FULL REPORT: Banking Crisis Survival Guide

Bank failures around the United States are a concerning trend for anyone who holds their money at select banks. We look at events leading up to the banking contagion and how bitcoin fixes this.

Relevant Past Articles:

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Silvergate Bank Faces Run On Deposits As Stock Price Tumbles

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

We are releasing this in-depth report across both PDF and Substack options. Click the “Download Report” button below to access the full report PDF.

Paid subscribers received this report on Wednesday. To get first access to future content, upgrade your subscription today!

Introduction

The last few weeks have been a worrying time for anyone who holds their money at select banks. Silicon Valley Bank (SVB) experienced the second-largest bank collapse in U.S. history, with $209 billion dollars in assets at the time of its failure. This is second only to Washington Mutual, with $307 billion in assets as it fell in 2008.

For the first time in decades, many are considering whether or not their deposits are verifiably safe in financial institutions. Many regional banks are experiencing significant financial distress in the aftermath of Silvergate and SVB. Wary depositors have begun to move their funds to larger, national banks colloquially recognized as “too big to fail.”

Banking is a confidence game after all, and that confidence is starting to wane everywhere you look. There is a distinction however between the Great Financial Crisis in 2008, and what we’re seeing play out over the last couple weeks. Today, it’s not about extreme credit risk in the system, excessive bank leverage and subsequent wave of defaults, but more about the duration risk of bank assets and liquidity. The rapid pace of interest rates rising have exposed those who haven’t managed that risk.

During this chaotic period, bitcoin — traditionally viewed as a risk-on asset — has seen exceptional appreciation, rising approximately 20% after SVB’s collapse. While this is not new for the volatile currency, it surprised many to see such resilient performance amid widespread anxiety from market participants. Although it’s exciting to see bitcoin moves like this short-term, it must sustain to act as a real safe-haven bid. Bear markets are known for their explosive volatility moves in an increasingly illiquid bitcoin market.

In this report, we unpack the cause of the banking crisis, the portfolio mismanagement of the failed banks and the role that monetary policy and the Federal Reserve has played in this context. We will also highlight issues with so-called stablecoins, and the ways in which bitcoin solves many of the issues of the modern-day banking system.

All things considered, these events serve as a stark reminder of the risks inherent to fractional reserve banking and highlight the use case of bitcoin, an asset with zero counterparty risk that exists as the liability of no third party.

