Preview: 2022 Year In Review

A year-end retrospective from Bitcoin Magazine PRO with a view of on-chain data, hash rate and mining metrics, public mining equities and the larger macroeconomic landscape.

Related Past Articles:

This is a preview of the “2022 Year In Review.” The full report has been released to paid-tier Bitcoin Magazine PRO subscribers. If you would like to view the report in full, upgrade your subscription or claim your 30-day free trial of our paid tier.

Compared to past cycles, 2022 looks just like any of the previous downtrend years with the bitcoin price down over 70% from the recent all-time high. Yet, 2022 is not like any other bitcoin cycle. Bitcoin now faces the headwinds of a global macroeconomic recession, a once-in-a-century performance for sovereign debt, rising persistent inflation around the globe and the popping of the global everything bubble that has affected nearly every asset, especially those further out on the risk curve. Somehow though, Bitcoin is once again “not dead.” Let’s zoom out and take a deeper look at the 2022 data relative to past years and see why the Bitcoin network is stronger than ever.

In terms of annual returns, bitcoin is down 64.49% this year while the S&P 500, bonds and gold are down 19.90%, 28.94% and 2.29%, respectively. Bitcoin has historically followed economic cycles and the relationships across financial markets with 2018 being an example. As each year passes and bitcoin’s profile as an asset class grows, bitcoin becomes more closely intertwined with the global liquidity dynamics that affect all markets.

Miner revenue took a beating this year after a euphoric rise in 2021. Public miner stock valuations followed the same path with valuations falling even more than the bitcoin price, all while the Bitcoin network’s hash rate continued to rise. This dynamic of price collapsing with hash rate increasing has pummeled Bitcoin miners’ hash price, total miner revenue per terahash and squeezed miner profit margins after a golden era of mining in 2021. Public miner valuations collapsed across the board with most losing 90% or more in equity valuations this year. Miner revenue in USD terms was down 44% in 2022 after rising 234% in 2021. In BTC terms, revenue was down 6.7% as of December 19.

The pressure on the mining industry likely isn’t letting up anytime soon as the competition only heats up for the continued decline in annual bitcoin issuance. We’re likely to see more mining fallout in 2023 for many reasons, but the bigger story is the continued rise in network hash rate over time. Network hash rate has still yet to see a negative year of growth. Even just using the average annual hash rate value for each year — as hash rate can fluctuate on any given day — network hash rate is still up 51% this year despite a recent decline from all-time highs.

