All Eyes On Ordinals: Addressing Bitcoin Decentralization & Block Space Concerns

Bitcoin inscriptions have been out for a few more weeks, so we follow up on the fee market and block usage to observe what’s changed after 100,000 inscriptions and our last update.

Relevant Past Articles:

State Of The Mining Industry: Public Miners Outperform Bitcoin

Earlier Than You Think: An Objective Look At Bitcoin Adoption

Upgrade to paid to get tomorrow’s PRO Market Dashboard and a summary of current market sentiment directly in your inbox.

Addressing Bitcoin Decentralization & Block Space Concerns

Two weeks ago, we addressed the new trend of using Bitcoin’s blockchain for storing arbitrary data in “Fee Market Competition: Bitcoin Ordinals And Inscriptions.” New users flocked to Bitcoin to create what are known as inscriptions — often called NFTs (non-fungible tokens) on other blockchains. These mostly image files were increasing demand for Bitcoin block space, which caused some network participants to worry about Bitcoin’s future decentralization. If the cost to run a full node increases substantially due to users needing the storage space and bandwidth to download all this data that is unrelated to monetary transactions, fewer people might run full archival nodes, centralizing Bitcoin’s ledger.

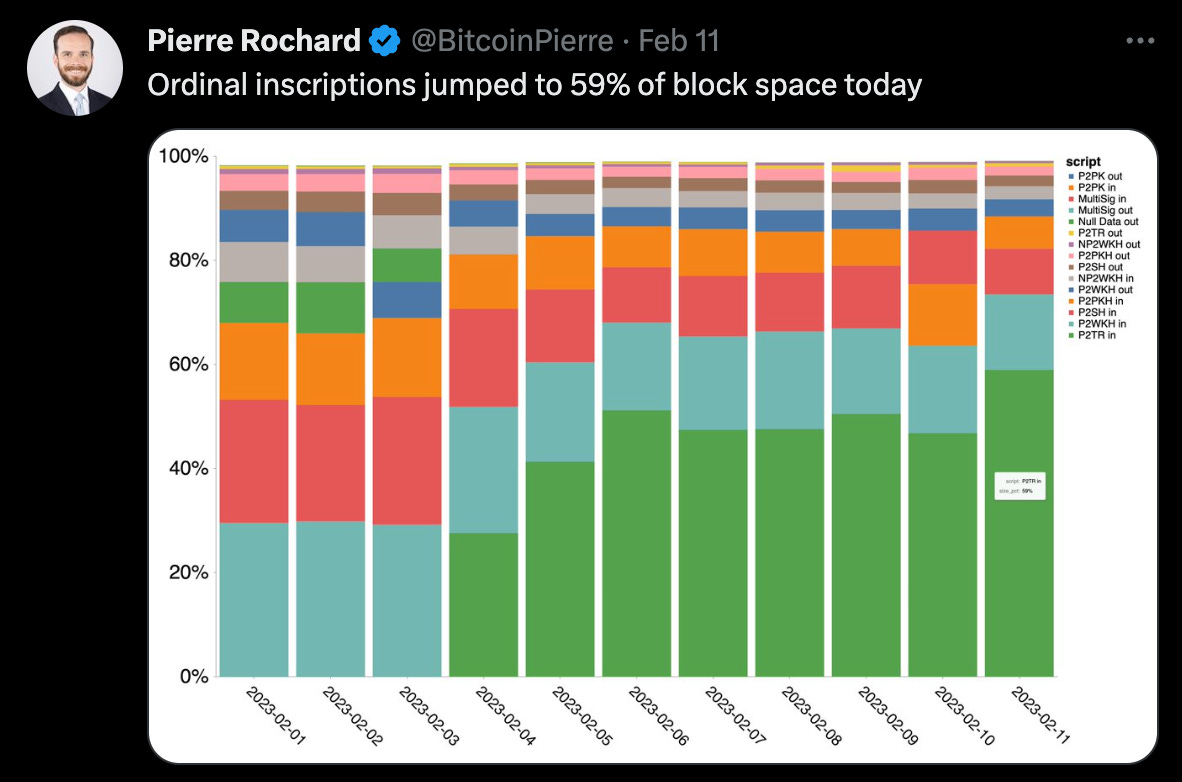

When we last examined the usage of Bitcoin’s block space, inscriptions were taking up 50% of the available 4 MB per block, which increased to 59% five days later.

