Report: The FTX Ponzi - Uncovering The Largest Fraud In Crypto History

Modern day alchemy, unsurprisingly, failed. A deep dive into FTX and the events leading to the collapse of the now notorious crypto exchange.

Relevant Past Articles:

We are releasing this in-depth report across both PDF and Substack options. Click the “Download Report” button below to access the full report PDF.

For paid subscribers who have already received the report, this email is simply to offer you the ability to download it in a PDF version.

Beginnings

Where did it all start for Sam Bankman-Fried? As the story goes, Bankman-Fried, a former international ETF trader at Jane Street Capital, stumbled upon the nascent bitcoin/cryptocurrency markets in 2017 and was shocked at the amount of “risk-free” arbitrage opportunity that existed.

In particular, Bankman-Fried said the infamous Kimchi Premium, which is the large difference between the price of bitcoin in South Korea versus other global markets (due to capital controls), was a particular opportunity that he took advantage of to first start making his millions, and eventually billions …

At least that’s how the story goes.

The Kimchi Premium - Source: Santiment Content

The real story, while possibly similar to what SBF liked to tell to explain the meteoric rise of Alameda and subsequently FTX, looks to have been one riddled with deception and fraud, as the “smartest guy in the room” narrative, one that saw Bankman-Fried on the cover of Forbes and touted as the “modern day JP Morgan,” quickly changed to one of massive scandal in what looks to be the largest financial fraud in modern history.

