Higher CPI Inflation Forces Markets To Reprice

August CPI inflation data worse than consensus expectations; markets reprice in response. Bitcoin falls more than 10% and the S&P 500 Index closes down 4.3%. Fed Funds Rate expectations climb to 4.46%

Relevant Pieces:

Inflation Is Not Over

Despite the overall consensus and sentiment for good inflation news this past month, the higher-than-expected U.S. August Consumer Price Index (CPI) print has derailed any short-term bullish momentum for risk assets that’s been building over the last week. As a result, equities, bitcoin and credit yields exploded with some volatility today. The S&P 500 Index closed down 4.3% with bitcoin following on a 10% plus down move. The last time this occurred for equities was June 2020.

It’s a similar event to what we saw last month for July data, but in reverse and with more magnitude. Markets cheered on a loosely confirming trend of peak inflation last month, only to have today’s data say otherwise. Now we look to the broader market for risk and rates over the next few days to confirm this new rally downtrend or some relief with the Merge expected to take place late tomorrow night.

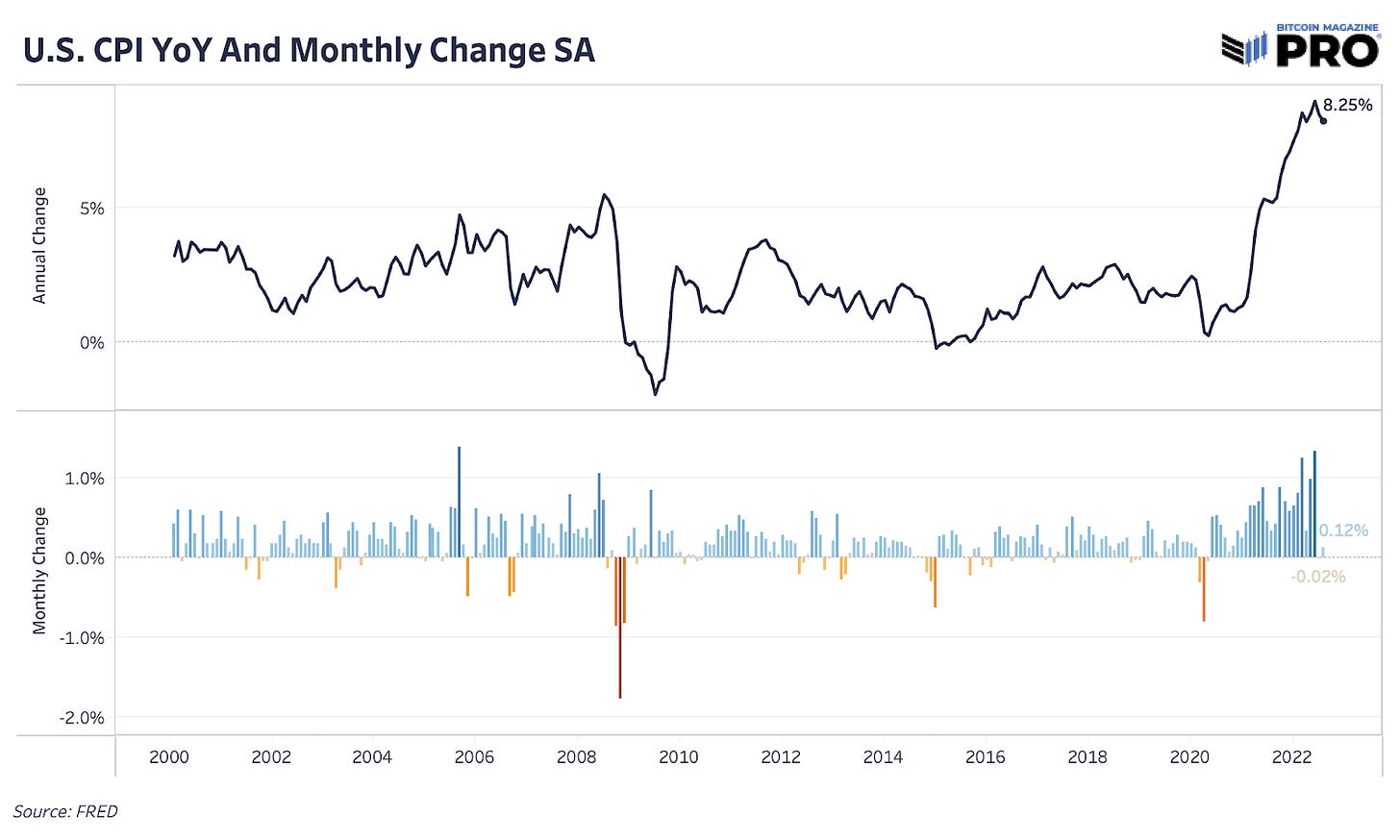

Both headline CPI and Core CPI beat expectations that had consensus positioning for month-over-month deceleration. Instead, we got both headline CPI and Core CPI rising month-over-month to 0.12% and 0.57% respectively. In simpler terms, inflation has not been vanquished yet and there’s more work to do (or attempt to do) on the monetary policy front. The Cleveland Fed Inflation Nowcast pretty much nailed their August forecast.