Source: Pierre Rochard

The amount of cumulative storage used by inscriptions continues to climb with almost 3 GB of storage specifically related to inscriptions at the time of writing.

Source: Data Always

Should the block space consistently be used to its full extent of 4 MB, it will add approximately 210.24 GB of data to the chain each year, which isn’t a major cost hindrance for running a full node but can still be considered pricey in places where technology isn’t as cheaply available. There is the ability to run a pruned node which does not require storage of any of this witness data and only keeps track of Bitcoin’s monetary transaction data. However, in order to create a pruned node, users still must download all of the data initially. This is where the concerns for insufficient bandwidth come into play. In areas of the world where there isn’t access to high-speed internet, the initial block download might take so long that it won’t be possible to sync to the chaintip.

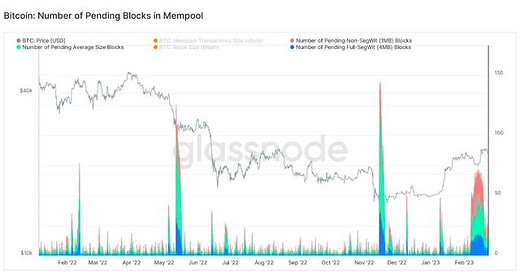

We can see in the chart below that the average block size has significantly increased after inscriptions made their way to Bitcoin on January 21.

That being said, the expectation for Bitcoin’s block space was always that it would be full at some point, which is partially why there is a cap on the block size. This cap was raised during the SegWit soft fork and included the fee discount for witness data — like inscriptions — that is unrelated to Bitcoin’s financial ledger and its unspent transaction output (UTXO) set.

Upcoming Twitter Spaces: Bitcoin Magazine PRO will host Jaran Mellerud of Luxor Mining and Hashrate Index on Thursday, February 23 at 4:00pm ET for a discussion about bitcoin mining data. Be sure to tune in!

Using data from Bitnodes, there hasn’t been a reduction in the number of full nodes since the launch of inscriptions in late January. In fact, there has been an 8.3% increase of 1,179 reachable full nodes since that time. This is likely due to the necessity of users running a full node if they want to create their own inscriptions without using a third party.

Source: Bitnodes

It remains to be seen if the unexpected growth in block size will have an effect on full node count in the long run. We will also leave the debate about the legitimacy of inscriptions on Bitcoin for other arenas. Since this publication focuses on on-chain data and bitcoin analysis, we are more interested in studying the effects that inscriptions have on the Bitcoin network fee market as opposed to the social and cultural implications of non-monetary transactions on the base layer.

“Bitcoin’s fee market is a constantly changing landscape. Fees rise when demand to transact on-chain is high and users want to get their transaction included in the next block. Inversely, the fee rate drops when demand is low and users don’t need their transactions confirmed in a timely manner.” — Fee Market Competition: Bitcoin Ordinals And Inscriptions

In the previous article, we observed transaction fees at the time and determined there wasn’t a significant increase in the fee rate. Even though the backlog of transactions in the mempool was nearly 50 blocks deep, people were either not interested in paying higher fees to get their inscription transactions confirmed quickly or it’s possible they didn’t quite understand Bitcoin’s transaction fee structure.

