Decoupling Denial: Bitcoin’s Risk-On Correlations

While many Bitcoin investors look for the asset to behave as a safe haven and store of value, bitcoin has ultimately acted as the "riskiest of all risk allocations" and a liquidity sponge.

Relevant Articles:

A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

Not Your Average Recession: Unwinding The Largest Financial Bubble In History

Short-Term Price Versus Long-Term Thesis

How bitcoin, the asset, will behave in the future versus how it currently trades in the market have proven to be drastically different from our long-term thesis. Over the last year, we’ve highlighted bitcoin’s high correlation and beta to “risk-on” assets many times. In today’s piece, we’re taking a deeper look into those risk-on correlations, and comparing the returns and correlations across bitcoin and other asset classes.

The many people who envision Bitcoin playing a more significant economic role in the future typically ignore these short-term relationships. However, these correlations have proven to be some of the most important drivers of bitcoin’s exchange rate, especially over the past few years.

Consistently, tracking and analyzing these correlations can give us a better understanding if and when bitcoin has a real decoupling moment from its current trend. We don’t believe we are in that period today, but expect that decoupling to be more likely over the next five years.

Macro Drives Correlations

For starters, we’re looking at the correlations of 1-day returns for bitcoin and many other assets. Ultimately we want to know how bitcoin moves relative to other major asset classes. There’s a lot of narratives on what bitcoin is and what it could be, but that’s different from how the market trades it.

Correlations range from -1 to 1 and indicate how strong of a relationship there is between two variables, or asset returns in our case. Typically, a strong correlation is above 0.75 and a moderate correlation is above 0.5. Higher correlations show that assets are moving in the same direction with the opposite being true for negative or inverse correlations. Correlations of 0 indicate a neutral position or no real relationship. Looking at longer windows of time gives a better indication on the strength of relationship because this removes short-term, volatile changes.

What’s been the most watched correlation with bitcoin over the last two years is its correlation with “risk-on” assets. Comparing bitcoin to traditional asset classes and indexes over the last year or 252 trading days, bitcoin is most correlated with many benchmarks of risk: S&P 500 Index, Russel 2000 (small cap stocks), QQQ ETF, HYG High Yield Corporate Bond ETF and the FANG Index (high-growth tech). In fact, many of these indexes have a strong correlation to each other and goes to show just how strongly correlated all assets are in this current macroeconomic regime.

As Jurrien Timmer highlights, the entire market over the last year has been positively correlated (in red) with few places to hide (in blue).

Source: Jurrien Timmer, Fidelity

Upcoming Twitter Spaces: Bitcoin Magazine PRO will host Preston Pysh on Thursday, February 16 at 4:00pm ET for a discussion on all things Bitcoin and macro. Be sure to set a reminder so you don’t miss it!

The tables below compare bitcoin to some key asset-class benchmarks across high beta, equities, oil and bonds.

Note: you can find any of these indexes/assets on Google Finance with the tickers above. For 60/40, we’re using BIGPX Blackrock 60/40 Target Allocation Fund, GSG is the S&P GSCI Commodity ETF, and BSV is the Vanguard Short-Term Bond Index Fund ETF.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Bitcoin’s more recent correlations to these assets. 👀

A different look at how bitcoin relates to risk-on. 🔎

How this dynamic might change over the next decade. 🔟

With bitcoin’s native sharp liquidation selloff in November 2022, subsequent recovery and a significant decline in market liquidity and bid depth, correlations to risk assets are lower over the last three months.

