PRO Market Keys Of The Week: Contracting Global Liquidity?

Surprising exchange flows from one bitcoin miner and a look at key support levels to watch for the bitcoin price. Federal Reserve quantitative tightening is impacting global net liquidity.

Relevant Past Articles:

PRO Market Keys Of The Week: Bitcoin Capital Inflows Are Back

A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

State Of The Mining Industry: Public Miners Outperform Bitcoin

Quantitative Easing Or Not? A Primer On The Fed’s Shiny New Tool

What We’re Watching

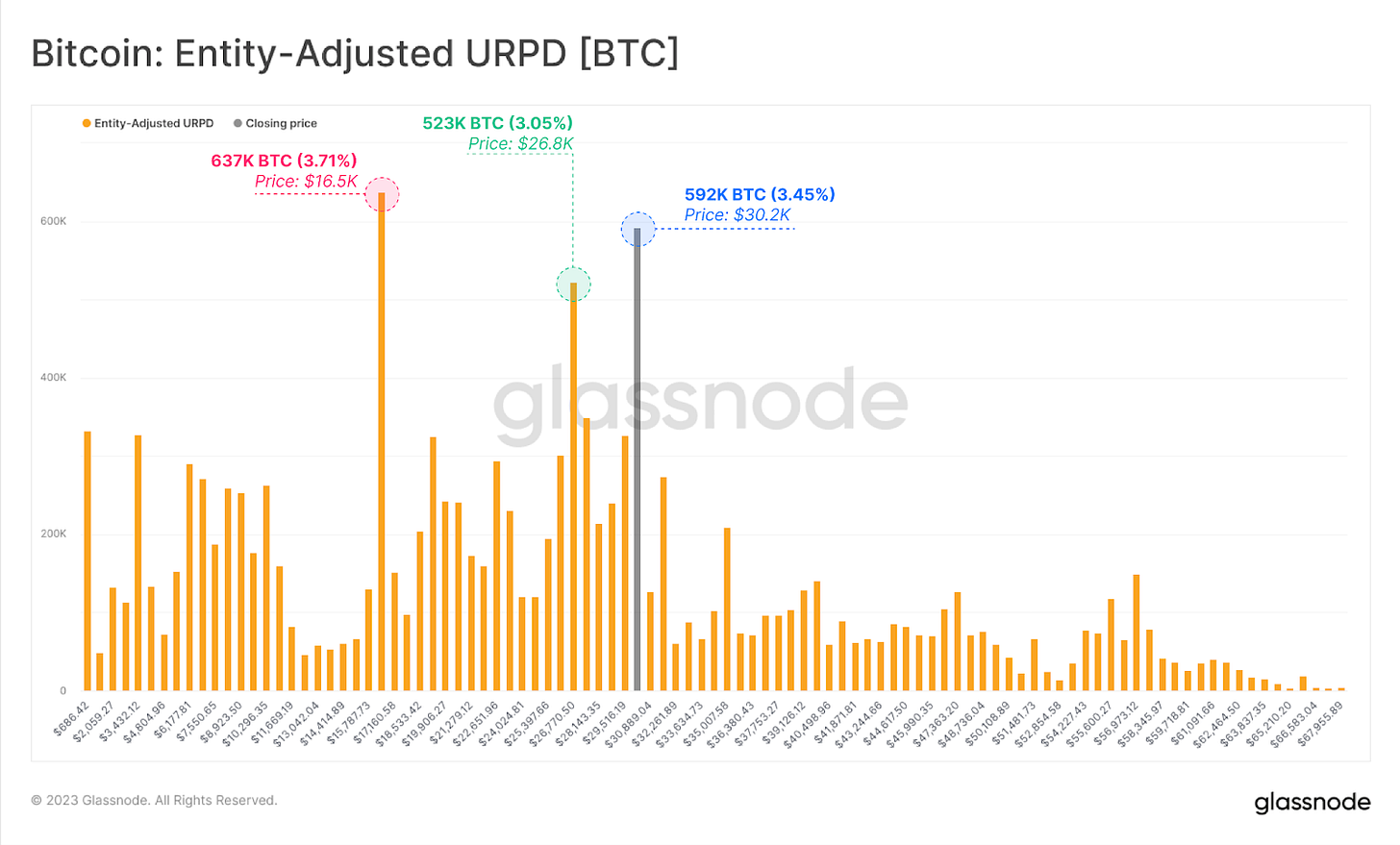

Price When Bitcoin Supply Last Moved

A useful on-chain metric to see key bitcoin price levels is Glassnode’s URPD (UTXO Realized Price Distribution). It shows the percent of circulating supply that last moved at a specific price. Based on their chart with the latest moves, it’s clear that the price levels of interest are at $30,200, $26,800 and $16,500. These line up well with key technical support and resistance areas. When zooming in on the current price area, 3.45% of all circulating supply has last moved hands around $30,200.

