PRO Market Keys Of The Week: Tether’s Massive Treasury Portfolio

When Tether’s U.S. Treasury portfolio is compared to nation states, the company is the 24th largest holder of the bonds in the world. Bitcoin transaction fees as a percentage of miner revenue drops.

Relevant Past Articles:

What We’re Watching

Bitcoin 2023 was one for the books! We’re rewatching Dylan LeClair’s main stage appearance at Bitcoin 2023 with Lyn Alden, Preston Pysh and Mark Moss. Check it out below and get your early bird ticket for Bitcoin 2024 in Nashville.

Tether Supply Nears All-Time High

Demand for Tether (USDT) continues to grow at the same time as USDC demand is falling. This trend has really taken shape since USDC issuer, Circle, announced part of their reserves were parked in Signature Bank when it collapsed. The failure of Signature Bank and an increasing appetite for Western regulations in the cryptocurrency industry seems to have forced capital into offshore alternatives. This also comes at a time when Tether recently announced that they will be rolling 15% of operating profits — thanks to money made from higher yielding interest rates — into bitcoin as “excess” reserves. Overall stablecoin supply, including many of the smaller market options, continued to decline this month falling over 6% year-to-date.

Tether’s announcement of future bitcoin purchases with 15% of operating profits comes at a time when Tether’s portfolio is generating more income from its short-duration Treasuries than ever before.

Considering Tether’s stated portfolio in its latest attestation, the company is earning more than $3.5 billion per year passively from it’s short-duration Treasury holdings, which would translate into approximately $550 million of annual bitcoin purchases, to add to its claimed holdings of $1.5 billion worth of bitcoin.

Tether’s CTO Paolo Ardoino said that the firm also has $2.5 billion in excess reserves on top of the company’s stated assets to back its liabilities of issued USDT tokens in order to ease skepticism of the firm’s gold and bitcoin holdings (4% and 2%, respectively).

Tether’s massive Treasury portfolio would size up as the 24th largest among nation states, an impressive feat for a stablecoin issuer that has faced plenty of criticism over the years. Here’s how portfolios of countries around the world compare:

1. Japan: $1,104.4 billion

2. Mainland China: $859.4 billion

3. United Kingdom: $668.3 billion

4. Belgium: $331.1 billion

5. Luxembourg: $318.2 billion

6. Switzerland: $290.5 billion

7. Cayman Islands: $285.3 billion

8. Canada: $254.1 billion

9. Ireland: $253.4 billion

10. Taiwan: $234.6 billion

11. India: $232 billion

12. Hong Kong: $226.8 billion

13. Brazil: $214 billion

14. Singapore: $187.6 billion

15. France: $183.9 billion

16. Saudi Arabia: $111 billion

19. Korea: $105.8 billion

20. Norway: $104.4 billion

19. Germany: $91.3 billion

20. Bermuda: $77.4 billion

21. Netherlands: $73.7 billion

22. United Arab Emirates: $64.9 billion

23. Australia: $62.2 billion

24. Tether: $60.497 billion

25. Mexico: $58.2 billion

26. Thailand: $52.8 billion

While Tether has yet to produce an audit and has only released reserve attestations due to past question marks of potential gaps in its balance sheet, there looks to be a new passive allocator on the bitcoin scene, and one with notable buying power.

Conclusion Of Tightening Cycle?

With the recent strength in the equities market, probabilities are rising for an additional hike in the Fed Funds Rate during the upcoming June FOMC meeting.

Implied Fed Funds futures for September of this year are currently at 5.18%, as the knee-jerk easing reaction that occurred during the Silicon Valley Bank failure has nearly retraced, with yields on six-month Treasury bills now at levels not seen since 2001.