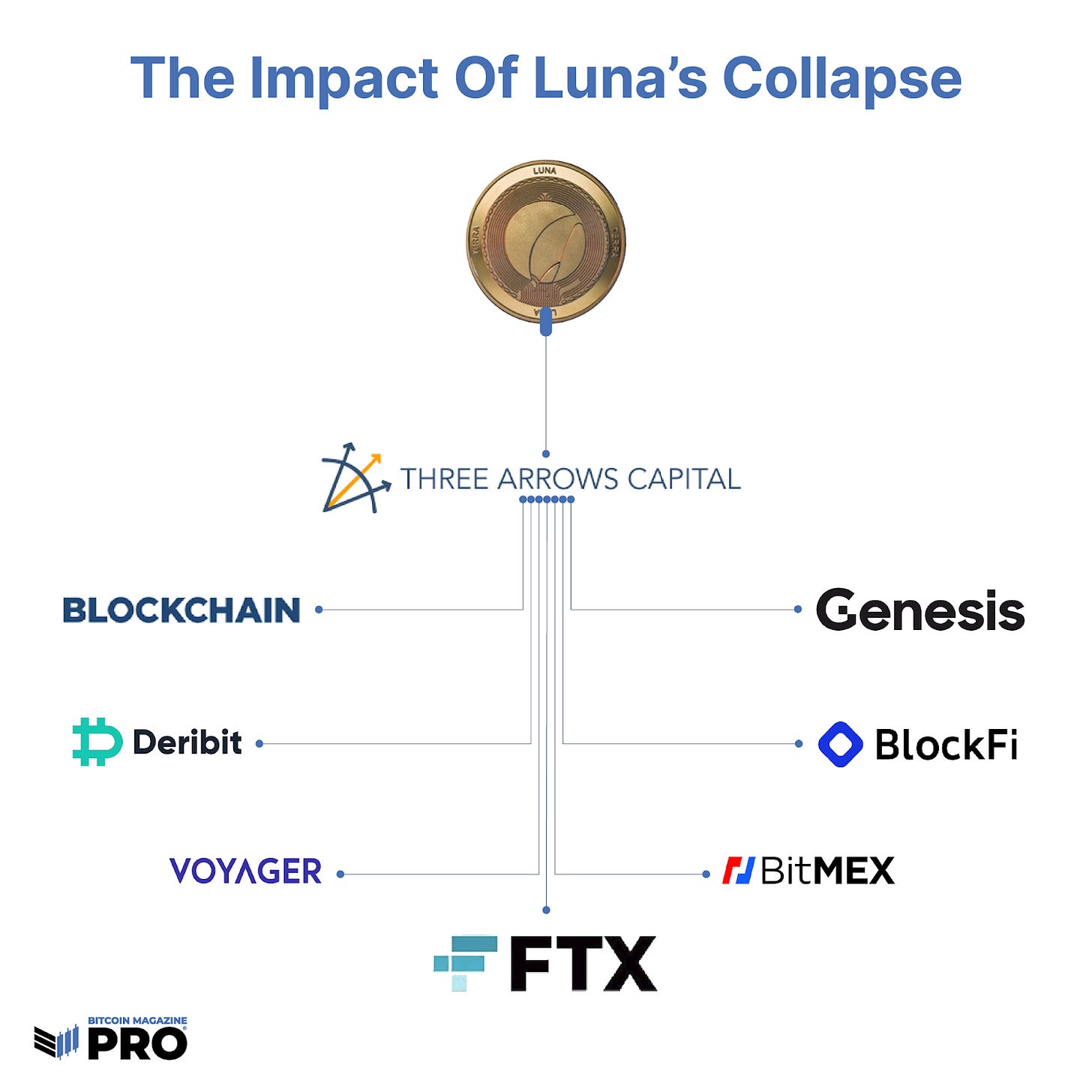

Contagion Recap

To start, it’s important to set the stage for what Bitcoin has experienced over the past year — chief among these events is the significant contagion unwind experienced in the broader crypto landscape. Unsurprisingly, contagion is pervasive in the cryptocurrency industry. We’ve been beating this drum since the fall of Celsius and Three Arrows Capital (3AC) in May 2022. What is more surprising to some observers of traditional financial markets is just how deep the contamination goes.

Bitcoin was created in part to eliminate third-party risk through peer-to-peer exchange of electronic cash. Time and time again, we have witnessed the essential vision of Bitcoin be distorted through intermediaries and the ensuing counterparty risk.

One of the more notable examples of the dangers of trusting third parties in Bitcoin’s history was the fall of the Mt. Gox bitcoin exchange in early 2014, when the company halted withdrawals and announced a loss of almost 750,000 of its customers’ bitcoin plus around 100,000 bitcoin of its own — about 4% of the total bitcoin supply, worth close to $473 million at the time of the bankruptcy filing. The Mt. Gox failure was due to a hack and subsequent draining of the company’s reserves.

These types of counterparty risks are exactly what Bitcoin was designed to avoid, but bitcoin needs to be held in self-custody in order for it to be safe from third-party malfeasance. Even after the notorious collapse of Mt. Gox, there were numerous other examples of exchanges running off with customer assets.

More recently, bitcoin that was not wholly owned by exchanges or created out of thin air — “paper bitcoin” — became popular as firms leveraged their customers’ bitcoin by lending it out while offering “yield.” We warned about some of the issues with yield services in May of last year.

These issues first came to light when the Terra stablecoin (UST) lost its peg, causing those with exposure to the Anchor protocol — which was offering as much as 110% APY on UST deposits — to face incredible losses. Little did we know at the time that we would spend the next few months covering the widespread contagion that permeated the larger cryptocurrency industry.

Shortly after the fall of Terra/LUNA, the Celsius exchange and lending platform halted withdrawals. On June 13, 2022, we took a closer look at this particular case in “Celsius Exchange Halts Withdrawals: What Went Wrong?”

“As of late, novel narratives have been employed to drive retail customers to believe in the power of ‘blockchain technology’ and ‘cryptocurrency’ as drivers for a revamped financial system. However, as argued before, blockchain serves a very specific purpose: to solve the double spending problem to port cash (peer-to-peer money) into the digital realm. This was achieved by Satoshi Nakamoto, who, after decades of research by many scientists and mathematicians, arrived at the design of Bitcoin — published in a proper white paper in 2008.”

