, which led to a massive rally over the previous couple of days.

Now compare that to bitcoin, which has yet to meaningfully squeeze.

Bitcoin could shortly approach $25,000, in mechanical fashion, as the largest buyers aren’t new bitcoin holders, but rather previous short sellers looking to cover positions.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

the rational and measured side of me (currently in a suppressed state) tells me that fedsters / inflation / ruskies are circling overhead in a black swan formation ....

anyway i refuse to think about any of that type of $hit until July 27+28...hell maybe i'll put blinders on for that day anyway. didnt Jpeezy's unnofficial outlet for media leaks (WSJ) all but confirm a 75 bsp hike? market tells us we dgaf

also is that "wen merge" meme propping up ether or is the $hitcoin outperformance reality just something we have to always live with?? i dont even wanna know the answer...

🔥🔥🔥🔥🔥🔥

them bitcoin miners though --- wolfiecaps been told you