A Tale of Tail Risks: The Fiat Prisoner’s Dilemma

Global central banks have manipulated the cost of risk in a competition of devaluation, leading to unsustainable debt and leverage. Is bitcoin the solution to the inevitability of fiat debasement?

Relevant Past Articles:

The Prisoner’s Dilemma

To start today’s piece, we are going to quote a masterful macroeconomic framework put forward by Artemis Capital Management. The piece, titled “Volatility And The Allegory Of The Prisoner’s Dilemma,” was written in October 2015, yet its prescience and relevance to the current environment cannot be overstated.

The 52-page article, which includes a wide variety of metaphors, graphics and financial data points, clearly maps out the macroeconomic environment we find ourselves in today.

“Global Capitalism is trapped in its own Prisoner’s Dilemma; fourty four years after the end of the Bretton Woods System global central banks have manipulated the cost of risk in a competition of devaluation leading to a dangerous build up in debt and leverage, lower risk premiums, income disparity, and greater probability of tail events on both sides of the return distribution. Truth is being suppressed by the tools of money. Market behavior has now fully adapted to the expectation of pre-emptive central bank action to crisis creating a dangerous self-reflexivity and moral hazard. Volatility markets are warped in this new reality routinely exhibiting schizophrenic behavior. The tremendous growth of the short volatility complex across all assets, combined with self-reflexive investment strategies, are creating a dangerous ‘shadow convexity’ that will fuel the next hyper-crash. Central banks in the US, Europe, Japan, and China now own substantial portions of their own bond or equity markets. We are nearing the end of a thirty year ‘monetary super-cycle’ that created a ‘debt super-cycle’, a giant tower of babel in the capitalist system. As markets now fully price the expectation of central bank control we are now only one voltage switch away from the razors edge of risk. Do not fool yourself - peace is not the absence of conflict – peace can exist on the very edge of volatility.

“Prisoner’s Dilemma describes when two purely rational entities may not cooperate even if it is in their best interests to do so, thereby replacing known risks for unknown risks. In an arms race when two superpowers possess the ability to destroy each other, the optimal solution is disarmament and peace. If the superpowers do not trust one another completely, the natural course of action is proliferation of conflict through nuclear armament despite great peril to all. This non-cooperation, selfishness, and conflict, ironically results in an equilibrium of peace, but with massive risk.

“Global central banks are engaged in an arms race of devaluation resulting in suboptimal outcomes for all parties and greater systemic risk. In this year alone 49 central banks have cut rates or devalued their currencies to gain a competitive edge and since 2008 there have been over 600 rate cuts worldwide(2). Globally we have printed over 14 trillion dollars since the end of the financial crisis(3) . The global economy did not de-leverage from the 2008 crash but instead doubled down as global debt has increased a staggering 40% since 2007(4) . The pace of global growth is slowing with the World Bank lowering GDP projections from 3% to 2.5%, and emerging economies from China to Brazil are struggling(5). Global currency reserves outside the US have declined over $1 trillion USD from their peak in August 2014 as foreign central banks have sold dollars to offset the ill effects of capital flight and commodity declines(6) . The last time the world economy experienced declines in reserves of this magnitude was right before the crash of 2008. Cross-asset volatility is rising from the lowest levels in three decades yet markets remain complacent with the expectation that central banks will always support asset prices. Volatility regime change is happening now and is a bad omen for a global recession and bear market.

“As global central banks compete in an endless cycle of fiat devaluation an economic doomsday clock ticks closer and closer to midnight. The flames of volatility regime change and an emerging markets crisis ignited on the mere expectation of a minor increase in the US federal funds rate that never came to be. The negative global market reaction to this token removal of liquidity was remarkable. Central banks are fearful and unwilling to normalize but artificially high valuations across asset classes cannot be sustained indefinitely absent fundamental global growth. Central banks are in a prison of their own design and we are trapped with them. The next great crash will occur when we collectively realize that the institutions that we trusted to remove risk are actually the source of it. The truth is that global central banks cannot remove extraordinary monetary accommodation without risking a complete collapse of the system, but the longer they wait the more they risk their own credibility, and the worse that inevitable collapse will be. In the Prisoner’s Dilemma, global central banks have set up the greatest volatility trade in history.

