Growth Deceleration and The Dollar Wrecking Ball

June PMI data for the United States and the eurozone show economic contraction underway and that the worst is yet to come. What does it mean for bitcoin?

Growth Deceleration to Economic Contraction

In today’s issue we present a broad overview of the ever-changing global macroeconomic environment, and finish with its implications for bitcoin.

“The pace of US economic growth has slowed sharply in June, with deteriorating forward-looking indicators setting the scene for an economic contraction in the third quarter.”

That quote is from Chris Williamson, Chief Business Economist at S&P Global Market Intelligence along with their latest release of the June 2022 S&P Global Flash US PMI Composite Index. Measured across new sales orders, input costs, employment, work backlogs and business confidence, PMI (Purchasing Managers’ Index) survey data acts as a timely and leading indicator to assess economic health. The latest PMI reading came in this morning at an extremely ugly 52, below expectations of 56. The slowdown in manufacturing can be attributed to sharp rises in the costs of energy and commodities at the same time that rates are increasing at a record pace.

The data shows the first contraction in new orders since July 2020, the steepest pace of new export order contractions since June 2020, slowing inflation in input prices, slowing employment gains and the lowest business confidence since comparable 2012 data. This is not just in the United States either. It’s a similar story in the U.K. and eurozone PMI data as well. Households are struggling under the weight of inflation and we will likely see this continue to show up as a hit to both earnings and growth as the business cycle turns over.

Williamson highlights this dynamic best in the below chart, which shows the G4 economies’ PMI New Orders Index charted alongside the the collective monthly change in policy rates at major central banks.

As the economic activity grinds to a halt due to the exploding price of energy and commodities, the structural “short dollar” position that many around the world find themselves in causes the USD to appreciate relative to other currencies and financial assets.

By a structural “short dollar” position we are referring to the reality that there is more than $10 trillion worth of dollar-denominated debt that exists offshore, meaning foreigners find themselves short dollars, which is serviced by selling local currencies and/or dollar-denominated assets.

The $10 trillion estimate comes from a BIS working paper published in October of 2018:

“The total stock of US dollar-denominated debt of non-banks outside the United States stood at $11.4 trillion according to the latest BIS estimate (BIS, 2018), of which non-banks from emerging market economies (EMEs) accounted for $3.7 trillion. This total of $3.7 trillion is more than double the level in 2010.”

Assuredly the size of this debt load has grown since 2018, but this figure works as a general estimation.

Dollar Short Squeeze

This dynamic, exacerbated by the sheer amount of dollar debt that exists outside the United States’ domestic economy (due to the dollar’s world reserve currency status) is the reason that global economic slowdowns and a strengthening dollar (relative to other currencies) come hand in hand.

This dynamic (a strengthening dollar) is exacerbated by a slowdown in economic activity in the United States, in part due to both the rising price of energy as well as the monetary tightening that is occuring due to the response in inflationary pressures by the Federal Reserve.

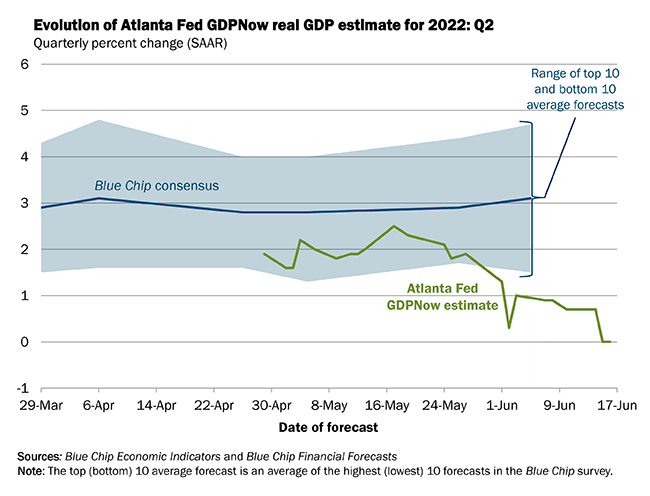

The economic slowdown underway can be seen through the Atlanta Fed’s expectations for real GDP growth in 2022, which has consistently been downgraded as the year has gone on, with expectations for growth now at an underwhelming 0%.The same goes for the New York Fed which released their latest models and a pessimistic view of annual growth for both 2022 and 2023, noting a 10% probability of the so-called “soft landing” actually materializing.

