Looming Credit Default Risk And The Fall of Zombie Companies

S&P 500 closes below 3600 today, negative for the quarter and month. Corporate credit risk rises alongside interest rates and the bill for zombie companies is due. Overheated valuations are unwinding.

Relevant Past Articles

U.S. Equities Outlook

Today’s issue will briefly cover the current outlook of global equities. We have covered the deteriorating macroeconomic backdrop extensively, but today in particular, we want to examine the structural forces driving the U.S. equity market.

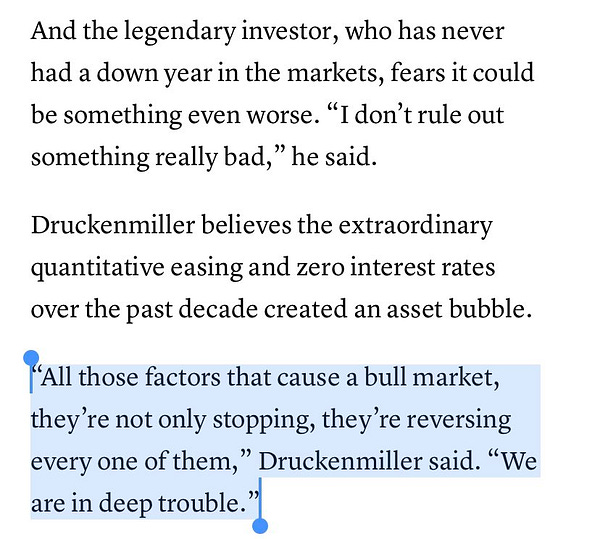

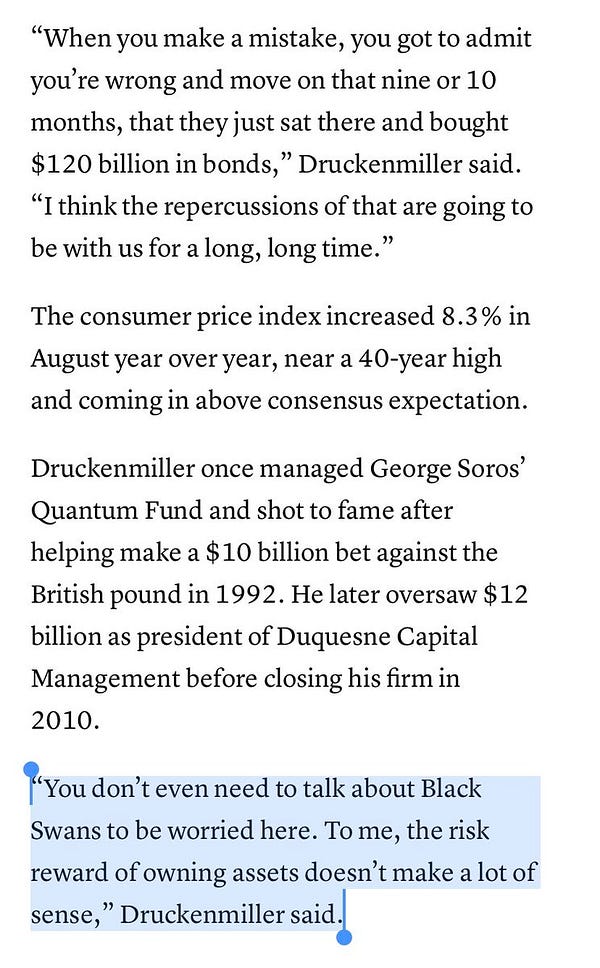

We are writing this piece as equities are closing down for the third quarter in a row for the first time since the GFC (global financial crisis). Today, the world is having a crisis of its own, in a similar yet very different manner. While the GFC was mainly a result of toxic loans and counterparty risk in the banking system, today we are facing the meltdown of the global everything bubble. Fueled by the lowest interest rates in recorded history, the valuations of every asset class on the planet exploded alongside debt levels.

As inflation has exploded across the globe from COVID-19 monetary and fiscal stimuli, combined with a global energy deficit, fixed income as an asset class has experienced a generational sell-off, while spiking yields in the process.

U.S. bonds with maturities greater than 10 years are experiencing their worst decline in percentage terms in the history of the data.

Source: Holger Zschaepitz

Aside from the sell-off in the bonds from an asset class, the sell-off subsequently means a rise in yields, which presents major problems for all participants of the economy, as credit expansion grinds to a halt and the game of musical chairs for dollars begins.

Particularly, in regards to equities, the spike in yields will come to present an increasing problem for over-indebted companies, of which have grown immensely since the GFC. Zombie companies are now a growing concern and are defined as companies with an interest coverage ratio <1 for three straight years (i.e., your profits don't even cover the debt plus interest you owe).