Upcoming Twitter Spaces: Bitcoin Magazine PRO is excited to welcome special guest Matthew Pines on Monday, Dec 19 at 4:00 pm ET. Click below to set your reminder so you don’t miss out.

“A pre-emptive war describes a violent action designed to eliminate a perceived threat before it even materializes. Since 2012, the Federal Reserve have been engaged in a pre-emptive war against financial risk, and other central banks are forced to follow suit in a self-reinforcing cycle of devaluation and a mad game of Prisoner’s Dilemma. This unofficial, but clearly observable policy has the unintended consequence of socializing risk for private gain and introduces deep ‘shadow’ risks in the global economy.

“Pre-emptive central banking is a very different concept than the popular idea of the ‘central bank put’. The classic ‘central bank put’ refers to policy action employed in response to, but not prior to, the onset of a crisis. Rate cuts in 1987, 1998, 2007- 2008, and Quantitative Easing I and II (‘QE’) programs were a response to weak economic data, elevated financial stress, and large drawdowns in credit and equity markets. To differentiate, pre-emptive central banking refers to monetary action in anticipation of future financial stress to avert a market crash before it starts, even if markets appear healthy and volatility is low. In executing a pre-emptive strike on risk, policymakers rely on changes in faster moving market data (e.g. 5yr-5yr breakeven inflation) rather than slower moving fundamental economic data (e.g. CPI and unemployment). Although well intentioned, their actions have created dangerous self-reflexivity in markets by artificially suppressing volatility and encouraging rampant moral hazard. Central banks have exchanged ‘known unknowns’ for ‘unknown unknowns’ creating the potential for dangerous feedback loops. A central bank reaction function is now fully embedded in risk premiums. Markets are pricing the supportive policy response before action is even taken. Bad news is good news and vice versa because the intervention is more important than fundamentals. Preemptive strikes on risk are contributing to the massive growth and popularity of any asset or strategy with a short convexity or mean reversion return profile. The unintended consequences of this massive short convexity complex will be born from phantom liquidity, shadow gamma, and self-reflexivity. In the past year alone, we have experienced 10+ sigma movements in the CBOE VIX index, US Treasury Yields, German Bunds, Oil, Chinese Equity Markets, and the Swiss Franc. Markets continue to exhibit bi-polar behavior as they struggle to gauge the level of anticipated forward invention by central banks against declining global growth.”