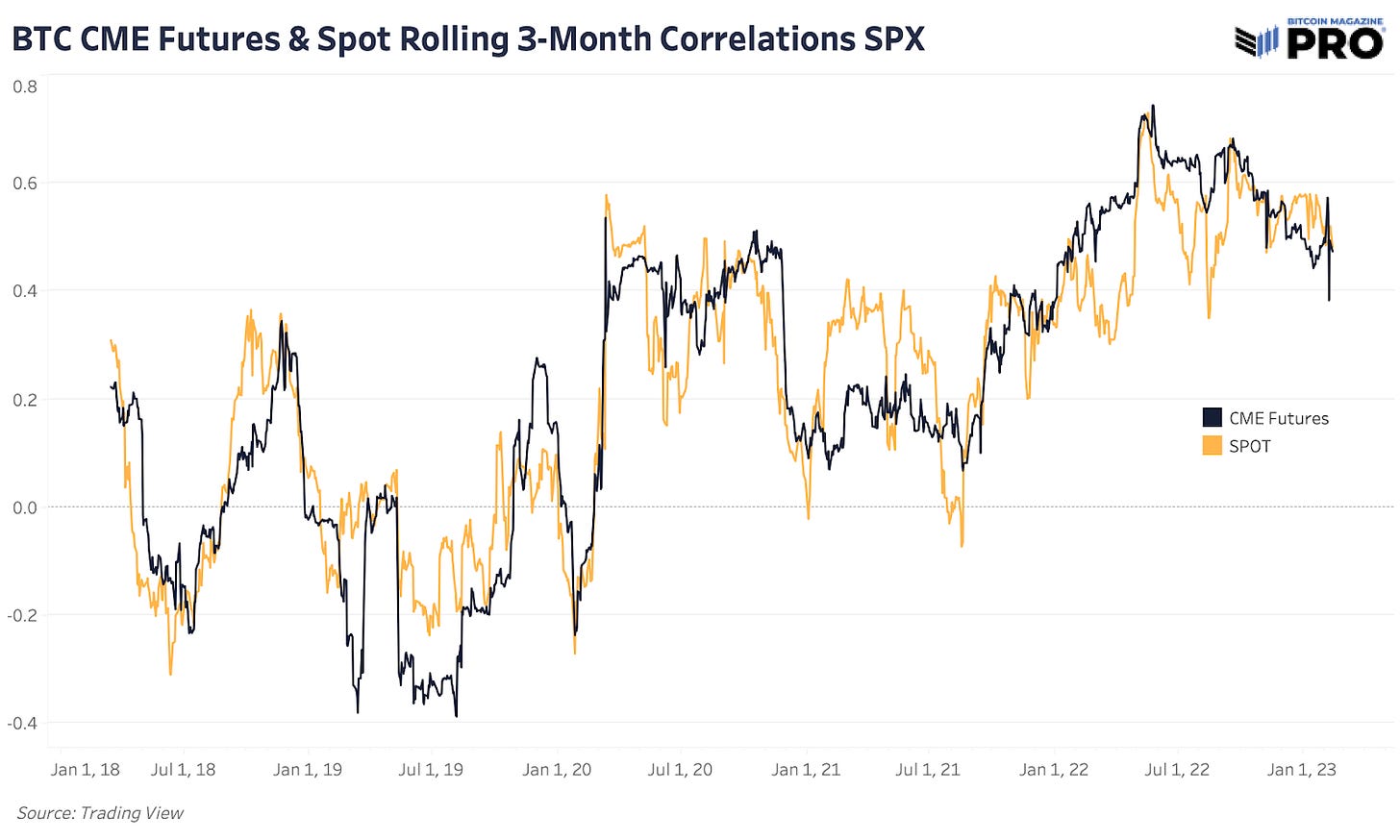

Another important note is that spot bitcoin trades in a 24/7 market while these other assets and indexes do not. Correlations are likely understated here as bitcoin has proven to lead broader risk-on or liquidity market moves in the past because bitcoin can be traded at any time. As bitcoin’s CME futures market has grown, using this futures data produces a less volatile view of correlation changes over time as it trades within the same time limitations as traditional assets. After months of a temporarily weakened correlation to the S&P 500 Index, we’ve started to see that correlation rise again over the last few weeks.

Looking at the rolling 3-month correlations of bitcoin CME futures versus a few of the risk-on indexes mentioned above, they all track nearly the same. Essentially, right before the cyclical top of bitcoin and many other assets in November 2021, there was a rising correlation which indicates how closely assets have traded together, including sell-offs during this bear market. The correlations have been stronger than what we saw back in March 2020, where every asset sold off in panic and subsequently rose together on the waves of unprecedented fiscal and monetary stimulus.

These tight-knit relationships in the market with risk-on assets is one of the arguments against bitcoin repeating another 4-year cycle like it has in the past. Without the tailwinds of loose monetary policies and higher asset prices like we’ve witnessed in the last decade, expecting a repeat of the 4-year cycles we’ve seen around the halving is not so clear cut.

In our view, there’s still a high chance that we have not seen the lows in traditional risk-on assets. Although bitcoin has had its own, industry-wide capitulation and deleveraging event that rival many historical bottoming events we’ve seen, these relationships to traditional risk haven’t changed much. A native bitcoin selloff without the catalyst of a much larger selloff in traditional assets is what makes this one of the more difficult periods to navigate in bitcoin’s history.

This is the first traditional bear market that bitcoin has faced and it must diverge and decouple from risk-on assets if we’re to see a strong reversal in trend. It would be a welcome sign to see this dynamic play out, but it’s hard to see evidence of that happening right now based on correlations.

Many point to bitcoin’s correlation with gold as being the likely candidate for a decoupling from traditional risk assets. Recent gold correlations have been higher than in the past, but are nowhere near what we’ve seen with bitcoin’s relationship to risk-on assets.

Bitcoin has ultimately acted as the riskiest of all risk allocations and as a liquidity sponge, performing well at any hints of expanding liquidity coming back into the market. It reverses with the slightest sign of rising equities volatility in this current market regime. Bitcoin’s trajectory to a market cap of just under $500 billion has been an impressive rise, but in reality, it’s still just a fraction of the amount of capital that can move markets on a whim. Regardless, bitcoin is being used more and more by traditional finance as the market’s current liquidity gauge.

We do expect this dynamic to substantially change over time as the understanding and adoption of Bitcoin accelerates. This adoption is what we view as the asymmetric upside to how bitcoin trades today versus how it will trade 5-10 years from now. It is possible that it remains the best liquidity sponge in the market as monetary and fiscal liquidity injections become more volatile and frequent over the coming decade. Or it might behave as a safe-haven asset with increased capital flight to a sound, hard money alternative in times of economic contraction. Ultimately, we don’t know the path, but expect that bitcoin’s high beta to equities is only a first step in a long evolutionary process.

Until then, bitcoin’s risk-on correlations remain the dominant market force in the short-term and are key to understanding its potential trajectory over the next few months.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Amazing! Love this take and appreciate your objective honesty.

A great post, thanks!