Bitcoin Inscriptions Bring Fee Revenue To Miners

The mempool has remained consistently backlogged since the addition of Bitcoin inscriptions. Fee markets have gotten more competitive as the protocol approaches one million inscriptions.

Relevant Past Articles:

All Eyes On Ordinals: Addressing Bitcoin Decentralization & Block Space Concerns

State Of The Mining Industry: Public Miners Outperform Bitcoin

Earlier Than You Think: An Objective Look At Bitcoin Adoption

Bitcoin Inscriptions Bring Fee Revenue To Miners

It’s been over a month since we last wrote an update about Bitcoin ordinals and inscriptions. At that time, there were around 160,000 inscriptions and the protocol had been released to the public for roughly one month.

Now, another month has passed and we are approaching the one-millionth inscription, demonstrating just how quickly this new experiment has gained traction. In about the same amount of time that the first 160,000 ordinals were inscribed on Bitcoin, another 800,000 have been inscribed.

When we wrote our first article about Bitcoin ordinals on February 7, the focus was predominantly on the question of how transaction fees would be impacted by the massive influx of these new inscription transactions that were larger than typical monetary transactions due to the added data of images, text, applications and more.

In “Fee Market Competition: Bitcoin Ordinals And Inscriptions,” we wrote, “[P]ending transactions have continued to fill up the Bitcoin mempool, but the fee rate still hasn’t adjusted to match this demand.” The fees to get included in the next block were 3 sat/vByte.

Since then, there were extended periods where fees were higher than average, notably in late March when NFT enthusiasts were racing to inscribe the 10,000 Apes from Bored Ape Yacht Club onto Bitcoin. These larger image sizes being inscribed raised fees into the 20-40 sat/vByte range.

Source: Johoe’s Bitcoin Mempool Statistics

In conjunction with the ordinals craze, Bitcoin’s hash rate continued to increase at an impressive clip, which we covered in “State Of The Mining Industry: Bitcoin Hash Rate On The Move.” Blocks were regularly being found faster than 10 minutes on average, so the difficulty kept increasing to bring the average time to 10 minutes between blocks.

“This rapid rate of mining blocks has allowed for some of the inscription transactions with lower fee rates to be mined because blocks were getting mined faster than new transactions were being broadcast to the network. We are interested to observe the mempool backlog after this next difficulty adjustment in two or three days.” — All Eyes On Ordinals: Addressing Bitcoin Decentralization & Block Space Concerns

Difficulty has only increased since the addition of inscriptions, with the exception of one tiny decrease of 0.49% in mid-February.

Source: BTC.com

Bitcoin 2023 ticket prices increase TONIGHT at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

After the most recent difficulty adjustment on April 6, blocks have been coming in a little slower, which has contributed to a slight increase in fees, but at the time of writing, the median fee to get in the next block was only 8 sat/vByte, even with over 100 blocks worth of transactions waiting to get confirmed. Though yesterday’s difficulty adjustment is a factor in a marginally increased fee, the depth of the mempool is mostly due to the sheer number of inscriptions and transactions waiting to get confirmed on-chain.

Source: Mempool.space

Historically, fees reached their highest levels in December 2017, at 120 sat/vByte — which was only a few months after SegWit was activated and had low adoption rates at the time. Before SegWit, transaction fees were determined by transaction size. SegWit introduced the concept of block weight, changing the fees to be charged by weight unit instead of transaction size. This change reduced transaction fees overall. Incidentally, SegWit is the soft fork that allows for inscriptions to receive a slight discount because the non-monetary data is included in the witness data.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

What’s going on in the Bitcoin mempool. ⏰

Miner revenue from Ordinal transaction fees. 💰

Updates on Bitcoin’s decentralization. ⚛️

Since the introduction of Bitcoin inscriptions, the mempool has only cleared once in late February, with some people expecting it to never clear again. Looking at the charts below, it is apparent when inscriptions began to take off and the difference in mempool weight when inscriptions were introduced is obvious.

Source: Johoe’s Bitcoin Mempool Statistics

While mempool weight tells one story about inscriptions, the miner revenue from fees paints a somewhat different picture. Zooming out to the last year, miner revenue from fees is up about 2%. Looking back further, miner revenue from fees was significantly higher throughout the bull market of 2021.