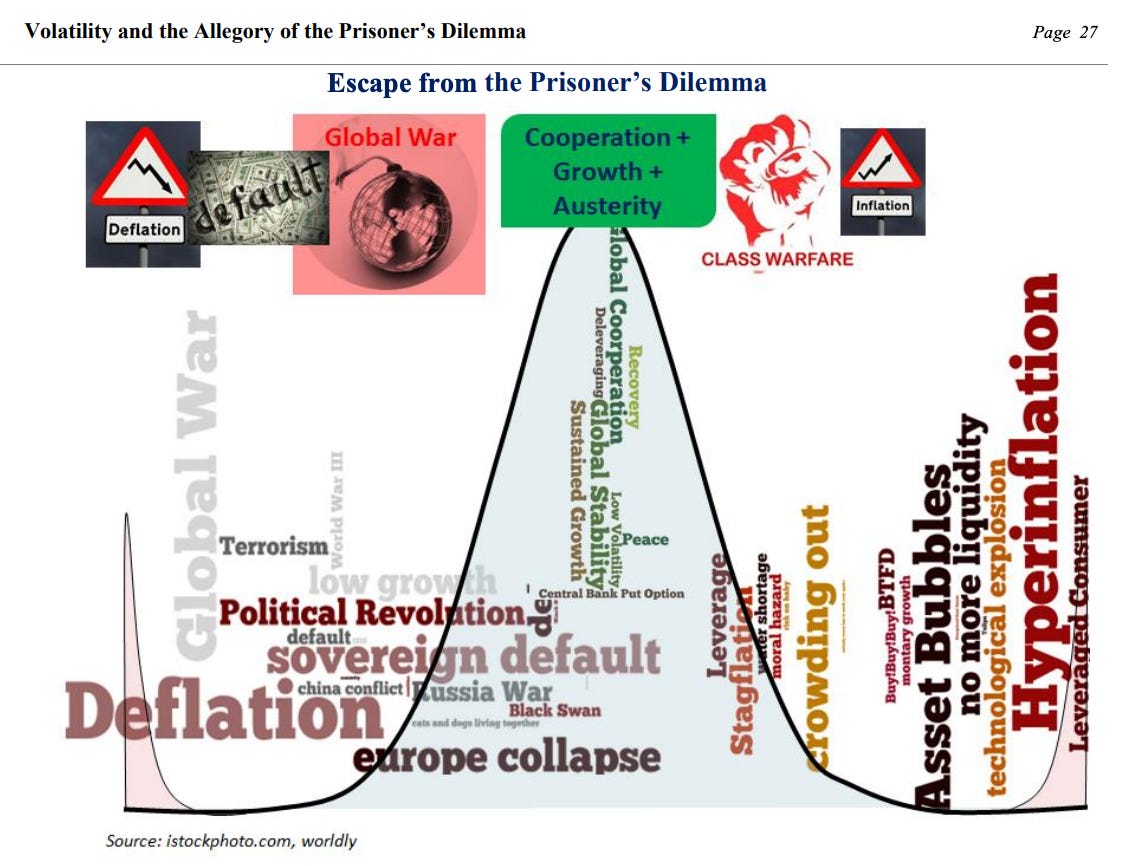

In essence, the paper argued that the suppression of risk and volatility post Global Financial Crisis actually transformed and transmuted that risk into fat tail outcomes in the form of deflationary busts or hyperinflationary crack up booms.

“Global equities are dependent on monetary expansion to justify elevated valuations in the regime of the Prisoner’s Dilemma. US stocks achieved the highest median price-to-earnings ratio in postwar history earlier this year and timetested valuation metrics like 10-year cyclically adjusted PE ratios, enterprise value to EBITDA, market value to replacement value, and price-to-sales ratios are on par with pre-crash periods like 2000, 2007 and 1928 (see ‘Deep Value’ and ‘Quantitative Value’ by Carlisle for good overview). Last year 95% of corporate earnings were spent on share buybacks which increased stock prices but did nothing to encourage fundamental growth or create middle class jobs(16) . This is the only multi-year bull-market in history whereby trade volumes are declining rather than increasing. Some investors claim stocks are in a new paradigm, an age of central bank omnipotence, where long-term valuation metrics no longer matter.

“We have heard this fluff before, in 1928, in 1999, all the way back to 1716 with John Law in France(17) – the original quantitative easing expert long before Bernanke, Yellen, Draghi, and Kuroda. It’s different this time works very well if you need to rationalize how to beat your return benchmark next quarter or win an election. Denial is not a trait you find in great investors. Beginning in 2012 a sharp divergence emerged between the performance of commodities and global equity prices (see red vs. green arrow in graph). From the date of Bernanke’s Jackson Hole speech the CRB Commodity index is down -38.6% while global equities are up +28.6%. The truth is that central banks cannot manipulate raw supply and demand the way they can financial assets. The global commodity super cycle is broken due to slower global growth, but risk assets continue to rise, showing an ominous divergence between the real economy and the surreal economy.”

Related: Bitcoin Magazine PRO’s “The Everything Bubble: Markets At A Crossroads.”