Miner Activity Outlier

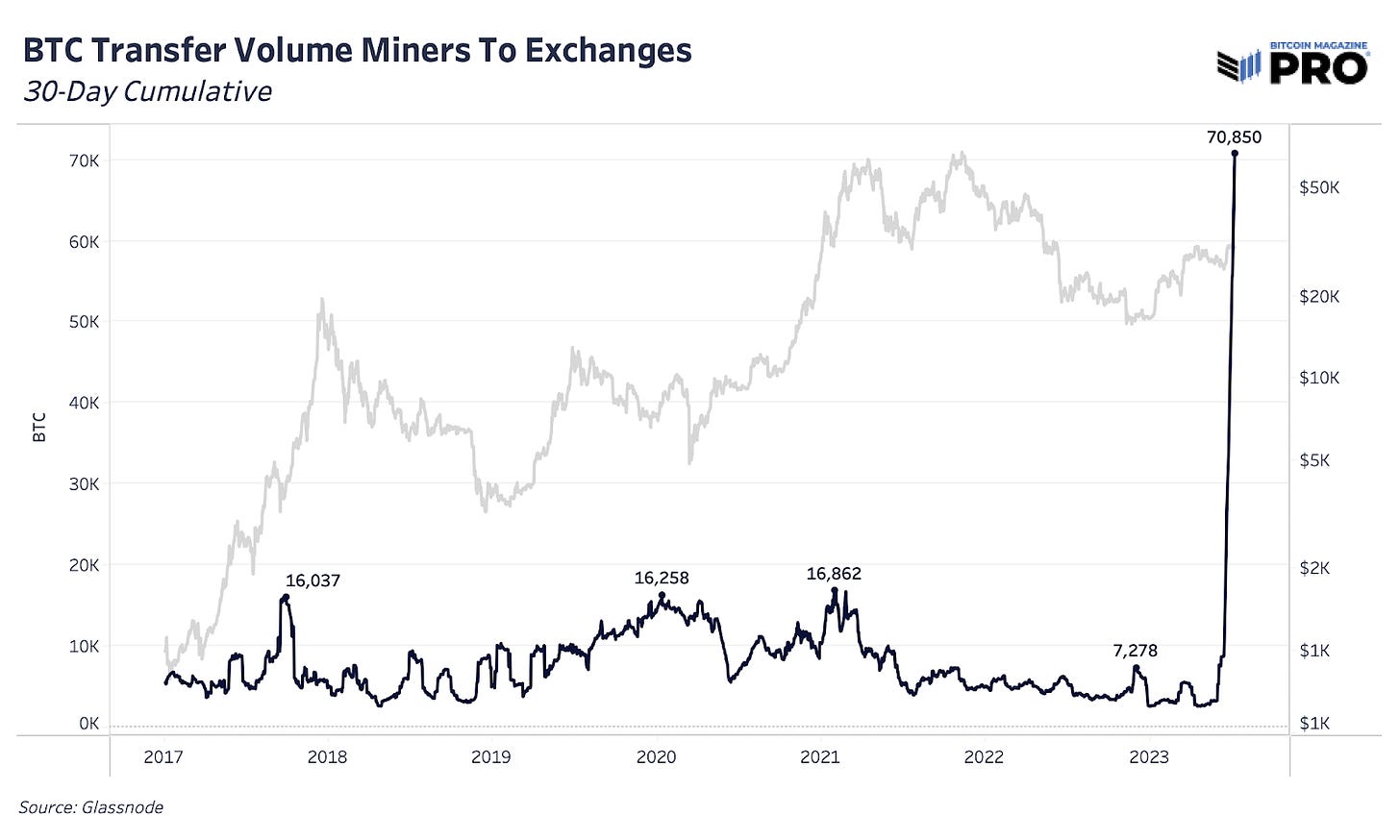

We’ve noticed heightened activity in the transfer volume data from miners to exchanges from on-chain data providers across Glassnode and CryptoQuant. The below chart looks at the 30-day cumulative transfer volume since 2016, and shows how much of an outlier June and July activity has been.

Digging into the detailed data, it seems that most of the activity is coming from one mining pool (Poolin) and is sent to only one exchange (Binance).

There are many reasons under the surface why this could occur outside of unique selling pressure. Miners could be hedging in the derivatives market, moving as part of an OTC order or moving via an exchange for other reasons. We don’t know for certain why this is the case, but it’s an interesting outlier to highlight nonetheless.

Note: CryptoQuant labels this similar activity as coming from Antpool instead of Poolin, as noted by Glassnode’s labeling.

Bitcoin Magazine PRO has teamed up with Samara Alpha Management to allocate $1 million in seed capital for a fund manager with a proven track record. We are currently accepting applications until July 31. Apply today!

Monitoring Quantitative Tightening: The Fed’s Attempt To Avoid 2019 Repeat

In a recent congressional testimony to the House Financial Services Committee, Federal Reserve Chairman Jerome Powell made comments about the feasibility of the Fed’s planned quantitative tightening program in context of the most recent historical failure to reduce the central bank's balance sheet, which prompted the 2019 repo crisis.

“We didn’t see this coming and forced the central bank to take actions it didn’t want,” Powell admitted on June 21 to the House Financial Services Committee, referring to the sudden problems that emerged in 2019. The advantage now is that “we have experience,” he said.