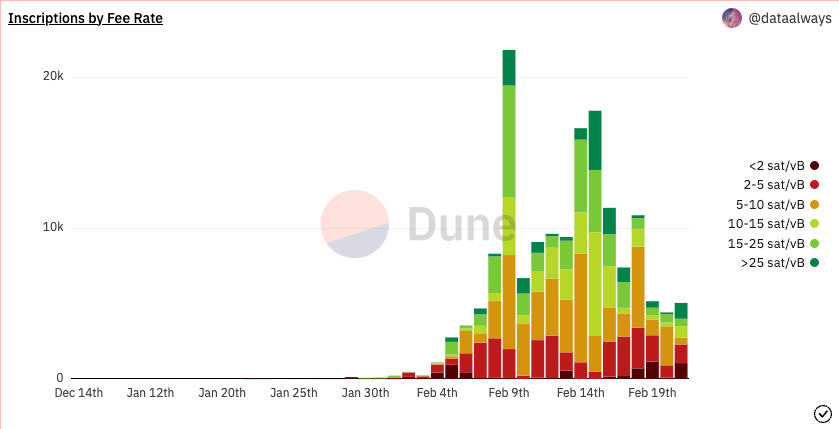

Looking at the fee rates broken down by sat/vByte ranges, we saw an increase in fee rate from two weeks ago to today. Whereas most transaction fees were set below 5 sats/vByte before February 5, there has been a noticeable bump in fees above that rate since then.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

What’s changed since the 100,000th inscription. 🚧

The state of Bitcoin’s memory pool of pending transactions. ⏹️

A new thesis for when inscribers might use Bitcoin. 🕰️

Bitcoin has been compared to a decentralized clock because of the way it keeps track of the order of transactions as they happen around the world. The nature of inscriptions on Bitcoin uses this ordering to number the inscriptions as they are written onto the blockchain, aka timechain. As the inscription count approached 100,000, people rushed to get their inscriptions confirmed before or exactly at that number. We saw the largest increase in fees around this time, which is shown above in dark green. By quickly glancing at the fee rate chart, it’s clear when the 100,000th inscription was made because of the most amount of fees greater than 25 sat/vByte.