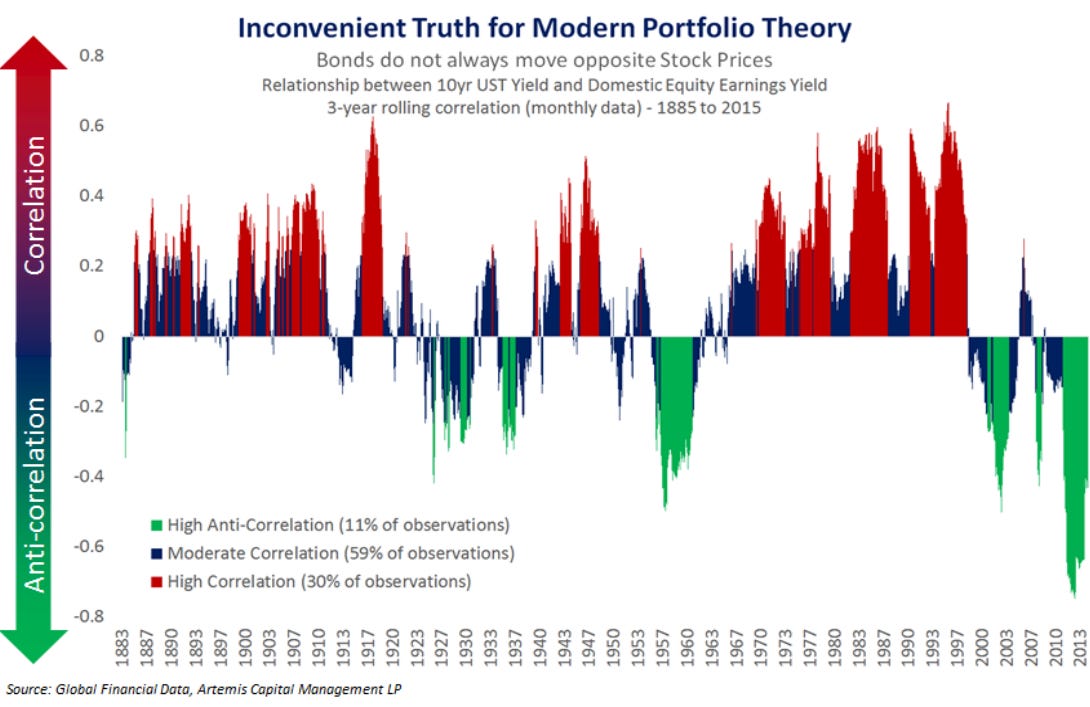

“The entire global financial system is leveraged to the theory that stocks and bonds are always anti-correlated. Risk parity funds currently manage approximately $1.4 trillion of notional exposure based on this theory (including leverage)(19) . It is impossible to estimate how many trillions of dollars are managed according to the simple 60/40 mantra… but let us just assume something north of $1.4 trillion and something south of ‘more money than God’. Given the unfathomable amount of assets leveraged to this simple relationship, I decided to test the anti-correlation between equity and fixed income, or positive correlation between yields and stock prices, based on over 132 years of price data. The truth about the historical relationship between stocks and bonds is scary. Between 1883 and 2015 stocks and bonds spent more time moving in tandem (30% of the time) than they spent moving opposite one another (11% of the time). It is only during the last two decades of falling rates, accommodative monetary policy, and globalization that we have seen an extraordinary period of anti-correlation emerge between stocks and bonds unmatched by any other regime in history. Not only are stocks and bonds positively correlated most of the time but also there is a precedent for multi-year periods whereby both have declined.

“In the event stocks and bonds simultaneously lose value, the classic 60/40 portfolio will become a 100% loser and volatility will be the only asset class that is capable of protecting your portfolio.”

The paper goes into depth about how inflation volatility will lead to the 60/40 correlation crises, which investors in today's current market regime have just barely begun to grapple with.

“The $1.4 trillion dollar question is… what would cause the relationship between stocks and bonds to completely melt down?

“The volatility of inflation appears to be a core driver of higher correlation between stocks and bonds. When inflation, as gauged by the consumer price index, is more volatile we tend to experience higher levels of stock and bond correlation as evidenced by data from 1885 to 2015. The early part of the 20th century, which experienced the most debilitating periods of stock and bond underperformance, was a period of wild fluctuations between inflation and deflation. The last three decades of extraordinary anti-correlation has been an era of falling rates, globalization, accommodative monetary policy, and very low volatility of CPI. The global economy is now at the zero bound whereby the effectiveness of competitive devaluations is coming into question.

“It is not hard to imagine a regime whereby central banks lose credibility or are not capable of moderating swings in inflation in a way consistent with the past three decades. Any period of sustained correlation failure will result in rising volatility and selling pressure across bonds and stocks in a self-reflexive cycle.”

Here we find ourselves in 2022, with bonds down 45% in purchasing power since 2020, and the first period of positive stock/bond correlations to the downside in every investor’s memory.