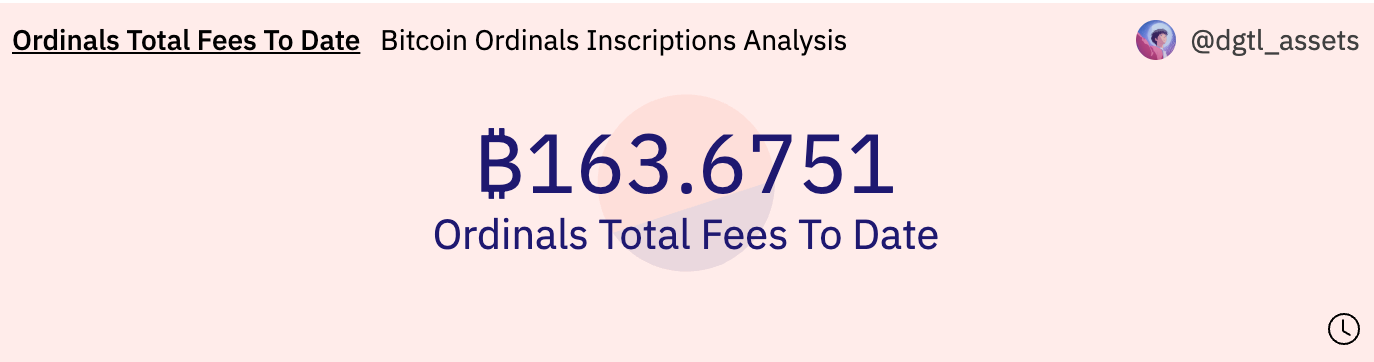

Even though more fees were collected in the height of the bull market, one analyst has calculated that inscriptions now account for over 163 bitcoin in fees paid to miners, which amounts to over $4.5 million in miner revenue. Using the approximate 2% increase in fees, inscriptions make up nearly half of the miner revenue, apart from the block reward. This is a benefit for miners, even if it comes at the detriment of users who are wanting to make purely monetary transactions.

Source: Dgtl_assets

Bitcoin has yet to experience a bull market while inscriptions are also being made. It remains to be seen how the fee market will be impacted with more transactions competing to get confirmed. Will inscriptions be priced out? Will users who want to make monetary transactions move to Layer 2 solutions, like Lightning?

We will not be sure what the full effect will be until bitcoin is at the height of the next bull market.

Bitcoin Decentralization

In our more recent ordinals update, we addressed concerns about Bitcoin’s decentralization by looking at node count.

“Using data from Bitnodes, there hasn’t been a reduction in the number of full nodes since the launch of inscriptions in late January. In fact, there has been an 8.3% increase of 1,179 reachable full nodes since that time. This is likely due to the necessity of users running a full node if they want to create their own inscriptions without using a third party.” — All Eyes On Ordinals: Addressing Bitcoin Decentralization & Block Space Concerns

When we wrote that article on February 22, there were 15,326 reachable nodes. Today, there are 17,429 reachable nodes, which is an all-time high for node count!

Source: Bitnodes

This data is exciting for the decentralization of the Bitcoin network, but it doesn’t answer the question of what will happen in the long term as the Bitcoin blockchain gets larger and requires more hard drive space to store. Currently, users need to have about 535 GB of storage space to run a full node, but blocks have been consistently full at about 4 MB, which would add 210 GB of data to the chain each year, should the inscription craze persists.

1,000,000 Inscriptions

There are currently over 960,000 inscriptions on Bitcoin. In February, there was a race leading up to the 100,000th inscription, as people hurried to participate at or below the 100,000 mark. According to Data Always (who has since made their account private), after that initial rush, demand dried up.

Source: Data Always

But since then, demand picked back up with daily inscriptions rocketing in the last few weeks. As we approach the monumental number of one million inscriptions, it is likely that we will see another rush to inscribe at or below this major milestone.

Source: Dgtl_assets

What will become of inscriptions after this next arbitrary event? Will there be another drop in demand or is the craze still in its infancy?

It’s hard to predict what will become of this nascent addition to Bitcoin. We’ve already seen popular NFT brands from other chains releasing collections on Bitcoin and luxury brands are just beginning to notice the new craze, with Bugatti announcing an ordinals collection.

Some people say that inscriptions are useless data bloating the blockchain, while others see them as a new landscape for experimentation. Regardless of the staying power of these ordinal inscriptions, Bitcoin is the only immutable chain, which is why many of these brands are shifting their focus to it. As the block subsidy continues to decline at a transparent rate that can’t be changed at the whims of bureaucratic leaders, ordinals are one marginal driver of miner revenue for their use of block space. Ultimately, fees will likely price out inscriptions or other inefficient uses of Bitcoin. The highest use case of bitcoin is trustless, censorship-resistant money without counterparty risk and it will continue to thrive, despite and because of rising transaction fees.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!