PRO Market Keys Of The Week: Market Says Tightening Is Over

The collapse of Silicon Valley Bank and the closure of Signature has sparked concerns for the entire banking sector. The market is no longer pricing in many more rate hikes for the Fed funds rate.

Relevant Past Articles:

Banking Update

In a joint statement issued by the Department of the Treasury, Federal Reserve and FDIC, they announced that all Silicon Valley Depositors would regain access to all their funds — including those over the $250,000 FDIC threshold — while equity holders and bond holders would be wiped out. The second part of the joint statement came as a surprise to many market participants with the announcement that Signature Bank was identified as a systematic risk and was being closed by state regulators.

Similar to SVB, all depositors at Signature Bank are promised to be made whole, while shareholders and unsecured creditors would not be protected. Senior management was removed.

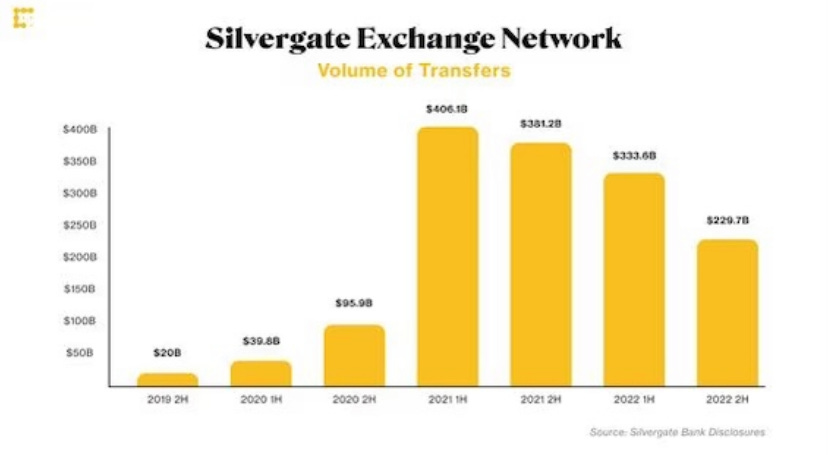

With the closure of Signature Bank (in addition to Silvergate Bank’s voluntary liquidation just last week), the two largest crypto on- and off-ramps are now shuttered. We touched on crypto-banking rails and their significance to market liquidity in many previous issues (listed above).

While the U.S. establishment will try to twist the failure of Signature and Silvergate on “crypto”, what really sank the firms, including Silicon Valley Bank, was their exposure to long-duration assets during times of heightened demand for short-term liquidity.

We alerted readers to this type of systemic issue shortly before there was any news about Silicon Valley Bank, which failed due to nearly the same reason we wrote about with Silvergate.

“As a traditional fractional reserve bank, Silvergate took client deposits — which drastically increased in 2021 — and lent them out over a long duration, into U.S. Treasury bonds, in particular. In practice, firms would lend their money to Silvergate by depositing at 0% in order to utilize their Silvergate Exchange Network (SEN), and Silvergate would then lend out those same dollars at a higher interest rate over a long period of time. This is a great business model — as long as your loans don’t fall in value at the same time as clients go to withdraw their funds.”

Once SVB failed, we outlined the specific events that led to its downfall in our Friday issue, “Largest Bank Failure Since 2008 Sparks Market-Wide Fear”:

“The following is a summary of events for these regional banks that are seeing their share prices plummet, including what previously happened with Silvergate Capital and is now in the process of playing out with Silicon Valley Bank.

“These banks catered to venture capital and crypto companies so their deposits went exponential during the post-2020 bubble.

“As short-end rates were pinned at 0% due to zero-interest-rate policy, these banks were suddenly flush with deposits and decided to make investments in long-duration securities in a bid for yield.

“As the bond bubble burst, these firms faced massive unrealized losses that were forced to be realized in the case of mass withdrawals.

“As the banks sold their bonds, the unrealized losses were crystallized, which led to panic from equity investors and depositors in a reflexive cycle which then led to a death spiral for the bank.”

Now that Signature has been closed by authorities according to the joint statement mentioned above, two of the largest dollar rails in the crypto ecosystem have been decapitated. Operation Choke Point 2.0, anyone?

Related: Crypto In The Crosshairs & Bitcoin Futures

Former Senator and Signature bank Board member Barney Frank, had this to say about the closure of Signature bank over the weekend to CNBC viewers,

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message.” — Barney Frank, co-author of the Dodd–Frank Wall Street Reform and Consumer Protection Act

Operation Choke Point 2.0 is all but confirmed.