“The global economy is suffering from a cancer of debt-deflation, income inequality, and low growth. Instead of treating the root cause, policy makers have treated the symptom of asset price declines. Whenever the patient feels weak an increasing amount of policy drugs are required to maintain the illusion of stability to the point where the patient is addicted to the painkillers. The root cause of the cancer is never confronted and as a result, the fundamental health of the patient does not improve. Neither the doctors nor the patient wish to face the reality that difficult and painful therapy is needed to destroy the cancerous leverage in the system. The inevitable result of this denial will be the death of the patient. In all instances, policy intervention has generated a short-term market fix at the expense of addressing the longer-term fundamental problems.”

As we continue to reference the bursting of the “global everything bubble,” this is what we are referring to. We are in the bursting process as inflation rears its ugly head, surging to the highest level since the ‘70s.

As investors grapple with hawkish central bank policy in the interim, the system is no closer to a return to sustainability. If anything, tightening interest rate policy with global debt burdens this high is going to result in a major economic shock for the global economy. The belt is tightening in a massive way and will ultimately result in the policy pendulum swinging back much harder in the opposite direction.

For readers interested in diving into the fuel piece in all of its depth, here is a link to “Volatility And The Allegory Of The Prisoner’s Dilemma.”

Bitcoin And FOMC Meetings

Now for a return to some of the recent market developments across the macro landscape. This week was one of the biggest weeks for economic data and new releases before the end of the year. In response, we’re seeing weakness in both equities and bitcoin headed into the weekend. After a ramp up in the bitcoin price leading up to the U.S. CPI data release and the December FOMC meeting, those gains are now turning over. Although not always the outliers, the days surrounding CPI releases and FOMC meetings have been some of the most volatile of the year.

A relationship that has held up well since March 2020 is the ratio of high beta versus low beta equities and bitcoin. They track nearly the same trajectory as this ratio reflects current weight and positioning of higher risk assets compared to lower risk (and lower volatility) assets in the market. Although decoupling some in the latest effects of the FTX contagion, this ratio is starting to turn over yet again as bitcoin looks to test below $17,000.

Is the top in sovereign debt yields in? It’s not looking that way as yield curve inversions and the spread in yields across EU countries start to widen further, especially the Italian-German yield spread that’s been closely monitored by the European Central Bank (ECB). Overall 10-year yields across the eurozone are on the rise and nearing recent October highs after ECB announcements of attempted quantitative tightening (QT) to kick-off in February 2022.

It’s the inflation picture that’s worsening — or at least the realization of entrenched inflation by central banks that’s worsening. Announced just this week, the ECB forecasts core inflation at 4.2% through 2023, the Bank of Italy forecasts inflation at 7.3% through 2023 and Germany’s Bundesbank forecasts 7.2% inflation through 2023. Those are just a few examples, but it’s the same story across every EU country. The EU picture may be a precursor for what could happen in the United States as risks of sustained inflation rise on the backs of China’s reopening policies and a resurgence in global energy prices.

We are still of the belief that the worst is to come for asset prices and the real economy. The lag response of monetary policy tightening is just beginning to be priced in. While the Fed attempts to jawbone markets lower to decrease inflationary pressures, conditions in the real economy continue to deteriorate under the surface.

In the short term, where the liquidity goes, bitcoin goes. Thus, we remain cautious on our short-term outlook for the bitcoin exchange rate. As described in the “Volatility And The Allegory Of The Prisoner’s Dilemma,” the unique dynamic of unserviceable debt burdens, falling financial asset prices and a debasing currency can lead to devastating societal outcomes. Our view over the long term is that bitcoin can serve as a solution to the inevitability of fiat debasement in the incumbent credit-based economy.

Central banks, in an attempt to ease economic conditions and financial markets, have embedded hidden tail risk at the societal level. The scary realization for many is that it just might mean that the tail risks are a deflationary bust and/or a hyperinflationary impulse; these might be the only two outcomes.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

This was a doozy. Ngl, when I read shit like convexity and high beta/low beta I feel retarded. Solid read though. I did read that article years ago and it went completely over my head. This article definitely clears some of it up. Thanks , boys. I’ll keep buying cheap Bitcoin in the mean time.

Very well written article by the Bitcoin Magazine team. Thanks and keep up the good work:)