Peer-to-peer money and the elimination of double spending and counterparty risk were always Bitcoin’s goals. After the fall of Celsius, it was more apparent that there would continue to be tail risks associated with the interconnected crypto industry and we once again warned that investors should exercise caution and expect more cards to fall.

While there were many further bankruptcies immediately after the collapse of LUNA, Celsius and 3AC — Voyager, BlockFi, Finblox, Derebit, Babel, Maple Finance and Coinflex — major exchange FTX came to the rescue with the offer for large bailouts for many of these companies.

We covered these events in great detail in our Contagion Report.

What became apparent later that year was that FTX did not actually have the capital to help these firms, and was largely impacted by the 3AC blowup along with the same firms it swooped in to save. On November 10, 2022 — the day before FTX filed for bankruptcy — we wrote “Counterparty Risk Happens Fast” to warn readers:

“This is a Long-Term Capital Management and Lehman Brothers-style moment, and is potentially larger in magnitude than what happened with the previous market contagion. There will be more names and bodies to surface in the aftermath. All eyes are now on the counterparties of Alameda, all other exchanges in the space, stablecoin operators and highly connected companies in the ecosystem: Genesis, Silvergate, Galaxy Digital, CoinShares and BlockFi are a few examples.

“We don’t intend to fuel any additional FUD (fear, uncertainty and doubt) on the fire, but once again, the contagion will spread and there will be second- and third-order effects to play out. For Silvergate, FTX was their largest customer; they announced a change in executive management just a few days ago, the stock is down over 31% in just five days and are in the midst of bleeding customer deposits. Even worse, they issued a statement highlighting that ‘they have the ability to borrow from the Federal Home Loan Bank to strengthen liquidity.’”

The destruction of FTX was swift and complete. We covered these events in The FTX Ponzi special report, so we won’t rehash them here.

One of the unanswered questions after the failure of FTX was what other institutions were severely affected. Just a week following the bankruptcy filing, we questioned how Silvergate Bank would fare.

“Who else is at the center of many institutions in the market? Silvergate Bank is one of those. Since the beginning of November, their stock is down nearly 56%. Silvergate Bank is at the nexus of banking services for the entire industry, servicing 1,677 digital asset customers with $9.8 billion in digital asset deposits…

“Even if a bank run scenario is unlikely, Silvergate deposits are likely to take a hit and we’ve yet to see second-order effects take shape from that happening. Signature Bank is the other main banking provider for the industry…” — The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Though we didn’t think a bank run was likely at the time, this was before rumors of the U.S. government discreetly forcing banks to cut ties with the crypto industry. In January, Silvergate saw a run on its deposits.

“As details emerged regarding the Silvergate operation, specifically in regards to the relationship with FTX — the fact that deposits to FTX were routed to the Alameda Research bank account at Silvergate — some investors began worrying about impending regulatory clampdown due to seemingly lax compliance and the possibility of anti-money laundering violations. As a result of this concern, the share price of Silvergate started to aggressively slide. Since the collapse of FTX, shares have fallen by nearly 80%.

“The worry for Silvergate following the collapse of FTX was unlike many of the crypto-native firms that went bust over the course of 2022. Some of the issues we saw that led to other blowups were sour crypto-native loan books and large directional exposure to faltering crypto assets. As a traditional fractional reserve bank, the largest worry for SIlvergate was having a run on its deposits, which is exactly what happened when Silvergate announced its quarterly report, leading to shares plunging by more than 40% in a single trading day.” — Silvergate Bank Faces Run On Deposits As Stock Price Tumbles

Then on March 3, Silvergate announced that it was closing the doors on its proprietary Silvergate Exchange Network (SEN). We explained the duration mismatch with the company’s long-term bonds and its depositors demanding their money back.

“As a traditional fractional reserve bank, Silvergate took client deposits — which drastically increased in 2021 — and lent them out over a long duration, into U.S. Treasury bonds, in particular. In practice, firms would lend their money to Silvergate by depositing at 0% in order to utilize their Silvergate Exchange Network (SEN), and Silvergate would then lend out those same dollars at a higher interest rate over a long period of time. This is a great business model — as long as your loans don’t fall in value at the same time as clients go to withdraw their funds.”

“A majority of Silvergate’s deposits came during a world of zero-interest-rate policy, where short-duration Treasury securities offered 0% yield. This phenomenon is one of the core reasons why Silvergate invested in longer-duration instruments. The bonds fell in value as global interest rates rose throughout 2022.