We discussed the Fed’s quantitative tightening program, in light of the March bank failures and the rollout of new Fed liquidity facilities, while comparing the balance sheet reduction to the 2019 repo spasm. Issued as a paid research report previously, we have now opened the piece up to all subscribers for interested readers.

Quantitative Easing Or Not? A Primer On The Fed’s Shiny New Tool

Relevant Past Articles: Another Fed Intervention: Lender Of Last Resort Banking Crisis Survival Guide PRO Market Keys Of The Week: Market Says Tightening Is Over Largest Bank Failure Since 2008 Sparks Market-Wide Fear A Tale of Tail Risks: The Fiat Prisoner’s Dilemma

The issue particularly focused on the Bank Term Funding Program (BTFP) that the Fed launched to respond to the banking crisis.

“The abbreviated version of the story: In September 2019, the U.S. repo market experienced a sudden and unexpected spike in overnight interest rates. The repo market is where banks, hedge funds, and other institutions go to lend and borrow short-term funds, with government securities serving as the typical form of collateral. The sudden overnight rate increase was due to a confluence of factors, including a large issuance of U.S. Treasury securities, corporations withdrawing cash from money market funds to make quarterly tax payments, and banks maintaining higher reserves due to regulatory requirements. The liquidity squeeze led to a sharp increase in repo rates, which in turn, put upward pressure on other short-term borrowing rates.” — Quantitative Easing Or Not? A Primer On The Fed’s Shiny New Tool

In the context of the then-recently created BTFP, we had this to say:

“The impacts of this facility — plus the recent spike of borrowing at the Fed’s discount window — has brought about a hotly debated topic in financial circles: Is the latest Fed intervention another form of Quantitative Easing?

