Elevated Market Volatility

For additional context on the topics covered in this issue read here.

As warned about in our February 18 daily issue - Higher Volatility And Less Liquidity, the backdrop in traditional financial markets continues to deteriorate. Bond market volatility as measured and estimated by the CBOE is close to surpassing its weekly COVID-19 highs, with only The Great Recession seeing less liquid credit markets.

Similarly volatility in equity markets also exploded higher on Monday, with the VIX closing at 36.4.

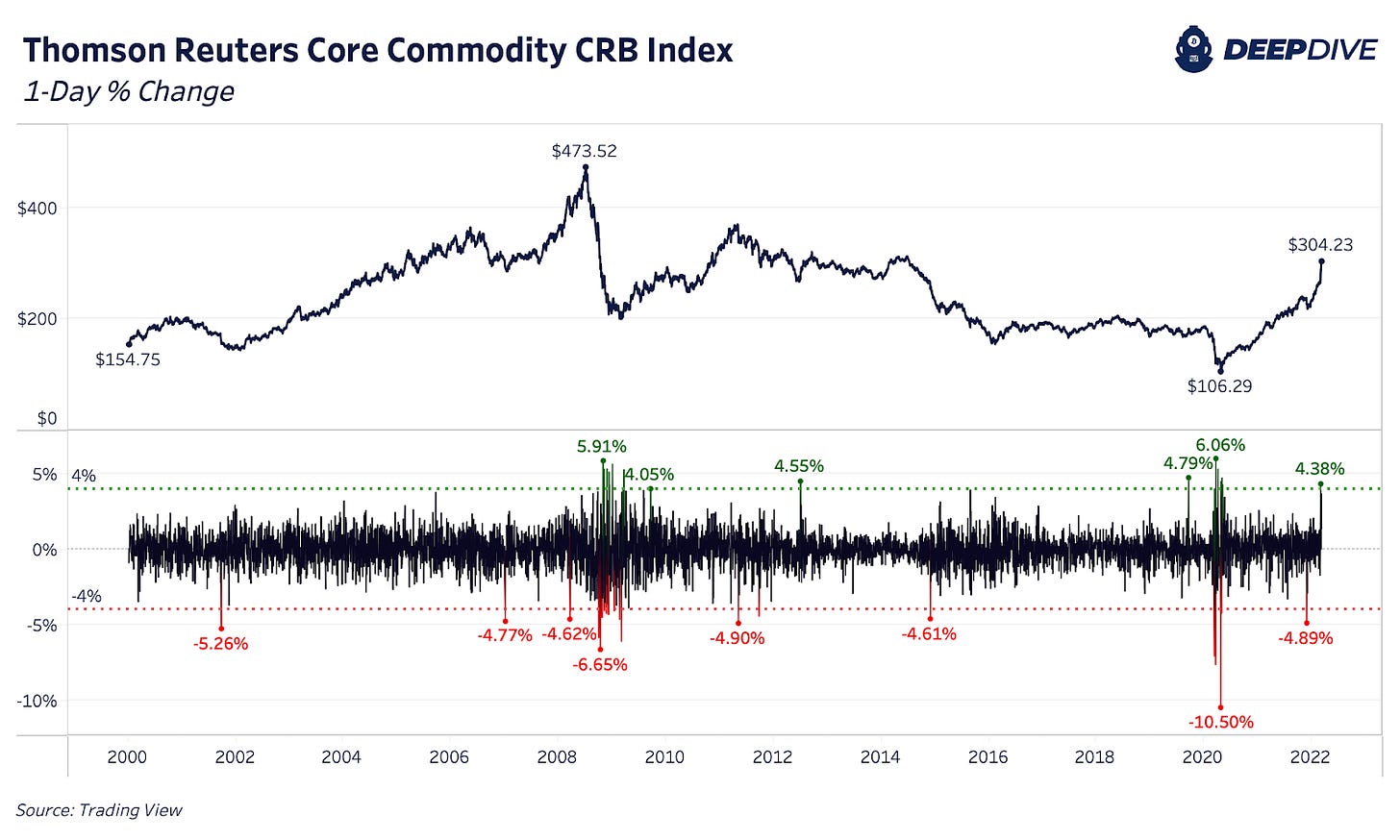

With the cost of commodities soaring across the globe in part due to the second and third order effects of the war occuring in Ukraine, it is increasingly unlikely that inflation is going to slow down. As a result, the Federal Reserve Board (as of now) is committed to tapering its quantitative easing programs and raising its federal funds rate.

In a recent testimony before the Senate banking committee, Fed Chair Jerome Powell spoke in response to Senator Richard Shelby of Alabama,

Shelby: “Is the leadership at the Fed under you prepared to do what it takes to get inflation under control and to protect price stability?”

Powell: “I hope history will record that the answer to your question is yes.”

Shelby: “So you're prepared to do what it takes without any reservation to protect price stability?”

Powell: “Yes”.

With Powell’s comments in mind, it is worthwhile to evaluate just how truly trapped the Fed currently is with inflation soaring and credit markets unwinding (in part due to inflationary concerns as well as due to deteriorating credit risk).

Yield Curve Flattening

The meltdown in equity and credit markets is occurring while the yield curve (10-year U.S. Treasury yield minus 2-year U.S. Treasury yield) is flattening in a dramatic way:

The yield curve is of great importance in the financial system due to the way that lending is conducted. Most creditors borrow short to lend long (i.e., take on short-dated liabilities and acquire long-dated assets), so when the yield curve inverts, it means that creditors are more incentivized to hold short-dated government paper than they are to lend out for duration. The implications of short-dated yields being higher than long-dated means it is also less risky to hold cash than it is to invest in risk assets (even with negative real yields) that sell off with weak economic activity.

This leads to liquidity issues in the economic system and it is why a yield curve inversion has predated every recession in the United States since the 1960s.

The most jarring aspect of the current environment is the reality that the Fed funds rate is still near 0%, with recession indicators flashing bright red.

It would be wise to warn our readers that despite being extremely bullish on bitcoin’s prospects over the long term, the current macroeconomic outlooks looks extremely weak. Any excessive leverage present in your portfolio should be evaluated.

Bitcoin in your cold storage is perfectly safe while mark-to-market leverage is not. For willing and patient accumulators of bitcoin, the current and potential future price action should be viewed as a massive opportunity.

If a liquidity crisis is to play out, indiscriminate selling of bitcoin will occur (along with every other asset) in a rush to dollars. What is occurring during this time is essentially a short squeeze of dollars.

The response will be a deflationary cascade across financial markets and global recession if this is to unfold.

This is why we prefer to maintain a multi-year (multi-decade even) outlook on bitcoin, as it is our belief that the response to this event will be only one viable “solution”: more stimulus.

This will likely come in the form of yield curve control, where the Federal Reserve monetizes any amount of debt securities across various durations at a certain level of yield.

Quantitative easing is a fixed amount of money printing at any price. Yield curve control is in theory an unlimited amount of printing to maintain a certain price. This is where the system is headed in our view.

And this is why we own bitcoin.

prepare. prepare. prepare.

das it mane...

rising oil prices alone seemingly assure this coming recession, yield curve backflips notwithstanding

apropos of war profiteering/devil's work, etc: oil could be headed to 180 a barrel; i like PSCE and NRGU. i do think gold is safer than oil though (too many moving parts in oil) gold seems to be on way to 2500$ an ounce this year (goldman agrees); should that happen GDXU is a multibagger from here ...just sayan