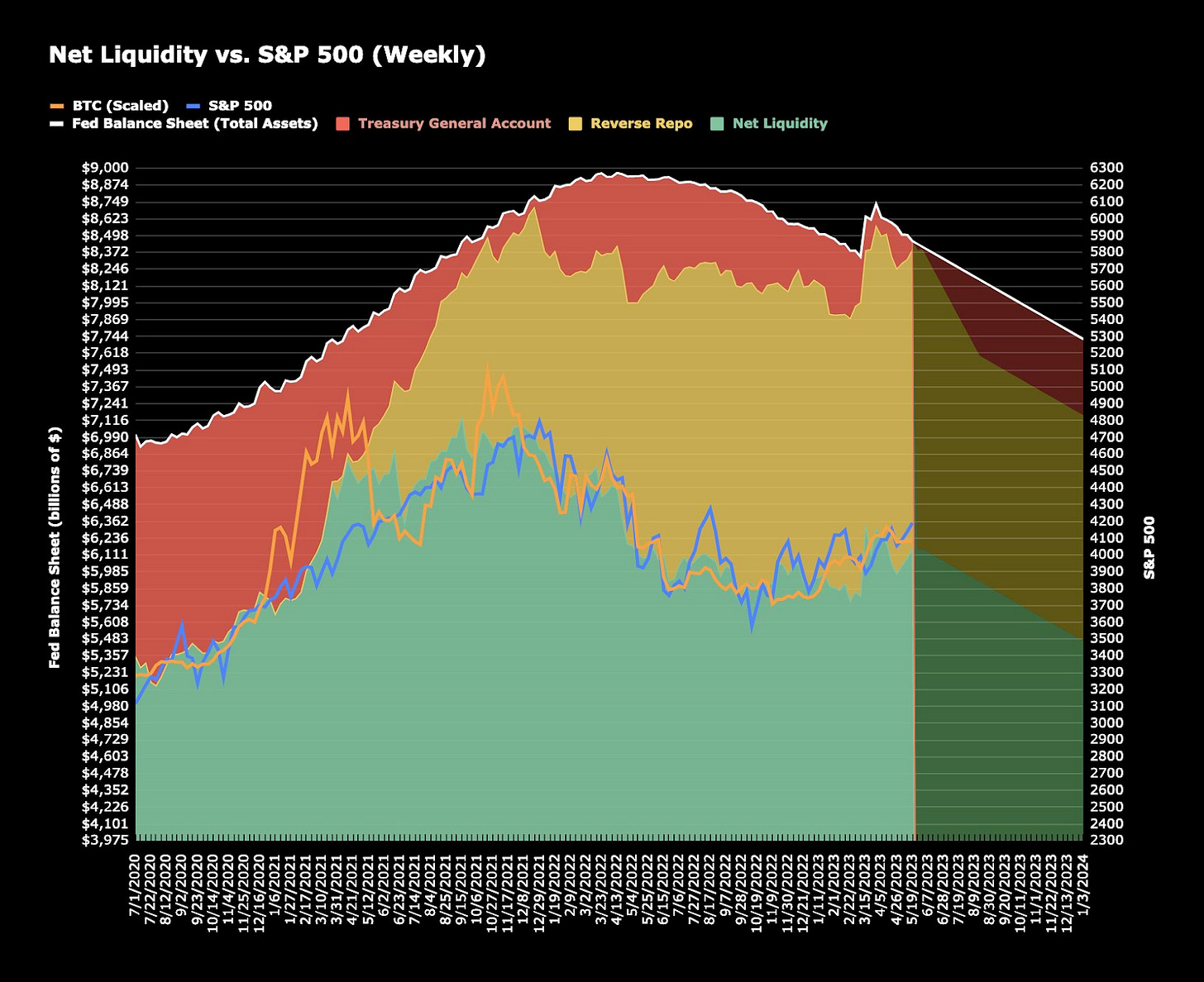

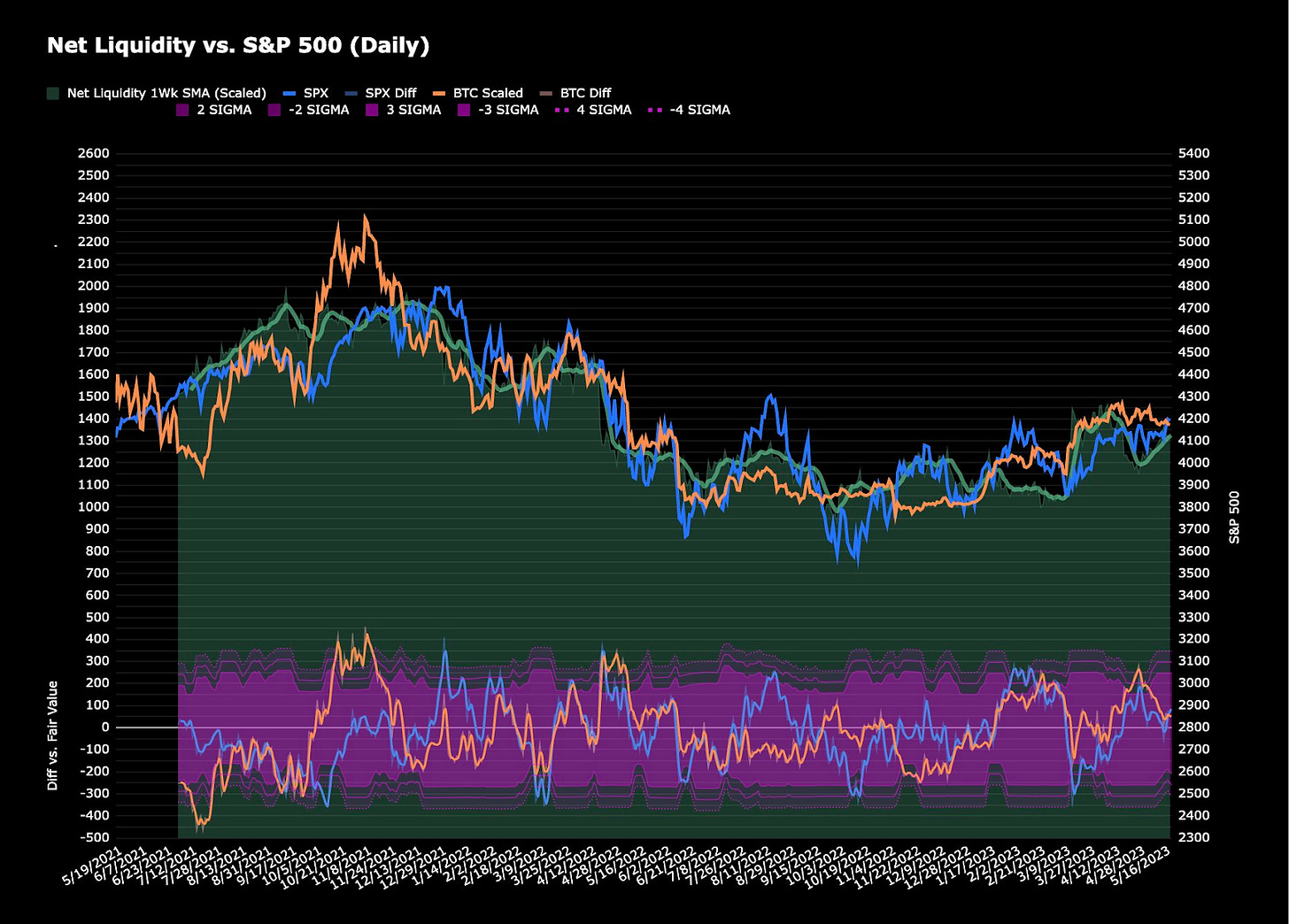

As we have covered in “The Debt Ceiling: It’s Going Up Forever,” the debacle currently unfolding is partly because the Treasury has offset much of the Fed’s quantitative tightening program through a drawdown in the Treasury General Account. Janet Yellen’s Treasury looks to refill its coffers and net liquidity is projected to decrease through year's end, likely resulting in a net drag on risk markets.