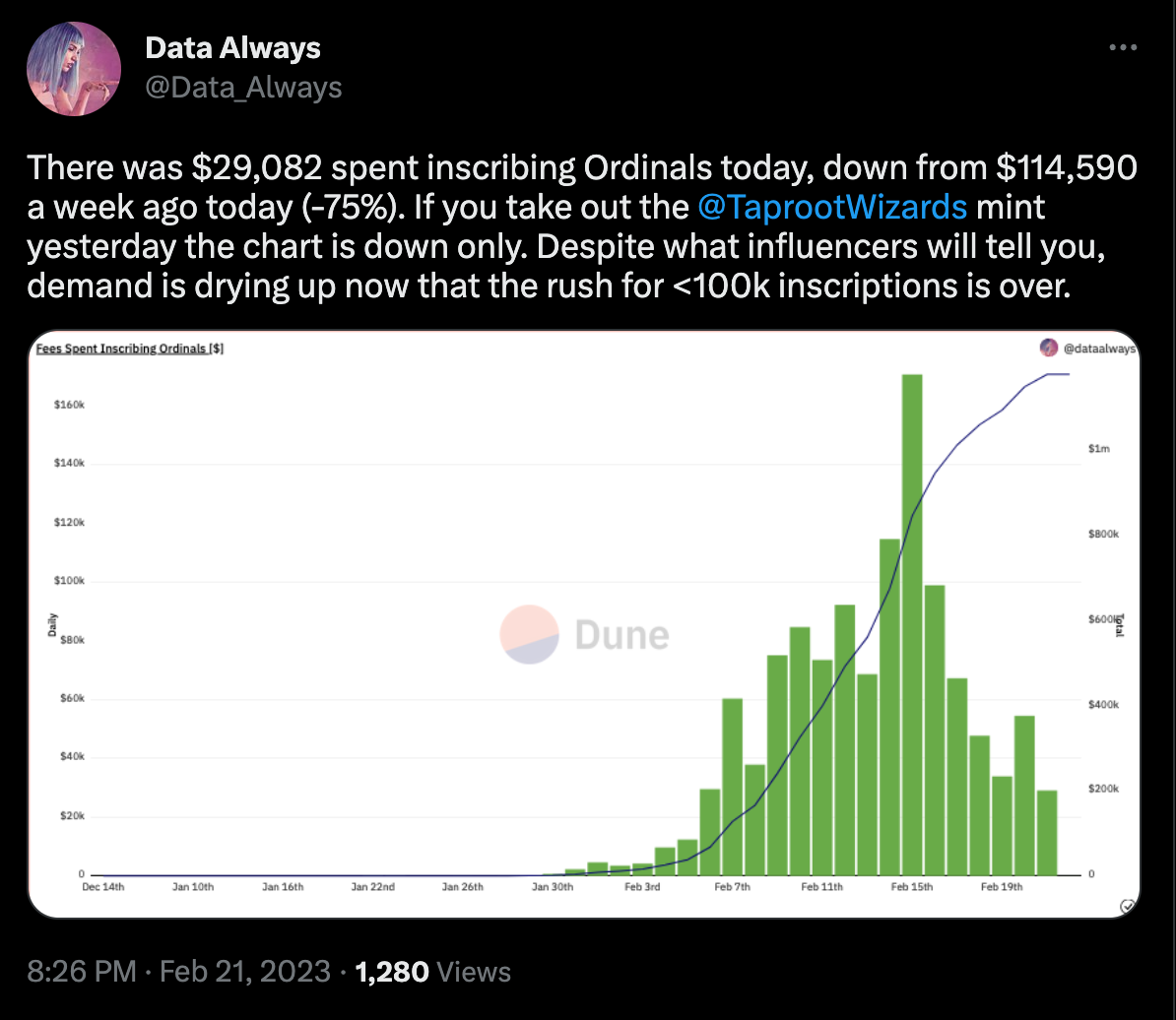

After this monumental inscription number on February 25, the rush to create NFTs on Bitcoin has drastically decreased. While there is still a backlog of transactions in the mempool, the fees required to get a transaction confirmed in the next block have dropped considerably and the daily total fees spent on creating inscriptions is “down only”.

Source: Data Always

Even though the fees are down along with the total amount of money being spent on inscriptions per day, the number of pending transactions in the mempool remain high and constant, with no signs of letting up in the short term.

In this past mining epoch, blocks are being mined so quickly that there is an expected difficulty adjustment of nearly +11%.

“The expected ratchet upward in mining difficulty will take away some of the relief that operations were feeling in recent weeks, due to the increase in USD-denominated revenue. Miner revenue denominated in bitcoin terms will once again head to new lows.” — State Of The Mining Industry: Public Miners Outperform Bitcoin

This rapid rate of mining blocks has allowed for some of the inscription transactions with lower fee rates to be mined because blocks were getting mined faster than new transactions were being broadcast to the network. We are interested to observe the mempool backlog after this next difficulty adjustment in two or three days.

Now that the initial rush to be an early inscriber is likely over, one theory for inscriptions is that they will become a buyer of last resort for block space in times when fees are low and fewer people are transacting on chain. We haven’t been in a block-space bull market since inscriptions have been possible, so we are unable to know what will happen with inscriptions when fees are higher than normal.

During bull markets and major negative news events, transaction fees can rise dramatically. We will continue to watch if inscriptions are prioritized during those times or if they will be outcompeted by purely financial transactions.

“Beyond extreme cases, transaction fees have been low for long stretches of time and have led to questions about Bitcoin’s long-term security budget as the block subsidy dwindles and fees must become a larger percentage of bitcoin miners’ revenue. Again, the hypothesis from Bitcoin proponents is that demand for block space will increase over time as bitcoin gains adoption and scales, causing more usage to migrate to other layers built on top of the protocol.” — Fee Market Competition: Bitcoin Ordinals And Inscriptions.

We will see if this thesis for inscriptions being the block-space buyers of last resort plays out. It’s possible that times of lower fees will be used by people opening up Lightning channels as well, which is one of the arguments against inscriptions as they potentially crowd out Bitcoin’s financial use cases.

Final Note

At this stage, we are still in the observation phase of this new market dynamic. There are unanswered questions about the bandwidth requirements for downloading an archival full node as well as the cultural questions of whether these non-monetary transactions should be happening on Bitcoin’s base layer or if it’s even possible to move them to a Layer 2.

There are many lines of defense for Bitcoin. Should this be seen as a major problem for fungibility or decentralization, node operators can run filters to prevent the relay of transactions with inscriptions. In the worst-case scenario, there may be a proposal to change Bitcoin’s consensus rules with a soft fork to prevent inscriptions from continuing to be added to the chain. Though some have called for the ossification of the protocol, Bitcoin’s software is still changing and evolving. We remain on the sidelines for many of the cultural discussions, but stand firm in our belief that Bitcoin is resilient and, at the end of the day, everything is good for Bitcoin.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!