“With long-duration debt securities, money isn’t lost in the case of rising interest rates as long as the bond is held to maturity (and not defaulted upon), but in the case of Silvergate, fleeing deposits forced the firm to realize the unrealized losses on their securities portfolio — a nightmare for a fractionally reserved institution.” — Banking Troubles Brewing In Crypto-Land

Silvergate’s collapse may have been a disastrous turning point for public trust of banking institutions and its liquidation preceded the events of the last week by demonstrating the harsh truth of our current financial system: the funds in your bank account may not be as liquid as you once thought.

Beyond Silvergate: The Ides of March

Over the last week we found out that was not an issue specific to Silvergate, but in fact a major issue for many regional banks that failed to manage duration and interest rate risks in a post-ZIRP world. In fact, Silvergate was the bank that was able to fully pay out all depositors while others were in need of support from the U.S. Treasury and Federal Reserve to make depositors whole.

When SVB failed on March 10, we outlined the problem with duration mismatch in “Largest Bank Failure Since 2008 Sparks Market-Wide Fear.”

“The following is a summary of events for these regional banks that are seeing their share prices plummet, including what previously happened with Silvergate Capital and is now in the process of playing out with Silicon Valley Bank (SVB):

These banks catered to venture capital and crypto companies so their deposits went exponential during the post-2020 bubble.

As short-end rates were pinned at 0% due to zero-interest-rate policy, these banks were suddenly flush with deposits and decided to make investments in long-duration securities in a bid for yield.

As the bond bubble burst, these firms faced massive unrealized losses that were forced to be realized in the case of mass withdrawals.

As the banks sold their bonds, the unrealized losses were crystallized, which led to panic from equity investors and depositors in a reflexive cycle which then led to a death spiral for the bank.”

In a world of excess stimulus money and bank reserves being pumped into the system, that money needed a place to go. To generate yield and park the cash, many banks poured into long-dated, “risk-free” U.S. Treasuries at relatively low interest rates. As rates rose in one the fastest rate tightening cycles ever seen, the price of U.S. Treasuries were falling. As long as you’re holding the debt to maturity (HTM), you won’t take a loss. The risk of bank runs force the selling and realized losses of this debt as banks have no choice but to solve their immediate liquidity issues. By doing so, that quickly spirals into a solvency issue.

As a result of the rise in the federal funds rate and failed strategies to manage the rise in interest rates, the banking sector now has a significant amount of unrealized losses on investment securities. In short, U.S. banks are sitting on $600 billion in bond losses and need to hold these assets until maturity to avoid taking the loss. If a larger bank run was to happen, the potential forced early selling of these assets to cover withdrawals would force many banks with liquidity problems to suddenly have solvency problems.

Many in the banking system, especially larger more established institutions, will be able to manage these HTM unrealized losses, but more complications will be sure to arise as the dust settles. For now, it looks as if the immediate liquidity problems have been resolved with the latest government loan program.

In a joint statement made by the U.S. Treasury, the Fed and the FDIC, SVB depositors will have access to all of their funds — including those over the $250,000 FDIC threshold:

“After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

Government agencies quickly moved to roll out the Bank Term Funding Program (BTFP) over the weekend offering loans up to one year to banks in exchange for pledged collateral like U.S. Treasuries, agency debt or mortgage-backed securities. Quickly, the FDIC insurance to cover up to $250,000 in deposits turned into more of a “whatever it takes” amount to curb any potential systemic risks for a few select banks.

The U.S. Treasury has initially allocated $25 billion for this program, drawing from the Exchange Stabilization Fund which has been a catchall for emergency funding in the past. In their initial release, they don’t expect any of the funds to be utilized, as they will be used for any potential capital losses the Federal Reserve would face when loaning out additional liquidity. However, this may only be the beginning of what’s necessary. On Friday, March 10, we can see the transfer of $40 billion from the U.S. Treasury to the FDIC. This makes up around 18.5% of total assets in the fund.

Source: U.S. Treasury Daily Statement

Regardless of where the funds came from, the message was clear: The U.S. government will bail out the banking industry. It will do whatever it takes to cover all major uninsured deposits during a bank run and crisis. The Federal Reserve will also lend whatever liquidity needed to stem bank runs while accepting marked down forms of collateral in unprecedented fashion. Yet, this facility and lending only works if you have U.S. Treasuries, agency debt or mortgage-backed securities to use as collateral.