Source: Atlanta Fed GDPNow

Source: New York Fed DSGE Model Forecast

A Potential Turning Point

As the market prices in a slowdown in growth (and increasingly a contraction in economic activity across the board), the first signs of a potential pivot have begun to emerge via the eurodollar futures market.

Eurodollar futures (the term “eurodollar” originates from the the name of offshore dollar-denominated deposits in European banks), a futures market for the federal funds rate, has begun to fall, with the market’s expectation of interest rates in December 2023 to be lower than rates in December 2022.

Eurodollar futures are based on the rate of interest paid for eurodollar time deposits, which is equal to the 3-month LIBOR (The London Interbank Offered Rate) interest rate. U.S. Fed policy decisions significantly affect eurodollar prices, which is why eurodollar futures are suitable for hedging against or speculating on rates.

The market’s current expectation for rates in December 2022 is 3.70%, while the curve begins to invert into 2023, signaling the expectation of future rate cuts as economic activity significantly slows.

The beginning signs of future rate cuts and a reversal of monetary tightening would be one where we expect bitcoin to once again outperform. This, we expect, will be due to the market’s realization that there is no alternative to perpetual monetary expansion in a fiat currency regime, and that the attributes of an absolutely scarce monetary asset are extremely desirable over the long term.

Similarly, we expect the dollar to continue to strengthen relative to financial assets until there is a pivot in policy and a reemergence of monetary easing. Once again, this is due to the reality that the global (and domestic) debt burden increasingly cannot be sustainably serviced as economic activity slows and financial asset values fall in tandem (increasing debt/equity ratios in the process).

Relation to Bitcoin

As the business cycle turns over, as it is today, risk assets (obviously including bitcoin) have taken a hit. While equities and bonds are subject to falling valuations due to rising discount rates, bitcoin has no cash flows or dividends, why is it acting similar?

When looking through bitcoin’s nascent history, we notice a few fascinating trends throughout the cycles. Relating to today’s topic of slowing growth and economic activity is the ISM Manufacturing Index and the bitcoin cycle.

While correlation is by no means causation, a slowing economy and a decrease in growth has shown to correlate nicely with the monetization cycles of bitcoin. While there are plenty of exogenous factors, this relationship, in particular as bitcoin grows in size and liquidity, is one that we don’t believe to be spurious. Increasing business activity and economic growth means more money in consumers’ pockets, meaning greater flows into financial markets, with the nascent bitcoin gaining the most from flows due to its previous (and current) size and liquidity profile.

On a similar note, one can look at the relationship between the DXY (Dollar Currency Index) and bitcoin since 2020. As financial assets cratered in 2020 due to the COVID-19 economic lockdowns, the dollar soared higher until being met with a dual fiscal and monetary response from the Congress and the Fed.

While the DXY is only a measure of relative strength between the dollar and other global fiat currencies, it is a useful gauge for “risk off” conditions in financial markets.

Final Note

The latest data we’ve highlighted above further illustrates why the worst is yet to come. Some data shows we’re in the beginnings of a global recession today while other data points to a prolonged recession right around the corner.

Although we see bitcoin as a beneficiary of the aftermath, it is not immune to the macro business and growth cycles turning over in front of us, which are far from over. With a market cap at a mere fraction of total global wealth, it moves with broader cycles just like any other asset. This, along with many other reasons we’ve outlined, leads us to believe that the bottom isn’t in yet.

"This, along with many other reasons we’ve outlined, leads us to believe that the bottom isn’t in yet." That's exactly right. While we can't time the market, the bottom won't be seen until investors believe that the Fed will reverse course and begin cutting rates again or reintroduce QE. This won't be for a while. Enjoy the summer -- the Fall will bring some larger swings once again.

But Bitcoin's value will return, especially over the long-run.