PRO Market Keys Of The Week: 5/1/2023

First Republic Bank fails and JPMorgan Chase comes in for the leftovers. Bitcoin miners welcome the rise in transaction fees from ordinals and inscriptions. Coinbase stock craters in bitcoin terms.

What We’re Watching

Upcoming Economic Calendar:

May 2, 2023

JOLTs Job openings Forecast: 9.775M, Previous: 9.931M

May 3, 2023

10:00 a.m. ISM Services PMI

2:00 p.m. FOMC Statement

2:30 p.m. FOMC Press Conference

May 4, 2023

Nonfarm Productivity (QoQ) Forecast: -1.8% Previous: 1.7%

First Republic Bank Failure

The latest in American bank failures is First Republic Bank (FRC) with JPMorgan Chase set to acquire the distressed bank in a government-led deal. Although not adjusted to comparisons of asset size over time, First Republic Bank is the second largest U.S. bank failure in history,

Source: Bloomberg

The deal involves JPMorgan Chase acquiring approximately $173 billion of First Republic’s loans, $30 billion of securities and $92 billion in deposits, with the firm sharing some $13 billion in losses with the FDIC, of which will be absorbed by the FDIC insurance fund. Interestingly, the deal also includes a new $50 billion five year, fixed-rate term financing to cover the liability shortfall that arose from the bank run, bringing about questions as to where the FDIC will get the money, and the historical precedent of such a move. At the very least, the acquisition further consolidates the banking sector, as JPMorgan’s share of banking deposits continues to grow. CEO Jamie Dimon was quoted as saying, “The system is very, very sound.”

Although JPMorgan offered the best deal in the acquisition process, this doesn’t necessarily make the firm altruistic in any way, the move was made purely from a profit-motive standpoint. As per a presentation on the transaction from JPMorgan, the firm estimates that with the FDIC loss sharing agreement, the deal will bring the bank a 20% internal rate of return while the tangible book value per share grows with interest, raising the firm’s net income.

For readers interested in further details on the acquisition, you can check out the JPMorgan Chase presentation on the transaction here.

All in all, the failure of FRC is yet another sign of an increasingly fragile and concentrated system, one where taxpayers will front the tab through FDIC losses while gains are privatized — JPMorgan Chase has added $10 billion in equity valuation since the announcement of the acquisition.

Read Bitcoin Magazine PRO’s Banking Crisis Survival Guide for more commentary on the banking crises of 2023.

Country Of Bhutan Admits To Mining Bitcoin

Bitcoin mining continues to showcase its global presence with the kingdom of Bhutan confirming that they have been mining bitcoin for the last few years. The mining operations seemed to be led through the state-owned holding company, Druk Holding & Investments.

From the latest Forbes article, “Last year, around $142 million worth of computer chips were imported into Bhutan.” Also, “Bhutan’s Ministry of Finance noted that the country’s total imports soared in 2022, partially due to spending on these chips by Druk Holdings & Investment ‘for special projects.’”

Based on Daniel Batten’s analysis, that puts their share of global hashrate just under 1% with estimates between 1.78 and 3.37 EH/s. That would put the operation on par with the smaller tier of public miner operations. The region has significant stores of hydroelectricity which have been a favorite energy resource for bitcoin miners because of the low cost and opportunity for energy that is typically stranded.

Bitcoin 2023 ticket prices increase FRIDAY at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

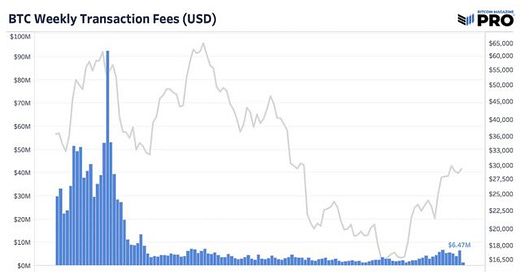

Bitcoin Mining Transaction Fees

Thanks to the recent wave of ordinals and the related inscriptions’ demand for block space, bitcoin miners are enjoying the highest transaction fees since Q2 2021. At the peak in April, transaction fees accounted for over 5% of all bitcoin mining daily revenue. Over the last 365 days, transaction fees have typically been just 2% of total mining revenue (block subsidies and transaction fees). April 30 was the largest day yet for the number of daily inscriptions and fees paid from those inscriptions. Amid slower block times over the last week, there was increased demand for priority in blocks, which drove transaction fees even higher.

Coinbase Craters In Bitcoin Terms

Leading U.S. crypto exchange Coinbase recently filed a lawsuit against the U.S. Securities and Exchange Commission in a bid to approve a rule specific to digital assets. Since then, the company’s stock has fallen to a new all-time low relative to bitcoin. Shares of COIN, which are currently -87.3% below its IPO price, have fallen 66% against the price of bitcoin as shares push to new lows in 2023.

The recent move has come as Coinbase 2028 bonds are off their lows, currently trading for 59.10, offering 15.07% yield-to-maturity.

Treasury Default

In an open letter to Congress, U.S. Treasury Secretary Janet Yellen urges representatives to take action to avoid default on the public debt. The Treasury has been using special accounting maneuvers to prevent a default since hitting the bent limit of $31.4 trillion in January, but this level is expected to be breached by June 1.

“If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.”

This liquidity constraint is the dominant force in legacy markets over the intermediate term, with the Treasury’s cash crunch coming at a time when the Federal Reserve is attempting to unwind its balance sheet.

Yellen acknowledges that the x-date — the day when the Treasury runs out of cash — is subject to fluctuations based on daily tax receipts and outlays and she admits that it is impossible to predict the exact date when the Treasury will be unable to pay the government bills. Yellen has committed to provide additional updates to congress in the coming weeks as more information becomes available.

Shown below is a chart on the debt limit from Goldman Sachs Investment Research.

In her letter, Yellen also mentions that the Treasury is suspending the issuance of State and Local Government Series (SLGS) Treasury securities to avoid breaching the debt limit. SLGS are special-purpose Treasury securities issued to states and municipalities, which count against the debt limit. Suspending these securities will deprive state and local governments of a valuable financial management tool.

With all of these worries, 1-year default risk is soaring as financial markets brace for the small potential of the U.S. deferring on its obligations.

In our view, the debt limit and fiscal cash crunch is merely a short-to-intermediate term headwind. The long-term reality of the situation is that the debt limit will be raised, considering there is no other available alternative in a debt-based monetary standard. Debasement of the currency underpins the very structure of the current monetary — and it will continue.

Final Note

“In the end, policy makers always print. That is because austerity causes more pain than benefit, big restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have-nots don’t happen in sufficient size without revolutions.” — Ray Dalio

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!