Larger banks typically have more of these types of assets so it’s a liquidity vehicle that favors them while encouraging other smaller and regional banks to be more conservative in their lending by opting for more government securities in their portfolios going forward. It also changes the risk/reward dynamics of holding longer-duration debt, encouraging banks to do so since the Federal Reserve has their back when unrealized losses pile up or liquidity issues arise.

Even with the backstop in place before the weekend, that didn’t stop many bank stocks from falling, hitting trading circuit breakers across the industry on Monday, March 13. Panic ensured in the market, especially for other regional banks and banks with large unrealized losses in their HTM portfolios. After that initial panic, markets have started to rebound some with many names still down over 30% year-to-date.

There are many questions surrounding regional bank deposits now as customers may look to move funds to larger institutions that benefit more from the BTFP program. As we watch that start to play out, there’s broader risk that the big banks only become bigger, increasing centralization and concentration. There’s not anywhere close to the credit risk in the market that we saw back in 2008, but liquidity risk still remains for many smaller banks outside of the top 10.

In all of the chaos, one of the last standing banks with significant crypto exposure, Signature Bank, was forcefully closed by New York state regulators with deposits covered by the new program. The collapse of both Silvergate and Signature Bank within the same week, along with the seizure of SVB, spark deeper concerns around an “Operation Choke Point 2.0” narrative where all of the traditional financial rails to the broader industry are quickly getting cut off at each new opportunity.

In the same joint statement referred to above, the Treasury, Fed and FDIC announced the closure of Signature:

“We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.”

Signature Bank board member and former U.S. Rep. Barney Frank highlighted in an interview that there was “no real objective reason” that Signature had to be seized and that they became the poster boy for “a very strong anti-crypto message” from regulators. If true, then there’s a clear decision where regulators chose to cut off some banks while bailing out others. It’s been known for some time that we would eventually see increased regulatory pushback and a fight against the broader cryptocurrency industry, and now it’s starting to heat up.

As we’ve already seen, bitcoin’s market liquidity was decimated over the last year leaving plenty of room for increased volatility. Taking more key financial rails out of the market will only decrease overall liquidity and increase potential market volatility short-term. It took many years for these banking relationships and financial rails to develop which leaves the broader industry with a large hole to fill. Silvergate’s SEN Network and Signature Banks’s Signet platform were vital networks to move clients’ money and payments around 24/7. Now it’s likely that many market players will have to turn upstream to larger banking partners and reestablish financial rails.

Bitcoin 2023 ticket prices increase March 24! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

Note: As we were in the middle of writing this report, European banks began facing a major selloff of their own led by Credit Suisse. At the time of writing, the bank’s stock has fallen over 20% to new lows and its credit default swaps were soaring to new all-time highs while facing significant deposit and capital flight. In the panic, Credit Suisse CEO highlighted similar words we’ve seen many times before in hopes to reassure markets, “Our liquidity base is strong.” At the same time, the EU bank index is down over 10% in one day, while other major institutions like BNP Paribas are being halted for trading. This is a key area to watch as it develops, to see if there will be more contagion. Any potential policy resolutions may be harder to come by due to the fragmented nature of the EU relative to what we’ve seen as a quick response by the Fed, Treasury and FDIC in regards to SVB.