The Start Of The Alameda Ponzi

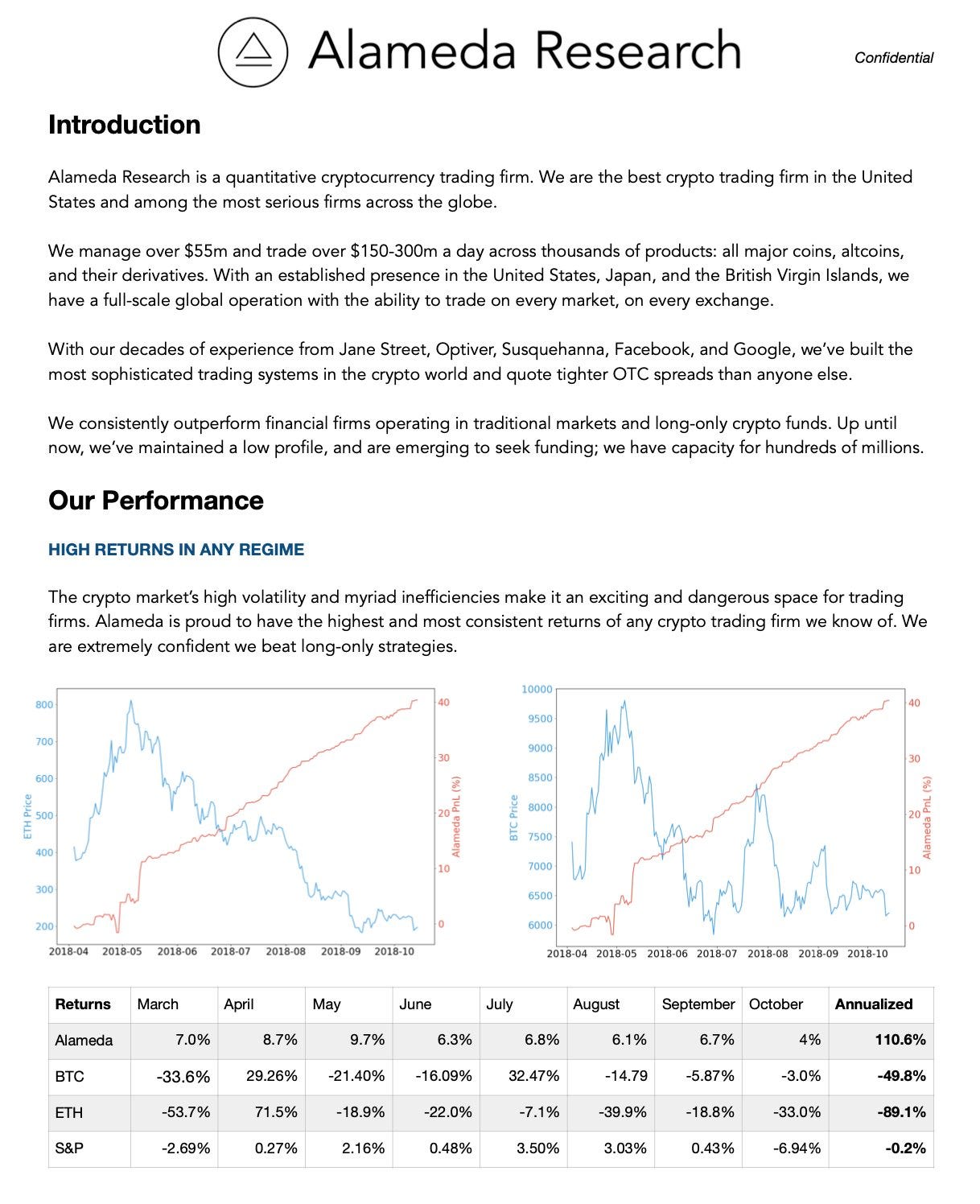

As the story goes, Alameda Research was a high-flying proprietary trading fund that used quantitative strategies to achieve outsized returns in the cryptocurrency market. While the story was believable on the surface, due to the seemingly inefficient nature of the cryptocurrency market/industry, the red flags for Alameda were glaring from the start.

As the fallout of FTX unfolded, previous Alameda Research pitch decks from 2019 began to circulate, and for many the content was quite shocking. We will include the full deck below before diving into our analysis.

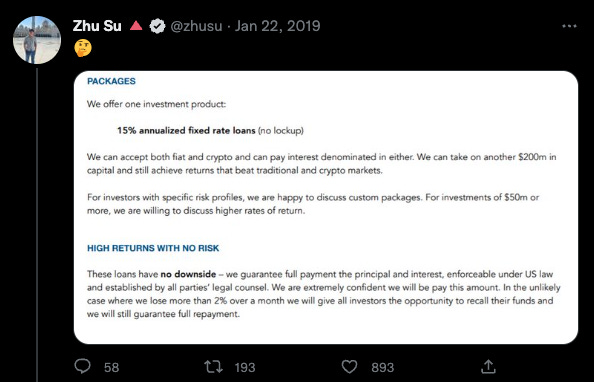

The deck contains many glaring red flags, including multiple grammatical errors, including the offering of only one investment product of “15% annualized fixed rate loans” that promise to have “no downside.”

All glaring red flags.

Similarly, the shape of the advertised Alameda equity curve (visualized in red), which seemingly was up and to the right with minimal volatility, while the broader cryptocurrency markets were in the midst of a violent bear market with vicious bear market rallies. While it is 100% possible for a firm to perform well in a bear market on the short side, the ability to generate consistent returns with near infinitesimal portfolio drawdowns is not a naturally occurring reality in financial markets. Actually, it is a tell-tale sign of a Ponzi scheme, of which we have seen before, throughout history.

The performance of Bernie Madoff’s Fairfield Sentry Ltd for nearly two decades operated quite similarly to what Alameda was promoting via their pitch deck in 2019:

Up-only returns regardless of broader market regime

Minimal volatility/drawdowns

Guaranteeing the payout of returns while fraudulently paying out early investors with the capital of new investors

It appears that Alameda’s scheme began to run out of steam in 2019, which is when the firm pivoted to creating an exchange with an ICO (initial coin offering) in the form of FTT to continue to source capital. Zhu Su, the co-founder of now-defunct hedge fund Three Arrows Capital, seemed skeptical.

Approximately three months later, Zhu took to Twitter again to express his skepticism about Alameda’s next venture, the launch of an ICO and a new crypto derivatives exchange.

“These same guys are now trying to launch a "bitmex competitor" and do an ICO for it. 🤔” - Tweet, 4/13/19

Beneath this tweet, Zhu said the following while posting a screenshot of the FTT white paper:

“Last time they pressured my biz partner to get me to delete the tweet. They started doing this ICO after they couldn't find any more greater fools to borrow from even at 20%+. I get why nobody calls out scams early enough. Risk of exclusion higher than return from exposing.” - Tweet, 4/13/19

Additionally, FTT could be used as collateral in the FTX cross-collateralized liquidation engine. FTT received a collateral weighting of 0.95, whereas USDT & BTC received 0.975 and USD & USDC received a weighting of 1.00. This was true until the collapse of the exchange.

FTT ICO

FTX spun up the FTT token ICO and raised seed rounds for $0.10 and $0.20 while FTX was bootstrapping. Of the 350,000,000 total FTT tokens, the company gifted itself 175,000,000 of the total supply that unlocked over a three-year period.

In particular, as per the FTX website, the 50% premined allocation of FTT that FTX received was meant to be used for the following purposes:

5% - Backstop Fund

Funds set aside in case traders run into bankruptcy.