Upgrade your subscription to receive the “Banking Crisis Survival Guide” report as soon as it goes live!

USDC Scare Passes Without Armageddon

As we published our last issue, USDC was on the ropes with $3.3 billion of funds trapped in Silicon Valley Bank. This led to a massive imbalance throughout the stablecoin swap market within the broader crypto ecosystem, as USDC broke from its $1 floating peg, trading as low as $0.86 against USDT on Saturday.

Key developments in the recovery of the peg were Circle’s announcements of temporarily halted redemptions — as any 1:1 redemptions would make the impairment larger as a percentage of USDC reserves — along with the stated intention to cover any potential lasting hole in reserves with the company’s corporate funds. Once the government announced a backstop to cover SVB depositors and Circle found a new redemption banking partner, the USDC de-peg was short-lived and traded back at $1 by Monday.

The Fed Blinked

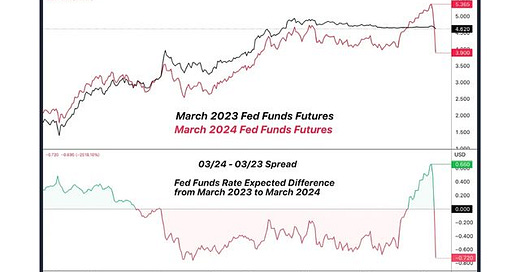

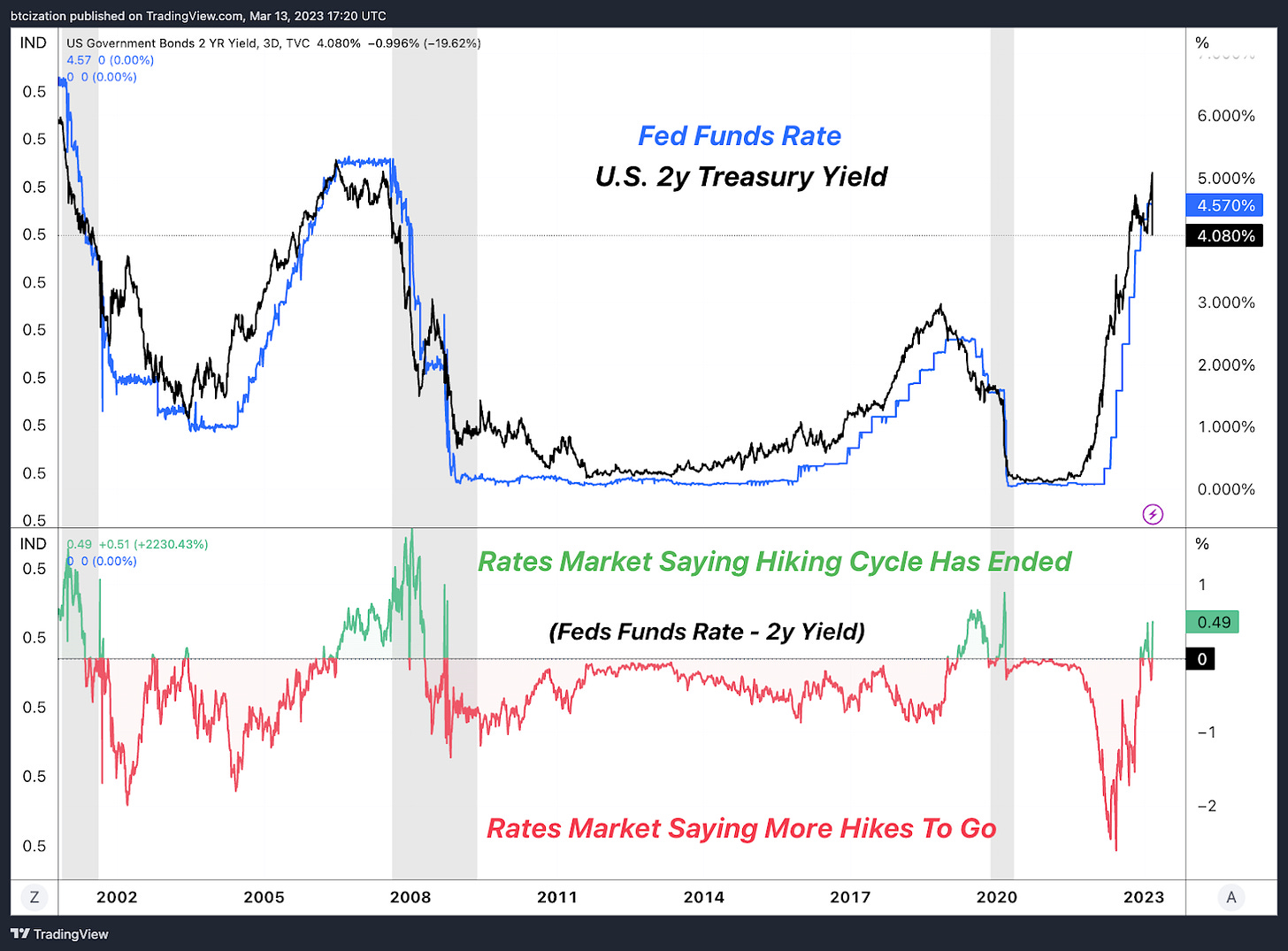

In a mere three trading days, expectations for Fed rate hikes over the next 12 months have gone from an expected +66 basis points of additional rate hikes to anticipation of -72 bps worth of rate cuts, a truly stunning reversal following fears of cascading bank failures in the U.S. banking system.

With that, the two-year Treasury note has deeply inverted against the current Federal funds rate, which is a sign from the market that the Fed’s current tightening regime is on its very last leg.

This move in two-year yields was the largest over a three-day period since October 1987, a testament of just how fast the market regime flipped rates.

Source: Liz Ann Sonders

Regional Banks Tanking

In Friday’s issue, along with acknowledging concerns about Signature, we highlighted the poor performance of other regional banks mainly because of the heightened fear of bank runs by depositors.

Interestingly enough, despite yesterday's joint announcement, those same regional banks continued to get hammered in Monday's trading session.

Despite the bailout of uninsured depositors at Silicon Valley bank, it’s clear that people are spooked, and consolidation among the biggest institutions in the banking system looks to be one of the results.

Volatility Spike

In addition to the massive move in short-end rates, equity volatility has come back with a vengeance.

Following Sunday’s bailout of SVB, and the announcement of additional Fed facilities to support banks that are facing short-term liquidity issues, top-of-depth order book liquidity in equities futures markets witnessed its largest one day reduction since the peak of the market in 2021.

In simple terms, this means that no matter the knee jerk reaction in markets, overall liquidity in the form of bids supporting the market has pulled back markedly.