Although we did see some inflation across energy commodities come down, it wasn’t enough to offset the growing inflation in the services sector. Higher and elevated wage inflation remains a key, sticky part of inflation that is yet to come down. Housing inflation is also still an issue and has yet to come down. Housing inflation and prices have typically been the last to fall into a pending deflationary and/or recessionary period. Rent inflation (aka owners' equivalent rent (OER)) is a significant component that can keep up CPI prints for longer as it’s usually a six-to-nine-month lag.

Overall, the inflation picture looks to be sticky and broadening. Based on the Federal Reserve’s statements over the last few months, it’s a clear sign to keep aggressive monetary policy via rate hikes going. More on that below.

Source: Michael McDonough, Bloomberg

Source: Federal Reserve Bank of Atlanta Wage Growth Tracker

Source: Len Kiefer, Freddie Mac

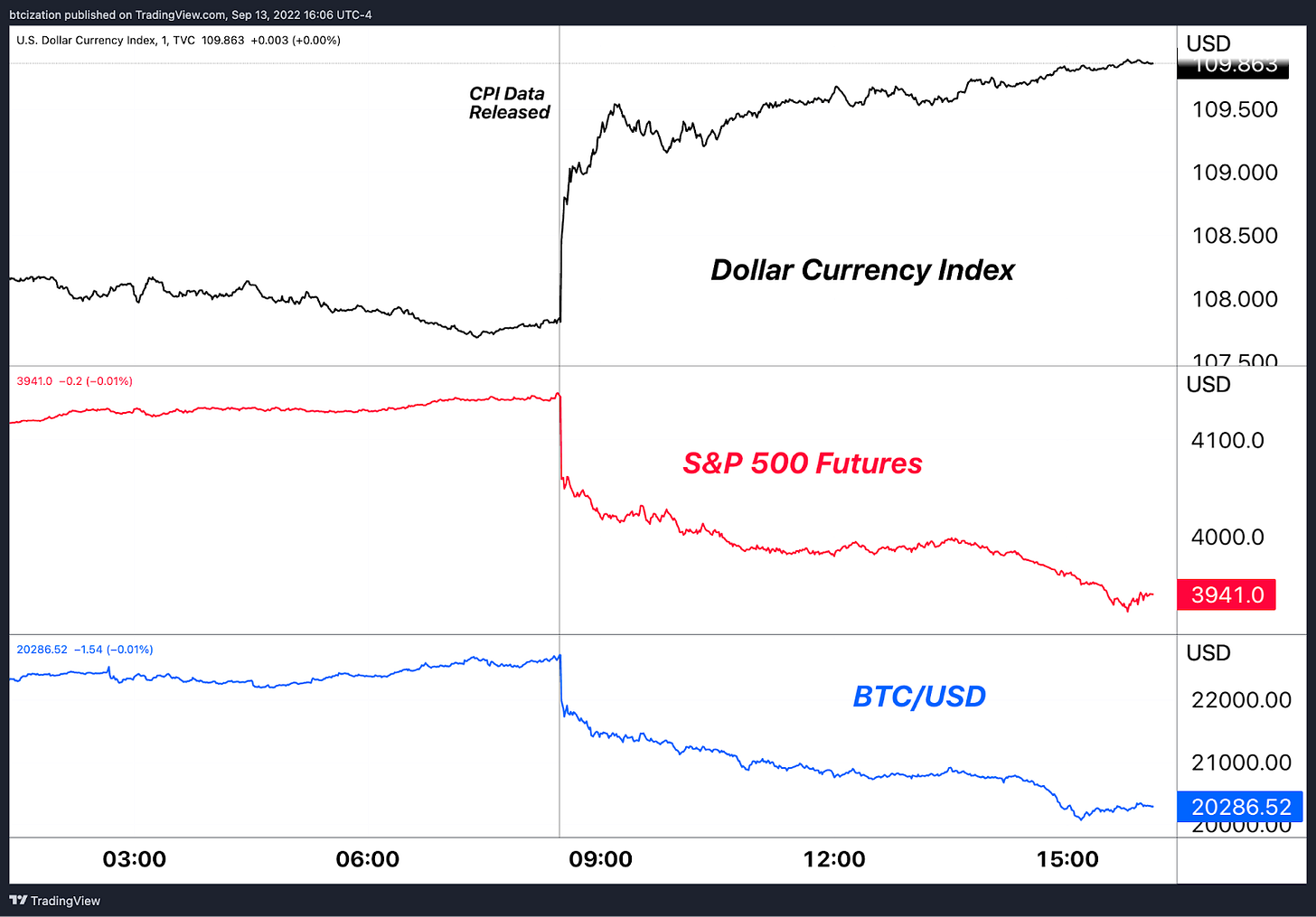

Immediately following the release of the CPI data, equities and bitcoin began to sell and the dollar soared. The price action of the asset classes was less about the inflation itself and more about the market’s expectations for future monetary policy from the Federal Reserve.