“Academics and economists can debate the nuances and intricacies of Fed policy action until they are blue in the face, but the reaction function from the market is more than clear: Balance sheet number go up = Buy risk assets.” - Quantitative Easing Or Not? A Primer On The Fed’s Shiny New Tool

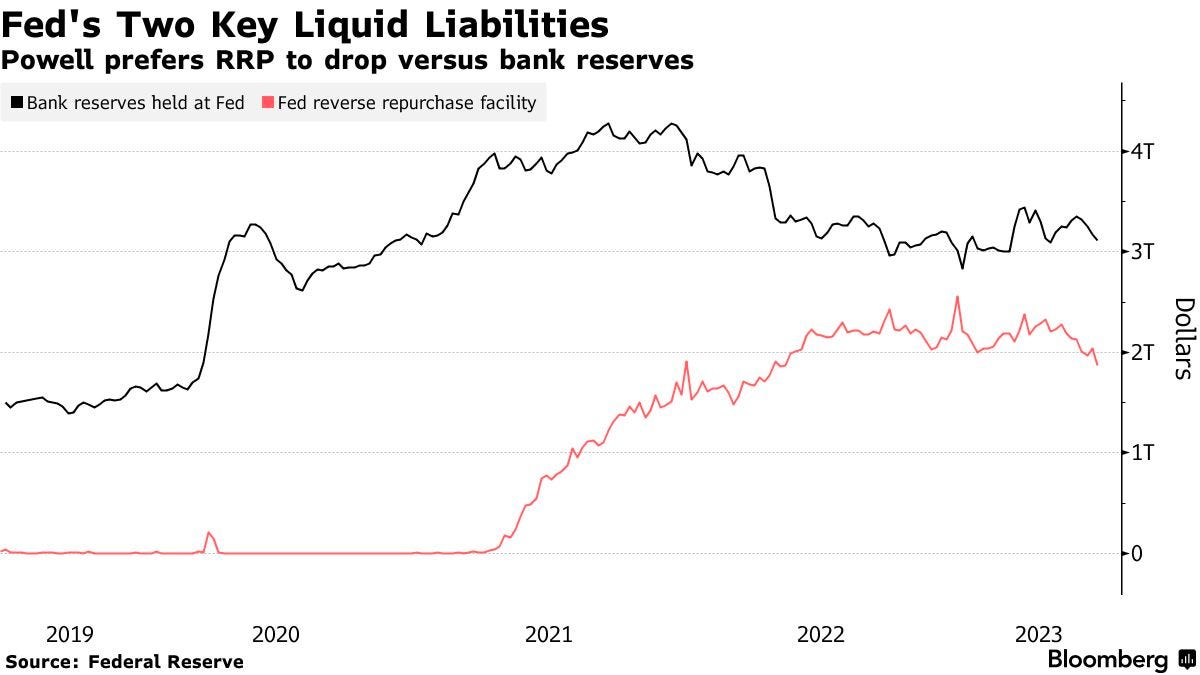

The uptake rate on the Fed’s new facilities have tapered off, and total loans outstanding for the BTFP facility are at just over $100 billion. Now market liquidity is beginning its decline, with balances parked in the Fed’s Reverse Repo facility (RRP) falling off their highs.

The Fed is currently reducing its bond holdings by roughly $1 trillion annually. With the market having to account for this diminishing liquidity, money is being withdrawn from the overnight reverse repo facility and entering the market, as evidenced by a three month decline of near $500 billion in funds from the RRP.

If we look globally, liquidity has contracted by $1.6 trillion USD over the last three months when aggregating the balance sheets of the Fed, European Central Bank, Bank of Japan and the Bank of China, while accounting for balances in the Treasury General Account and Reverse Repo Facility as counteracting forces for the liquidity tide. This recent decline in liquidity amidst near year-to-date highs in equity markets presents an interesting position for equity investors: Does the direction of liquidity not matter in this case, due to strengthening equity market fundamentals and a year to date resurgence in sentiment amongst tech investors? Or will the jaws close between the diverging lines of market liquidity and equity indices?

Time will tell, but our stance is that liquidity is the market, and when the tide is contracting, buyer beware.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!