Public Miners See Revenue Bounce, Increase Bitcoin Holdings

Public miners are holding more bitcoin on their balance sheets thanks to rising hash rate, hash price and mining revenue. More machines are coming online as revenue increases from transaction fees.

Relevant Past Articles:

Brc-20 Brings Tokenomics To Bitcoin, Spiking Transaction Fees

All Eyes On Ordinals: Addressing Bitcoin Decentralization & Block Space Concerns

State Of The Mining Industry: Public Miners Outperform Bitcoin

Public Miner Update

Lately, we’ve written about the rise in Bitcoin transaction fees due to ordinals and brc-20 tokens, but we haven’t focused as closely on one of the main beneficiaries: miners. In this post, we’ll highlight how the mining industry is doing after a substantial rise in their top-line revenue over the last couple months.

For starters, monthly production updates throughout March and April show that bitcoin holdings have stabilized and are slightly increasing again for the top public miners who report it. This is the first meaningful turn in a larger trend of public miners who were selling off bitcoin holdings over the last year. The price rally, rise in hash price and rise in transaction fees have put less sell pressure on miners, allowing them to hold more of the bitcoin they produce.

At the same time, there has also been a relentless rise in hash rate as new rig deployments come online. Although we have to account for some missing data points across miners, there’s been over 15 EH/s added to the network since December. The biggest additions come from Marathon Digital Holdings, Iris Energy, Riot Platforms, HIVE Blockchain and Terawulf. Marathon expects a total of 23 EH/s by the middle of this year, Riot expects 12.5 EH/s in 2023 and TeraWulf expects 5.5 EH/s in the coming weeks. Some of the largest public miner expansion plans that have been in the works for years, are now closer to being completed.

That growth has contributed to the total Bitcoin network hash rate consistently reaching around 350 EH/s in this latest rally.

Miner Revenue

After more than a year of declining monthly revenues, we’ve had five straight months of rising monthly revenue for miners in USD terms. It’s been much more lucrative for miners during this time with hash price nearly doubling in this period. This is a significant change in both current miner revenue and when comparing current miner revenue relative to the much lower revenue over the last 365 days. One of our favorite cyclical metrics for gauging the trend in the mining industry is the Puell Multiple, measuring current revenue relative to the 365-day moving average, which currently shows miners as in a fairly neutral part of the Bitcoin cycle. We’ve seen a period of stabilization and growth for the industry after a tough period of capitulation.

Transaction fees have played a role in that revenue rise throughout March and April, but will be much more noticeable in miners’ May revenue. Weekly transaction fees have exploded to cycle-peak levels in USD terms because of the brc-20 craze.