Source: Stansberry Research

As yields soar, this problem becomes even larger, and further puts strain on companies to roll over their debt.

As liquidity troubles turn into solvency risk, we can expect many of these “zombie firms,” and even some businesses that were thought to be strong, to go bankrupt, as balance sheets deteriorate from soaring expenses and higher interest rates.

The Darwinian process known as economic “creative destruction” is now being rapidly expedited by the Federal Reserve after its own policies attempted to stave off creative destruction for decades on end.

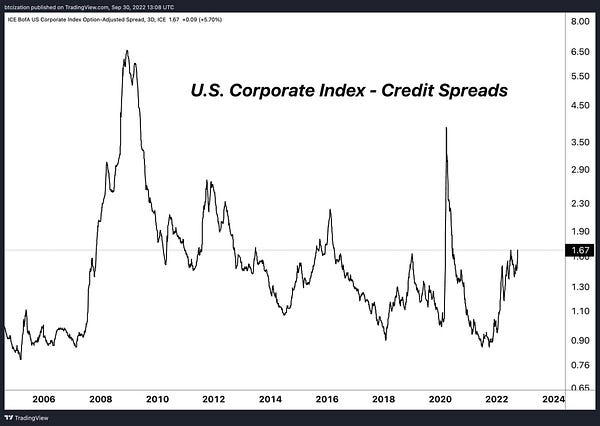

The monetary tightening will be felt, and many participants will go under as a result. Credit default swaps on investment grade and high-yield debt are exploding to new highs as we write.

The huge regime change in liquidity conditions has not yet been fully felt by the market, in our view. First liquidity risk, then solvency risk:

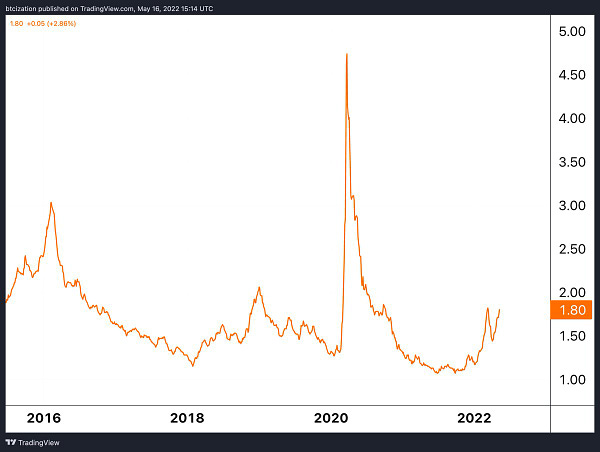

Shown below are the credit spreads for corporate issuers by credit rating:

When conducting analysis on the performance of equity markets since the GFC, a structural tailwind was the massive amount of buybacks corporates conducted, where with excess profits, corporations would buy and retire shares from the open market, reducing their float and increasing share price, with all else being equal. For many corporations, including some of the best and biggest names (like Apple, for example), debt-financed buybacks were all the rage.

As Treasury yields have increased, as well as corporate credit spreads, this structural tailwind no longer exists and rolling debt becomes increasingly difficult.

Similarly, a high volatility environment in equities and elevated levels of credit risk for the corporate names go hand in hand.

Let’s now turn an eye on some valuation metrics.