Expectations for rates immediately jumped to new yearly highs, with the market now

pricing in a Fed Funds rate of 4.46% for December of this year, which is almost 200 basis points less than the current rate target rate range of 2.25-2.50%.

In terms of rate hike probabilities, the odds of a 100 basis point rate hike during the September 21 Federal Open Market Committee (FOMC) meeting soared, finishing the day at 34% (66% of a 75 basis point rate hike) after closing yesterday’s trading session at a measly 9% probability.

Source: CME FedWatch Tool

Bitcoin in particular was subject to a large unwind in open interest as traders speculating on peak inflation by going long futures now were underwater en masse.

The decline in stablecoin margin open interest was greater than 30,000 bitcoin from the release of CPI data to the close of legacy markets. Assuming the majority of the decline in open interest was longs closing positions, the market faced the equivalent of approximately 25% of MicroStrategy’s bitcoin stash in selling pressure in the course of a few hours.

As covered before, derivatives are always net neutral over the long run, and any upwards pressure from longs opening will eventually be felt in the form of sell pressure as those positions close.

The majority of the move upwards in recent days was a combination of shorts closing and longs opening. For recent optimistic bulls, the positions quickly soured and resulted in realized losses.

Developing Debt Crises

As trading occurred throughout the day, the dollar continued to inch higher, with the DXY( a measure of dollar strength relative to a basket of fiats) finishing the day +1.5%. In the later hours of trading, the International Monetary Fund chief, Kristalina Georgieva, came out with a statement claiming approximately 25% of emerging markets are at or near distressed debt levels.

In one of our most popular issues to date, “Brewing Emerging Market Debt Crises,” published on July 12, we covered the risks of a soaring dollar and yields, and laid out the issues presented to the global economy.

To quote our July 12 issue,

“The massive implicit short position around the world creates a supply/demand imbalance; a shortage of dollars. The response is that dollar-denominated assets are sold to cover positions on dollar liabilities, which creates a feedback loop of falling asset prices, declining liquidity, debtor creditworthiness, and increasing economic weakness.”

“Bitcoin is absolutely scarce but has no structural shortage built into the system. During a credit unwind, bitcoin sells off as people rush for dollars to cover their short positions (debts).” - “Brewing Emerging Market Debt Crises”

Our thesis of a broad-based deleveraging across financial markets is unchanged since spring:

“It would be wise to warn our readers that despite being extremely bullish on bitcoin’s prospects over the long term, the current macroeconomic outlooks looks extremely weak. Any excessive leverage present in your portfolio should be evaluated.

“Bitcoin in your cold storage is perfectly safe while mark-to-market leverage is not. For willing and patient accumulators of bitcoin, the current and potential future price action should be viewed as a massive opportunity.

“If a liquidity crisis is to play out, indiscriminate selling of bitcoin will occur (along with every other asset) in a rush to dollars. What is occurring during this time is essentially a short squeeze of dollars.” - Bitcoin Magazine Pro, March 7, 2022

It is important to be able to distinguish the future that bitcoin provides the world while also acknowledging the reality of the current economic environment.

Bitcoin’s future as an apolitical, absolutely scarce monetary bearer asset purpose-built for a digital world is unchanged.

That doesn’t isolate it from short/intermediate-term volatility as the global credit-based fiat monetary system meets a harsh reality of rapidly tightening monetary conditions. Ultimately, tight monetary policy at the whims of the Federal Reserve is futile due to the size and nature of global debt burdens. That doesn't mean they cannot induce quite a large amount of pain on financial markets and the global economy in the meantime, and that's what they seem purpose-bent on executing on.

As network fundamentals continue to improve, such as hash rate and mining difficulty pushing towards new highs, it's important to remember the long game being played with bitcoin.

With that said, we are as convicted as ever in an ultimate capitulation moment having yet to occur across global financial markets. Long-term investors shouldn’t fear downside volatility, but rather embrace it, understanding the unique opportunity it provides to buy high-quality assets at fire sale prices.

Former Secretary of the Treasury Larry Summers, who has recently been a large critic of the Federal Reserve, expressed his opinion on the inflation problem:

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

TLDR: down only

What else can I do but stay long BTC? I wait for good coffee and yogurt to go on sale, when I see the prices dip, I load up. Why would buying bitcoin be any different in my life? I really won't know if my thesis is wrong for at least 18 more months. Until I'm proven otherwise, I'm glad and humbled to be in the company of Dylan and other smart Bitcoin researchers. 👍🏻✊🏻