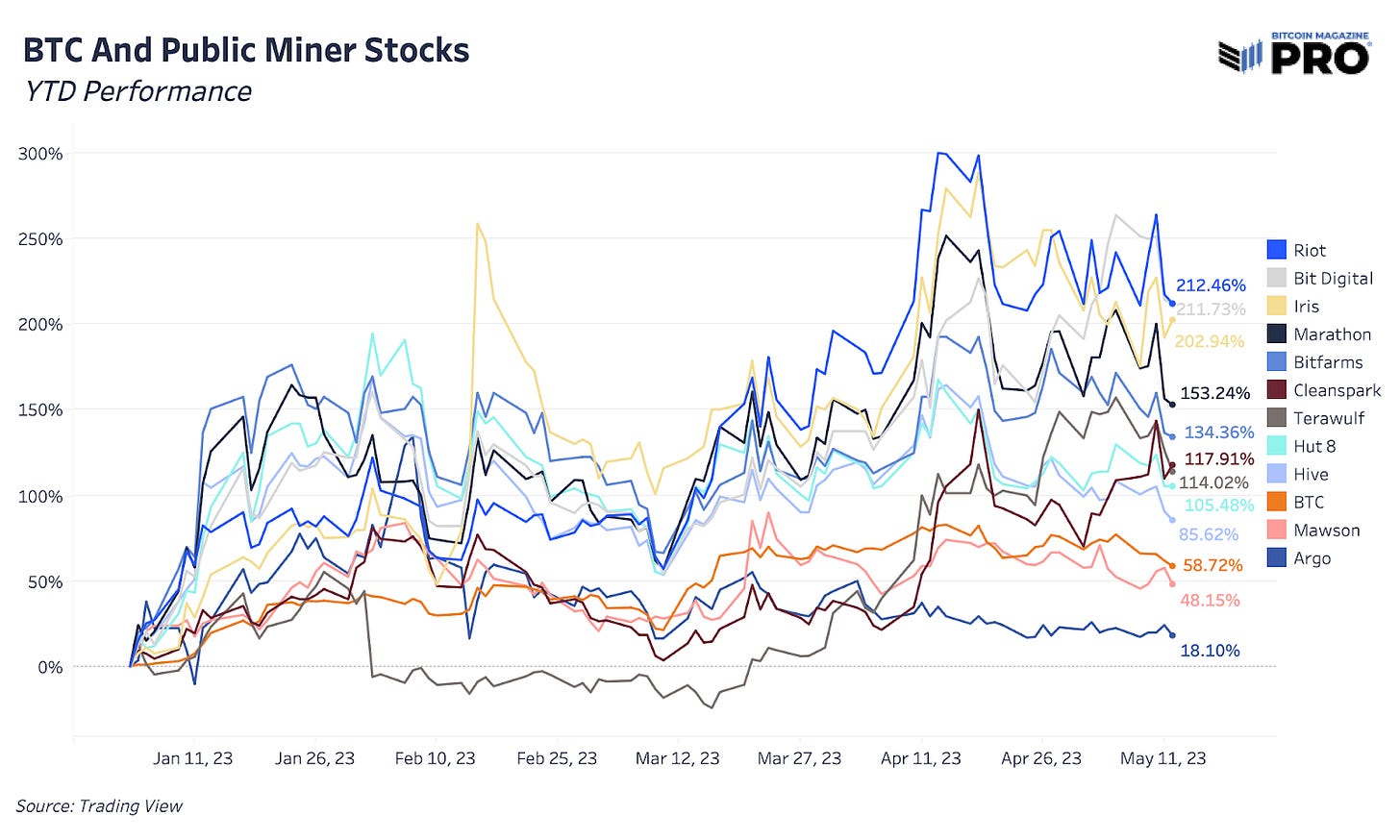

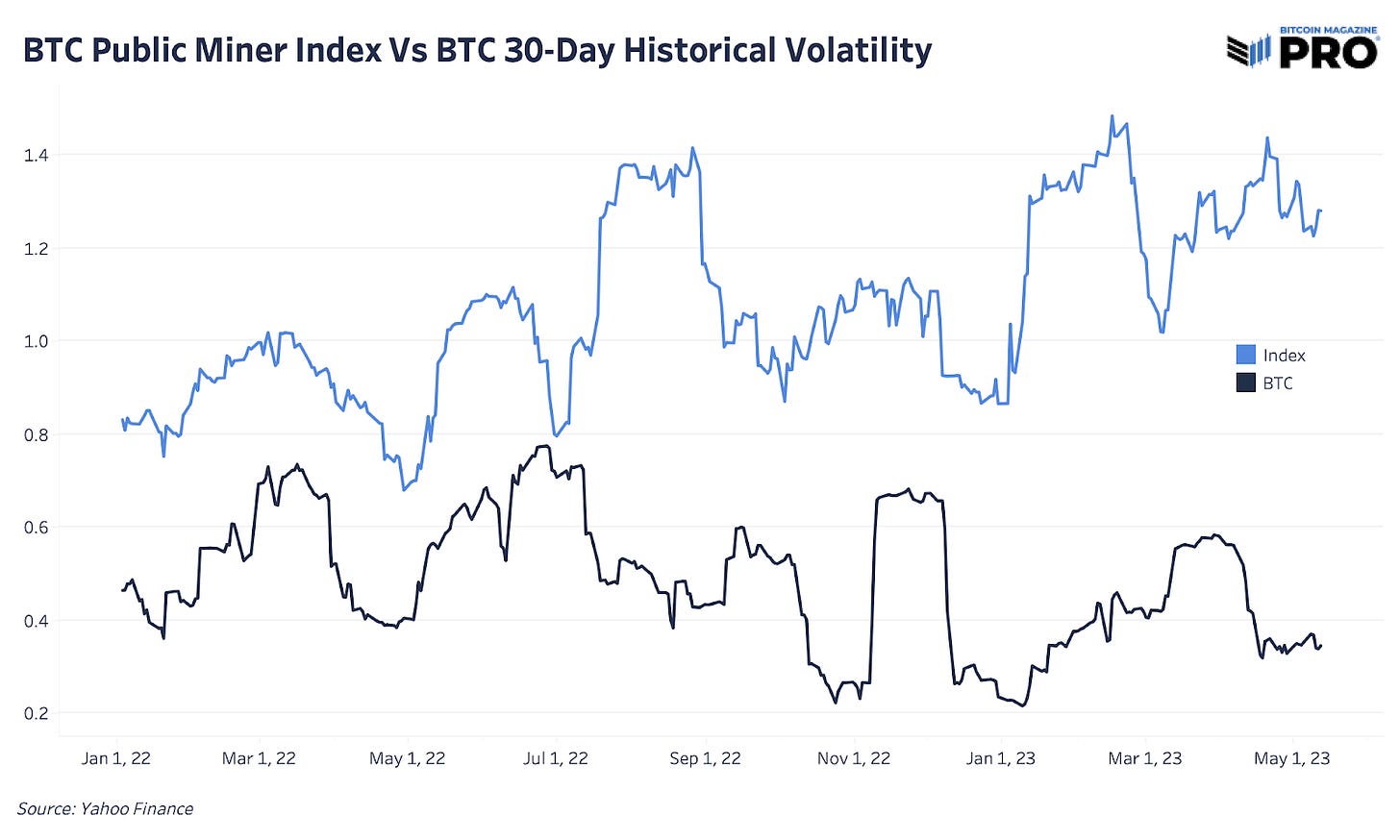

As for public miner equity performance, volatility has come back to the upside with Bitcoin miners being one of the best performing industries since the $15,000 bottom at the turn of the year. Below, we’re showing a dynamically weighted index (based on daily market capitalization) of select public miners in both USD and BTC terms. Although still well under their starting point at the beginning of 2022, this miner index shows public miners up 167% in USD terms and up 63% in BTC terms over the last five months.

There’s only been a couple public miners to underperform bitcoin over this time, but the clear winners have been Riot, Bit Digital, Iris and Marathon all up over 150%. We’ve highlighted our framework that a hash price bull market or bullish period means Bitcoin miners typically outperform bitcoin. That’s certainly what we’ve seen this year so far.

Meet The PRO Team At Bitcoin 2023!

Bitcoin 2023 is just one week away and we couldn’t be more excited for the upcoming event. Bitcoin Magazine PRO will be at the conference and attendees will have the chance to hear the team speak at multiple panels. There will also be two opportunities to meet the team and pick up some swag!

Bitcoin 2023 ticket prices increase TONIGHT at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

Our hash price framework, which we state in many of our mining issues, is as follows:

Hash price bull market = Bitcoin miners outperform bitcoin

Hash price bear market = Bitcoin miners underperform bitcoin

Note: Hash price divides daily miner revenue per 1 TH/s by hash rate, as first coined by the team at Luxor.

With hash price flying more than 100% off its lows due to rebound in the BTC/USD exchange rate and along with the mempool mania of recent weeks, miner outperformance has been the theme of 2023. Particularly, the firms that led the pack in terms of equity returns are the ones that delivered on their hash rate buildout roadmaps and have proportionally outpaced the growth in network hash rate.