5% - Safety Fund

Funds set aside in case there are platform losses.

20% - FTT Liquidity Fund

Funds used to provide liquidity in FTT markets.

20% - Team Tokens

Tokens given to project employees.

5% - Adviser Tokens

Tokens given to advisers of FTX.

25% - Company Tokens

Funds locked up over a 3-year period, like the rest of the company tokens.

10% - Ecosystem Fund

Funds used to grow the FTX ecosystem.

10% - User Acquisition Fund

Funds used to help grow the userbase and volume on FTX.

In reality, this was just a long form way of saying that FTX was attempting monetary alchemy; a way of creating nothing from something. When FTT trading launched on FTX, the spot price per token was $0.10 and finished the day trading at $1.60. For the FTX team, they found themselves sitting on hundreds of millions worth of “locked FTT.”

If only they knew that this modern attempt at alchemy would invariably lead to their downfall.

FTT Futures

Interestingly, the FTX team held off on launching FTT perpetual swaps, which was an oddity considering their listing of spot and futures markets for seemingly every other token. Zhu Su once again questioned the delay in launching FTT futures in a series of responses to SBF:

“@SBF_FTX … When do you plan to launch FTT/USDT perps, and any reason for the delay? Might be easier if I just wait for that if it's soon.”- Zhu Su tweet, 7/30/19

“I'd prefer to wait for your FTT/USD derivatives to launch so I can short perps. Is there any ETA on that?” - Zhu Su tweet, 7/30/19

“When will FTT/USD perps launch? That seems like the smoothest way to make this bet, and you already have the tech to launch perps on just about anything. That way the fans can go long also and liquidate my shorts at $4 :)” - Zhu Su tweet, 7/30/19

As we will cover more in-depth shortly, a key feature in the Alameda/FTX scheme was the launch of tokens with extremely bloated FDVs (fully diluted valuations) with low floats at launch. The small amount of tokens that are in circulation are thus extremely easy to pump in price. Similarly, the existence of only a spot market without perpetual swap futures eliminates the ability for others to short and/or hedge their token allocations.

FTT To Directionally Trade

Fast-forward to 2020, and the crypto market has recently gotten obliterated as the March 2020 financial market crash occurred as a result of the pandemic-induced lockdowns. The narrative for bitcoin started to strengthen as the massive fiscal and monetary stimulus that followed the lockdowns had investors looking for a safe haven from monetary debasement. Tangentially, in the land of “crypto,” a phenomenon that later became known as “DeFi Summer'' emerged, whereas the protocols built on Ethereum that allowed for borrowing and lending into pools of collateral emerged. These protocols allowed you to pledge various ETH-based assets as collateral, and borrow stablecoins (or other assets) in return, with variable rates based on the supply and demand for lending.

Alameda Research, with FTT collateral that was almost entirely illiquid and owned by themselves, began to use their massive pile of FTT as collateral to short other tokens. Given that there was very little liquidity in FTT, and almost no outstanding float except for their ownership and some owned by friendly VC firms, the token price of FTT itself was nearly impossible to budge.

This dynamic sent alarm bells off throughout the DeFi ecosystem, due to the uncompetitive nature of using your own illiquid exchange token as collateral for directional trading.

Source: Spencer Noon

This was among the first examples of Alameda directionally trading using the FTX exchange token as underlying collateral. Here, you can find a thread of SBF defending these actions (using FTT on Cream Finance to borrow DeFi tokens to short sell) at the time.

The FTX/Alameda Token Model

Source

Another stage in the Alameda/FTX scheme was more monetary alchemy, in the form of their own DeFi ecosystem, built on Ethereum competitor, Solana.

(It should be noted that was announced before the Cream Finance debacle.)

Serum

“Crypto exchange FTX has announced plans to launch a decentralized exchange (DEX), called Serum, built on the Solana blockchain within the next few weeks. FTX CEO Sam Bankman-Fried and crew selected Solana over Ethereum because it’s reportedly more scalable and cost-efficient than its counterpart. But the team intends to integrate a cross-chain gateway between Serum and the Ethereum network that will provide an entry point for current DeFi users to start trading on Serum.” - Messari, 7/20/20

While the supposed advantage of using Solana over Ethereum was one of speed and efficiency, it was clear to outside observers that this was simply a ploy to print tokens out of thin air that could later be sold for an aggressive markup price.

