BM Pro Daily - Evaluating Bitcoin’s Risk-On Tendencies

Bitcoin’s Correlation With Market Volatility

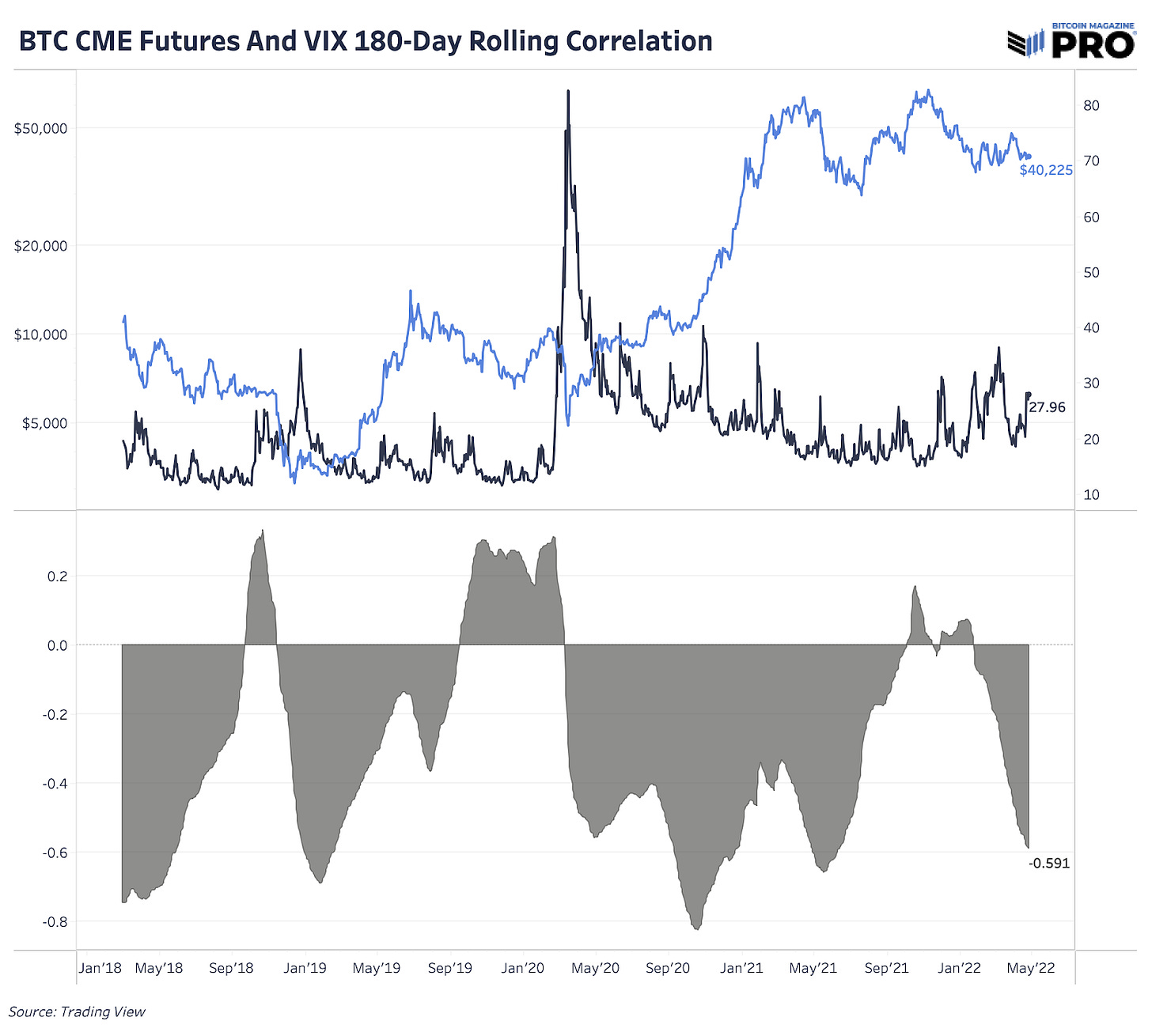

Bitcoin is much more than an “inverse VIX” but that doesn’t stop the market from trading it as such. (“VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options.”)

As Bitcoin’s education, adoption and monetization carries on, fundamentals and network growth will be the more important driver of price appreciation. But in the current environment, risk-off market signals and broader market volatility are in the driver seat. Our base case is that equities volatility has yet to peak this year and that further volatility spikes will negatively impact bitcoin’s price.

We can roughly quantify this bitcoin and volatility relationship by looking at the Chicago Mercantile Exchange bitcoin futures and VIX rolling correlations across 30-day, 90-day and 180-day timeframes over the last few years. On all timeframes, the correlations are nearing the strongest they have ever been since the March 2020 COVID-19 crash with the VIX spiking to 82.69. The last three sharp sell-offs in bitcoin, making higher lows this year, all coincided with VIX spikes over 30. Today, equities volatility is rising yet again with a VIX close of 27.96 yesterday and a value of 29.47 at the time of writing.

On the other hand, March 2020 gave us an interesting example of how bitcoin may perform post market crash, massive volatility spike and increased debt monetization across monetary and fiscal policies to help rescue the market and economic conditions. Bitcoin is now 716% up from its March 2020 bottom of $4,930. Bitcoin’s correlation to the VIX is bad now during a credit unwind, but it’s a positive attribute during reflationary periods and falling volatility.

From a broader macroeconomic perspective, this is why we remain bullish on bitcoin on a longer time horizon post another scenario crash in risk assets. If we’re to see this scenario play out and when the dust settles, bitcoin will be primed to outperform almost every other asset in our view based on its adoption curve, fundamentals and as a superior monetary network. Although we have many issues where we speak to this macroeconomic bitcoin thesis, our Macroeconomic Outlook section on page 21 of the January Monthly Report is a good reminder and overview, highlighting,

“The solution should be obvious: non-sovereign, credibly scarce asset with built-in native property rights to synergize global energy and financial markets. Bitcoin is a check on central bank irresponsibility during a time where they have painted themselves into a corner, with few options at their disposal.”

Have you looked at a long term comparison of the BTC price movements versus the dollar in particular the recent strenght of the dollar contributing to the recent price decline of BTC