Public Miner Spotlight

Now that we've explored the general mining landscape, let's delve deeper into some of the largest publicly traded mining companies and examine the latest updates on their forward strategies, hash rate buildout and production numbers. We will cover the latest details for miners that reported quarterly results recently.

Marathon Digital Holdings (MARA) - Marathon Q1 2023 Report

Marathon reported a net loss of $7.2 million in Q1 2023, a year-over-year improvement from the $12.9 million net loss in Q1 2022. Revenues of $51.1 million were slightly lower than the Q1 2022 figure of $51.7 million, but the figure is impressive considering that bitcoin production increased 74% year-over-year, offsetting a falling BTC/USD exchange rate.

Key takeaways from the report:

Q1 2023 revenue: $51.1 million.

YoY Bitcoin production increase: 74%.

BTC produced in Q1 2023: 2,195.

Average BTC produced per day: 24.4.

Operational/Energized Hash Rate (Q1 2023): 11.5 EH/s.

Installed Hash Rate (Q1 2023): 15.4 EH/s.

Adjusted EBITDA: $18.6 million.

Unrestricted cash and cash equivalents: $124.9 million.

Unrestricted Bitcoin holdings: 11,466 BTC.

Note: Marathon defines Energized Hash Rate as the total hash rate that could theoretically be generated if all mining rigs that have been operational are currently in operation and running at 100% of the manufacturers’ specifications (includes mining servers that are offline for maintenance or similar reasons.

“With more hashrate coming online in the months ahead, Marathon remains on track to reach our 23 exahash goal near the middle of this year. We remain optimistic that we can achieve our primary growth targets and establish Marathon as one of the largest, most energy efficient, and most technologically advanced Bitcoin mining operations globally.” — Fred Thiel, CEO

Riot Platforms, Inc. - Riot Q1 2023 Report

Key takeaways from the report:

Q1 2023 Bitcoin production: 2,115, a 51% increase compared to Q1 2022.

Average cost to mine Bitcoin in Q1 2023: $10,354 per Bitcoin, down from $13,590 in Q1 2022.

Q1 2023 mining revenue: $48.0 million, down from $57.9 million in Q1 2022.

Q1 2023 data center hosting revenue: $9.0 million, down from $9.7 million in Q1 2022.

Q1 2023 engineering revenue: $16.1 million, up from $12.1 million in Q1 2022.

Working capital as of March 31, 2023: $253.6 million, including $158.3 million in cash.

Deployed fleet of 94,176 miners and hash rate capacity of 10.5 EH/s as of April 30, 2023.

Ongoing 400 MW expansion at Rockdale Facility, expected to complete in Q2 2023.

Anticipated 12.5 EH/s hash rate capacity target in the second half of 2023.

“Riot’s vertically integrated strategy has once again positioned us during this quarter as an industry leader in low-cost, large-scale Bitcoin mining, and I continue to be excited to work with our team to achieve Riot’s vision of becoming the leading Bitcoin-driven infrastructure platform.”

CleanSpark - CleanSpark Q1 2023 Report

CleanSpark reported Q2 revenue of $42.5 million and GAAP net loss of $18.5 million, while adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to $12.7 million. The company mined 1,871 bitcoin during the period, representing a 109% increase YoY.

Key takeaways from the report:

Q2 revenue increased by 14% YoY to $42.5 million.

GAAP net loss of $(18.5) million in Q2, compared to a GAAP net loss of $(0.2) million in the same period last year.

Adjusted EBITDA decreased to $12.7 million, down from $19.6 million YoY.

Total assets amounted to $531.6 million as of March 31, 2023.

Cash and bitcoin liquidity stood at approximately $15.6 million.

Debt totaled $17.6 million, with a reduction of 11% in the second quarter.