Similar to what we have been saying in regards to bitcoin, expect heightened volatility for global risk assets because confidence in the banking system has recently eroded.

Bitcoin Illiquidity

Source: Kaiko

In the midst of operation Choke Point 2.0, along with the spillover effects of the SVB dilemma causing USDC to temporarily de-peg, top-of-marker depth across bitcoin exchanges is back below FTX lows, highlighting the vast level of illiquidity currently in the market.

What To Watch For

With both Silvergate’s SEN and Signature’s Signet now out of service, expect weekend liquidity to greatly decrease across the broader crypto market.

Source: Coindesk

The two platforms served as dollar rails for exchanges and market makers that allowed them to send each other dollar liquidity instantaneously, while staying within the United States banking system. With these two rails gone, weekend liquidity for the 24/7/365 market is likely to take a hit during periods when legacy financial institutions are closed.

Final Note

The last five days have served as the most powerful 1-2-3 punch advertisement for bitcoin in quite some time.

We have reiterated numerous times that bitcoin is not merely an “inflation hedge”, but rather an opt out of the insanity of a fiat regime that increasingly offers a binary outcome: deflationary credit contraction or persistent and ongoing credit expansion.

With the failure of Silicon Valley Bank wreaking havoc on markets, followed by the de-peg and panic around the trust-based USDC stablecoin, only to have government agencies with access to the money spigot respond in the way they are incentivized to with bailouts.

Leverage in the incumbent monetary regime has become systemic. The debasement of the currency is the only escape valve for policy makers, and they made that abundantly clear on Sunday.

The FDIC threshold is now unofficially infinite, implicitly guaranteed by the U.S. government. Unrealized bank losses can be wiped away with an accounting gimmick.

A system built entirely on math and cryptographic proof and where no one can cheat has never been more appealing.

Lastly, if Operation Choke Point 2.0 hasn’t made it entirely clear, Bitcoin has entered the “and then they fight you” phase of adoption. Liquidity and lack of reliable, large on- and off-ramps will provide short-to-intermediate-term headwinds, but after the last week of developments, bitcoin’s value proposition cannot be anymore clear.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Just received an email by Gemini: their banking partners are JPMorgan, Goldman Sachs, Fidelity and State Street Bank. I am not sure for the other exchanges but it seems that, for now, the dollars can still flow into Bitcoin.