“Of the 10 billion SRM supply, the Serum team and contributors kept 43% and sold 3% in a private sale that has raised ~$7 million to date. The remaining tokens will be split evenly between a collaborator fund and ecosystem incentives fund.” - Messari, 7/20/20

Serum (SRM)’s seed round price for private investors was $0.05, then secondary seed round price was $0.08 to buy a “megaserum.”

Upon listing on FTX, SRM opened at a price of $0.11 and finished the day at $1.55, a massive move that got people talking about the potential for an “Ethereum killer” DEX. SRM continued to pump, reaching $2.70 before its perpetual swap contract was listed on FTX. Serum, similar to many of the other “Sam coins” (in reference to an Alameda/FTX backing) as many began to refer to them as, carried an extremely high fully diluted market cap relative to the current circulating supply. Even today, approximately 3% of SRM’s total supply is in circulation. This is why the existence of perpetual swaps for these tokens is/was so key. With perpetual swaps, locked coins could be initially sold/hedged via short leverage, with any form of underlying collateral.

SRM Current supply relative to its max supply, via CoinMarketCap

FTX/Alameda also aggressively promoted the “assets” OXY and MAPS, both of which had similar dynamics to SRM in terms of its low float/massive fully diluted valuation, along with the launch of spot markets only on FTX (which was an oddity compared to normal FTX operations).

Shown in the screenshot below is the promotion of both OXY, MAPS, and Serum by FTX in late 2020.

Source: Twitter

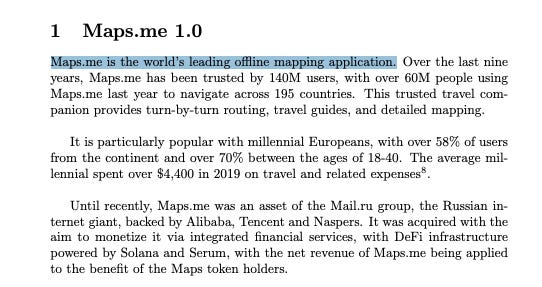

For those curious about the stated purpose of OXY and MAPS:

OXY: A DeFi protocol that matches borrowers and lenders built on Solana.

MAPS: A maps application with a DeFi wallet built in. No, seriously.

For anyone that is looking for a good laugh, check out the MAPS whitepaper.

“Today, Maps.me is launching the MAPS token. And later this quarter, http://Maps.me is integrating a Serum-based wallet for all of its 100m+ users.” SBF, 1/25/21

“An offline mobile map for travelers has raised $50 million in a funding round led by Alameda Research. Announced Monday, the fresh capital will go toward the launch of a multi-currency wallet on Maps.me and enable a decentralized finance (DeFi) ecosystem on the platform.

Cryptocurrency lender Genesis Capital and institutional cryptocurrency firm CMS Holdings also participated in the round.” - CoinDesk, 1/17/21

So how did the tokens trade upon their launch on FTX? The results are shown in chart form below:

The fully diluted market cap of OXY is 245x times higher than current market cap, with a fully diluted valuation on FTX of $44,600,000,000 the day of listing price, with a market cap of approximately $182 million.

For MAPS, the fully diluted market cap 219.7x times higher than current market cap, with a fully diluted valuation of $5,500,000,000 (~$25m market cap) on the day that FTX listed spot MAPS trading, and $11,000,000,000 (~$50m market cap) the day of perpetual swaps listing price.

TLDR: Pump and dump vaporware.

“At times, there did not appear to be much of a firewall between the businesses. Alameda was supposed to operate out of a separate office, but a guest who visited FTX’s complex in recent months said Ms. Ellison had been sitting within view of computers displaying the exchange’s trading data.” - NYT, How Sam Bankman-Fried’s Crypto Empire Collapsed, 11/14/22

FTX had a backdoor built into the exchange that allowed for Alameda Research to access FTX user funds without alerting auditors - FTX Insider, Link to Twitter Thread

Maps perps started trading on March 17th, while Maps spot started trading on

“An offline mobile map for travelers has raised $50 million in a funding round led by Alameda Research. Announced Monday, the fresh capital will go toward the launch of a multi-currency wallet on Maps.me and enable a decentralized finance (DeFi) ecosystem on the platform.

Cryptocurrency lender Genesis Capital and institutional cryptocurrency firm CMS Holdings also participated in the round.” - CoinDesk, 1/17/21

Now you may be thinking, what if FTX/Alameda simply just took bets on things that didn’t turn out to be? Wrong.

SBF was well aware of the pump-and-dump scheme that was being played. Interested readers should listen to/read Sam describing “yield farming” on a podcast appearance with Joe Weistenthal and Matt Levine.