“Our planned expansions are proceeding according to timelines, with Washington expected to be fully operational next month and with the Sandersville land already graded and ready to start construction... The addition of these machines into our fleet, most of which are Bitmain's XPs, are expected to make us one of the most efficient miners on the network, positioning us to take optimal advantage of halving next year.” — Zach Bradford, CEO

Cipher Mining - Cipher Q1 2023 Results

Cipher Mining reported the completion of its first growth phase at the Odessa facility, achieving a self-mining capacity of over 6.0 EH/s. The company also purchased 11,000 miners from Canaan, which are expected to be delivered and energized in Q3, raising the total self-mining capacity to over 7.2 EH/s.

Key takeaways from the report:

Four data centers are operational, with a combined hashing capacity of over 6.0 EH/s.

Additional 11,000 Canaan A1346 mining rigs purchased, to be delivered and energized in Q3.

Once new rigs are operational, the total self-mining capacity will reach 7.2 EH/s.

Weighted average power price of approximately 2.7 c/kWh with 96% fixed price power.

GAAP diluted net loss of $0.03 per share in Q1 2023.

Non-GAAP diluted net income of $0.03 per share in Q1 2023.

“We have completed the first phase of growth at our Odessa facility and have achieved a self-mining capacity of over 6.0 EH/s across our portfolio... We have also purchased an additional 11,000 miners from Canaan, which we expect to be delivered and energized in the third quarter. This will complete the buildout at our Odessa facility and bring our total self-mining capacity to over 7.2 EH/s across our portfolio." — Tyler Page, CEO

Hut 8 - Hut 8 Q1 2023 Results

Key takeaways from the report:

Q1 2023 revenue of $19.0 million, down from $53.3 million in Q1 2022.

Mined 475 Bitcoin in Q1 2023, a 50% decrease compared to Q1 2022.

High performance computing (HPC) operations generated $4.5 million in Q1 2023, up from $3.3 million in Q1 2022.

Installed hashrate of 2.6 EH/s as of March 31, 2023.

9,133 self-mined Bitcoin held in custody, valued at $352.0 million.

Q1 2023 net income of $108.5 million and net income per share of $0.49.

Mining profit of $2.6 million in Q1 2023, compared to $32.9 million in Q1 2022.

Adjusted EBITDA of negative $3.7 million in Q1 2023, compared to $27.1 million in Q1 2022.

“We will continue to focus on strategically increasing our stack of Bitcoin and growing our HPC business including exploring opportunities in the growing Artificial Intelligence market… We expect that our proposed business combination with USBTC will increase our installed self-mining hashrate to 7.02 EH/s, enhance our geographic reach into new energy markets, and further diversify our lines of business with capex-light, scalable, fiat-based revenue streams.” — Jaime Leverton, CEO

Final Note

Public mining companies remain the lowest barrier to entry for individuals and institutions to gain access to bitcoin mining. The development of ordinals has reinforced the bullish case for miners, and looks to have resulted in an inverse halving to miner revenue in bitcoin terms, at least temporarily with block rewards from fees sometimes outpacing the block subsidy. While the ordinals craze and the subsequent fee rate per block seems to have abated from peak frenzy levels, the newfound demand for block space is wildly bullish for miner revenues and valuation, and looks likely to expedite the network’s transition to a majority fee-based security model.

A sustained spike in fee-driven revenue and a related increase in hash price would result in a repricing of mining equities higher. Lastly, investors in the mining industry should prepare for eye-watering levels of volatility, even more so than bitcoin investors are accustomed to. In a bull market, market leaders will wildly outperform bitcoin, with a broad index also likely outperforming as well.

While we remain cautious on our short- and intermediate-term outlook on bitcoin due to macro worries and a recession likely looming on the horizon, we believe that on a longer time frame, publicly traded miners look primed to serve as beta to bitcoin during the next bull market. For the investors willing to stomach excess volatility, we view a basket of operationally excellent public miners to be a great option.

The biggest winner of the recent ordinals trend is the miners, and public markets are the most accessible way for investors to capitalize.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!