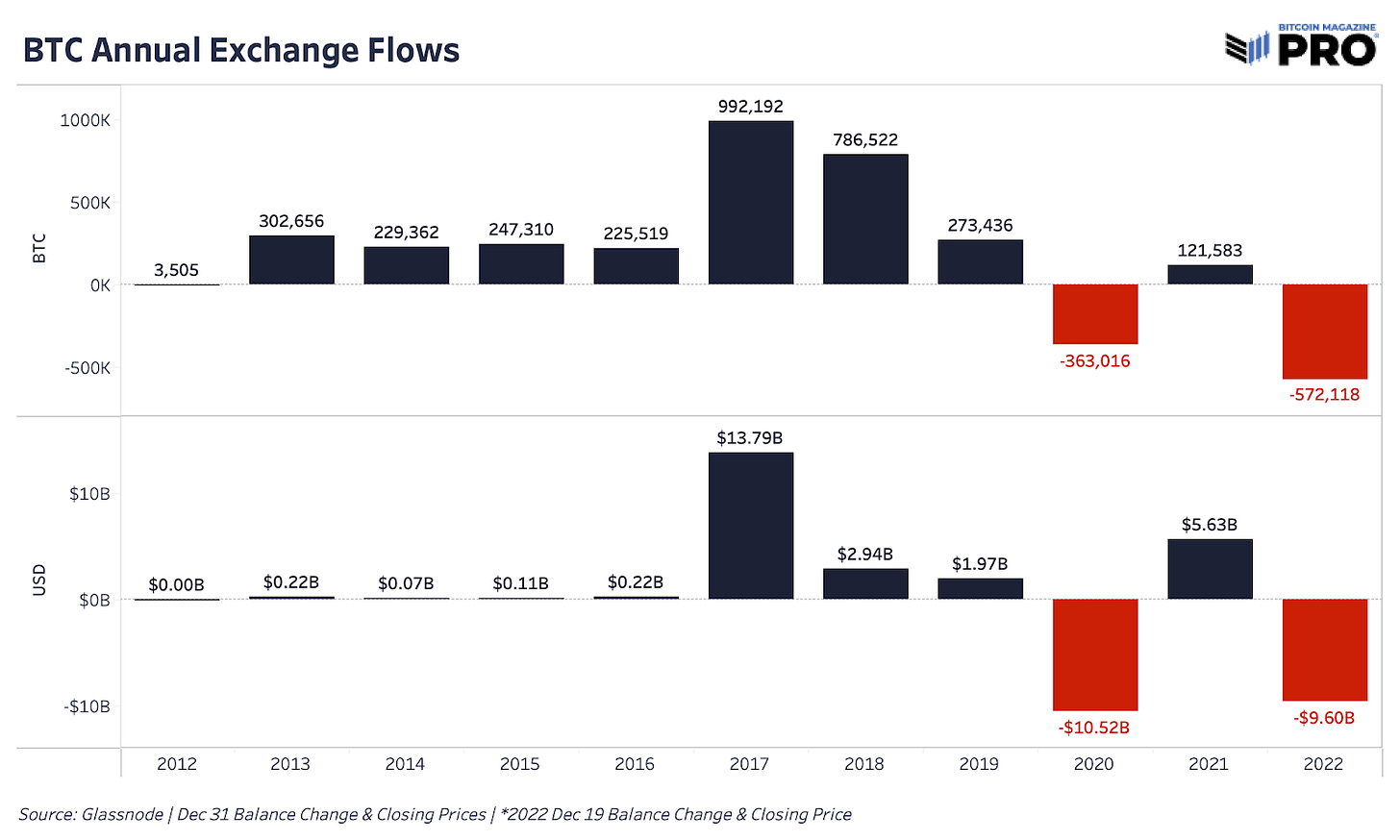

2022 was the year of getting bitcoin off exchanges. Every recent major panic became a catalyst for more individuals and institutions to move coins into their own custody, find custody solutions outside of exchanges or sell off their bitcoin entirely. When centralized institutions and counterparty risks are flashing red, people rush for the exit. We can see some of this behavior through bitcoin outflows from exchanges.

In 2022, 572,118 bitcoin worth $9.6 billion left exchanges, marking it the largest annual outflow of bitcoin in BTC terms in history. In USD terms, it was only second to 2020, which was driven by the March 2020 COVID crash. The Terra/LUNA and FTX (FTT token) crashes were the sparks to drive the outflow trend this year as bank runs and rushes for liquidity ensued. After years of a rising share of circulating supply finding its way onto exchanges, we’re now seeing that trend reversing. 11.68% of bitcoin supply is now estimated to be on exchanges, down from 16.88% back in 2019.

As mentioned above, the two implosions of the year were Terra/LUNA and FTX (FTT token). Between the values of just these two inflated tokens alone, over $50 billion of “value” was wiped out in 2022. This had significant impacts on bitcoin’s price as waves of collateral damage played out in the broader industry. Even though none of these projects have any material impact on the Bitcoin protocol or its growing fundamentals, the unknown leverage in the market and paper bitcoin built on top of these tokens were certainly affected.

Announcement: Thank you to our readers for helping us reach 20,000 subscribers! If you get value from Bitcoin Magazine PRO, please share the newsletter with friends and family and consider upgrading to the paid tier with a 30-day free trial.

In the waves of forced capitulation and liquidations that came through this year, there was heightened demand for transferring bitcoin. With only a few days left of the year, there was over 556 million bitcoin in change-adjusted transfer volume (BTC denominated) that happened on-chain this year, up 102% from 2021. In USD terms, the Bitcoin network settled just shy of $15 trillion in value in 2022.

Despite bitcoin’s price drawdown this year, the number of unique addresses holding smaller amounts of bitcoin continue to grow in rapid fashion. Addresses don’t translate to the number of users, but can act as a rough proxy for overall growth. Unique addresses with bitcoin amounts can be growing as new users acquire bitcoin or as current bitcoin holders use many unique addresses to spread out their holdings — a common privacy practice. Estimating Bitcoin’s total number of users has always been a difficult task and requires leveraging on-chain data and adoption survey data to come up with an estimate.

A more sophisticated view to estimate user growth is to use Glassnode’s estimated entities data which are modeled from proprietary data science techniques that cluster many addresses to a single entity, either an individual or institution.

It’s another imperfect measure, but one that shows us that bitcoin entities grew over 17% in 2022 after consistently growing more than 20% over the last four years. We roughly know that there are over 33 million separate entities with a non-zero bitcoin balance. The number of bitcoin users is likely much higher for many reasons. One of those is that an exchange would be classified as one entity that holds bitcoin on behalf of many users.

This concludes the preview of our full “2022 Year In Review” report which has been released to paid-tier Bitcoin Magazine PRO subscribers. If you would like to view the report in full, upgrade your subscription or claim your 30-day free trial of our paid tier.