“It doesn't do anything but let you put things in it if you so choose. And then this protocol issues a token, we'll call it whatever, ‘X token.’ And X token promises that anything cool that happens because of this box is going to ultimately be usable by, you know, governance vote of holders of the X tokens. They can vote on what to do with any proceeds or other cool things that happen from this box. And of course, so far, we haven't exactly given a compelling reason for why there ever would be any proceeds from this box, but I don't know, you know, maybe there will be, so that's sort of where you start.

And then you say, alright, well, you’ve got this box and you’ve got X token and the box protocol declares, or maybe votes by on-chain governance, or, you know, something like that, that what they're gonna do is they are going to take half of all the X tokens that were re-minted. Maybe two thirds will, two thirds will offer X tokens, and they're going to give them away for free to whoever uses the box. So anyone who goes, takes some money, puts in the box, each day they're gonna airdrop, you know, 1% of the X token pro rata amongst everyone who's put money in the box. That's for now, what X token does, it gets given away to the box people. And now what happens? Well, X token has some market cap, right? It's probably not zero. Let say it's, you know, a $20 million market …

That's right. So, and obviously already we're sort of hiding some of the magic impact, right? Like some of the magic is in like, how do you get that market cap to start with, but, you know, whatever we're gonna move on from that for a second. So, you know, X tokens [are] being given out each day, all these like sophisticated firms are like, huh, that's interesting. Like if the total amount of money in the box is a hundred million dollars, then it's going to yield $16 million this year in X tokens being given out for it. That's a 16% return. That's pretty good. We'll put a little bit more in, right? And maybe that happens until there are $200 million dollars in the box. So, you know, sophisticated traders and/or people on Crypto Twitter, or other sort of similar parties, go and put $200 million in the box collectively and they start getting these X tokens for it.

And now all of a sudden everyone's like, wow, people just decide to put $200 million in the box. This is a pretty cool box, right? Like this is a valuable box as demonstrated by all the money that people have apparently decided should be in the box. And who are we to say that they're wrong about that? Like, you know, this is, I mean boxes can be great. Look, I love boxes as much as the next guy. All of a sudden people are kind of recalibrating like, well, $20 million, that's it? Like that market cap for this box? And it's been like 48 hours and it already is $200 million, including from like sophisticated players in it. They're like, come on, that's too low. And they look at these ratios, TVL, total value locked in the box, you know, as a ratio to market cap of the box’s token.

And they’re like ‘10X’ that's insane. 1X is the norm.’ And so then, you know, X token price goes way up. And now it's $130 million market cap token because of, you know, the bullishness of people's usage of the box. And now all of a sudden of course, the smart money's like, oh, wow, this thing's now yielding like 60% a year in X tokens. Of course I'll take my 60% yield, right? So they go and pour another $300 million in the box and you get a psych and then it goes to infinity. And then everyone makes money.”

It’s clear that SBF and co. were not truly interested in the technical aspects of the “crypto revolution”, but rather pessimistic realizing the entire charade for what it is, a pump and dump scheme of worthless crypto tokens spun up out of thin air.

Ironically, they failed in historic fashion.

FTT Token

The FTT token was described as the “backbone” of the FTX exchange and was issued on Ethereum as a ERC20 token. In reality, it was mostly a rewards based marketing scheme to attract more users to the FTX platform and to prop up balance sheets. Most of the FTT supply was held by FTX and Alameda Research and Alameda was even in the initial seed round to fund the token. Out of the 350 million total supply of FTT, 280 million (80%) of it was controlled by FTX and 27.5 million made their way to an Alameda wallet.

FTT holders benefited from additional FTX perks such as lower trading fees, discounts, rebates and the ability to use FTT as collateral to trade derivatives. To support FTT’s value, FTX routinely purchased FTT tokens using a percentage of trading fee revenue generated on the platform. Tokens were purchased and then burned weekly to continue driving up the value of FTT.

FTX repurchased burned FTT tokens based on 33% of fees generated on FTX markets, 10% of net additions to a backstop liquidity fund and 5% of fees earned from other uses of the FTX platform. The FTT token does not entitle its holders to FTX revenue, shares in FTX nor governance decisions over FTX’s treasury.

Alameda’s balance sheet was first mentioned in this Coindesk article showing that the fund held $3.66 billion in FTT tokens while $2.16 billion of that was used as collateral. The game was to drive up the perceived market value of FTT then use the token as collateral to borrow against it. The rise of Alameda’s balance sheet rose with the value of FTT. As long as the market didn’t rush to sell and collapse the price of FTT then the game could continue on.