Overheated Valuations

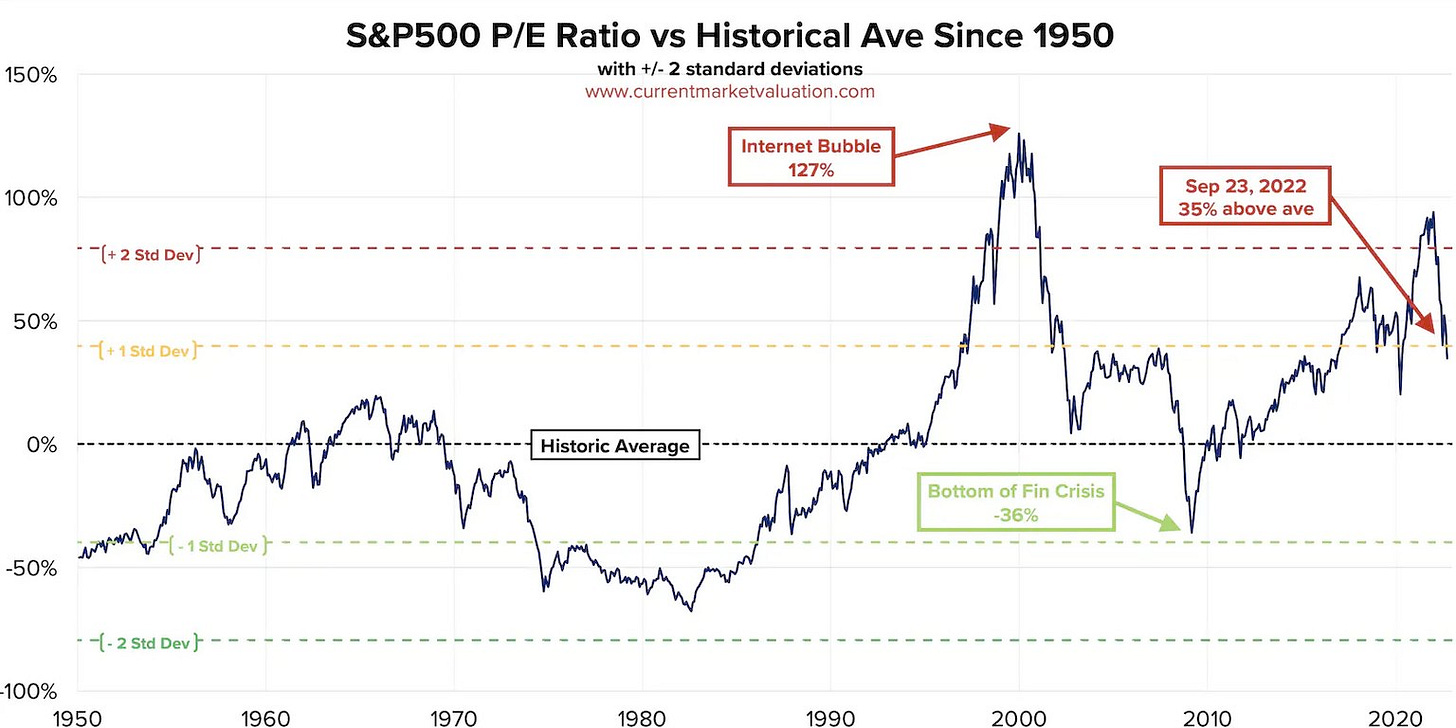

As we've highlighted before, one main concern we still have is the current market valuations relative to history looking at equity price-to-earnings (P/E) ratios. We highlighted the CAPE ratio in one of our previous pieces which acts as a decent measure to show how overheated valuations can become throughout history.

If the idea that we’re currently in the middle of an “everything bubble” going through its deflating period still holds true, then we still seem far away from its conclusion. Even if we expect a reinflation of that bubble from desperate central bank policy in the future, have valuations really come down enough to justify that action in an environment where demand destruction and the reverse wealth effect have been at the top of the agenda?

Another way to visualize that is the rate of change in the regular S&P 500 P/E ratio. Currently, we’re still around 1 standard deviation above the historical average. We could easily see the ratio fall below the historical average in this cycle and that doesn’t even include increased negative impacts to prices based on a potential earnings recession as we go into the end of the year.

Source: Current Market Valuation

Ultimately now we live in a hyperfinancialized world and the share of held equities relative to all financial assets is coming down from a record high. This is a similar trend and story that we’ve seen play out in previous cycles. When U.S. equities are too sought after relative to all other financial assets, we’ve always seen mean reversion take shape. This is a telling chart for how demand destruction takes shape. As the chart measures the overall equities share for households, a major drawdown in equities results in major drawdowns of net worth on paper resulting in many feeling poorer.

As mentioned briefly, one of the supporters of sky high valuations WAS the sheer amount of stock buybacks in a ZIRP (zero-interest rate policy) environment during a period of record corporate profits.

Buybacks have been rising to record levels since the QE monetary policies after 2009 creating a passive bid for equities that look to be winding down rather quickly. Now we’re at a clear point where those buybacks have looked to reach their peak with a major decline in Q2.

Source: Yardeni

Source: Yardeni

Final Note

Pain is coming. Even with an eventual slight pivot, the world has (at least momentarily) left the funny money bonanza of the last decade. With record debt levels across the economic picture, we look to firmly kick off the dominos of a debt deleveraging event.

While many expect a slight “pivot” in expectations or outlook from Fed members to steer the train back on the tracks, we believe it will take an absolutely massive fiscal and monetary response from policymakers to “fix” the result of this current crisis.

In the meantime, we are in the unwind phase. Steady lads…

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

This was probably the most powerful analysis you’ve printed and what better a time than the end of a 3rd quarter. Real juicy, meaty morsels you’ve fed to a group of patient ‘stackers’.

I wished I had more to add but you spelled it out clearly and succinctly. 👍🏻👏🏻👏🏻👏🏻

Thank you once again.

This was a treat of a birthday gift 🎁

Have a great weekend

great work as usual lads