Source: Bloomberg, Holger Zschaepitz

The State Of Stablecoins

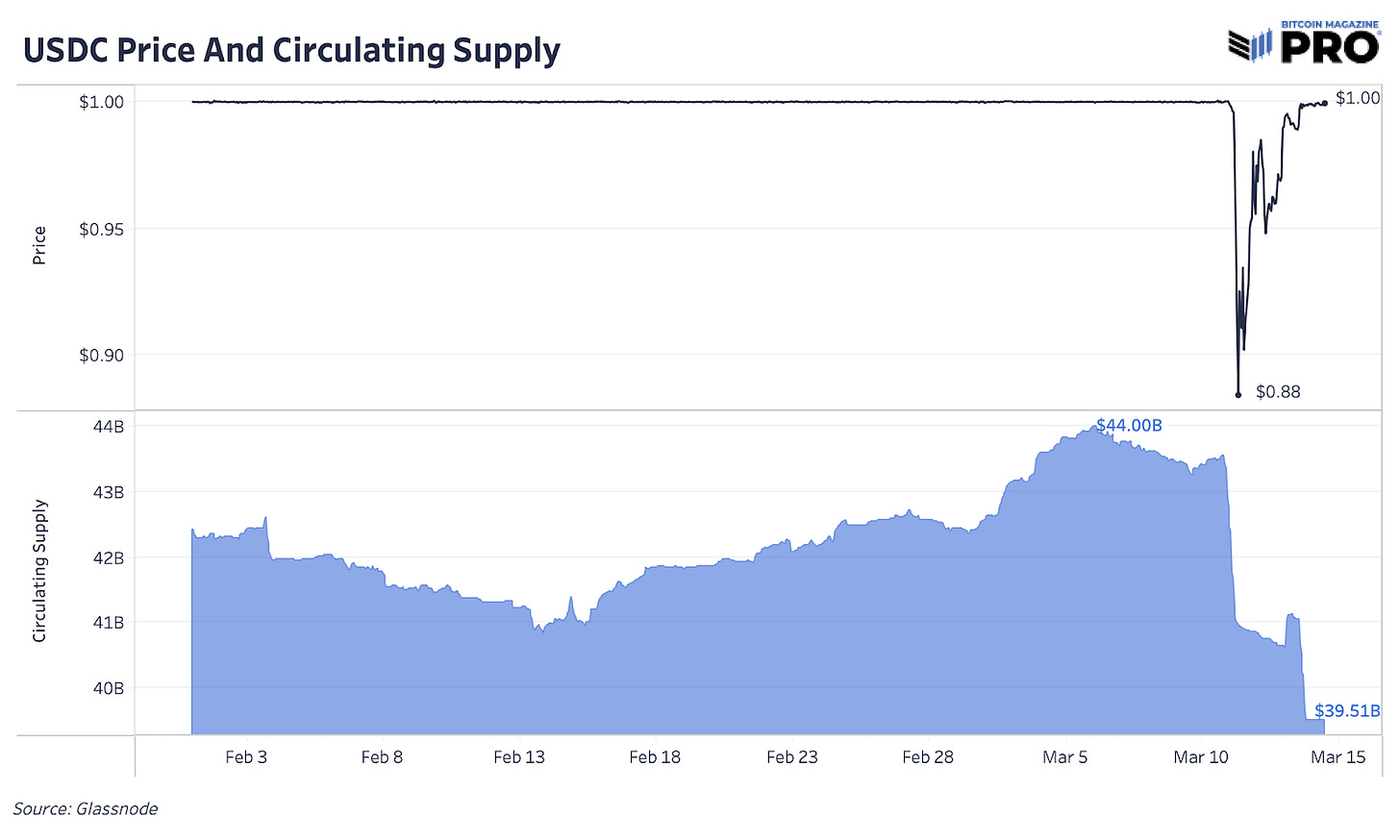

What seemed to be one of the safest and most regulated stablecoins in the market, USDC, became one of the largest stablecoins in question in just a matter of hours. Although exaggerated by many illiquid trading pairs in the market, USDC faced a depeg down to $0.864 on Coinbase while many questioned the ability for Circle to cover USDC 1:1 in the case that uninsured SVB deposits were not bailed out.

Circle’s USDC collateral was 77% U.S. Treasury bills with three month or less maturation date and 23% cash. The $3.3 billion in cash with SVB was roughly 8% of USDC’s total collateral backing and a sizable portion of cash they had on hand to honor redemptions. With enough redemptions and speculation coming into the market, a lack of 1:1 funds backing USDC may have led to a wave of redemptions and Circle potentially having to seek temporary funding or a liquidity injection to fill the gap.

However, by Monday with the government program announcement, the peg had closed and Circle announced a new banking partnership with Cross River to maintain USDC minting and redemptions. So far, we’ve seen a significant share of circulating USDC supply (nearly 10%) redeemed and taken off the market in less than a week. At the time of writing, circulating supply has fallen to $39.5 billion from a recent peak of $44 billion.

In the coming weeks, we will see if minting demand comes back but the overall stablecoin market has been in a significant downtrend since March 2022 with total stablecoin balances falling 21% from $161 billion to $127 billion. Tracking stablecoin supply is significant as it is the primary fuel and financial rails to acquire bitcoin: Apart from some USD volume directly, the bulk of bitcoin trading volume comes from BTC/USDT (Tether) pairs. Over the last year, March 10 was one of the largest 1-day contractions in circulating stablecoin supply we’ve seen, falling 1.76%. While USDC, DAI and BUSD supply was shrinking, USDT saw increased minting as market participants looked for safety and alternatives.