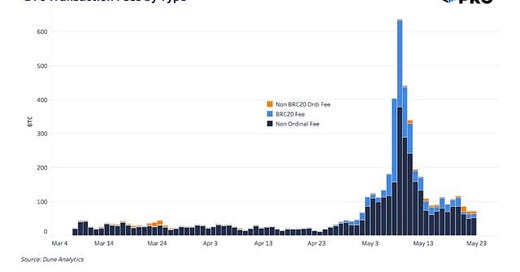

Easing Backlog Of Bitcoin Transaction Fees

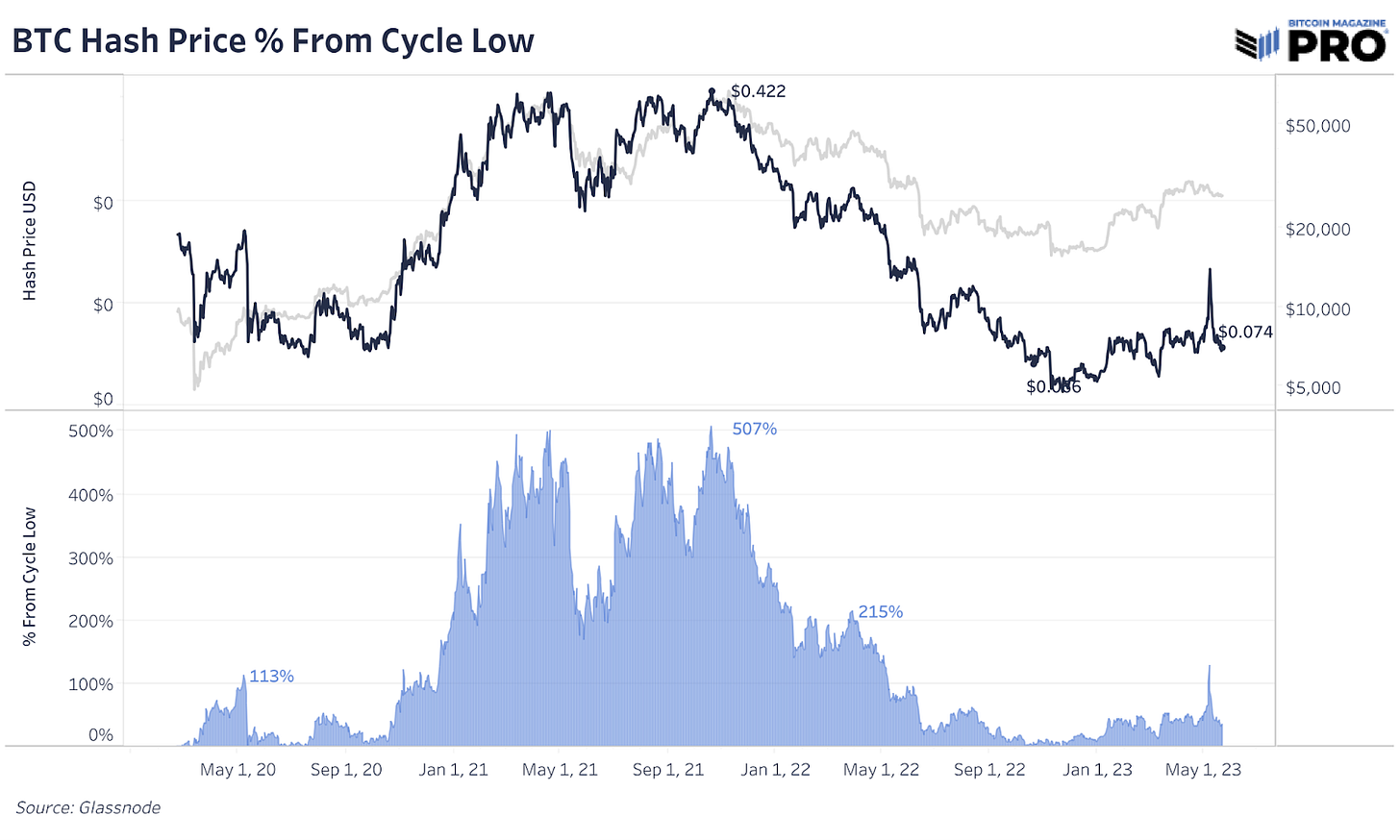

Recent pressure in Bitcoin’s transaction fee market has begun to ease, with fees as a percent of miner revenue over a rolling 24-hour basis falling from over 40% in the last few weeks to just around 7% now. Non-ordinal based fees accounted for 70% of fee revenue over the last 24 hours, from a daily low of under 40%.

While revenue from ordinals has fallen from its astounding highs, it remains a driver in block space and fee pressure, still serving as a tailwind for miner revenue. With fee rates abating, miner revenue per Terahash — which in the midst of the fee spike reached 130% above all-time lows — has fallen back to a mere 35% above all-time lows.

The fee market has been continuously evolving as the craze in ordinals, inscriptions and brc-20 tokens developes. We will continue observing and report further analysis of notable trends.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!