FTT rode on the backs of the FTX marketing push, rising to a peak market cap of $9.6 billion back in September 2021 (not including locked allocations, all the while Alameda leveraged against it behind the scenes. The Alameda assets of $3.66b FTT & $2.16b “FTT collateral” in June of this year, along with its OXY, MAPs, and SRM allocations, were combined worth tens of billions of dollars at the top of the market in 2021.

The price of FTT with a side profile showing FTT trading volume on FTX (logarithmic scale)

FTT Market Cap (logarithmic scale) - Source: CoinMarketCap

CZ Chooses Blood

In one decision and tweet, CEO of Binance, CZ, kicked off the toppling of a house of cards that in hindsight, seems inevitable. Concerned that Binance would be left holding a worthless FTT token, the company aimed to sell $580 million of FTT at the time. That was bombshell news since Binance’s FTT holdings accounted for over 17% of the market cap value. This is the double edged sword of having the majority of FTT supply in the hands of a few and an illiquid FTT market that was used to drive and manipulate the price higher. When someone goes to sell something big, value collapses.

As a response to CZ’s announcement, Caroline of Alameda Research, made a critical mistake to announce their plans to buy all of Binance’s FTT at the current market price of $22. Doing that publicly sparked a wave of market open interest to place their bets on where FTT would go next. Short sellers piled in to drive the token price to zero with the thesis that something was off and the risk of insolvency was in play.

Ultimately, this scenario has been brewing since the Three Arrows Capital and Luna collapsed this past summer. It’s likely that Alameda had significant losses and exposure but were able to survive based on FTT token loans and leveraging FTX customer funds. It also makes sense now why FTX had an interest in bailing out companies like Voyager and BlockFi in the initial fallout. Those firms may have had large FTT holdings and it was necessary to keep them afloat to sustain the FTT market value. In the latest bankruptcy documents, it was revealed that $250 million in FTT was loaned to BlockFi.

With hindsight, now we know why Sam was buying up all of the FTT tokens he could get his hands on every week. No marginal buyers, lack of use cases and high risk loans with the FTT token were a ticking time bomb waiting to blow up.

How It All Ends

After pulling back the curtain, we now know that all of this led FTX and Alameda straight into bankruptcy with the firms disclosing that their top 50 creditors are owed $3.1 billion with only a $1.24 cash balance to pay it. The company likely has over a million creditors that are due money.

The original bankruptcy document is riddled with glaring gaps, balance sheet holes and a lack of financial controls and structures that were worse than Enron. All it took was one tweet about selling a large amount of FTT tokens and a rush for customers to start withdrawing their funds overnight to expose the asset and liability mismatch FTX was facing. Customer deposits weren’t even listed as liabilities in the balance sheet documents provided in the bankruptcy court filing despite what we know to be around $8.9 billion now. Now we can see that FTX never had really backed or properly accounted for the bitcoin and other crypto assets that customers were holding on their platform.

It was all a web of misallocated capital, leverage and the moving of customer funds around to try and keep the confidence game going and the two entities afloat. As written by The Block, Sam explains it in a much different way:

“According to Bankman-Fried, FTX had around $60 billion in collateral and $2 billion in liabilities this spring, but a market crash meant the collateral's value was reduced to half. The drying up of credit in the industry meant FTX's collateral was worth around $25 billion, though liabilities jumped to $8 billion. Another crash in November "led to another roughly 50% reduction in the value of collateral over a very short period of time," at $17 billion at the time. Then a bank run, caused by what Bankman-Fried called "attacks" in November, reduced the collateral to $9 billion, he said.”

$60 billion in collateral doesn’t evaporate overnight. The truth is that it was never even collateral but rather just a pile of overinflated and overstated supply token schemes that were always destined to unwind given the right market spark. Add on layers of speculative trading,leverage, custody and lending relationships covered in counterparty risk and you end up with the massive fallout and cleansing of an entire industry. We’re not yet finished in seeing the domino effect from other institutions that will fall or be severely impacted in the wake of the FTX collapse.

Source: Messari

Most of the bull run in broader cryptocurrencies throughout 2020 and 2021 was simply layers of obfuscated leverage and financial engineering presented as “blockchain innovation”.

Sam Bankman-Fried’s empire was built on liquidity, leverage, and lies.

Modern-day alchemy, unsurprisingly, failed.

END.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Nice article.

We will watch a movie about it soon 🙃