Tether has been under fire and scrutiny from regulatory agencies for years, but continues to increase its market share and dominance. Some of that is due to the latest regulatory pressures for Paxos to shut down BUSD, Binance’s once-growing stablecoin alternative. Since November 2022, BUSD supply now sits at $8.41 billion, down from $23.38 billion, and is continually being phased out from platforms outside of Binance. Even in the latest news, Binance CEO Changpeng Zhao, announced a $1 billion purchase swapping BUSD in their industry recovery initiative to be deployed into BTC, ETH and BNB. Without another major entrant into the market, USDT and USDC remain the two dominant market solutions.

However you look at it, it’s increasingly clear — especially after this week — that all of the current stablecoin options in the market have faults, with no clear path for regulatory adoption yet. This comes at a time when many governments are wrestling with their own ideas and experiments for central bank digital currencies, some considering partnerships with privately issued stablecoins. Even when backed 1:1 by U.S. Treasuries, cash, short-term bills and collateral from our existing monetary system, stablecoins will always have some level of counterparty and centralization risk that only bitcoin has proven to escape in times of bank runs and crises.

Bitcoin Fixes This

One of the larger fears during the initial bank run on Silicon Valley Bank was that startups and companies wouldn’t have access to their accounts to make payroll or other capital needs. It can be hard to remember that these banking crises affect real people and while many people see bitcoin as a solution or hedge to impending financial collapse, this type of real-world impact cannot be overstated. In this case, money was inaccessible for a few days and could have been much worse without an immediate bailout and response.

That being said, bitcoin does help fix this problem. As Tim Draper pointed out, by holding bitcoin on their balance sheets, companies are less likely to be decimated by collapsing banks. Yes, companies would have to put up with a more volatile asset, however, in a real crisis they would be able to access and transfer those funds at any time regardless of their bank or counterparty risk. This idea is yet another useful case for bitcoin that may gain traction over time, regardless of its exchange rate.

To iterate this point, Yassine Elmandjra of ARK said it well, “Over the weekend, Bitcoin settled ~$33 billion, facilitated ~600k transactions, & issued 2,037 new BTC at a steady & predictable ~1.8% inflation rate.” While many who rely on the pitfalls of the current financial system were left uncertain, Bitcoin continued to operate and facilitate billions in transactions.

Yet, bitcoin can only function this way if its users can access it when they need it most. Over the last year, we’ve seen many centralized institutions custody and loan bitcoin on their clients’ behalf only to never return it. Today, the number of Bitcoin addresses and entities tell us that very few in the market actually self-custody their bitcoin, likely at the fault of education of the technology, complexity and inconvenience. Although growing every year, 11.7 million addresses holding at least 0.01 bitcoin is still relatively small.

For users to be able to access their bitcoin at any point in time without worrying about counterparty risk, it must be held in self-custody. This is the only way that completely eliminates trusted third parties and gives the user total control over their assets. We have a ways to go before a meaningful percentage of bitcoin users custody their own bitcoin themselves.

The hard truth is that for Bitcoin’s adoption to continue growing significantly, there will have to be many crises: bank runs, continued monetary debasement, deflationary events or other things that expose the need for a competing store of value and alternate monetary system. But, after over a decade of central bank quantitative easing and 0% interest rates, a long-term debt cycle nearing its shelf life, unprecedented emergency fiscal stimulus in the trillions, the fastest rate-tightening cycle in history, a multiyear sustained inflationary period and much more, the cracks in the current system are showing.

The recent decision to stem a larger bank run by guaranteeing uninsured depositors and providing liquidity at any cost really may be the only viable solution at this point. The American banking system cannot function if the population believes their deposits to be unsafe. Yet, with every new Federal Reserve decision to suppress volatility and curb potential economic destruction, the risk of more volatility and greater economic destruction rises. The latest solution is yet another quick fix to maintain short-term stability and move towards socializing the potential losses and consequences from the fallout. If we’re to see banking issues continue or even worsen over the next year, then expect the bailouts to continue, the concentration of big banks to grow and the reliance on the Federal Reserve to increase. In our view, there’s only one option to counter these inevitable market forces long-term and that’s Bitcoin.

That concludes the “Banking Crisis Survival Guide.” You can download the report in PDF format by clicking the link below.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!